#ECBRateDecision#

1.84k 浏览

253 讨论

The European Central Bank (ECB) fully controls the interest rate and announces changes or status quo from time to time depending on the economic situation. This affects the euro currency and overall trading industry.

🚨 22-26 Juli: Minggu Krusial! ECB, RBA, dan Powell Bisa Bikin Market Bergejolak

Market bakal panas minggu ini! Dari pidato Powell, suku bunga ECB, sampai data PMI dan Retail Sales - semua bisa picu volatilitas besar. 🔥 Highlight Kalender: Senin, 21 Juli 2025 🇯🇵 JP Sepanjang Hari – Hari Laut (Libur Nasional Jepang) → Potensi likuiditas rendah di sesi Asia Selasa, 2

The dollar story ahead of ECB

The US and Canadian markets are closed today for Labor Day hence ıt will be a quiet start to a week that is busy with central bank decisions and a lot of Fed speakers. It will give one more day to ruminate over the August jobs report and whether the very disappointing 235k increase in August or the

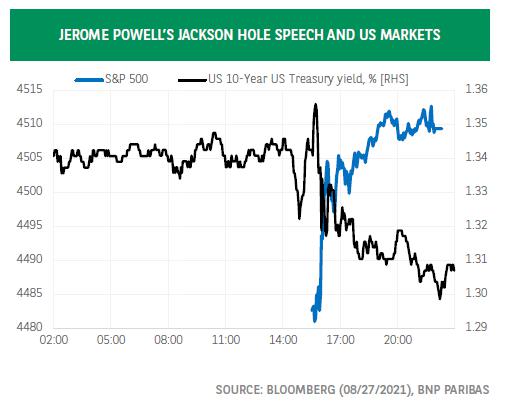

Fed adapts forward guidance, will ECB do the same?

In the early phase of QE, financial markets perceive central bank forward guidance on asset purchases and on policy rates to be closely linked. This generates a mutual reinforcement of both instruments. At a later stage, there may be mounting concern that the signalling works in the other direction

Talk now, act later: Five questions for the ECB

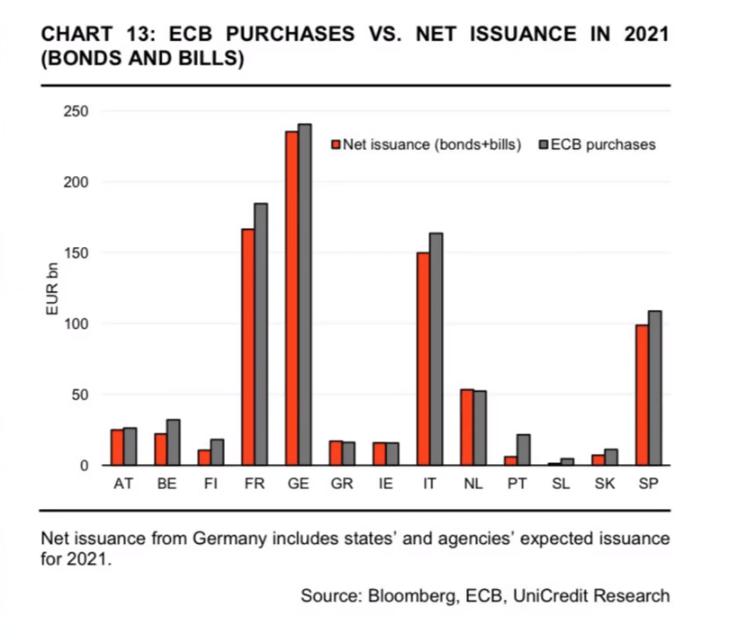

LONDON - European Central Bank officials are back from their summer break and with the hawks pushing for a slowdown in bond buying, Thursday’s meeting could prove a key market event. Chief economist Philip Lane believes it’s too early for the ECB to lay out plans to wind down the 1.85 trillion euro

MUFG: ECB move this week could slow EUR/USD rally

Tradehay.com: 06/09/2021 - 07:02 Comments of MUFG: "We don't expect the ECB to change the size of the PEPP next week. I think December would be a more reasonable time for the ECB to slow down its bond purchases, like the Fed." “We think the next Thursday meeting will be when the ECB announces the ne

EU: ECB tightening monetary is a mistake!

Tradehay.com: 06/09/2021 - 07:00 The European Union's Economic Commissioner, Paolo Gentiloni, said in an interview with Bloomberg, sticking to the view that inflation is transient: "We are monitoring inflation in the euro area, we should track it accurately, but not jumping to conclusions too soon."

Fundamental Updates – ECB Meeting And Its New Inflation Target (23 July 2021)

#OPINIONLEADER# #Signal# JUL 23, 2021 New monetary policy strategy. Earlier this month, the European Central Bank (ECB) reconvened its policy review that was postponed since last year due to the COVID-19 pandemic. During the review, the central bank revised its cu

EUR/USD on the verge of a breakdown, all eyes on the ECB [Video]

The ECB will announce its latest policy decision on Thursday with a press conference from President Lagarde. There are no expectations of any change in interest rates. The commentary will, however, be watched very closely, especially with the central bank announcing its revised inflation target earl

ECB preview and trading day ahead [Video]

- Overview of market sentiment & headlines in play at the EU open (00:00). - Look at the S&P 500, Nasdaq 100, GBPUSD, WTI crude charts (1:29). - What to expect from the ECB meeting today (6:42). - Powell enjoyed broad support for renomination at the White House (10:48). - US-China trade boom

ECB recap & looking ahead to next week’s Fed meeting

This week’s ECB monetary policy meeting highlighted the economic calendar along with rising CPI data out of the US and the passing of a new $1.9 trillion stimulus bill in Congress. ECB prescribes a higher dose of “monetary medication” The ECB kept its interest rate policy unchanged, as expected. Its

EUR/USD Forecast: ECB gives a modest boost to the shared currency

EUR/USD Current Price: 1.1987 The ECB will increase the pace of bond-buying “significantly,” starting today. Lower US Treasury yields amid stimulus-related news weighed on the greenback. EUR/USD approaches 1.2000, could extend gains in the upcoming sessions. The EUR/USD pair peaked for the day at 1.

How will ECB address the recent rise in yields

Market movers today The big event of the day is the ECB meeting which will focus on the financing conditions, the rise in yields and the PEPP implementation. We expect the ECB to contine monitoring the situation, stopping short of specific action at today's meeting. The EU is set to approve the John

正在加载中...