Are the American bulls strong? Apakah banteng Amrik gagah?

The greenback had a great fortnight since early May. The start of the third week, the bulls seems sluggish. With the Debt Ceiling issue still hanging in the balance, it could go either way. As such, the general consensus is that the Fed had done a good job in reducing the inflation rate to 4.9% with

The bears are taking a breather for the dollar.

Fed talks has been key in the direction of the US dollar. With a presumed end point of 5% for its key rate, analysts are still looking at hawkish Feds. Its expecting for a smaller hike of 50bp for December, as hinted by Powell earlier. Fighting inflation is not by increasing rates alone. Consumer Pr

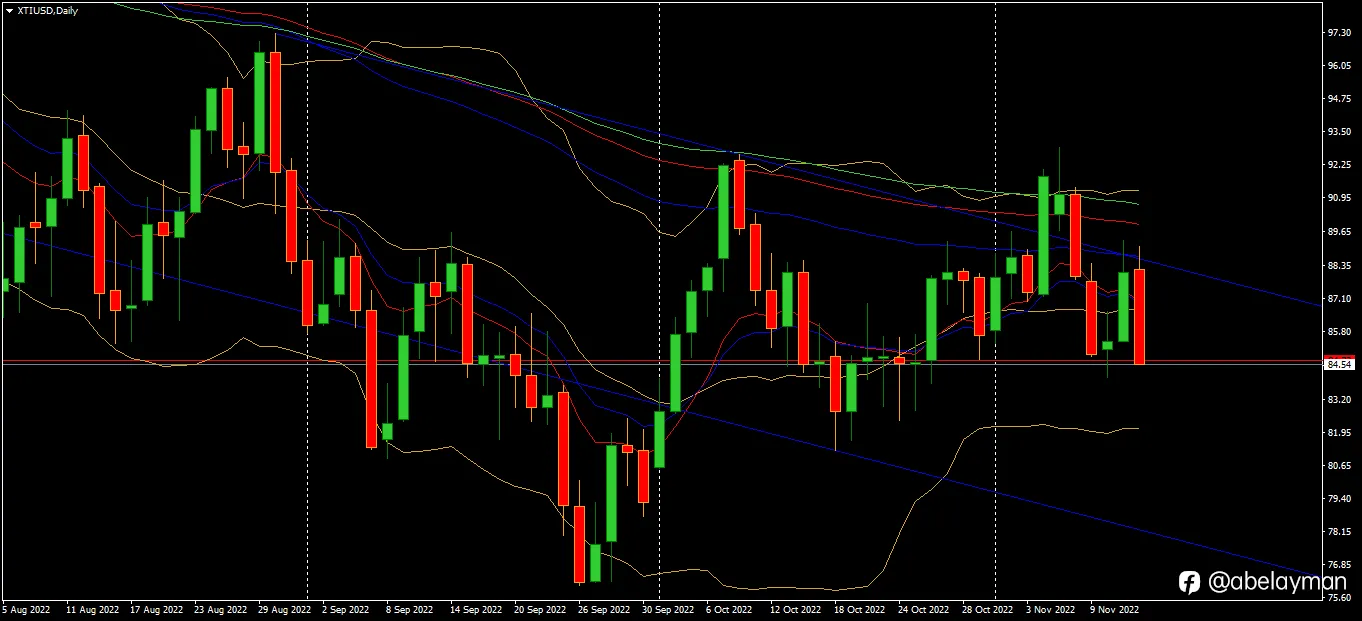

Zelensky cry wolf, China's demand for oil in question.

The missile that exploded in Poland was not Russian, as Zelensky claimed, rather its Ukranian, unintentionally, as confirmed by Poland, Nato and the US. The initial shock that shook the oil market died down and its back China's demand. Rather, a lower demand as China's zero-covid policy has not been

Bleak corporate earnings are going to sink the Dow.

Major US retailers; Target, Macy's, Kohl's, Nordstrom and Gap, all posted negative corporate earnings for the third quarter. More bad news are on the way for the current corporate earnings season. Analysts have noticed that US consumers are only spending on groceries and living needs, and not on the

FTX contagion has reach Genesis Global.

FTX's bankruptcy has made Genesis Global to suspend temporarily redemptions and new loans, said the crypto institutional lender. The FTX saga, and new victim, Genesis Global, are sending bad vibes to the cryptosphere across the board. As such we are seeing ETH going below $1k mark, very soon. Kepail

FTX ghosts haunting Bitcoin.

The FTX contagion is getting wider and deeper into the current geo-politcal issues. Apparently SBF is Democrats 2nd biggest donor, which sends funding for Ukrainian causes, by which Ukraine invest back into FTX. SEC has not the regulations to pin down SBF nor FTX. Its going to be a total loss of $20

Russian misguided missile, guiding golden bulls.

Further to the previous post, 9 Nov, early 1800s is within reach. Russia's misguided missile landed in Poland that created a market turmoil for oil. Ukraine's Zelensky is urging for G20 to condemn Russia and pushing for NATO to take decisive actions. This turn of events that happened last night is t

Technical rally has peaked for US stocks.

The expected year end technical rally seems to have peaked. Unemployment is set to rise after Amazon announces that its firing 10,000 employees beginning this week. This follows Musk's Twitter that laid off 4,000 and Zuckerberg's Meta fired 11,000 employees. The bad vibes from Nasdaq will eventually

Oil easing down after China changes its mind.

