EURNZD

Euro / New Zealand Dollar

1.95995

-0.00015

(-0.01%)

Prices By FOLLOWME , in USD

数据

LOW

HIGH

1.95921

1.96080

1 W

-0.29%

1 MO

-0.56%

3 MO

-4.00%

6 MO

-3.18%

- 1056322 :Hello 👋

- Lindzee Wvwvbaby :hello

- Mark Jeffrey :Trading with an expert is the best strategy for newbies and busy investor send a private message to Magdalena J Gabriel for good tips @Fb📚

Best Forex Broker in USA 2022: Top US Forex Brokers List

The foreign exchange market, also known as the Forex market or the FX market, is also one of the global markets that witnesses a trading volume of almost $6.6 trillion every day. Foreign exchange refers to exchanging one currency trading with another for different reasons that include tourism, inter

- Fernandez Morgan :I started my investment with $100 and I made $1450 in just 3days of trading with Henriella Geoffrey fxtrade on Instagrám

- Important_Rain77 :thank you for being a great fan of mine send me friend request I promise to accept it.........

What Is The US Dollar Index And How Can You Trade It?

What is the US Dollar Index? The US Dollar Index (DXY, DX, USDX) measures the value of the United States dollar relative to a basket of other currencies, including the currencies of some of the US’s major trading partners. The Dollar Index rises when the US dollar gains strength compared to the othe

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

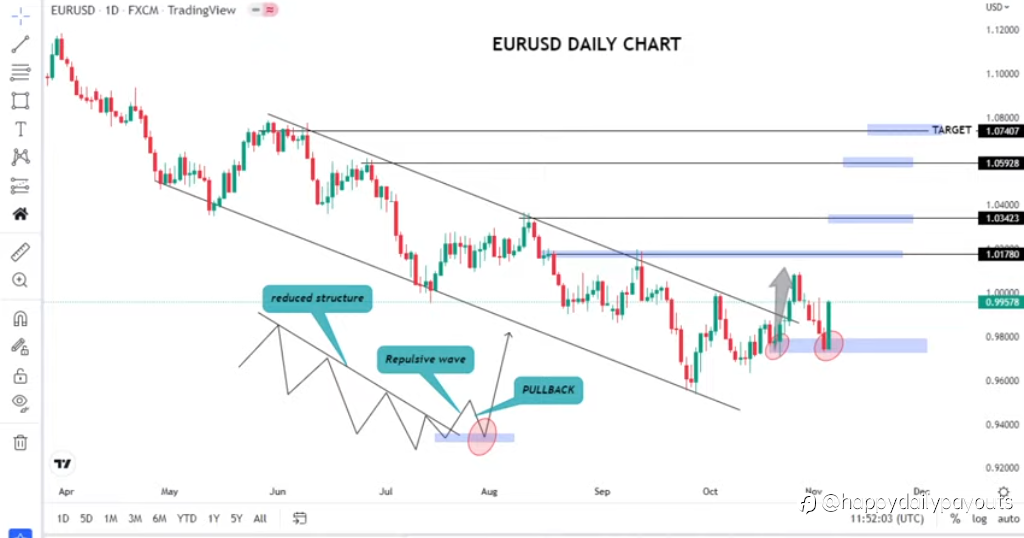

Euro (EUR) Forecast – EUR/USD Bearish Trend Remains in Complete Control

EUR/USD Price, Chart, and Analysis Fundamentals and technicals look weak.The next ECB policy meeting is over a month away. The ECB raised all three of its policy rates by 75 basis points at the September 8 central bank meeting, steadying the single currency in the short-term, but with a host of othe

- morgan freeman :I'm making profit of $5,900 every week with a little capital of $600 with the help a good mentor 👉Emliy-Fx-Exchanged on facebok

- Fernandez Morgan :I started my investment with $100 and I made $1450 in just 3days of trading with Henriella Geoffrey fxtrade on Instagrám

There is an analysis of the NZDUSD H1 chart

We used the theory of price action in order to conduct this analysis, so that we could guide our decision-making process. Based on the results of this analysis, we can see that the price is moving upwards while using the ascending channel to do so. In the past several months, the price has given us

Everything You Need To Know About The Bank Of England

What is the Bank of England (BoE)? The Bank of England is the United Kingdom’s central bank. The BoE is tasked with setting monetary policy and issuing currency, as well as regulating banks and being the lender of last resort – meaning it provides loans to banks and other institutions that are in fi

- 北极帮 :💪

- imeji2 :As a beginner investor, it's is essential for you to have a mentor to keep you accountable. Myself, I'm guide by Magdalena J Gabriel. @FB📚

- Bitter_Snow9530 :Would you like to earn 200$ daily? Inbox me for more information

NZDUSD’s Minor Uptrend Prevails after Deflection Off 200-MA

#OPINIONLEADER# NZDUSD has generated positive traction off the 50-day simple moving average (SMA), which is bordering the tentative uptrend line pulled from the 16-month low of 0.6528. The longer-term 100- and 200-day SMAs are defending the broader bearish trend in the pair, whil

