他点赞了

跟随收益

208.6

USD

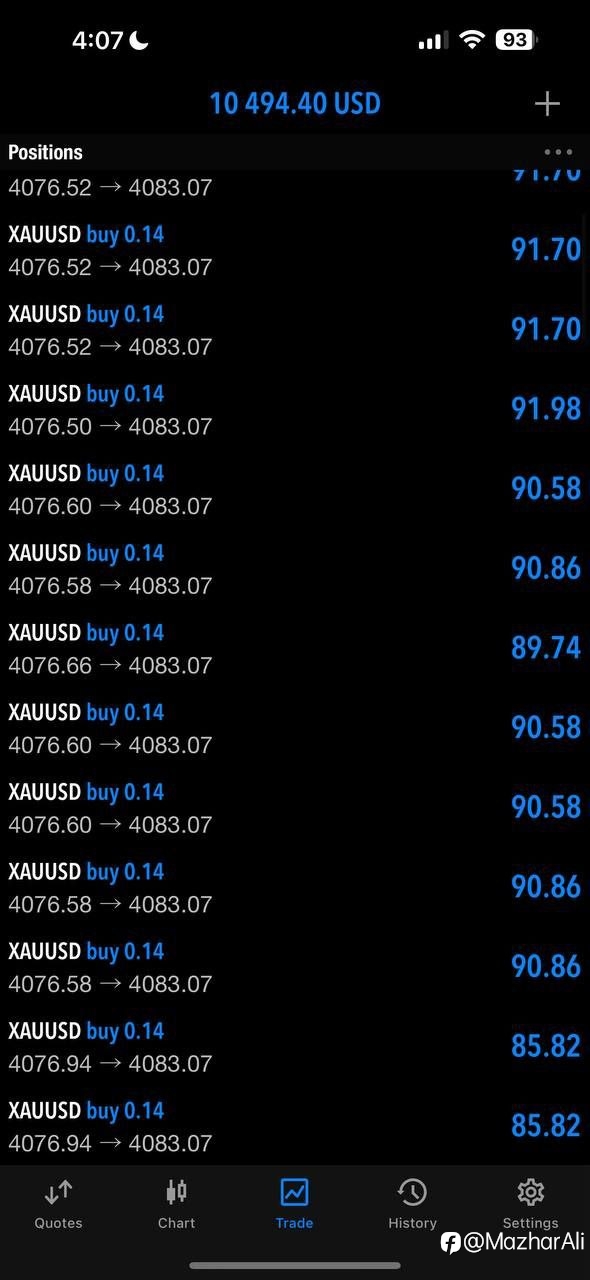

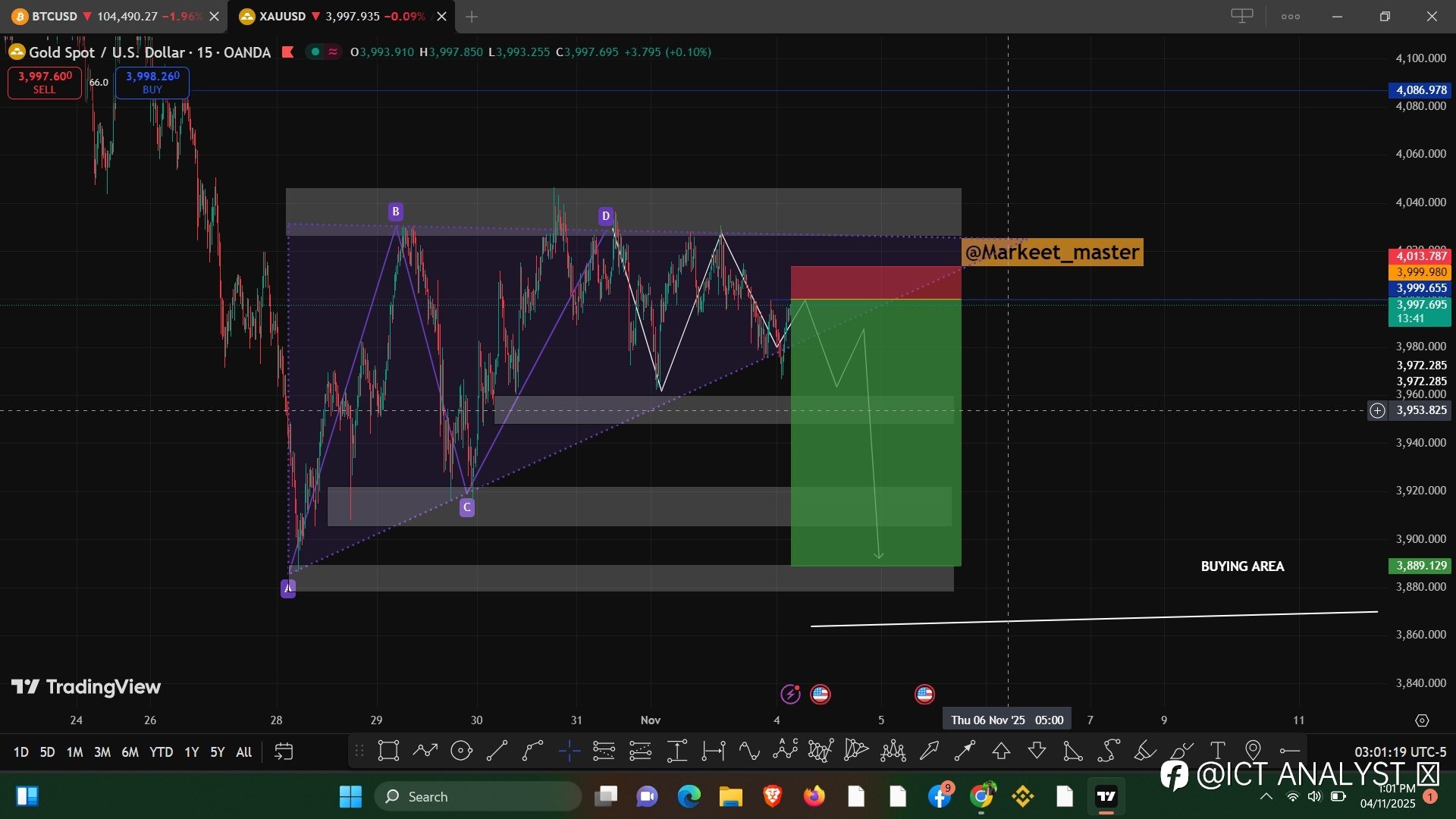

- 品种 XAU/USD

- 交易账户 #1 20031595

- 交易商 KVB

- 开/平仓价格 4,585.99/4,562.82

- 交易量 卖出 0.4 Flots

- 收益 926.80 USD

- vsign :小号 多少U可以跟单?

他点赞了

SanDisk (NASDAQ: SNDK) Bullish Path Beyond $440

SanDisk (NASDAQ: SNDK) surged over 1000% since its IPO last year and it shows no signs of slowing. Today, we decode the Elliott Wave structure behind its powerful breakout. Consequently, our analysis charts a precise path to higher targets. This technical blueprint reveals a compelling setup fu

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

- Satellite d'Arusha :hello how are you?

