0749140

他点赞了

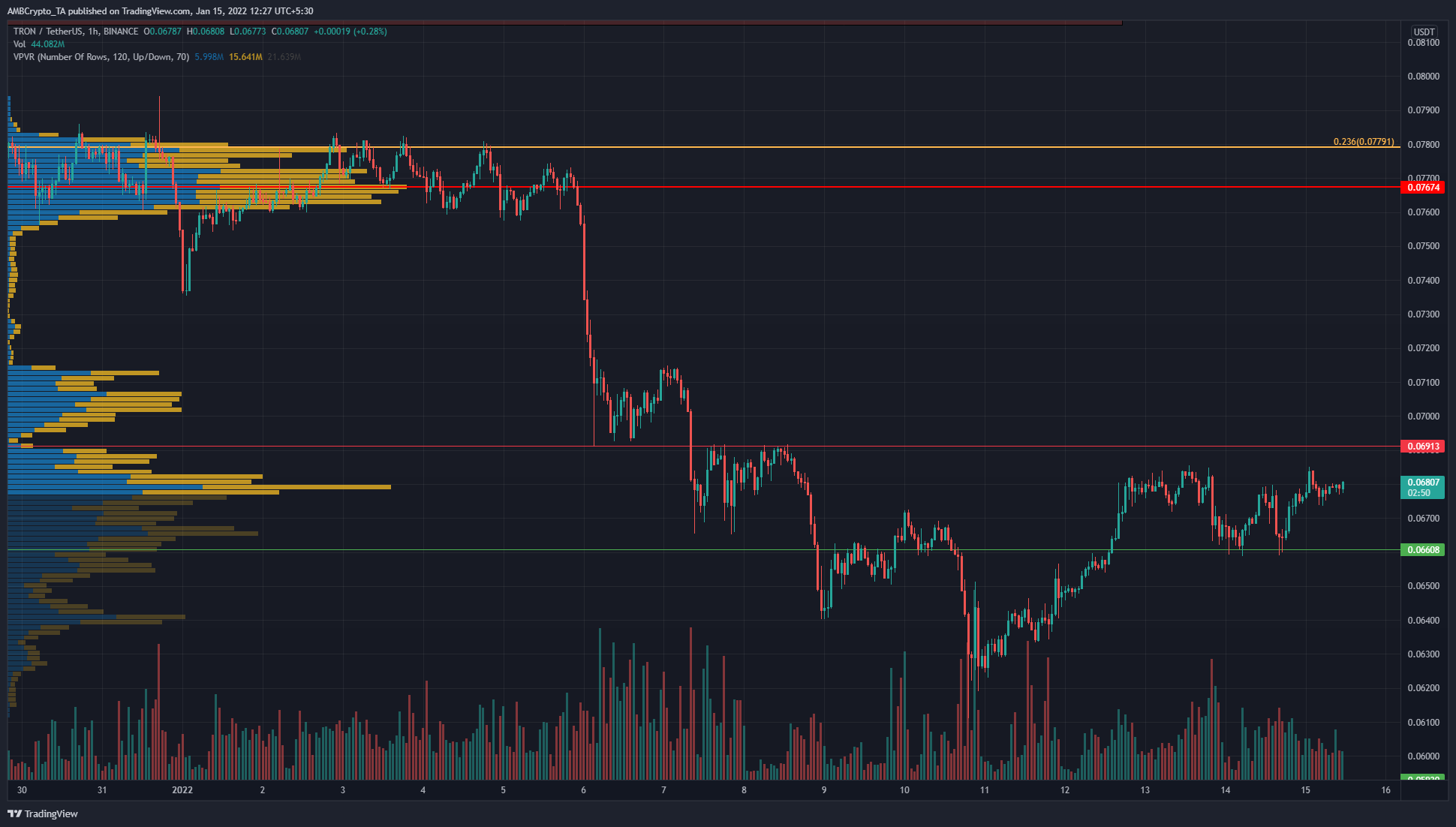

Can TRON mount a recovery as it finds support at $0.066

TRON has faced steady selling pressure since mid-November. This downtrend has been interrupted for brief moments by relief rallies. Another such move upward could possibly occur for TRON in the next few days. Above the $0.069 resistance level, TRON did not face too much resistance on the low timefra

他点赞了

OJK Larang Aset Kripto, Net89 Withdrawal Member Robot Trading Ke Bitcoin?

Bisnis.com, JAKARTA – Otoritas Jasa Keuangan (OJK) dengan tegas melarang jual beli asset kripto, di sisi lain member net89 dijanjikan untuk withdrawal dana ke Bitcoin. Ketua Dewan Komisioner OJK Wimboh Santoso mengatakan bahwa regulator sudah menetapkan bahwa sektor keuangan tidak boleh memfasilitas

他点赞了

OJK Larang Aset Kripto, Net89 Withdrawal Member Robot Trading ke Bitcoin?