Broker News | CMC Markets Renews Rugby Team Blues Sponsorship for 3 More Years

#Industry 01 Q&A Weekly Review - What's Asked This Week? A Q&A Weekly Review keeps traders informed of the latest regulatory status and trading details of brokers mentioned by our users in a given week. 02 CFreserve - Your Investment Might Be At Risk! Financial frauds have always been a conc

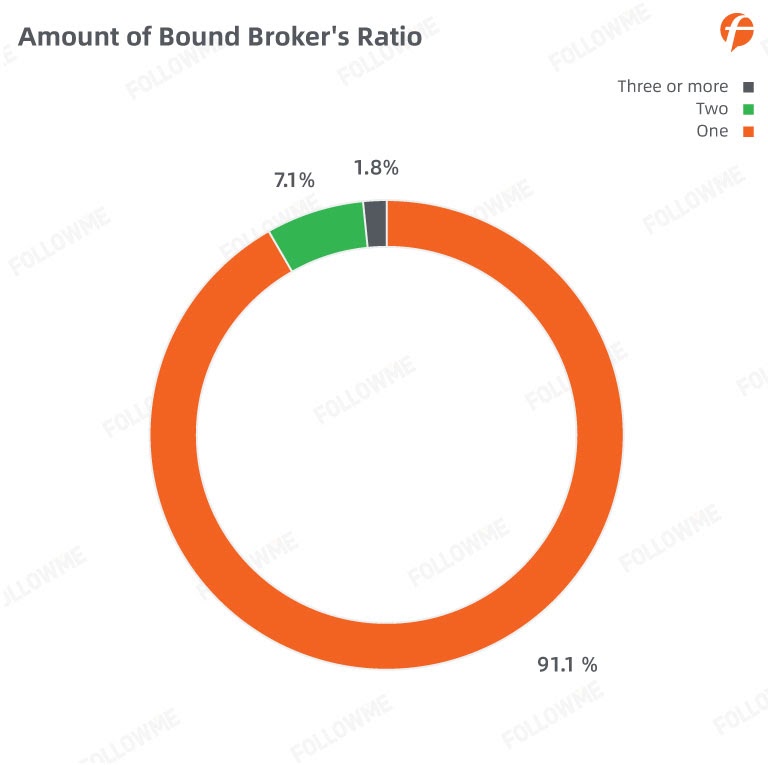

FOLLOWME Community Trading Report the third quarter of 2020

Introduction: Since the beginning of the year, the global outbreak of COVID-19 has prompted countries and major economies around the world to adopt a series of large-scale economic stimuli to ease policies. Central banks, led by the Federal Reserve, have adjusted their monetary policies to inject li

- LittleRabbit :wow very informative! thanks a lot!

- Tony Stark :wow cool😎

- elleefx :Thanks for the info

Stock Markets Dive Further, But Others Steady

#OPINIONLEADER##OPINIONLEADER# Markets are staying in risk aversion today with heavy selling in stocks. Expectations on the negotiation between Ukrainian President Volodymyr Zelenskyy and Russian President Vladimir Putin are low. Meanwhile, other markets are relatively

- AbuSalaam :hi

- 钉子侠 :💪

Trading Safe Haven Assets

#OPINIONLEADER# Where does money flow in times of financial stress and why? Safe haven assets are financial instruments or commodities that investors turn to in times of stress. We’re not talking about personal stress, not in this article, anyway, but the type of stress seen in the wi

- Fernandez Morgan :Invest $100 and earn $8500 weekly with Henriella Geoffrey fxtrade @Instagrám and recover your funds as well

- jesh49 :To Get Professional Trading services with good trading signals, ℭOMMUNℑℭATE. 𝗸𝗮𝘁𝗵𝗿𝘆 on ⒾⓃⓈⓉⒶⒼⓇⒶⓂ 𝗸𝗮𝘁𝗵𝗿𝘆𝗻 𝗰𝗮𝗿𝗹𝘀𝗼𝗻0

- 雄鹿之角 :🍺

How Regulations Can Protect Retail Traders in Africa

CAPITAL markets in Africa are generally not as sophisticated as those abroad. Some stock exchanges in Africa can stay for one year without listing a single company. With the exemption of South Africa, Kenya and most recently Nigeria, the derivative market is not functional nor properly regulated in

- adipati_katebe :platform apa yang paling populer disana?

READ N' GO-Daily News Recap

Good morning traders! This is the official account to find out all the breaking news that may/may not affect your trading decision such as economic policies, political moves, global agendas, etc. BUT first, to start off your day with a bang, here's a recap of the important news we think you should r

Crude oil rallies ahead of OPEC+ meeting and inventory data

The Canadian dollar moved sideways after the latest interest rate decision by the Bank of Canada. The bank decided to hike interest rates by 0.50%. Pushing the overnight rate to 1.50%. In addition, Tiff Macklem warned that more rate hikes were necessary to curb the soaring inflation. This was more h

- Mr ROGERS :@Mrjack708

- imeji2 :Trading with an expert is the best strategy for newbies and busy investor send a private message to Magdalena J Gabriel for good tips @Fb📚

正在加载中...