#BoE_InterestRateDecision#

2.15k 浏览

132 讨论

BoE Interest Rate Decision is announced by the Bank of England. If the BoE is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the GBP. Likewise, if the BoE has a dovish view on the UK economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

Forex Weekly Outlook: BoE policy decision, US NFP loom big

The FOMC remained in dovish mode, despite promising US numbers. The UK economy is gradually reopening, but the eurozone is still hampered by a slow vaccine rollout. In April, German Inflation rose above the 2% level for the first time in two years. In the eurozone, CPI is expected to rise to 1.6% in

Week Ahead – BOE and RBA rate decisions in focus; US April NFP report could show over a million jobs created

Everyone on Wall Street is trying to figure out if the peak in Treasury yields will stick for a while now that the US is approaching peak growth. The best expansion since World War 2 is being accompanied with a Fed that remains committed to supporting the economy until a complete recovery. The playb

Week ahead: RBA to stand pat but BoE might taper, can a bumper NFP excite after dovish Fed? [Video]

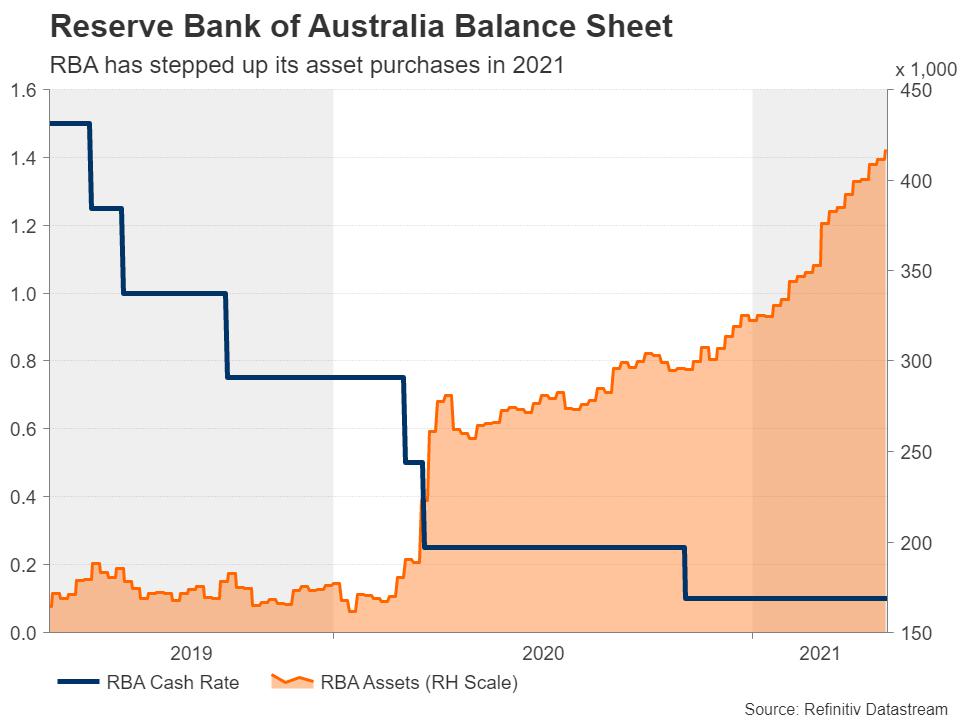

The central bank theme will continue over the next seven days with policy meetings by the Reserve Bank of Australia and Bank of England. The RBA will probably maintain some caution after weak inflation figures but there is some speculation the BoE could start to taper its asset purchases as early as

Talk of the Week

Hey traders, we hope you had a great week! This week, these were some of the hot topics raised by FOLLOWME's users in line with the market sentiment, let’s see if you are on the same page: #AstraZenecaVaccine# Countries including France, Denmark, Ireland and Thailand have temporarily

Fed, BoE step back, yields push up

Both of the Federal Reserve and the Bank of England vowed to keep liquidity plentiful and not to taper support in the face of rising inflation until they see prolonged signs of an economic recovery. The FOMC served up a surprise with the majority of the dots flat through 2023. Both USD and GBP fell

Forex Weekly Outlook: Fed, BoE in spotlight

US Treasury yields have had a strong impact on the currency markets and remain in focus. The Fed and BoE hold policy meetings this week, and the eurozone and Canada release inflation reports. The ECB announced that it would accelerate its purchase of Eurobonds under its emergency PEPP program, in re

正在加载中...