他点赞了

他点赞了

他点赞了

China says trade deal with U.S. will 'drain Taiwan’s economy' for American benefits

China has doubled down on its criticism of the trade deal between Taiwan and the U.S. agreed last week, warning that it would benefit Washington, while eroding the island's industrial strength. The trade agreement saw U.S. tariffs on the Taiwan's exports reduced to 15% with Taipei committing billion

他点赞了

China's annual trade surplus hits a record $1.2 trillion as December exports sharply beat estimates

China's exports growth in December sharply beat expectations, catapulting the annual trade surplus to a record high, even as imports rose at their fastest pace in three months. Exports surged 6.6% in U.S. dollar terms last month from a year earlier, Chinese customs data showed Wednesday, topping ana

他点赞了

他点赞了

Morning

Market Wrap-Up 📊 | Trade Smart into Year-End As the year closes, markets remain active with high volatility driven by global economic data, central bank signals, and geopolitical developments. This is not the time to chase trades — it’s the time to respect risk, protect capital, and wait for high-p

他点赞了

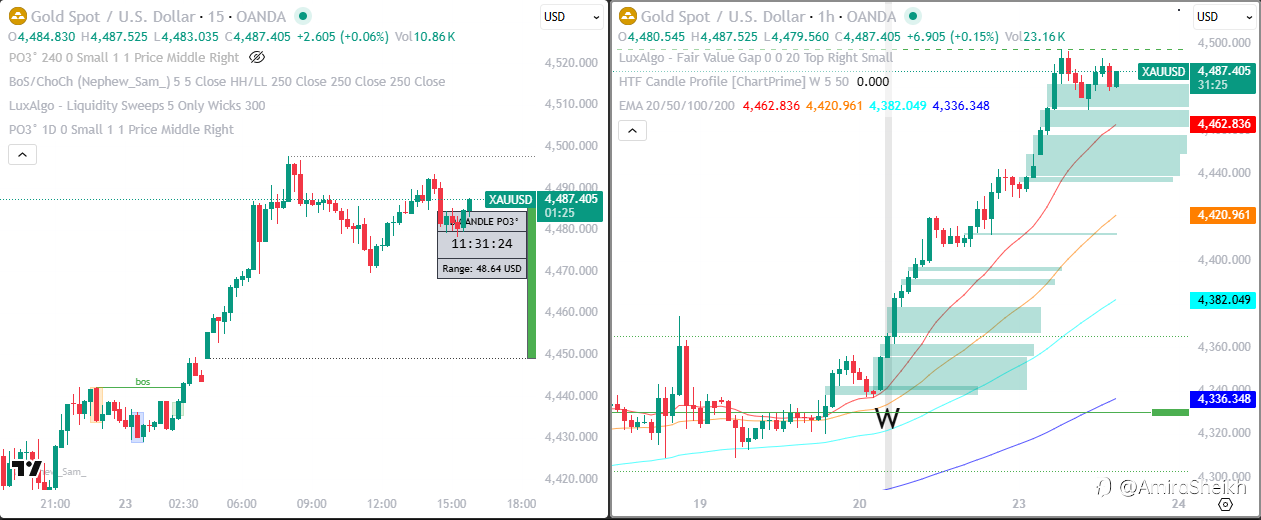

XAUUSD trade Idea and Technical analysis

Gold remains firmly bullish, holding above the key breakout zone near 4,460–4,470 after a strong impulsive rally. The 1H structure continues to print higher highs and higher lows, with price comfortably above the 20/50/100/200 EMAs—confirming trend strength. On the 15-minute chart, price is consolid

他点赞了

他点赞了

If a “Broker” Needs Telegram to Operate, It’s Not a Broker — It’s a Trap

As someone who has been trading long enough to see scams repeat themselves in different disguises, this GO Markets impersonation case follows a painfully obvious pattern. Legitimate brokers do not onboard clients through Telegram, do not coordinate deposits in chat groups, and certainly do not ask f

他点赞了

Understanding Spreads and Trading Costs

#OPINIONLEADER# When traders talk about “costs,” they often think only of losses from bad trades. In reality, every trade carries built-in costs that can quietly erode profitability if not managed carefully. Two of the most important are spreads and transaction costs. What Is a Spread

他点赞了

跟随收益

465.91

USD

- 品种 XAU/USD

- 交易账户 #1 8081309

- 交易商 Windsor Brokers

- 开/平仓价格 4,169.68/4,212.26

- 交易量 买入 0.1 Flots

- 收益 425.80 USD

正在加载中...