The changing demographics of retail investors

May 2024 Access to financial markets can have a material impact on the financial health trajectory of families and individuals seeking to build wealth. In aggregate and over the long run, financial assets have offered solid returns in exchange for accepting market volatility. Alongside a decline in

Household Pulse: Balances through February 2024

April 2024 Introduction Following fiscal policy interventions and limited spending opportunities during the COVID-19 pandemic, households built up large reserves of excess savings and maintained those excess savings well into 2023.1 Publicly available metrics showed that households held $500 billion

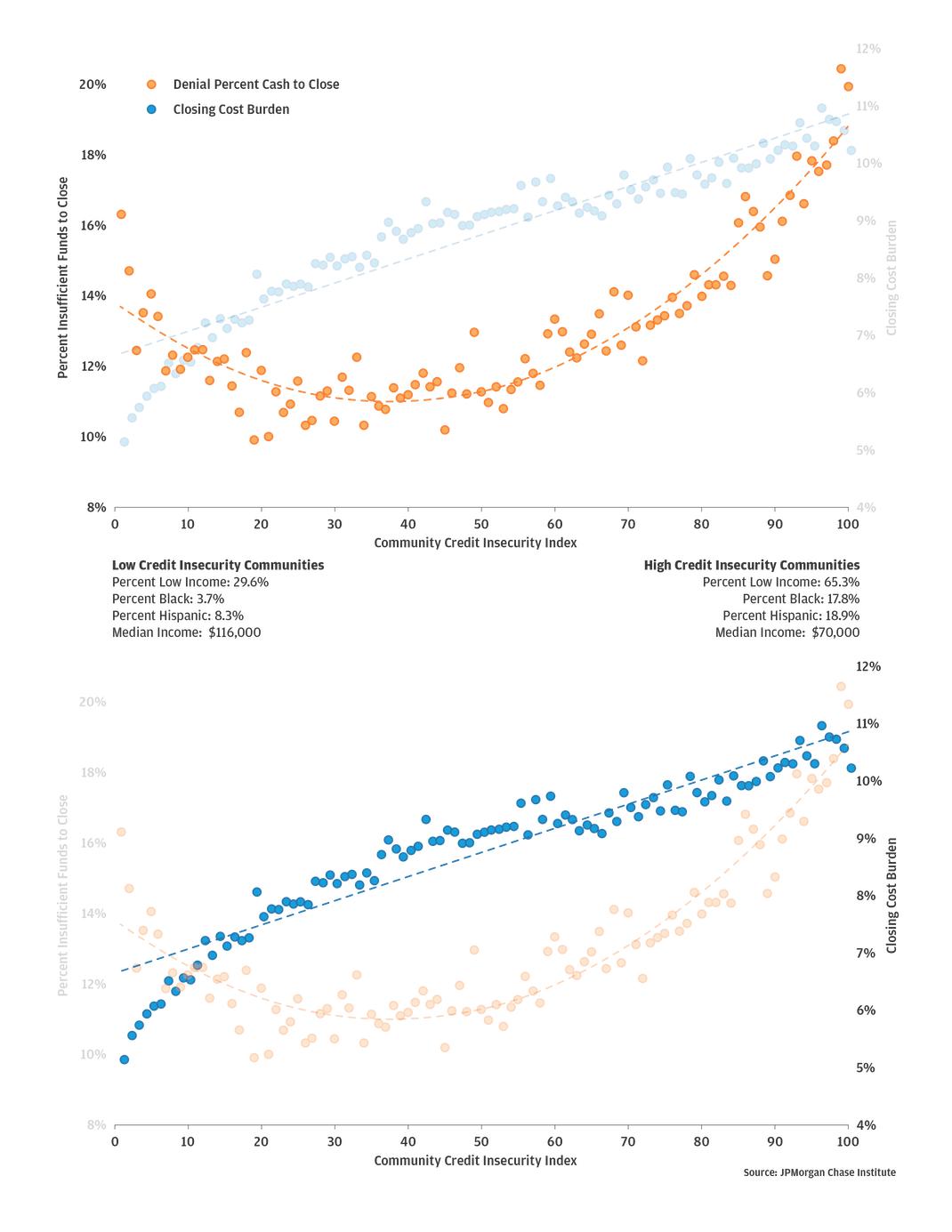

Hidden costs of homeownership: Race, income, and lender differences in loan closing costs

