他点赞了

Bitcoin Update

BTC is NOT trending — and that’s the trap most traders fall into 👀 📊 Market is range-bound ⚖️ No clear direction 🔥 Only scalping makes sense right now 💡 Selling near 90.2K–90.4K 💡 Buying near 89.2K–89.0K 🚫 Avoid trading the middle — pure chop This is where discipline matters more than bias. 👇

Bitcoin Update

BTC is NOT trending — and that’s the trap most traders fall into 👀 📊 Market is range-bound ⚖️ No clear direction 🔥 Only scalping makes sense right now 💡 Selling near 90.2K–90.4K 💡 Buying near 89.2K–89.0K 🚫 Avoid trading the middle — pure chop This is where discipline matters more than bias. 👇

GOLD TREND UPDATE – STRONG BULLISH CONTINUATION

Gold is in a powerful uptrend, moving inside a steep ascending channel with momentum firmly bullish. 📌 Upside zones to watch: • 4815 → 4860 → 4890 • Major resistance: 4925 • Psychological supply: 4966–5010 / 5000 📉 Dip-buying zones (if pullback comes): • 4818 (short-term support) • 4760 (healthy c

Gold

Gold is still under pressure after breaking down from the 4,460–4,470 supply zone. The recent bounce from 4,415 looks corrective, not a trend reversal. As long as price stays below 4,444–4,451, rallies are likely to face selling pressure. A breakdown below 4,395 could accelerate the move toward 4,37

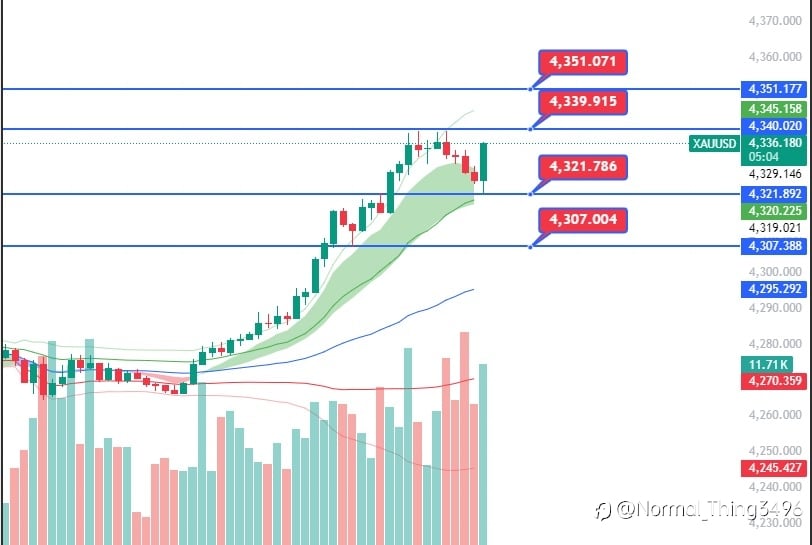

Gold Support & Resistance: Key Levels Driving the Next Move

Gold remains technically constructive, holding above the critical $4,300–$4,310 zone. This area acts as a psychological and dynamic support, aligning with the 100-hour moving average and prior pivot levels. As long as price holds above this region, the broader bullish structure remains intact. Below

Major Forex Themes: Central Banks Take Center Stage

The US Dollar continues to trade firm against major currencies as markets position ahead of key central bank decisions from the Bank of England, ECB, and Bank of Japan. The dollar index remains supported amid cautious sentiment, though softer US labor market data has kept expectations alive for furt

Gold Intraday Outlook: Buyers in Control Above 4310

Gold is trading around 4331, maintaining a mildly bullish structure while holding above the 4310 pivot level. Price action suggests cautious optimism, with buyers still active on dips, though upside momentum may slow near resistance zones. On the upside, 4348 and 4365 remain key intraday resistance

High-Impact Trading Session Ahead: NFP & Jobless Claims in Focus

Markets are gearing up for a volatile session today as key US labor data — Nonfarm Payrolls (NFP) and Unemployment Claims — are set for release. These events are well known for triggering sharp moves in Gold, often producing $50–$80 price swings within a short time frame. Price action will depend he

Gold Holds Near Record Highs Ahead of Key U.S. Data

Gold prices remain elevated near record levels around $4,300 per ounce as markets turn cautious ahead of major U.S. economic releases. The metal is holding firm in early Asian trade, reflecting a balance between expectations of Fed easing and easing geopolitical risks. The key focus is today’s U.S.

Crude Oil Intraday Outlook – CMP 56.20

Crude Oil is trading around 56.20 and remains under selling pressure as long as price stays below the 56.60 pivot. The short-term structure is bearish to sideways, with sellers defending rallies near resistance zones. Key Levels to Watch: Resistance: 57.20 / 57.80 / 58.40Support: 55.70 / 55.10 / 54.

Silver Intraday Outlook – CMP 62.73

Silver is trading around 62.73 and continues to respect the 62.40 pivot, keeping the short-term trend bullish. Buyers are defending dips well, and sustained trade above 62.60 suggests momentum remains intact. Key Levels to Watch: Resistance: 63.10 / 63.60 / 64.20Support: 62.20 / 61.70 / 61.10 Bullis

Gold Intraday Outlook – CMP 4283

Gold is trading around 4283 and continues to respect the 4275 pivot, keeping the short-term trend mildly bullish. Price stability above the 4280–4275 zone signals continued dip-buying interest, with buyers aiming for higher resistance levels. Key Levels to Watch: Resistance: 4300 / 4325 / 4350Suppor

XAGUSD

Intraday Market Update – Consolidation With Bullish Bias Price is holding near 4328–4330, forming higher lows as long as 4260–4256 support holds. Key Levels: 🔹 Pivot: 4318 🔼 Resistance: 4342 / 4365 / 4390 🔽 Support: 4295 / 4272 / 4245 Bias: ✔️ Above 4318 → Buy on dips ❌ Below 4318 → Short-term se

Gold Holds Near 7-Week High as Dovish Fed Boosts Momentum — Stay Ahead with Smart Market Insights

Gold continues to hover near a 7-week high after a decisive breakout, powered by the Federal Reserve’s dovish stance and a sharp decline in the US Dollar. With markets now pricing in two rate cuts in 2026, the environment remains highly supportive for precious metals. The breakout above the key 4245

Musk Confirms SpaceX IPO — One of the Biggest Listings in History May Be Coming

Elon Musk has officially confirmed that reports of a SpaceX IPO in 2026 are accurate, setting the stage for one of the most anticipated market events of the decade. If the valuation estimates hold, the SpaceX offering would rank as the second-richest public share sale ever, behind only Saudi Aramco’

正在加载中...