教你一招:如何避开社区的那些骗子

#创作者# #汇市叨叨叨# #你经历过哪些外汇骗局# 从我18年左右进入followme社区开始,那时候就有好多骗子了,后来消停了一段时间(不知道是不是骗子躲开了我,没来找我?),近期又有一堆变着法来了。 下面我将把我遇到的骗子分一下类。 类型1:不挂交易账户,信口开河拿着一堆漂亮的盈利截图发动态,开始钓鱼。一有人评论马上私聊开始套路你。 类型2:推荐自己的EA,和展示盈利曲线,跟你谈代操盘或者你投资入股,给你分成等等。此类型的骗子的聊天截图我记得有,但是现在找不到了,没法贴出来。可能我以前的微博有。 类

- Cutie-pie :最近正打算写同类型的话题,你写出了心声。

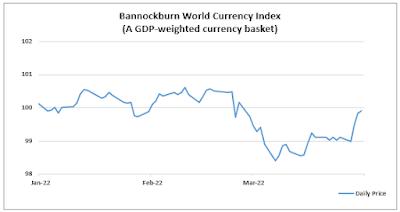

April 2022 monthly

Russia's invasion of Ukraine and the unprecedented sanctions and private sector decoupling are unleashing forces that slow growth and exacerbate price pressures. As a result, the geopolitical crisis has become a key force shaping the economic climate. Commodity prices, energy, metals, and foodstuff

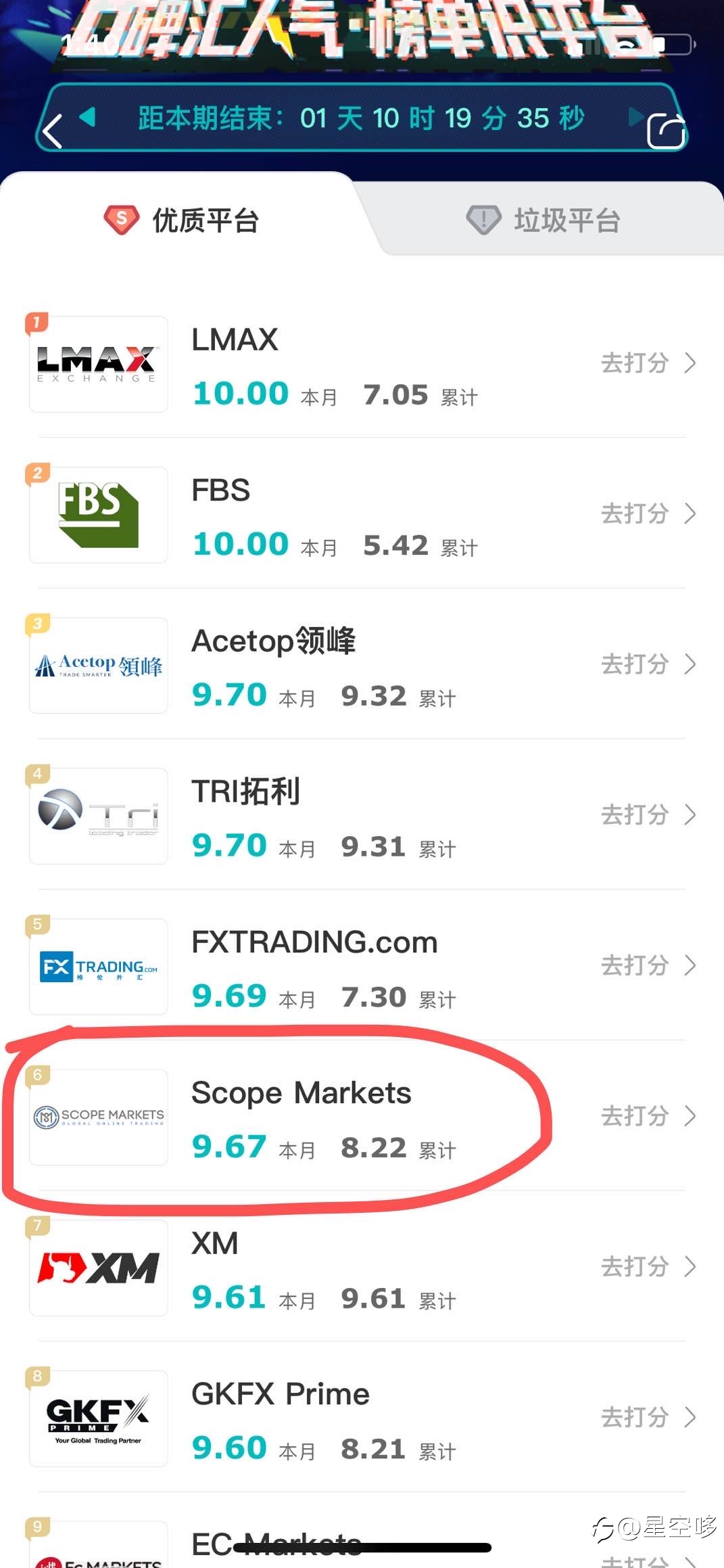

Scope Markets斯科普退出中国市场,叫SMFX时就劣迹斑斑!