April 2024 Soaring home prices are making homeownership significantly less affordable for American consumers, especially young and first-time homebuyers, with nearly 39 percent of Gen Z hopefuls citing saving for a down payment as their greatest obstacle.1 While down payments are often the focal poi

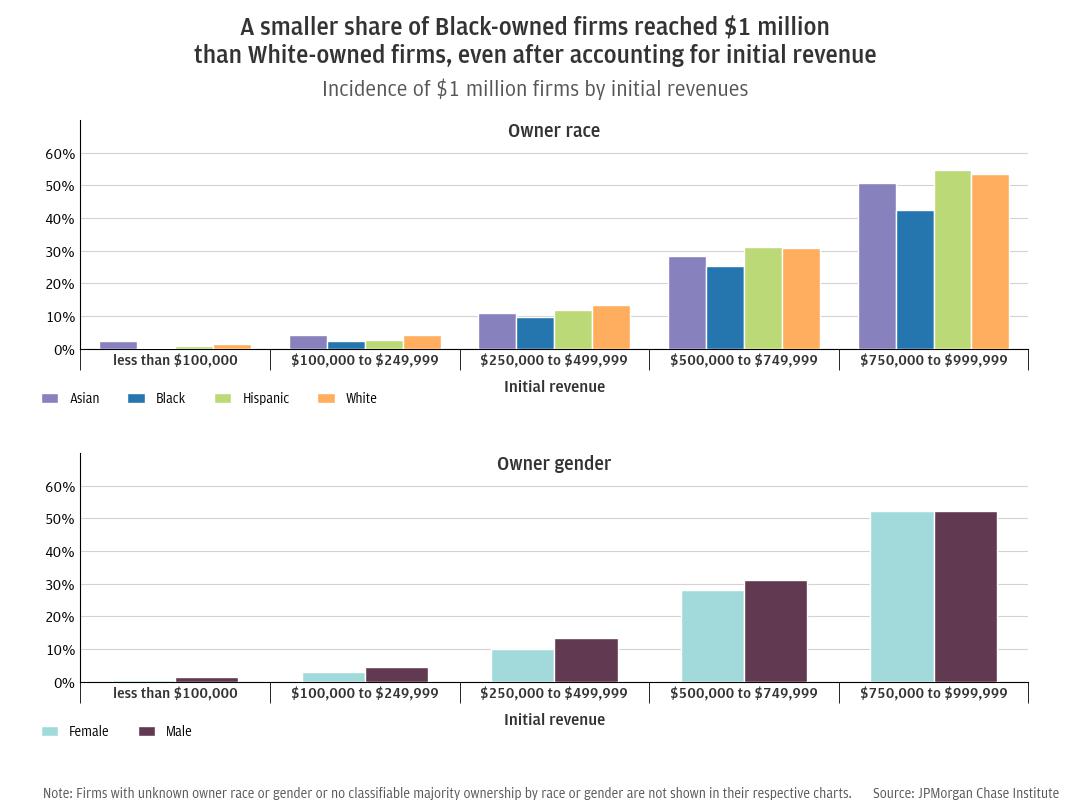

Scaling to $1 Million: How Small Businesses Fare by Owner Race and Gender

April 2024 Small businesses rarely scale to $1 million annual revenues, especially those with Black, Hispanic, and/or female owners. While policymakers often focus on how to scale smaller businesses into larger ones, there is surprisingly little empirical evidence on the process by which these firms

The rise in retail investing: Roles of the economic cycle and income growth

April 2024 The use of investment brokerage accounts has increased notably in recent years, broadening the population that is able to earn returns on wealth in the stock market and other financial assets. In the U.S., the percent of households with stock holdings increased to an all-time high of 58 p

How did advance Child Tax Credit payments affect households’ 2021 tax year outcomes and spending response?

