ช้อปดีลพิเศษ

他点赞了

The Final Countdown: Cast Your Vote for the TrustFinance Community Choice Awards!

Vote for Followme in the TrustFinance Community Choice Awards! It’s time for the TrustFinance Community Choice Awards, where your vote determines who takes the crown. If you believe in Followme and love being part of a vibrant trading community where knowledge is shared, strategies are exchang

他点赞了

他点赞了

他点赞了

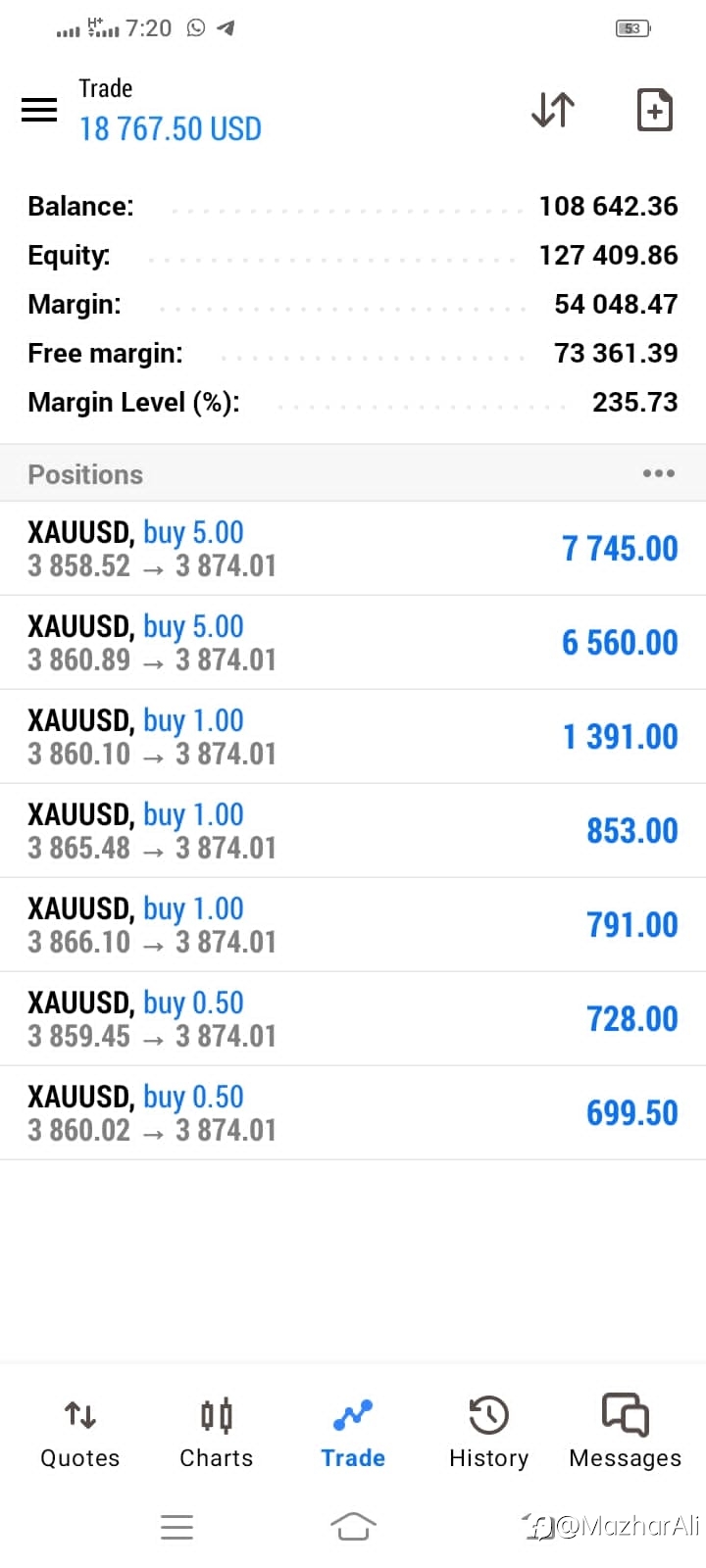

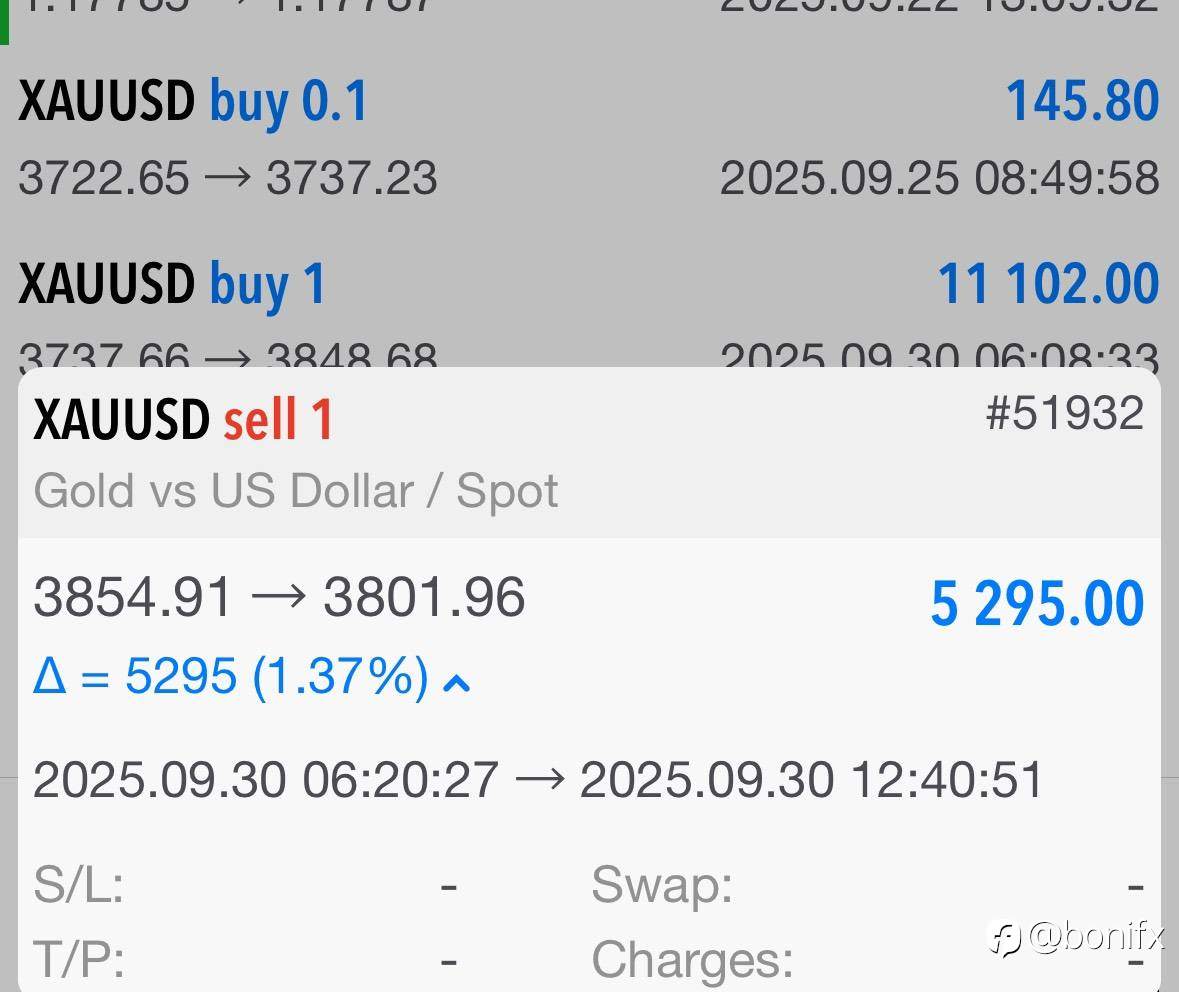

The Gold Rush 2.0 — When Trading Becomes Serious Fun 😎

Gold is back in the spotlight breaking above $4,000 and stealing attention across global trading screens. Some call it a safe haven, others say it’s the perfect inflation hedge. But for most traders right now… it’s simply pure FOMO. 🤭 We’re living through The Gold Rush 2.0,

- Kanjana :🔥🤑

他点赞了

他点赞了

USD/JPY: Any advance is likely part of a higher range of 149.20/150.15 – UOB Group

Further US Dollar (USD) strength is not ruled out, but any advance is likely part of a higher range of 149.20/150.15. In the longer run, USD could rise further to 150.15, with lesser odds of reaching 150.90, UOB Group's FX analysts Quek Ser Leang and Peter Chia note. USD might rise further to 150.15

他点赞了

The week ahead: US payrolls, UK Q2 GDP revisions and Tesco results