他点赞了

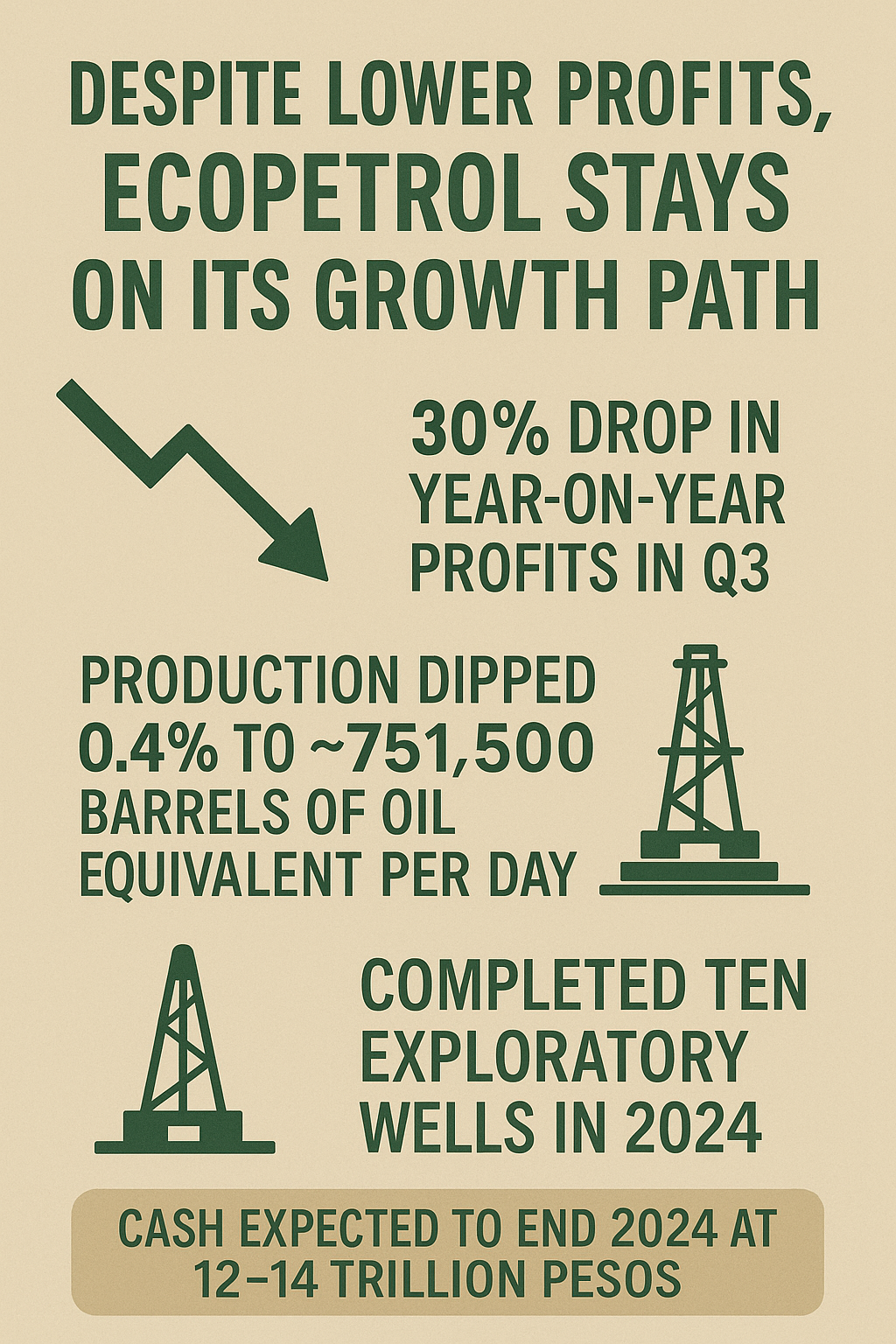

Despite Lower Profits, Ecopetrol Stays on Its Growth Path

Ecopetrol recently shared its latest financial update, revealing some mixed results. The company reported a 30% drop in profits year-on-year during the third quarter. Production also saw a small dip, falling 0.4% to around 751,500 barrels of oil equivalent per day. Even with these setbacks, Ecopetro