近日,关于Scope Markets斯科普(中文网站:https://www.scopemarkets.bz,以下统称“Scope”)即将退出中国市场的声音甚嚣尘上,我们联系Scope官方客服后,验证了消息的真实性。 z (赛与Scope在线客服的聊天记录) z 根据Scope官方消息,Scope中文站即将结束运,交易账户最后交易日期为:2021 年 10 月 1 日(周五),投资者需在最后交易日收盘前自主关闭交易账户的全部持仓单,并在 2021 年 10 月 14 日(周四)之前提取资金。 z z Scope成为继HFGFX奥弗国际、OANDA安达、DK Trade、Vantage FX万致

The Greenback has struggled even as rate expectations rise

The effectiveness of the Federal Reserve's communication seems clear. The market has nearly 90 bp of tightening discounted here in Q2. This means that after a 25 bp hike to initiate the tightening cycle, the labor market's strength will allow the central bank to accelerate the pace. By the end of th

AI一周见闻:生成式AI持续火爆,英伟达加单,光模块价格达到历史新高 | 见智研究

一周焦点 1、生成式AI持续火爆,英伟达加单,光模块价格达到历史新高; 2、大举降低模型使用成本,OpenAI降价95%; AI应用: 1、微软股价创新高,市场对AI的预期还在膨胀? 2、360智脑大会,有灵魂的数字人大超市场预期; 3、Adobe业绩超预期,上调全年业绩预期,成为软件公司的风向标; 4、公募基金正式推出AI交易员,金融AI正在加速发展; 5、奔驰将接入ChatGPT做为AI语音助手; 前沿技术 1、眼球追踪技术成为重要探索方向,眼球反射能够解锁3D世界; 2、AMD发布AI芯片 MI300X,仍无法挑战英伟达CUDA壁垒; 名人焦点 1、Meta首席人工智能科学家Yann L

GBP/USD: Potential to climb as high as 1.35 on strong April seasonals – BofA

Economists at the Bank of America Global Research discusses GBP/USD seasonal outlook. They believe that strong April seasonals may result in cable rallying to upper end of channel at 1.35. Scope for a rally in April “The markets showed support for price at 1.30 in March and we presume this is a leve

Powell speech: Fed rate hikes won't bring down gas or food prices

FOMC Chairman Jerome Powell is testifying before the Senate Banking, Housing, & Urban Affairs Committee on "The Semiannual Monetary Policy Report to Congress." Key takeaways "Fed rate hikes won't bring down gas or food prices." "String of additional rate increases are priced in, that's appropria

IHSG Hari Ini Diprediksi Menguat Agresif, Cek Menu Sahamnya

IHSG Hari Ini Diprediksi Menguat Agresif, Cek Menu Sahamnya. (Foto: MNC Media) IDXChannel - Indeks Harga Saham Gabungan (IHSG) hari ini, Rabu (28/12/2022) diprediksi menglami penguatan IHSG yang cukup agresif. Mengutip MNC Sekuritas Daily Scope Wave, posisi IHSG saat ini diperkirakan sedang membentu

USD/CNH to advance nicely towards the 6.95 mark – Credit Suisse

Despite news of potential tariff reductions, economists at Credit Suisse still think that upside to Chinese exports and the yuan is limited. They target 6.95 in USD/CNH. Continued upward USD momentum against EUR and JPY points to higher USD/CNH “Although a tariff reduction runs counter to our initia

USD/JPY: Resistance at 130.00 to cap at first for some consolidation – Credit Suisse

The dramatic strength in USD/JPY looks to be finally stalling near-term at 130. But although analysts at Credit Suisse see risk for finally a pause in the rally and some consolidation the bigger picture outlook stays seen constructive and a sustained move above ‘neckline’ resistance at 127.33 would

AUD/USD: Australian fundamentals are relatively strongly positioned – Rabobank

According to analysts from Rabobank, the AUD/USD pair could drop a little further in the near term, but they see Australian fundamentals strongly positioned, favoring a rebound later. They forecast AUD/USD at 0.64 in three months and at 0.65 in six months. Key Quotes: “In early October the RBA was t

EUR/USD is unlikely to shoot further higher from here – MUFG

EUR/USD surged to its strongest level in over six months at 1.0737 on Thursday. Nonetheless, economists at MUFG Bank expect the pair to struggle to see more gains from here. Scope for further notable gains in EUR/GBP “The worsening risk sentiment means EUR/USD is unlikely to shoot further higher fro

Usai Menguat, IHSG Hari Ini Diprediksi Masih Berpeluang Melemah

Usai Menguat, IHSG Hari Ini Diprediksi Masih Berpeluang Melemah (foto: MNC Media) IDXChannel - Pergerakan Indeks Harga Saham Gabungan (IHSG) pada perdagangan hari ini, Rabu (4/1/2023), diperkirakan masih berpeluang untuk kembali berkubang di zona merah. Prediksi ini didasarkan pada analisa bahwa mes

正在加载中...