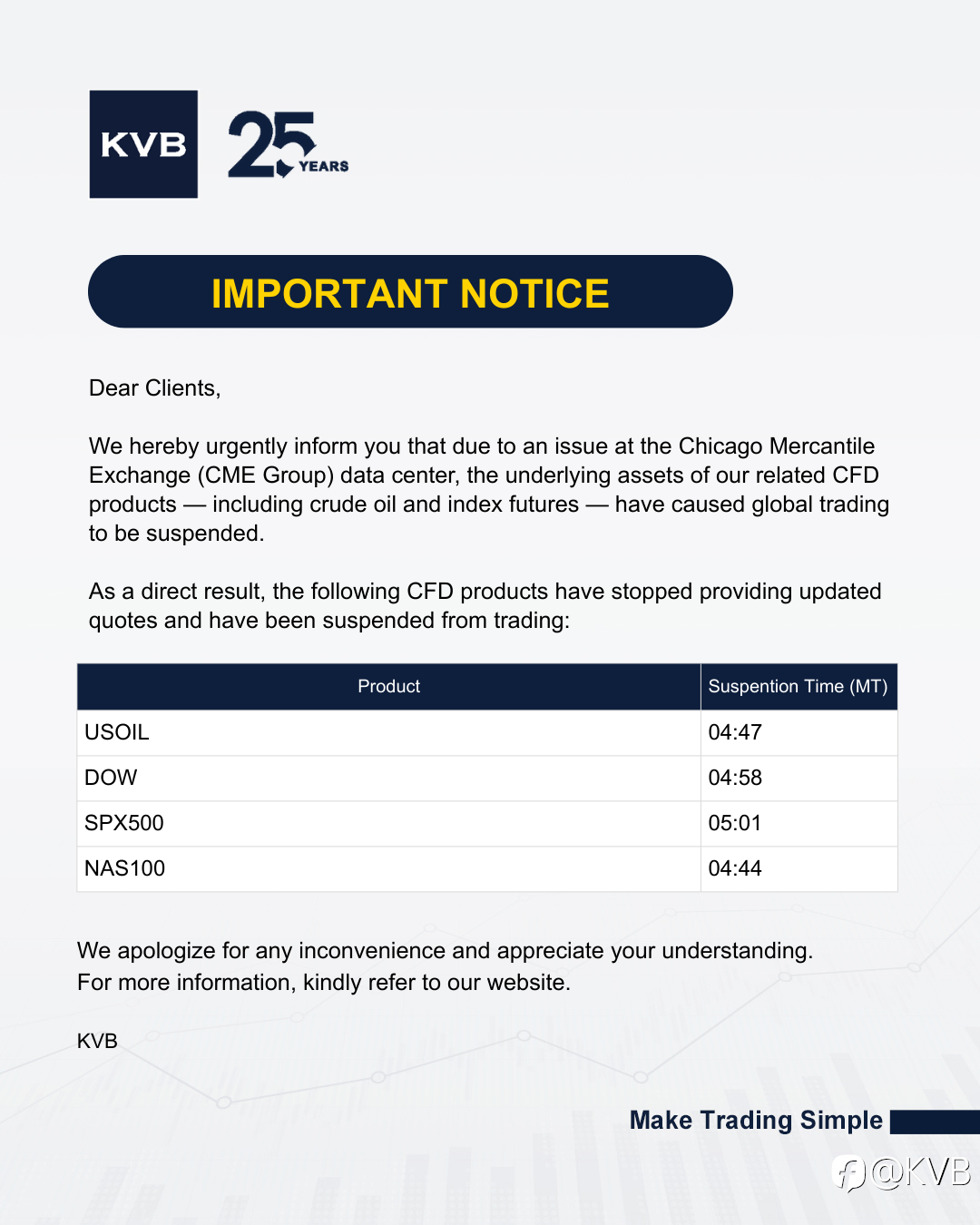

SPX500

Standard & Poor's 500 Index

6992.3

19.0

(0.27%)

