他点赞了

他点赞了

他点赞了

- Special_Word698 :29million

他点赞了

他点赞了

🌍 Morning Update - 15 January 2026 (Thu)

📈 Equities US equity index futures are rebounding after two days of selling, supported by strong results from TSMC - a key sentiment test for AI-linked giants such as Nvidia and AMD. Nasdaq futures are leading the gains (US100: +0.3%), followed by the Russell 2000 (US2000: +0.25%), S&P 500 (US5

他点赞了

他点赞了

他点赞了

他点赞了

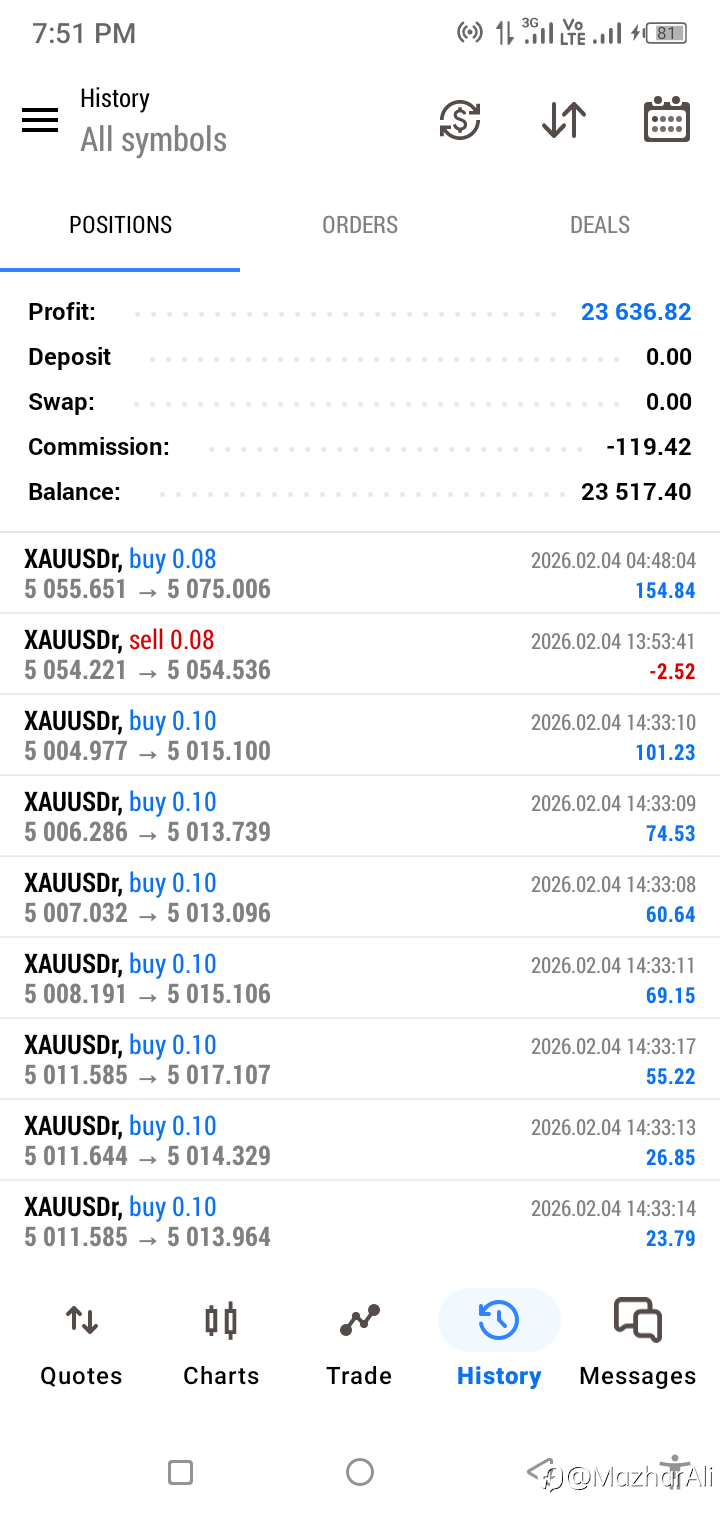

跟随收益

211.29

USD

- 品种 XAU/USD

- 交易账户 #1 8081309

- 交易商 Windsor Brokers

- 开/平仓价格 4,411/4,445.54

- 交易量 买入 0.06 Flots

- 收益 207.24 USD

他点赞了

Haflong Herbal Tea: A Natural Path to Wellness and Relaxation

In today’s fast-paced world, finding a moment of calm is essential. Haflong Tea’s Herbal Tea Collection offers a variety of caffeine-free teas crafted from organic herbs, flowers, roots, and fruits. These blends are designed to support wellness, relaxation, digestion, and overall health, making each

他点赞了

正在加载中...