The yield spread between Germany 2-year bond yields and United States equivalent has been widening in favor of the dollar for the last two trading days. Historically the yield spread leads or moves in tandem with exchange rates. Europe is more exposed to global recession due to its economy being more reliant on trade. As market participants price in more recession fears yields on Germany bonds will fall further and dollar will more likely get a boost from haven trades.

Leveraged funds have turned bearish on the euro according to CFTC data on non-commercial net positions on futures and options.

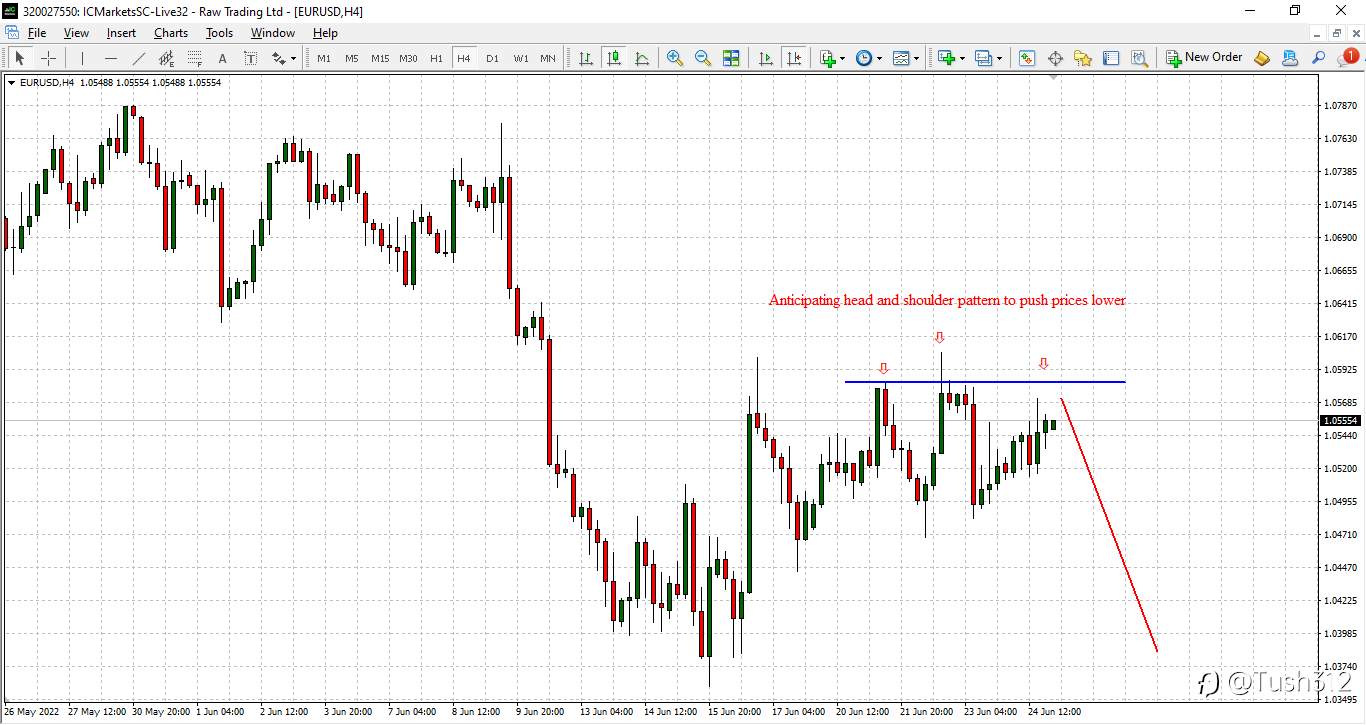

Price action from the charts show euro losing momentum to the upside and its more likely to form the famous head and shoulders price pattern suggesting further move to the downside.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发