Prices By FOLLOWME , in USD

数据

LOW

HIGH

6970.1

6998.3

1 W

+0.97%

1 MO

+0.97%

3 MO

+2.20%

6 MO

+8.29%

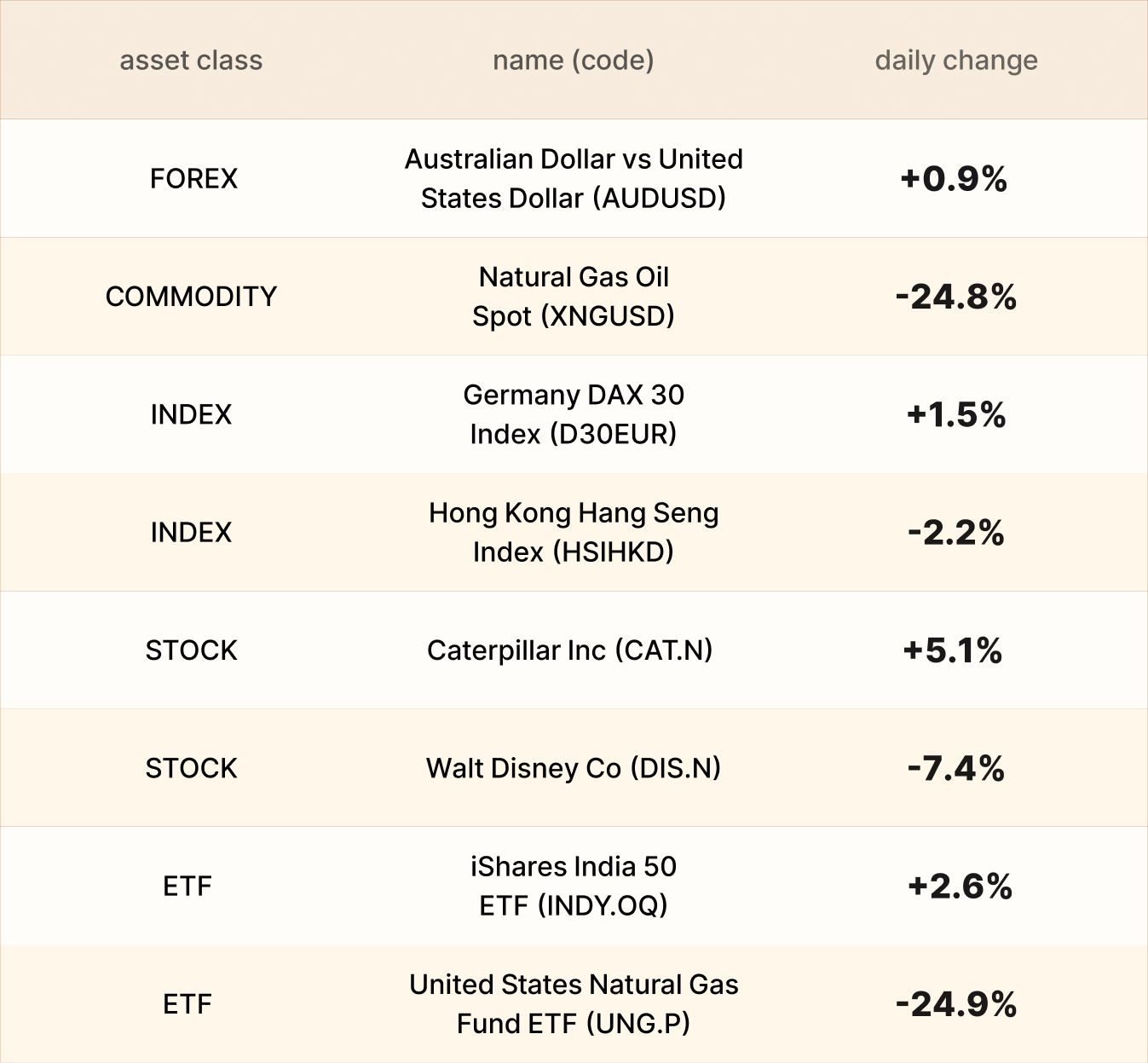

EBC Markets Briefing | Wall St resilient; Disney concerns jeopardized shares

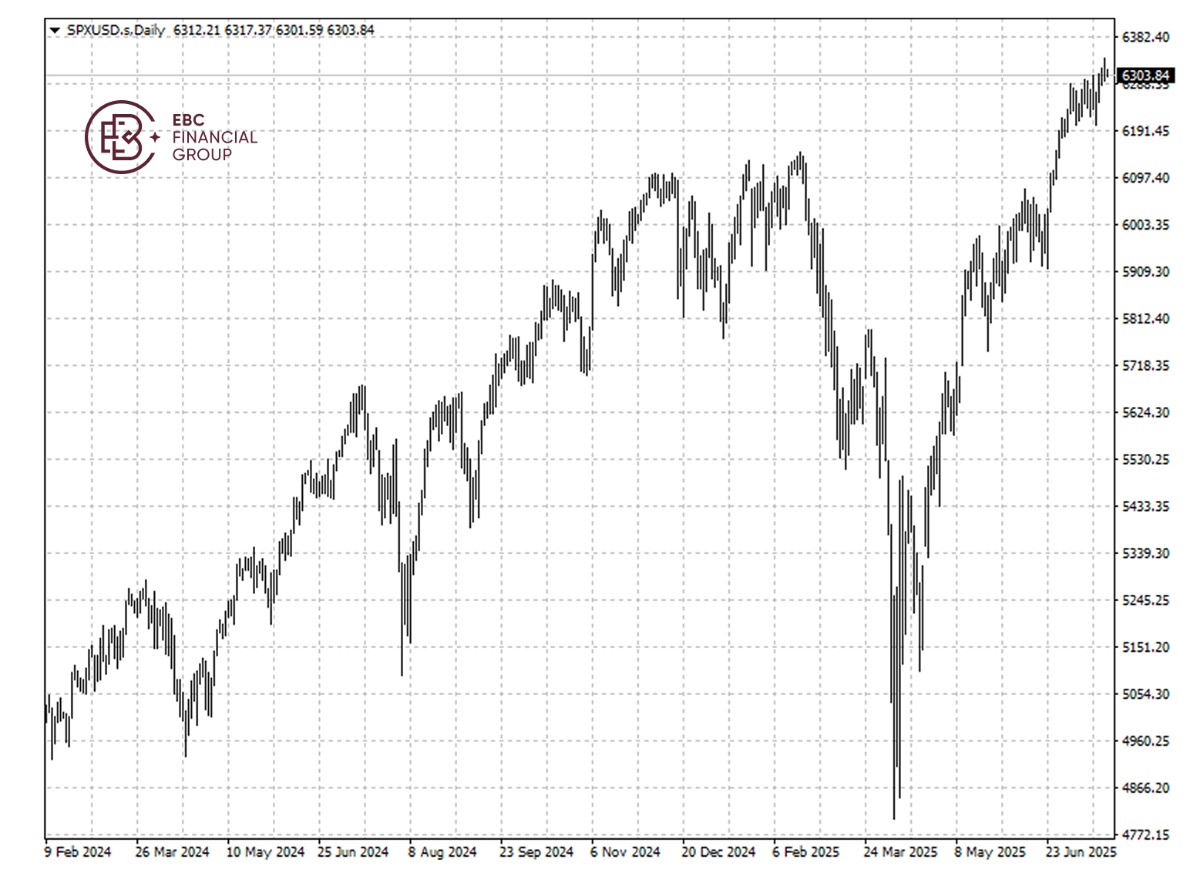

Wall St opened the new month higher on Monday, with focus shifting to Nvidia. According to WSJ, the chipmaker's plans to pour $100 billion into OpenAI had stalled on doubts over potential benefits. Deutsche Bank said earnings growth is on track to be the strongest in four years. So far, about one-th

- School app _Motivation :Every ten minutes

South Korea Bourse Poised To Extend Its Gains

The South Korea stock market on Wednesday ended the three-day losing streak in which it had fallen almost 60 points or 2 percent. The KOSPI now sits just beneath the 2,990-point plateau and it may add to its winnings on Thursday. The global forecast for the Asian markets is upbeat following results

