Weekly Fundamental Japanese Yen Forecast: An Uphill Climb

Advertisement Fundamental Forecast for the Japanese Yen: NeutralThe Bank of Japan was lackluster as expected, but the Ministry of Finance’s surprise intervention caught FX markets off-guard, sparking a huge turnaround in the Japanese Yen.The Ministry of Finance’s efforts are unlikely to produce a la

US Dollar Roars to New Highs Since 2002 in a Crushing Winning Streak, Where to?

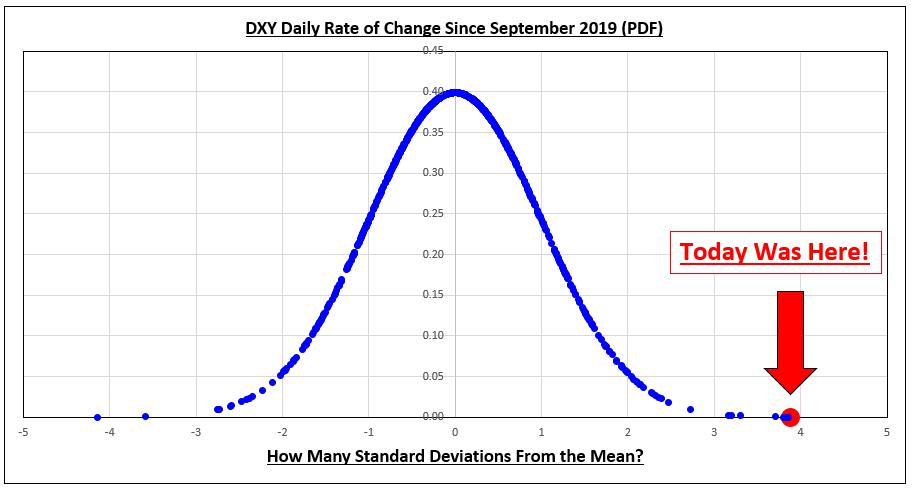

US Dollar, DXY Index, 2002 Highs, Rare Trend – Weekly Technical Outlook The odds of US Dollar’s 1.5% rise last Friday was about 0.1%DXY shot past key levels of resistance, eyeing new highs since 2002What are key technical levels to watch to the upside/downside? Trade Smarter - Sign up for the DailyF

Euro (EUR) Forecast – EUR/USD Bearish Trend Remains in Complete Control

EUR/USD Price, Chart, and Analysis Fundamentals and technicals look weak.The next ECB policy meeting is over a month away. The ECB raised all three of its policy rates by 75 basis points at the September 8 central bank meeting, steadying the single currency in the short-term, but with a host of othe

US Dollar Strength to Persist with US PCE to Show Sticky Inflation

US Dollar Talking Points The US Dollar Index (DXY) clears the June 2002 high (112.04) as the Federal Reserve implements another 75bp rate hike, and the update to the US Personal Consumption Expenditure (PCE) Price Index may keep the Greenback afloat as the report is anticipated to show sticky inflat

Australian Dollar Outlook: Fed Decision Rocks Currency Markets

AUSTRALIAN DOLLAR FORECAST: BEARISH The Australian Dollar sunk in the aftermath of the Fed’s rate riseThe RBA has signaled a less hawkish approach to monetary policyThe Fed’s jumbo hike has given USD some backbone. Will AUD/USD go lower? The Australian Dollar appears captive to the machinations of t

Markets Week Ahead: Nasdaq 100, S&P 500, Gold, US Dollar, British Pound, CPI Data

Market volatility cooled in the first full trading week of September after a mostly rough August. On Wall Street, the Nasdaq 100, S&P 500 and Dow Jones climbed 4.73%, 4.17% and 3.1%, respectively. Things were also looking rosy in Europe, with the DAX 30 and FTSE 100 climbing 0.29% and 0.96% resp

Canadian Dollar Forecast: USD/CAD Hinges on US Inflation Data as Fed Weighs Path

USD/CAD OUTLOOK: SLIGHTLY BULLISHUSD/CAD has been trending higher in recent weeks despite the moderate retreat over the past few days and heading into the weekendBroad-based U.S. dollar strength and oil market weakness have been two bearish catalysts for the Canadian dollar since early AugustThe Aug

Euro Fundamental Forecast: EU Emergency Energy Meeting, ECB Aftermath & HICP

Euro Weekly Fundamental Forecast: BearishEU Emergency Meeting - Draft Proposals Well Received OverallMarkets unconvinced by ECB Pseudo-Hawkish StatementsRisk Events Ahead: ZEW sentiment, EU balance of trade data and eurozone inflation Advertisement EU Emergency Energy Meeting – Draft Proposals Well

Gold Price Rebound Vulnerable to Sticky US Inflation

Gold Price Talking Points The price of gold appears to be on track to test the 50-Day SMA ($1743) following the failed attempt to test the monthly low ($1689), but fresh data prints coming out of the US may curb the recent rebound in bullion as the Consumer Price Index (CPI) is anticipated to show s

US Dollar Eyes CPI Data as FOMC Members Go Dark: DXY Weekly Outlook

US Dollar Fundamental Forecast: NeutralUS Dollar cooled after the ECB boosted the Euro with a jumbo rate hike FOMC members go dark as markets see solid chance for a 75-bps hike The US consumer price index (Aug) offers the next cue for USD direction US Dollar strength cooled last week. The DXY Index

Australian Dollar Outlook: RBA Hikes are Lost in Global Turmoil

AUSTRALIAN DOLLAR FORECAST: BEARISHThe Australian Dollar could see interest rate disparity widen against it RBA intimated a deceleration in rates while the Fed and ECB are full steam aheadChina’s slowdown is sabotaging prospects. Will AUD/USD go lower? The Australian Dollar had moments of volatility

Markets Week Ahead: Dow Jones, US Dollar, EUR/USD, USD/CAD, AUD/USD, Gold, ECB, BOC, RBA

Global equity markets closed the week with steep losses as traders shifted their money out of risk assets, worried by economic concerns and inflation-focused central banks that appear ready to continue tackling high prices even if it induces recessions. US stocks opened higher on Friday after the US

Markets Week Ahead: Dow Jones, US Dollar, Gold, Bitcoin, Oil, Inflation, China, Jackson Hole, Fed

US stock indexes turned lower last week, with losses accelerating into the weekend as the US Dollar surged. Federal Reserve rate hike bets firmed up a bit after hawkish rhetoric from James Bullard and Esther George, two FOMC voters. The Dow Jones Industrial Average fell 0.86% on Friday, trimming ear

USD/CAD Rate Outlook Hinges on BoC Interest Rate Decision

Canadian Dollar Talking PointsUSD/CAD appears to be reversing course following the failed attempt to test the yearly high (1.3224), but the Bank of Canada (BoC) interest rate decision may keep the exchange rate afloat as the central bank is expected to adjust its approach in combating inflation. Fun

Euro ( EUR) Forecast – The ECB Needs to Ramp Up Interest Rates and Fast

EUR/USD Price, Chart, and AnalysisMarket pricing expects a 75 basis point hike. Any dovish disappointment will see the Euro tumble. The European Central Bank meeting next Thursday is likely to see the central bank hike rates by 75 basis points to 1.25% in an effort to stem sky-high inflation. The de

正在加载中...