他点赞了

S&P 500: DECLINE IN BONDS SUPPORTS INDEX

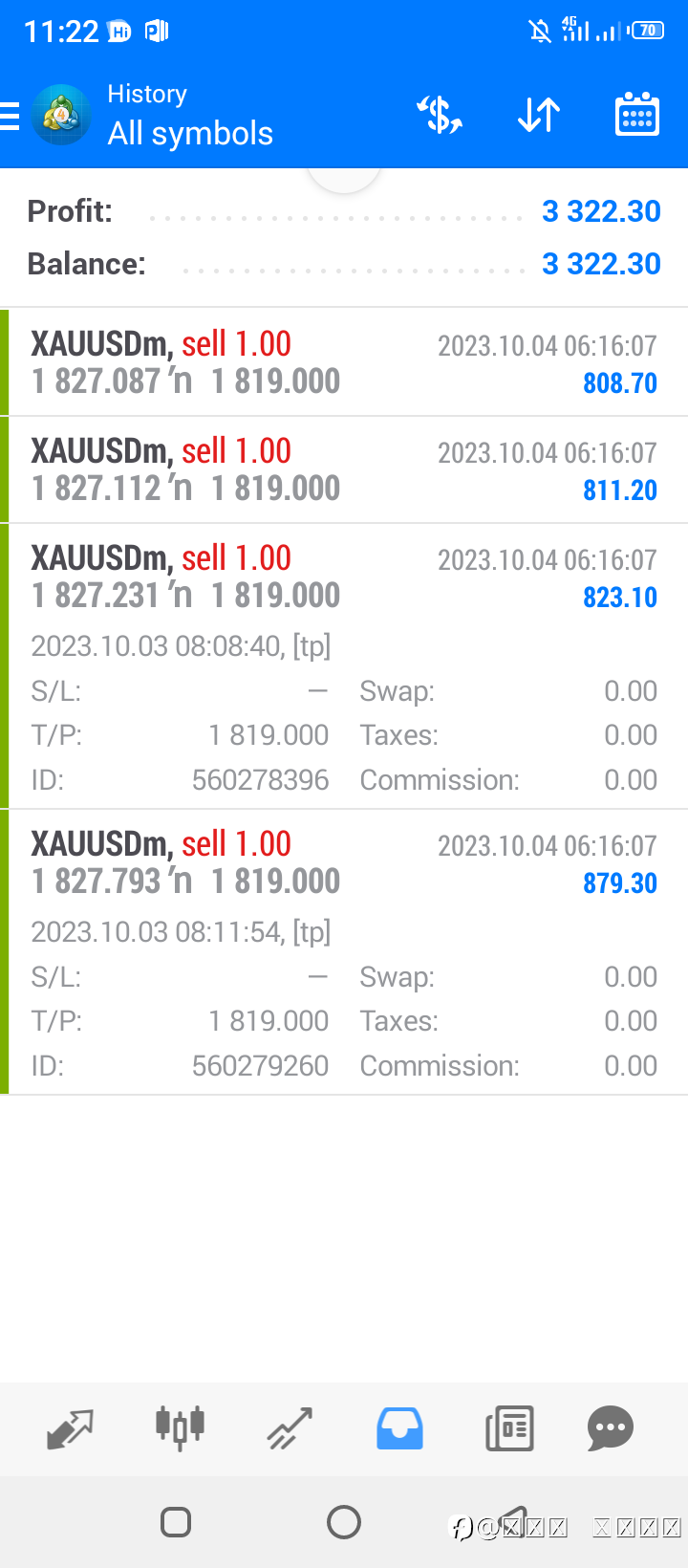

ScenarioTimeframeWeeklyRecommendationBUY STOPEntry Point4400.5Take Profit4500.0Stop Loss4350.0Key Levels4200.0, 4300.0, 4400.0, 4500.0Alternative scenarioRecommendationSELL STOPEntry Point4299.5Take Profit4200.0Stop Loss4350.0Key Levels4200.0, 4300.0, 4400.0, 4500.0Current trend The leading index of