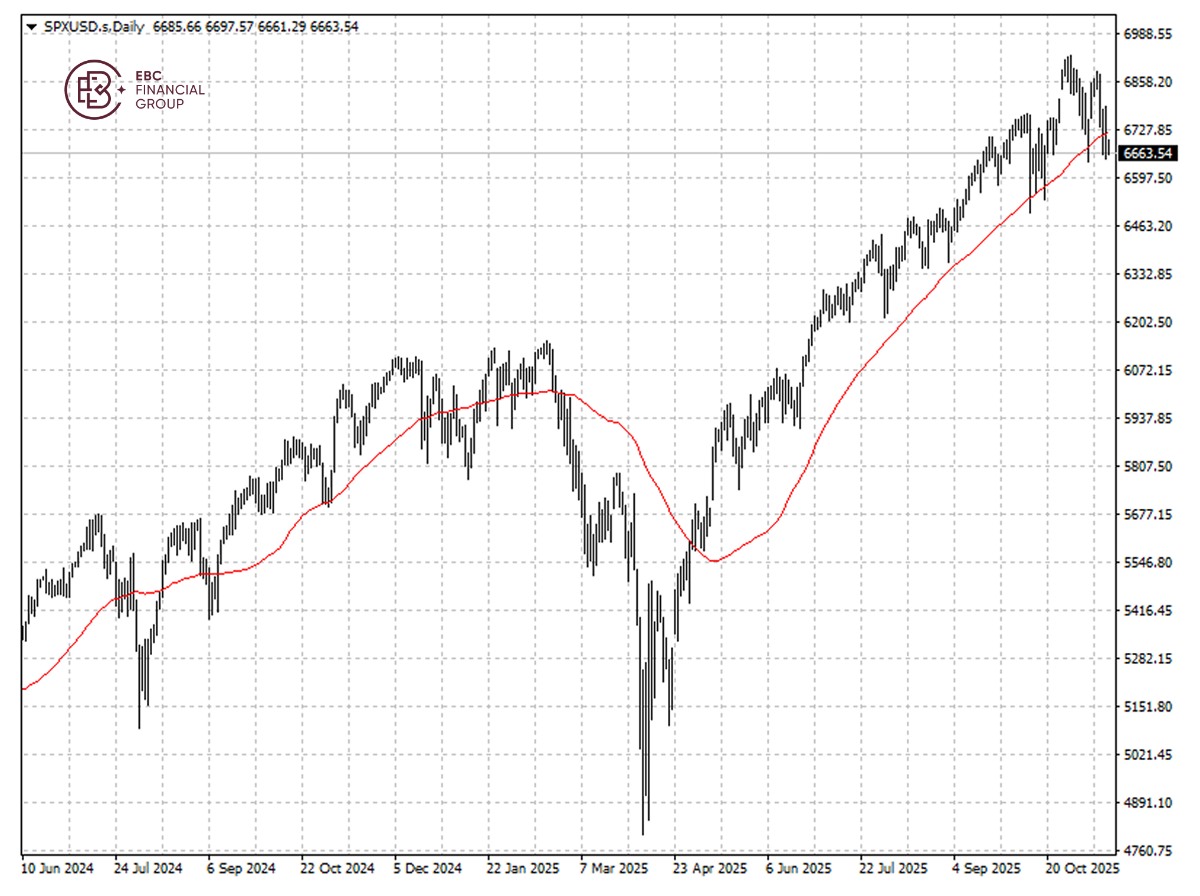

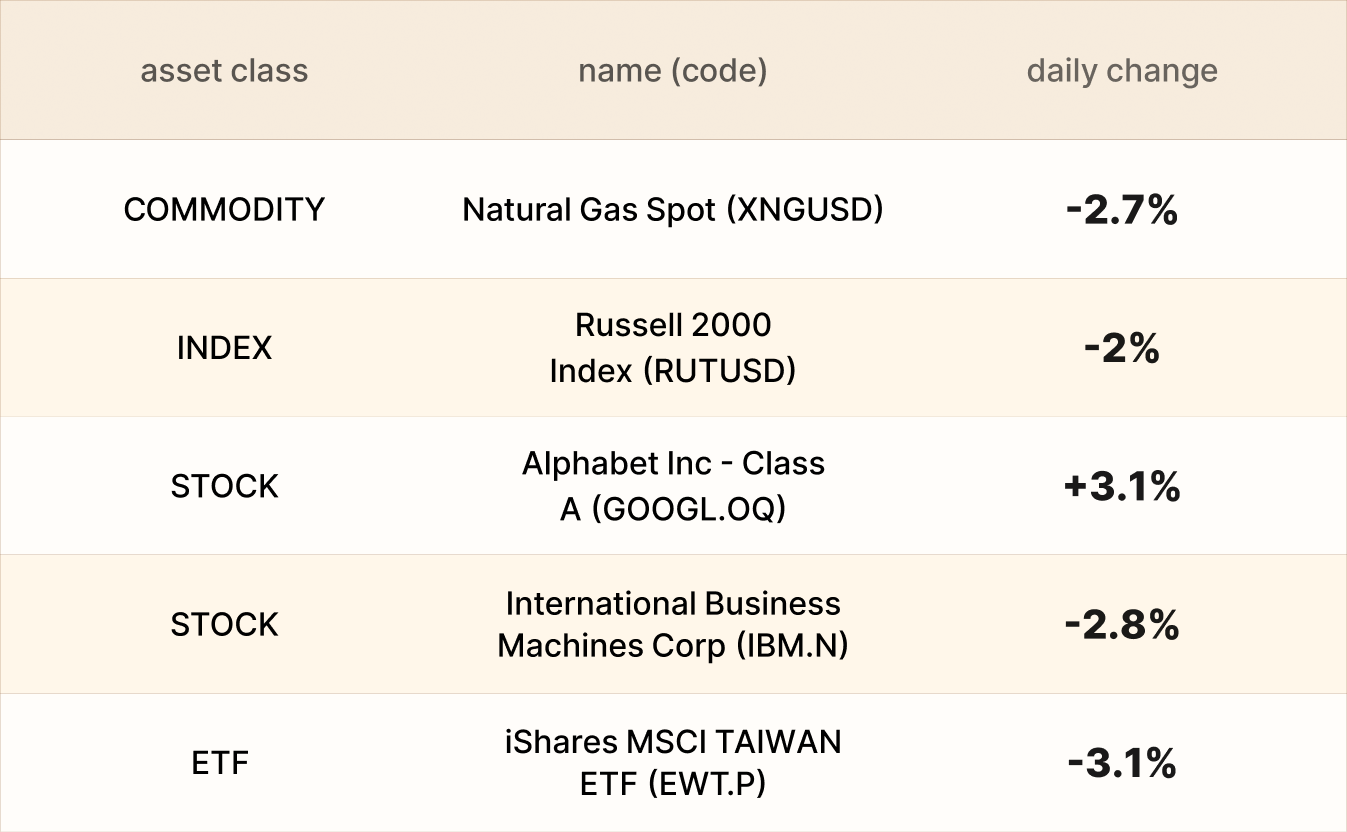

EBC Markets Briefing | Wall St wallows; Berkshire endorses Alphabet

US stocks ended down sharply on Monday, with the S&P 500 closing below a key technical indicator for the first