1) US non-farm payrolls – (Sep) – 03/10 – having seen the US economy add jobs at the slowest rate since November last year, prompting the Federal Reserve to deliver their first rate cut this year it is slowly becoming apparent that jobs growth has been much weaker than expected. This was borne out b

他点赞了

Switzerland FX Today: Swiss Franc weakens as SNB is set to maintain status quo

The Swiss Franc (CHF) retreats on Wednesday against the US Dollar (USD) just hours before the Swiss National Bank's (SNB) eagerly-awaited interest rate decision on Thursday at 07:30. Investors are closely watching for any signals of a possible reintroduction of negative interest rates or adjustments

他点赞了

Gold hovers near record highs as markets await US core PCE inflation data

Gold (XAUUSD) remains steady as markets shift focus to upcoming U.S. inflation data. With no significant economic releases this week, markets are closely watching Friday’s core PCE inflation reading. This release is expected to shape expectations for future rate cuts. Meanwhile, Fed Chair Jerome Pow

他点赞了

他点赞了

他点赞了

The buck stops with the buck

The Trump 2.0 market era is teaching us something brutally clear: the dollar is taking the bruises while everything else keeps dancing. Equities surge as if nothing matters, gold tears higher, and even the bond market is absorbing blows without a full collapse. But the world’s reserve currency, once

正在加载中...