It’s Time to Stop: A Guide to Stop Losses

Setting stop orders isn’t a linear process. In fact, there are many questions concerning how one should exactly place his or her stop loss order and which technique should be followed. It is no secret that every successful trader will plan every single trade before actually taking it. This means tha

Inflation is a hot topic. Should you be worried?

Regardless of any real consensus on how concerned the general population should or shouldn’t be about it, some economists will still panic at the sound of this word. Considerably, there is no better way to understand the inevitable and unavoidable inflation than to learn to recognize it and, of cour

What is a year-over-year analysis, and why do most people prefer it?

What is year-over-year? One of the most important things that companies care about includes growth. They will always want to know whether they improved or not. A year-over-year is one of those measures that can help them understand how they have faired every year. It can be defined as something that

Create your own trading strategy in 5 easy steps

When it comes to trade or investing, there are many different ways one can successfully record consistent profits. All you need to do is find your own way of doing so. To help you set out on your path you will be needing a set of ground rules. They will make or break your trading system and define j

What is deleveraging and why it's so frightening

Leverage is the dirty little secret of financial markets in the low interest rate era. Trades are often measured in simple percentage terms but the routine use of leverage magnifies everything. It wasn't always this way but the era of cheap money has led to an infatuation with leverage. This is most

continue my previous

#XAU/USD#

with my mistake moderate hided podt i drew two channel for gold if see that you can understand completely but i explain why i think gold maybe reduce : if see rsi in 4 hours and daily time frame you can understand gole move over buy and should doing edition and if see macd

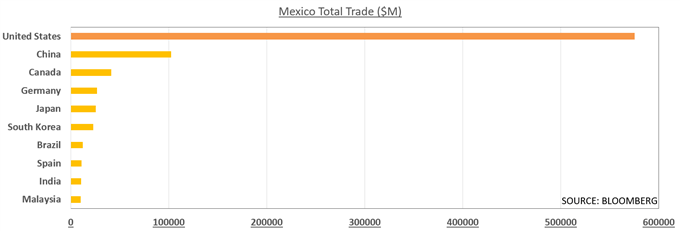

Mexican Peso Outlook at the Mercy of US Economic Trends

US DOLLAR, MEXICAN PESO, US-MEXICO TRADING RELATIONS, UNDERSTANDING THE CORE-PERIMETER MODEL – TALKING POINTS

How to trade the Mexican Peso against the US Dollar

What is the US-Mexico trading relationship and why does it matter for USD/MXN?

How the relationship between the US and Mexico fits into t

Asia Oil: A surprisingly robust week for oil markets

It was a surprisingly robust week for oil markets that saw Brent trading above $45/b for the first time since March this year, supported by better than consensus inventory draws.

However, prices were held in check by uncertainly over the trajectory of the Covid-19 spread, with global cases counts a

Forex Today: Dollar ticks up after Trump's TikTok move, all eyes on Non-Farm Payrolls

Here is what you need to know on Friday, August 7:

Trump's executive order against TikTok and WeChat has dampened the market mood and strengthened the dollar. Fiscal stimulus have made limited progress and investors are now focused on July Non-Farm Payrolls, which carries high uncertainty amid the r

Silver price soars to $28 as the US dollar falls

The British pound rose against key currencies as investors reacted to positive numbers from the UK and the Bank of England (BOE) interest rate decision. According to Markit, construction PMI in the UK increased to 58.1 in July from the previous 55.1. That was the second consecutive month that the PM

Gold hits a fresh record high, near $2065 region

Gold continued scaling higher for the third consecutive session on Thursday.

Doubts about the US economic recovery benefitted the safe-haven commodity.

Declining US bond yields provided an additional boost to the non-yielding metal.

Gold edged higher during the early North American session and shot

EUR/USD: Options market data shows more bullishness

EUR/USD's options market shows strongest bull bias in five months.

Investors expect the single currency to extend its recent rally.

Sino-US tensions and political deadlock in the US could play spoilsport.

The EUR/USD options market data shows investors are anticipating continued rally in the sin

We are in a huge uptrend, and it would continue at least 3385..

#SPX500USD#

I clearly see that we need to head down towards my white trendline before any more push to the upside This week could be huge, we might heading towards all time high? SCENARIO 1: Long when it hits white trend line SCENARIO 2: Short at top of this structure now, if you confident with

Major indices higher in early New York trading

Disney helps to push the Dow higher

The major indices are opening higher after Disney's earnings and their pivot away from theaters and more toward their Disney plus channel. They announced that they would release Mulan on that station for a one time fee of around $30. Disney shares are up over 6%

正在加载中...