Canadian Dollar Talking Points

USD/CAD appears to be reversing course following the failed attempt to test the yearly high (1.3224), but the Bank of Canada (BoC) interest rate decision may keep the exchange rate afloat as the central bank is expected to adjust its approach in combating inflation.

Fundamental Forecast for Canadian Dollar: Bearish

USD/CAD continues to pullback from the weekly high (1.3208) as the US Non-Farm Payrolls (NFP) report does little to prop up the Greenback, and the exchange rate may face a further decline over the coming days as it snaps the series of higher highs and lows from earlier this week.

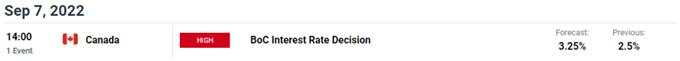

However, the BoC rate decision may sway the near-term outlook for USD/CAD as Governor Tiff Macklem and Co. are expected to deliver a 75bp rate hike after deciding to “front-load the path to higher interest rates by raising the policy rate by 100 basis points” at the last meeting.

As a result, the Canadian Dollar may face headwinds if the BoC shows a greater willingness to normalize monetary policy at a slower pace, and a shift in the forward guidance for monetary policy may prop up USD/CAD as the Federal Reserve prepares US households and businesses for a restrictive policy.

With that said, recent price action raises the scope for a near-term pullback in USD/CAD as it snaps the recent series of lower highs and lows, but the exchange rate may stage further attempts to test the yearly high (1.3224) as the BoC is expected to implement smaller rate hikes.

--- Written by David Song, Currency Strategist

Follow me on Twitter at DavidJSong

暂无评论,立马抢沙发