time since April, as optimism following the end of government shutdown faded. Trade Representative Jamieson Greer said on Friday that Trump was ready to follow through with pledges to g

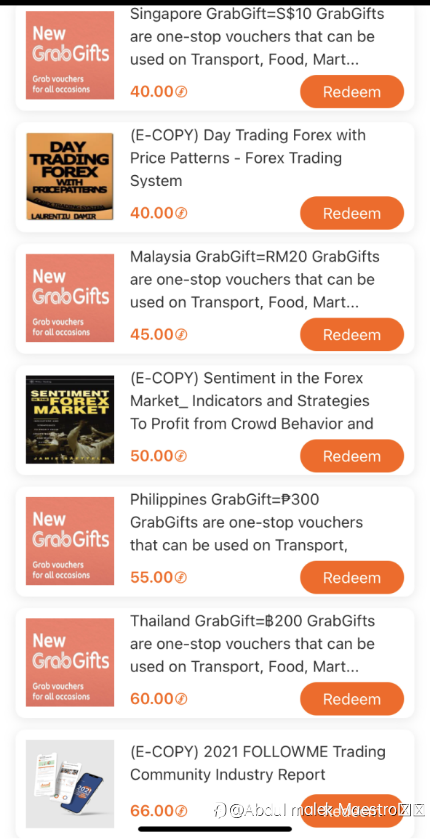

What Are The Best Indices To Trade?

