他点赞了

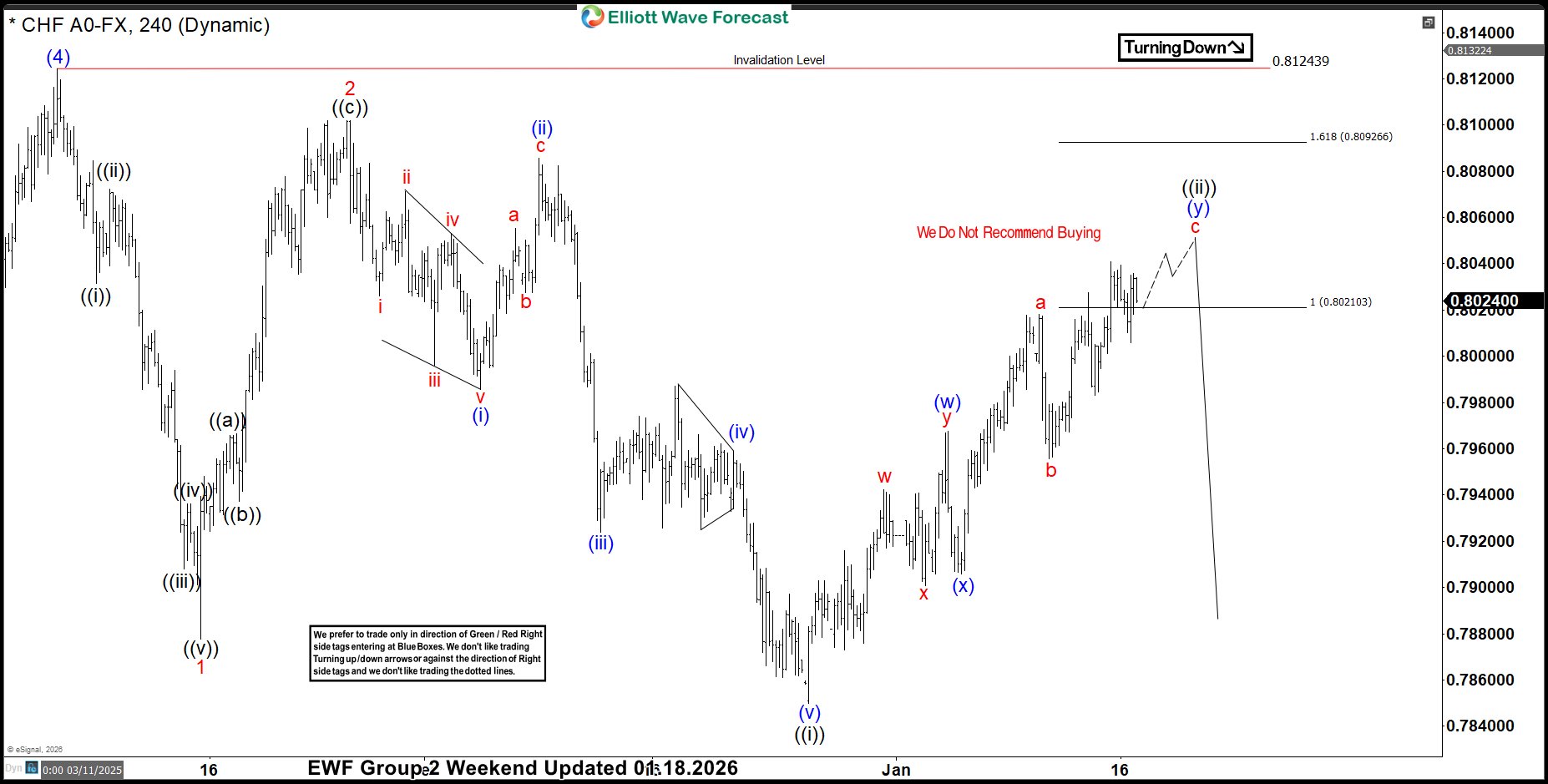

USDCHF: Sellers Reject Fibonacci Extension Zone, Decline Resumes.