他点赞了

他点赞了

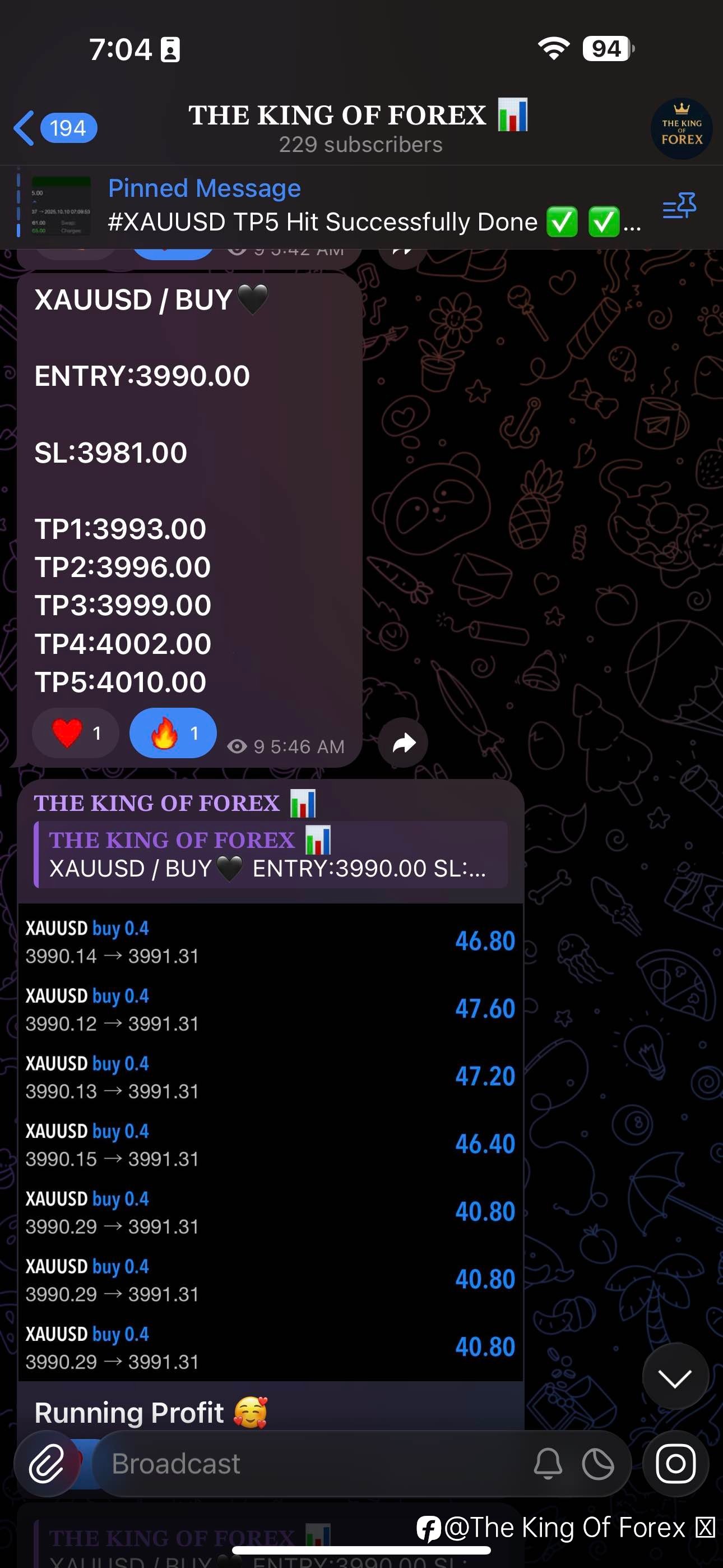

Our Investment Plan is now active!

This is an ideal opportunity for novice traders and busy people who don’t have time to monitor signals or manage trades themselves. TRADING INVESTMENT PLAN 5 days plan Deposit $2000 → Receive $40,000 Deposit $4000 → Receive $80,000 Deposit $5000→ Receive $100,000 10 days plan Deposit $10,000 → Recei

正在加载中...