The biggest oil importer, China, has decided not to open its market freely, rather, cautiously. The pandemic has still made its presence felt as cases rise over the weekend. Slightly stable dollar also made oil slid down. With demand dwindling, we can expect WTI to extend its slide to 80s. Importir

Busy week for UK Chancellor Jeremy Hunt.

Several economic indicators are due to be released later this week, and UK Chancellor, Jeremy Hunt, will present his Autumn budget on Thursday. Expect cuts in spending but increase in taxes, as the UK struggle to coverup £50 billion fiscal hole in public finances. Bearing in mind the weakening dolla

FTX saga brewing, cryptos sinking.

Bahamian authorities have taken actions against the 3 head honchos of FTX; Sam Bankman-Fried, Gary Wang and Nishad Singh. Currently the 3 are under supervision of the Bahamas Securities Commission. Elon Musk, the non-grata persona, has put his weight on SBF stating in his tweet,"SBF was a major DEM

Musk created Arabiaphobia thru Twitter.

Joe Biden is concerned with investments put up by Prince Al Waleed of Saudi Arabia and Qatari Invesment Authority to Elon Musk takeover of Twitter. Prince Al Waleed is the second biggest investment worth $1.9b while QIA is $375. With the FIFA World Cup Qatar 2022 to be kicked off soon, its pretty sm

Still lazy, sterling's bulls.

The pound sterling got a boost from US CPI numbers which pummeled the dollar to levels not seen for a decade. UK's GDP will be released later, and expected to shrink, but we may be in for a surprise. Nevertheless, a further slide of the dollar will spell well for the sterling. Pound sterling mendapa

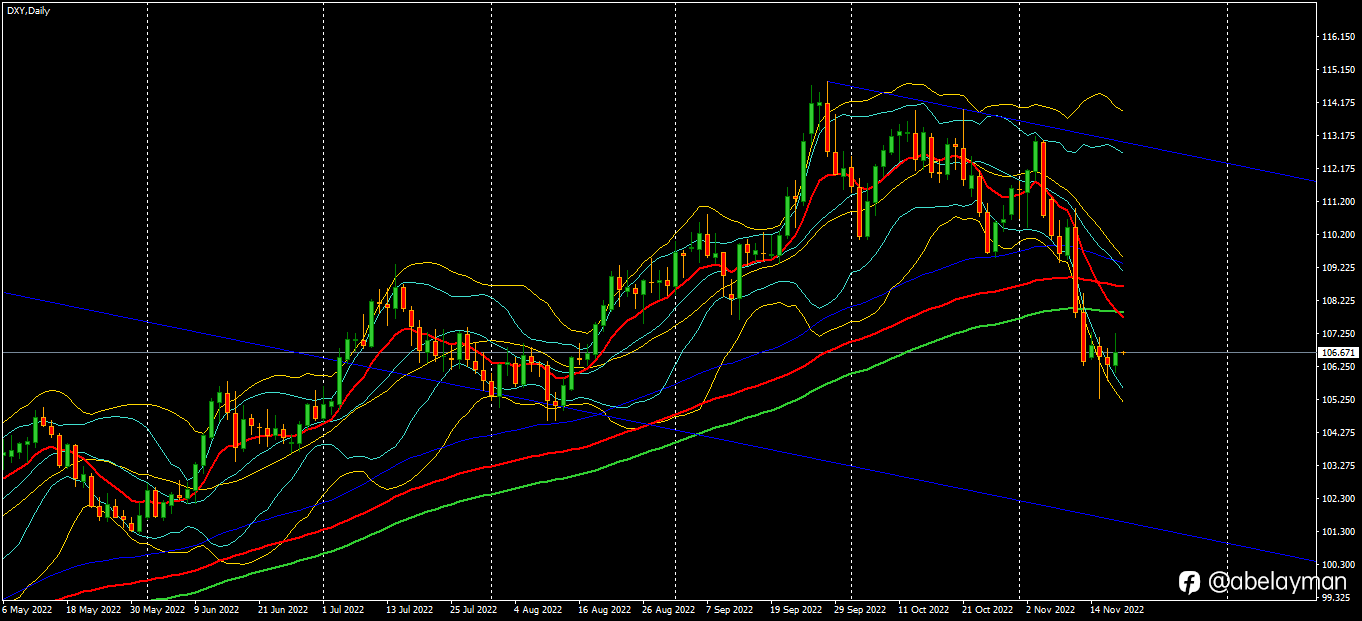

Weak CPI, weaker dollar.

US inflation has lowered beyond expectation and CPI numbers were softer at 7.7% against expected 7.9% year on year. That and a higher unemployment claims pummeled the dollar to 107s. On the other hand stocks posted huge gains, thus putting more pressure for the dollar to slide lower. Tingkat inflasi

Cryptos tanked to support the Dollar.

US President, Joe Biden, put on a brave face to say that 'US economy is not in a recession'. And Meta lays off 11,000 workers. Bank of America predicted 175k job losses in Q1/23. Everywhere in the US, rental prices have lowered and reduced occupancy. These bad news will creep to the dollar, again, s

正在加载中...