他点赞了

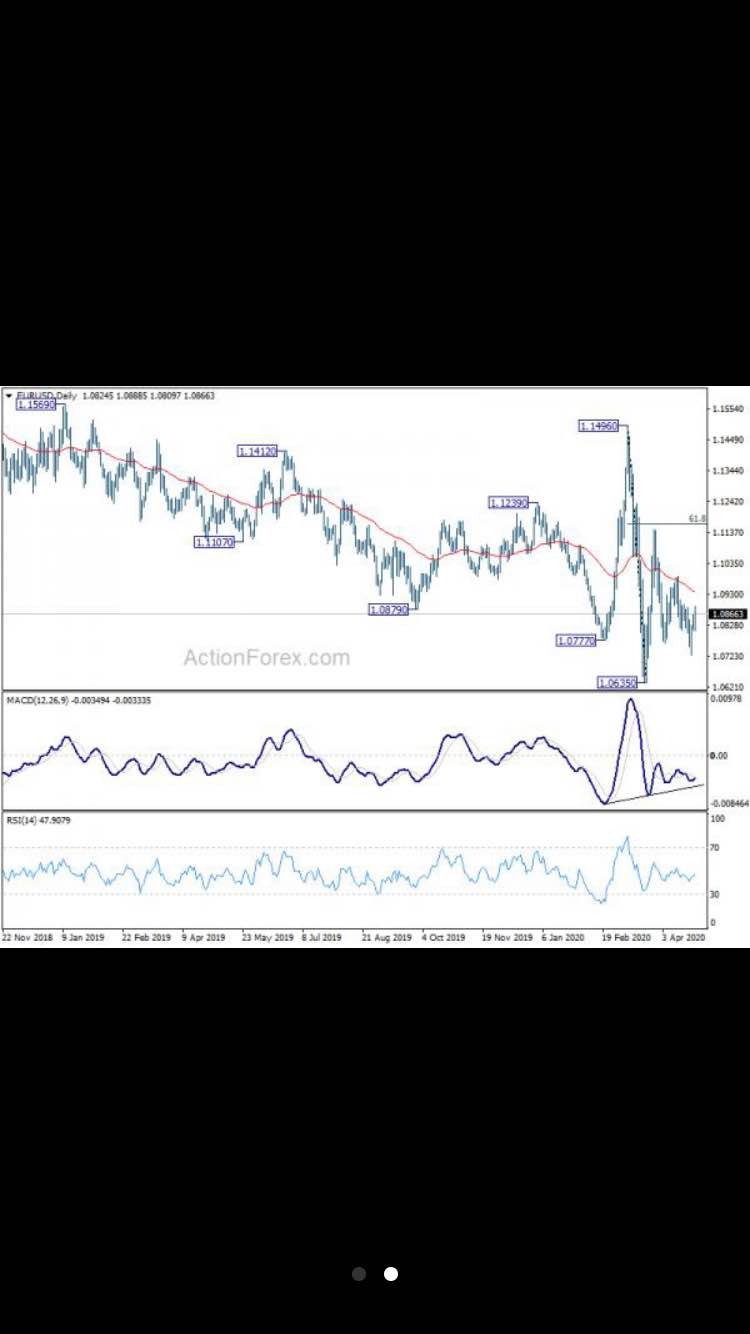

EUR/USD relegated to the 1.0725/1.0940 range – UOB

In opinion of FX Strategists at UOB Group, the outlook on EUR/USD remains mixed and still prevails the rangebound theme between 1.0725 and 1.0940 for the time being.

Key Quotes

24-hour view: “EUR traded between 1.0816 and 1.0885 yesterday, higher than our expected range of 1.0790/1.0870. Despite the

他点赞了

他点赞了

他点赞了

他点赞了

European Economics Preview: ECB Rate Decision Due

The interest rate announcement from the European Central Bank is due on Thursday, headlining a hectic day for the European economic news.

The ECB is expected to leave its key interest rate, which is the rate on the main refinancing operations, at a record low zero percent.

ECB President Christine La

他点赞了

Gold Price Analysis: Bear flag on 4-hour chart

Gold's 4-hour chart shows a bear flag pattern.

A breakdown would imply a continuation of the pullback from $1,740.

Gold's bounce from the April 28 low of $1,690 has taken the shape of a bearish continuation pattern called bear flag, according to the 4-hour chart.

At press time, the lower end of t

他点赞了

Forex Today: Trump lifts dollar after the Fed fallout, Bitcoin blasts $9,000, ECB, US jobless claims eyed

Here is what you need to know on Thursday, April 30:

April is ending with a bang with markets digesting comments from US President Donald Trump and the Federal Reserve's decision. Events are coming thick and fast with top eurozone data, the European Central Bank's decision, and weekly jobless claims

他点赞了

他点赞了

ECB Preview: New initiatives unlikely to support the euro

The ECB is expected to increase its bond buying program but the new bank programs are unlikely to provide support to the euro, in the opinion of FXStreet’s analyst Joseph Trevisani.

Key quotes

“The ECB is expected to ramp up its bond purchase program to assist governments in defraying the cost of fi

他点赞了

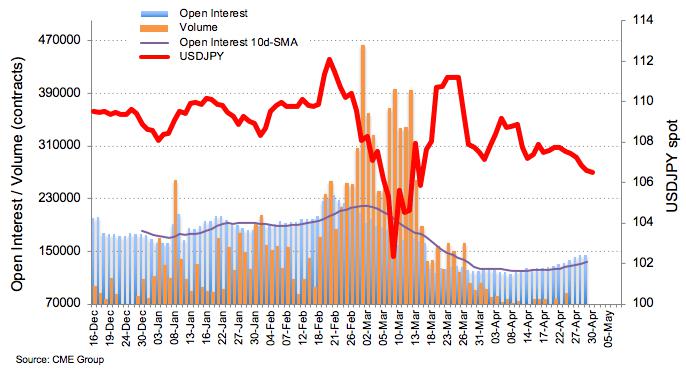

JPY Futures: Room for extra gains

According to flash data from CME Group for JPY futures markets, traders increased their open interest positions for yet another session on Wednesday, now by just 873 contracts. On the other hand, volume reversed two consecutive builds and shrunk by nearly 12.2K contracts.

USD/JPY eyes a move to 106.

他点赞了

ASX 200 Index: Moving higher despite the reverberation of trade war tones

Markets have settled post the trade-war comments and the index has hung onto gains.

Chinese data arrives mixed, markets shrugged off the negatives and take to the positives.

The ASX 200 Index is currently trading at 5,461.60 between a range of 5,393 and 5,472.60 and is performing well despite the

正在加载中...

黄金1697

黄金1697