Otoritas Jasa Keuangan (OJK) dengan tegas melarang jual beli asset kripto, di sisi lain member net89 dijanjikan untuk withdrawal dana ke Bitcoin. Ketua Dewan Komisioner OJK Wimboh Santoso mengatakan bahwa regulator sudah menetapkan bahwa sektor keuangan tidak boleh memfasilitasi transaksi kripto kar

他点赞了

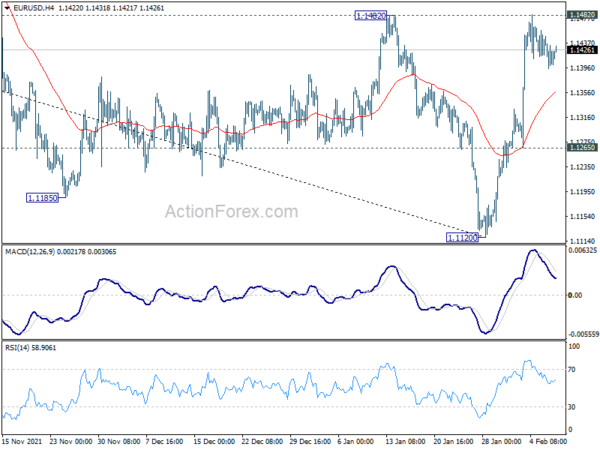

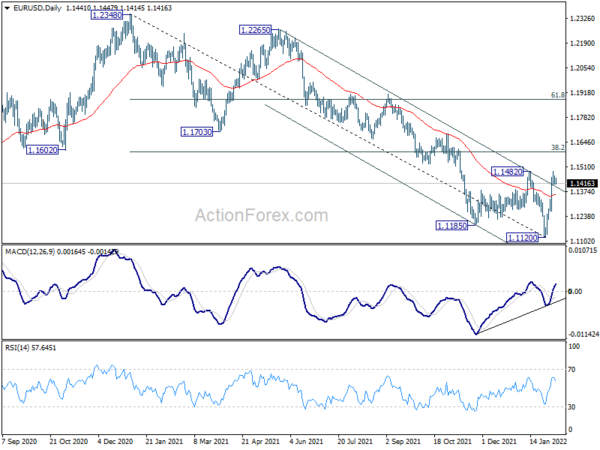

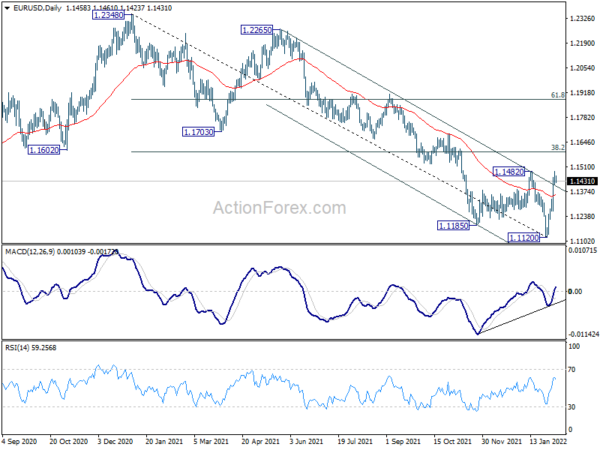

EUR/USD Daily Outlook

#OPINIONLEADER# Intraday bias in EUR/USD remains neutral for the moment. A medium term bottom could be in place at 1.1120, on bullish convergence condition in daily MACD. Break of 1.1482 resistance will target 38.2% retracement of 1.2348 to 1.1120 at 1.1589 next. Sustained break there

他点赞了

Become a Successful and Balanced Trader with These 5 Trading Virtues

#OPINIONLEADER# Get to know the trading virtues you need to develop for a successful trading career. Virtues are described as traits that revolve around moral excellence and positive characteristics. Commonly used for spiritual teachings, virtues are also great tools for traders

他点赞了

US Dollar Index: Dollar Eyes US Inflation Data

#OPINIONLEADER# The dollar index edges lower on Wednesday after rebound on better than expected US NFP showed signs of stall. Repeated failure to clear initial Fibo resistance at 95.66 (23.6% of 97.42/95.12 bear-leg) weakened near-term structure, as daily MA’s (10/20/55) remain in neg

他点赞了

Higher Yields Start to Bite but Stocks Fight Back, Dollar Edges Up

#OPINIONLEADER# Bond yields climb to fresh highs as inflation and tighter policy fears grip marketsEquities nevertheless perk up globally but Wall Street on shaky groundDollar regains front foot, oil prices pressured by optimism around US-Iran talks Sentiment improves despite surging

他点赞了

Daily Forex Analysis (08 Feb 2022) with LCMS Traders

#OPINIONLEADER# Daily Forex Analysis (08 Feb 2022) Any information shared during this session is not intended to be a trade recommendation, it is solely the opinion and views of the speakers. So, please remember to do your own analysis prior to entering any trades.