There is a wide range of stock indices available to trade today. Some of the most popular indices among traders include: The Dow Jones Industrial Average (DJ30): Launched in 1885, the Dow Jones is one of the oldest stock indices in the world. It comprises 30 large publicly-owned companies in the US.

- Fernandez Morgan :All thanks to this company getting my first profits of $9.000 was a grateful day reach her now on Instagrám Henriella Geoffrey fxtrade

- zarewa188 :hello

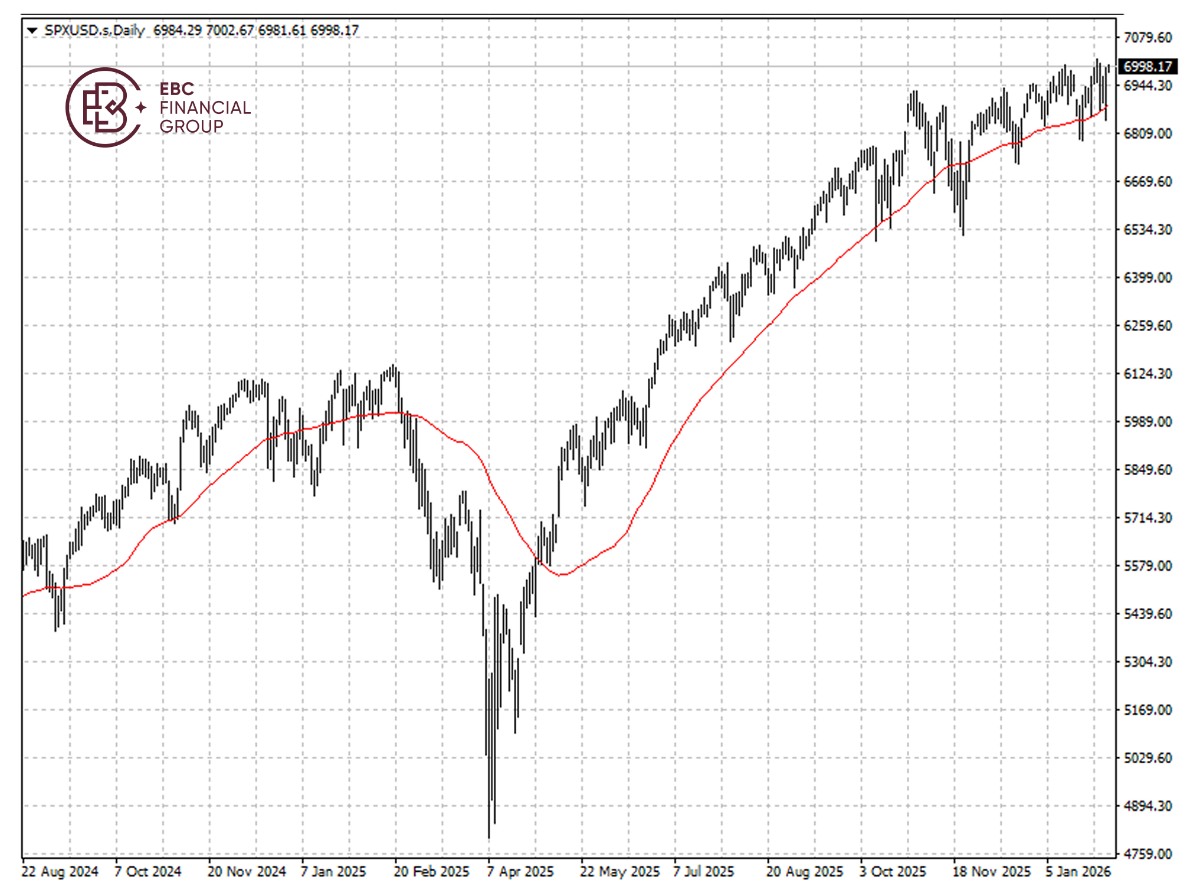

EBC Markets Briefing | US stock bulls are roaring back

A report that Trump wanted a minimum of 15%-20% tariffs – higher than the anticipated universal 10% rate - on the EU only dealt a minimal blow to markets. The S&P 500 is sitting around its record peak. An upbeat start to earnings season has also helped to quell tariff fears for now. Around 83% o

正在加载中...