USDCHF has provided traders with a textbook example of how Fibonacci extension zones can act as powerful resistance. After an extended move higher, price reached the 0.8020–0.8092 extension area, where sellers decisively stepped in. The rejection at this zone not only halted the advance but triggere

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

Indian Rupee Volatility Returns as RBI Steps In to Steady Markets

The Indian rupee (INR) has re entered a period of heightened volatility, reflecting a complex mix of offshore flows, hedging activity, and central bank intervention. After a brief rebound driven by strong buying in the non deliverable forward (NDF) market, the rupee weakened again, underscoring how

他点赞了

Asia Market Weakness: What It Really Means for Forex Traders

Asian markets have extended their losses, but for forex traders, the story goes far beyond falling stock indices. Beneath the surface, currency markets are responding to a familiar mix of risk sentiment, central bank expectations, and capital flows. This is not just about equities under pressure. It

他点赞了

他点赞了

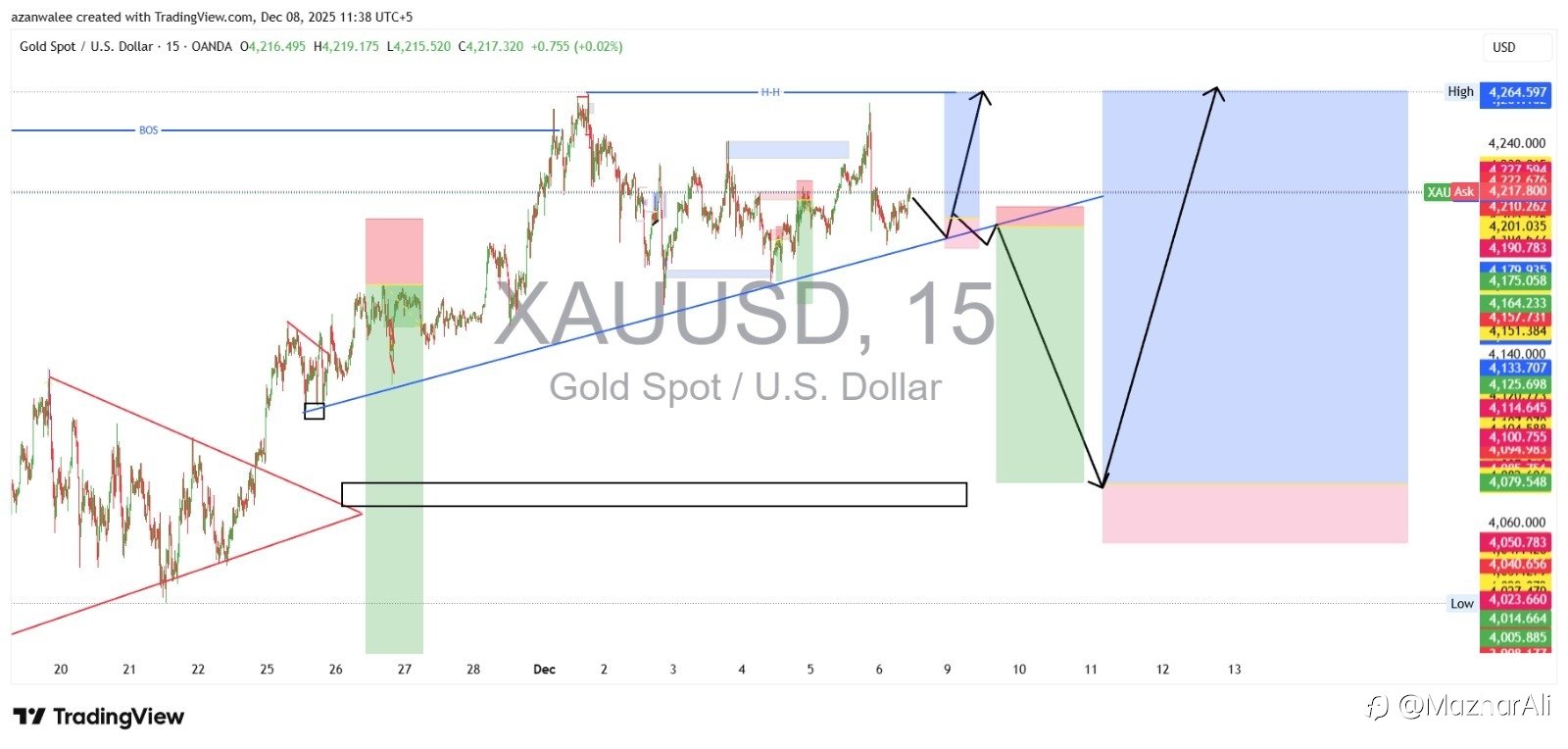

📈 XAU/USD (Gold Spot / U.S. Dollar) 15-Minute Chart Analysis

Key Observations Higher High (HH): The market has established a significant Higher High (HH), indicating a prevailing bullish structure. Break of Structure (BOS): There was a recent Break of Structure (BOS) to the upside, confirming the strength of the bullish momentum. Ascending Trendline: Price is

他点赞了

正在加载中...