他点赞了

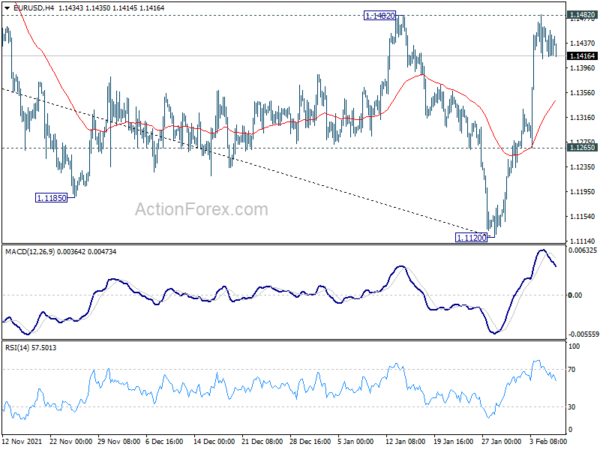

EUR/USD Daily Outlook

#OPINIONLEADER# Intraday bias in EUR/USD is turned neutral as it failed to break through 1.1482 resistance for now. A medium term bottom could be in place at 1.1120, on bullish convergence condition in daily MACD. Break of 1.1482 resistance will target 38.2% retracement of 1.2348 to 1

他点赞了

Chinese property developers face big debt maturities

Chinese property developers face big debt maturities in 2022 - Reuters ~ According to Refinitiv data, Chinese real estate developers have $117 billion worth of debt maturing in 2022, with $36 billion of those denominated in dollars. o~ According to Refinitiv data, the developers face debts worth $27

他点赞了

Bitcoin’s Bullish Pattern

#OPINIONLEADER# On Monday, Bitcoin rose 5.5%, ending the day around $44,100. Ethereum added 5%, and other leading altcoins from the top ten also showed growing dynamics: from 4% (Solana) to 18.5% (XRP). The total capitalization of the crypto market increased by 5.5% over the day to $2

他点赞了

ECB’s Lagarde Repeats that “a Rate Hike Will Not Occur” Before QE Ends

#OPINIONLEADER# Market movers today Very quiet day on data front, only Swedish industrial production data from December due. Two ECB speakers on the wires, Villeroy (neutral) and de Cos (dove). After last week’s ECB meeting, the markets will pay close attention to any clues from polic

他点赞了

他点赞了

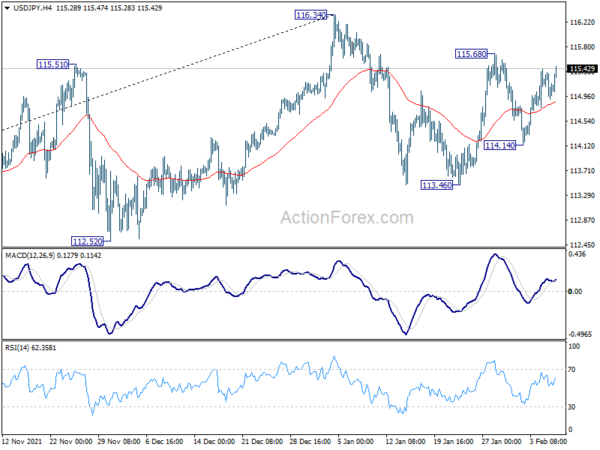

USD/JPY Daily Outlook

#OPINIONLEADER# USD/JPY rises slightly today but stays in range of 114.14/115.68, and intraday bias remains neutral first. Overall, consolidation pattern from 116.34 is still extending. On the upside, break of 115.68 will resume the rebound from 113.46 to retest 116.34 high first. On

他点赞了

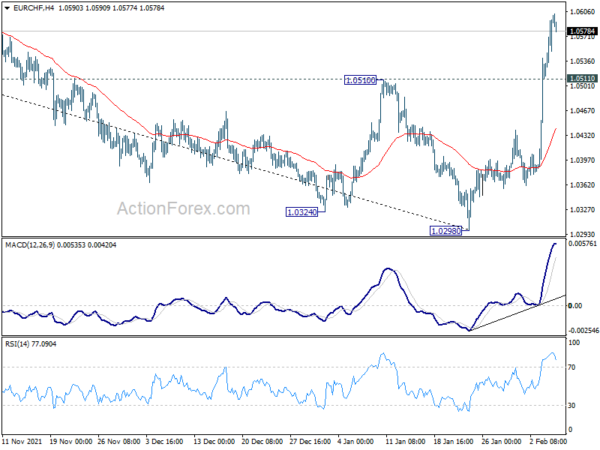

Euro Retreats ahead of Key Resistance, US CPI the Biggest Event for the Week

#OPINIONLEADER# The markets are steady in Asia in a quiet start to the week. Euro is softening slightly, paring some of last week’s gain. Aussie and Kiwi also turn weaker on mild risk aversion. On the other hand, Dollar and Canadian are both regaining some grounds. It’s a relatively l

正在加载中...