March 2024 Introduction On March 11, 2021, President Biden signed the American Rescue Plan Act of 2021 (ARPA) into law. The stimulus bill aimed to deliver direct relief to families and workers continuing to struggle financially during the ongoing COVID-19 pandemic.1 A notable component of ARPA was t

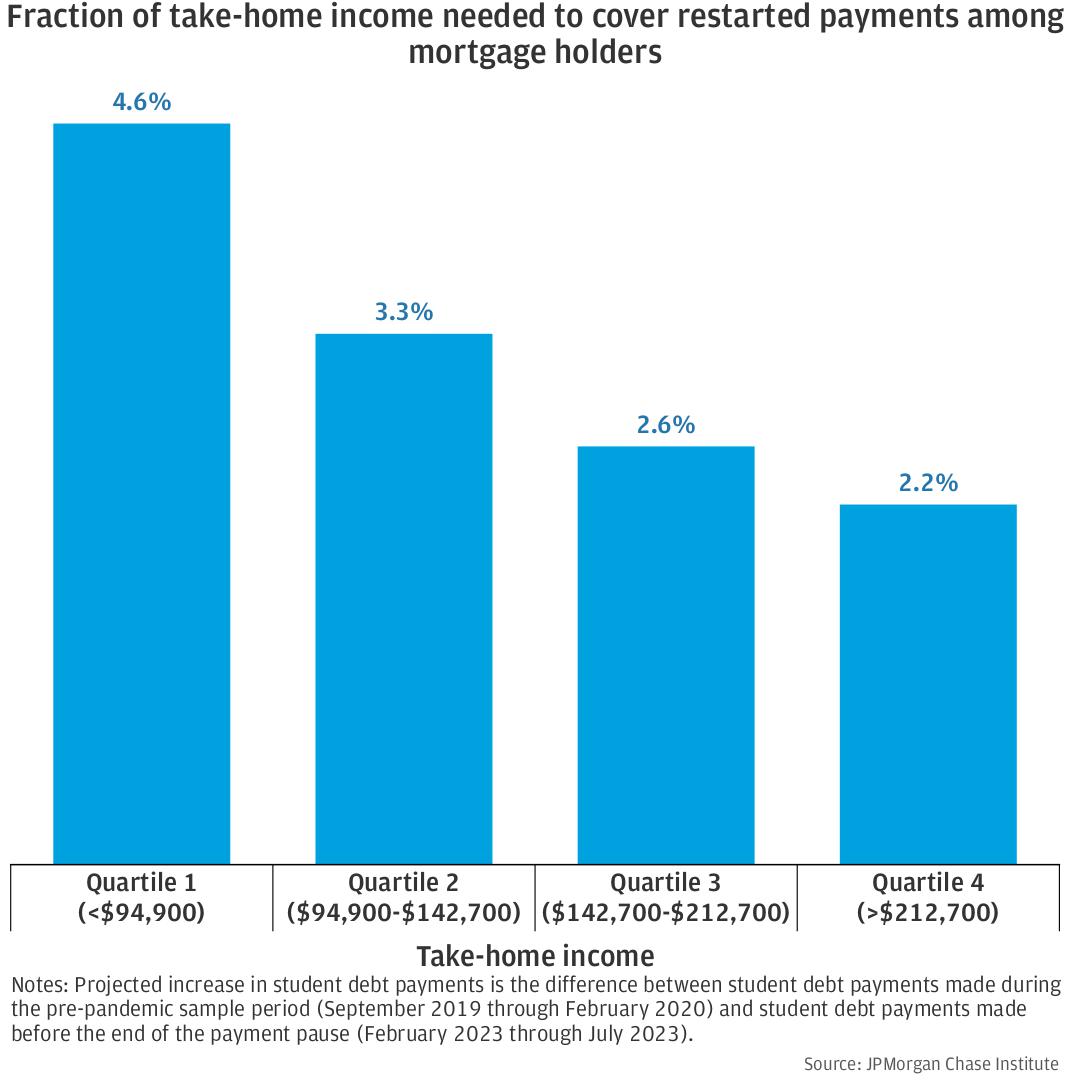

Balancing restarted student loan payments and a mortgage: How will household budgets adapt?