他点赞了

EUR/NZD: ICHIMOKU INDICATORS ANALYSIS

ScenarioTimeframeIntradayRecommendationSELLEntry Point1.76170Take Profit1.75255Stop Loss1.76900Key Levels1.75000, 1.75255, 1.76615, 1.76900Let's look at the four-hour chart. Tenkan-sen line is below Kijun-sen, the lines are horizontal . Confirmative line Chikou Span is below the price chart, current

他点赞了

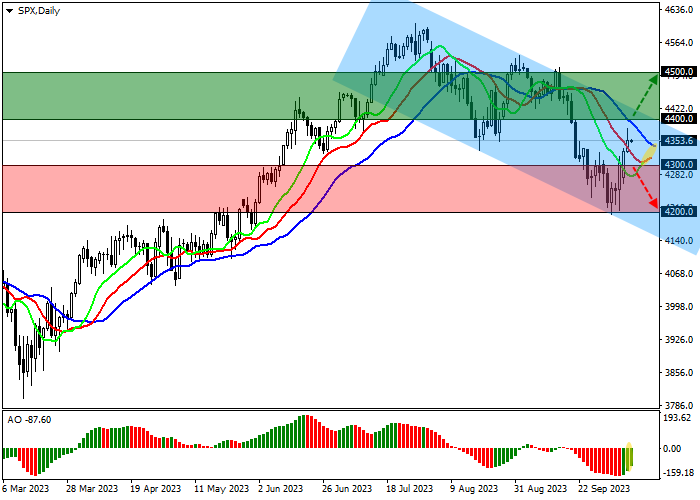

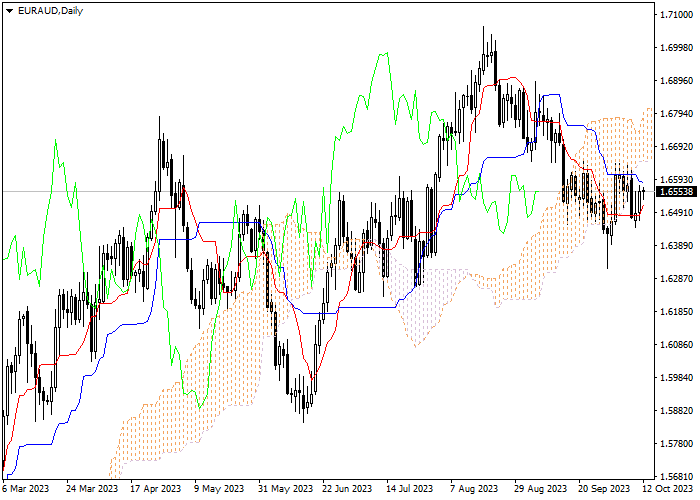

EUR/AUD: ICHIMOKU INDICATORS ANALYSIS

ScenarioTimeframeIntradayRecommendationBUYEntry Point1.6552Take Profit1.6673Stop Loss1.6511Key Levels1.6370, 1.6511, 1.6611, 1.6673Let's look at the four-hour chart. Tenkan-sen line is below Kijun-sen, the lines are horizontal . Confirmative line Chikou Span is approaching the price chart from below

他点赞了

AUD/NZD: ICHIMOKU INDICATORS ANALYSIS

ScenarioTimeframeIntradayRecommendationBUYEntry Point1.0668Take Profit1.0795Stop Loss1.0634Key Levels1.0487, 1.0634, 1.0729, 1.0795Let's look at the four-hour chart. Tenkan-sen line is below Kijun-sen, the red line is directed upwards, while the blue one remains horizontal. Confirmative line Chikou

他点赞了

MORNING MARKET REVIEW

EUR/USD The EUR/USD pair is developing upward dynamics, updating local highs from September 25. The instrument is testing the level of 1.0630, while investors are in no hurry to open new positions ahead of the publication of minutes of the European Central Bank (ECB) meeting and September statistics

他点赞了

正在加载中...