Japanese economy has been stagnant since the Asian crisis. In an effort to stimulate growth and inflation the Bank of Japan has kept interest rates in the negative territory. Negative rates and lackluster stock market performance has pushed Japanese investors to overseas market. Japanese pension funds and banks hold vast amount of US treasury debt.

Negative rates make Japanese Yen a perfect funding currency for carry trades. Carry trades involves borrowing in low interest rate currencies and investing in higher interest ones. During good times Yen gets sold to fund carry trades. Yen normally strengthens during crisis times as speculators unwind their speculative bets in anticipation of asset repatriation and unwinding of carry trades.

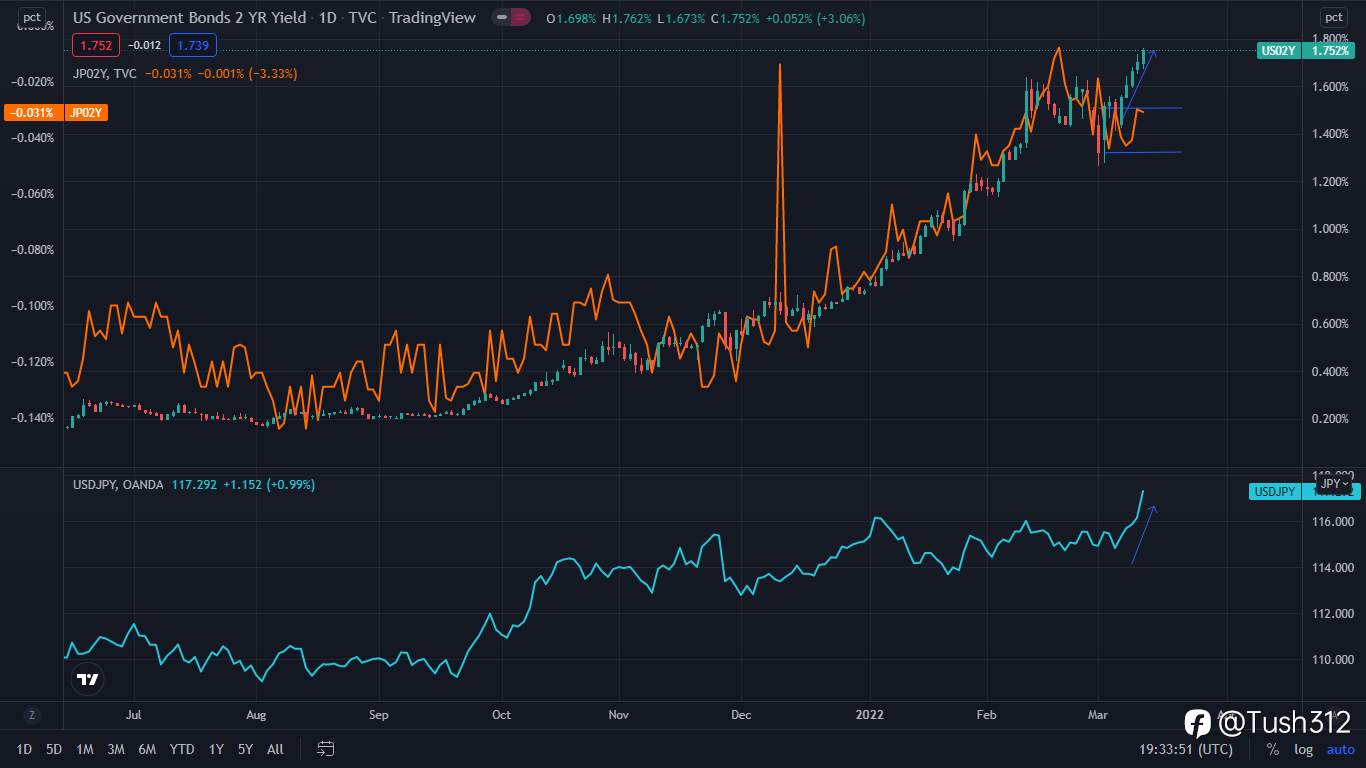

This time is different. Yen has Weakened as the Russia – Ukraine invasion unfolded. Japan is a net importer of commodities from crude oil to grains. Russia-Ukraine crisis has disrupted supply of those commodities causing their prices to soar. Higher commodity prices will dampen the outlook of Japanese current account putting pressure on the Yen. Increasing pressure on the FED to hike rates to curb hot inflation is also putting upward pressure on US bond yields. Raising US bond yields and flat Japanese equivalents is causing the spread between them to widen. The yield spread best explains movements in USDJPY exchanges rates.#OPINIONLEADER#

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()