February 2024 With the three-year moratorium on student loan payments having ended in October 2023, more than 28 million borrowers are now confronted with the reality of resuming payments.1 Household finances have changed dramatically since the beginning of the pandemic: Incomes have risen, but so h

Household Pulse: Balances through October 2023

January 2024 Introduction Following the period of elevated liquid assets driven by the fiscal policy response and changes in household spending and saving during the COVID-19 pandemic, publicly available metrics still show $500 billion in excess savings in March 2023 relative to the level observed p

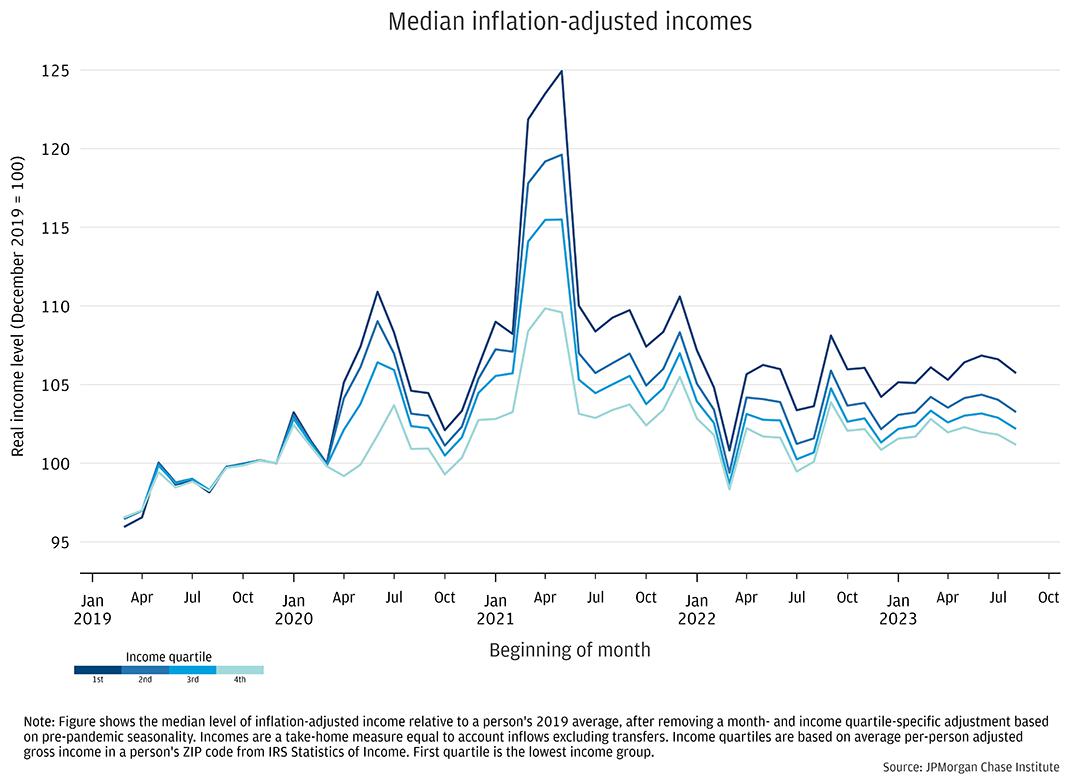

The Purchasing Power of Household Incomes: Worker outcomes through August 2023 by income and race

November 2023 The labor market remains strong, but high inflation has partially eroded the purchasing power of nominal income gains. Indicators of how much incomes have (or haven’t) increased relative to consumer prices since the pandemic—and which workers are faring best—can vary significantly acro

Household Pulse & Cash Buffer Management throughout the pandemic

June 2023 Since March 2020, COVID-19 drove uncertainty in the U.S. economy first by being an unprecedented global health event and then by generating an equally unprecedented economic policy response. This uncertainty was further exacerbated by record high inflation and correspondingly high interest

Household Cash Buffer Management from the Great Recession through COVID-19

July 2023 Introduction Cash balances are a linchpin of household financial health. Maintaining a sufficient level of liquidity—which varies with spending needs—allows households to manage spending through short-run changes to income. Over time, savings in the form of cash can also be used for large

Household Pulse: Balances through March 2023

July 2023 Introduction Following the unprecedented economic impact and significant fiscal policy response prompted by the COVID-19 pandemic, soaring inflation continues to impact consumer finances.1 This release of the Household Pulse leverages de-identified administrative banking data to examine th

Measuring the gap: Refinancing trends and disparities during the COVID-19 pandemic

June 2023 Background Amidst widespread economic instability brought on by the COVID-19 pandemic, the Federal Reserve moved to quell market fears by swiftly dispatching its toolkit. It cut its headline policy interest rate to zero and implemented quantitative easing (QE)—large-scale asset purchases t

正在加载中...