#BullishSentiment#

1.09k 浏览

375 讨论

Market sentiment refers to the overall attitude of investors toward a particular security or financial market. In broad terms, rising prices indicate bullish market sentiment.

- eddi clack :hi

- eddi clack :how are you doing today

EUR/USD before the FED

Today, an important comment from the FED on fiscal policy. The market expects nothing to change. The EUR / USD is in a continual correction after the recent decline on April 26. Always before a FED meeting, traders take profits in fear of a policy change. For me, this is a chance to buy EUR / USD at

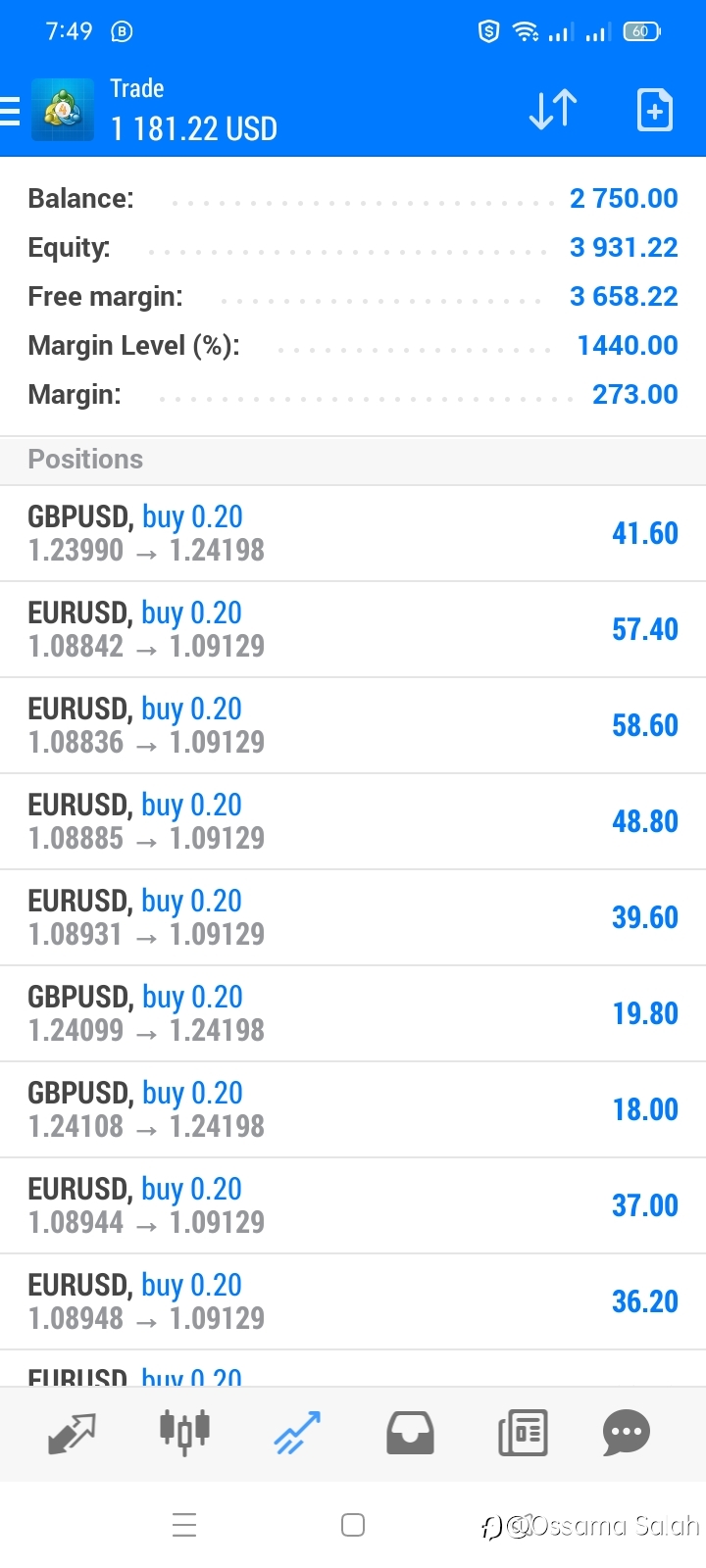

GBPUSD LONG on Order Flow - Follow the smart money!

#GBP/USD#

GBPUSD LONG on Order Flow - Follow the smart money!

Strong Bullish Signal: The Pound demonstrated an abrupt and sharp growth supported by the large volume and positive delta. Moreover, the pair has already broke out the previous resistance level . All these factors show the

Nikkei bullish price action is targeting W H5 camarilla

The Nikkei has formed an inverted head and shoulders pattern. The price is bullish and the pattern might provide a breakout to the upside.

22600-650 is the POC zone. We can see the bottom of the right shoulder as the price is trying to bounce. The first target is the trend line confluence around D H

USD/CHF Price Analysis: Wednesday’s bullish engulfing suggests scope for a rise to 0.95

USD/CHF's daily chart shows a bullish candlestick pattern and RSI divergence.

A move to 0.95 could be in the offing.

USD/CHF is trading at 0.9453 at press time.

The pair created a bullish engulfing candle on Wednesday, confirming a reversal higher from the downtrend from the March high of 0.9902.

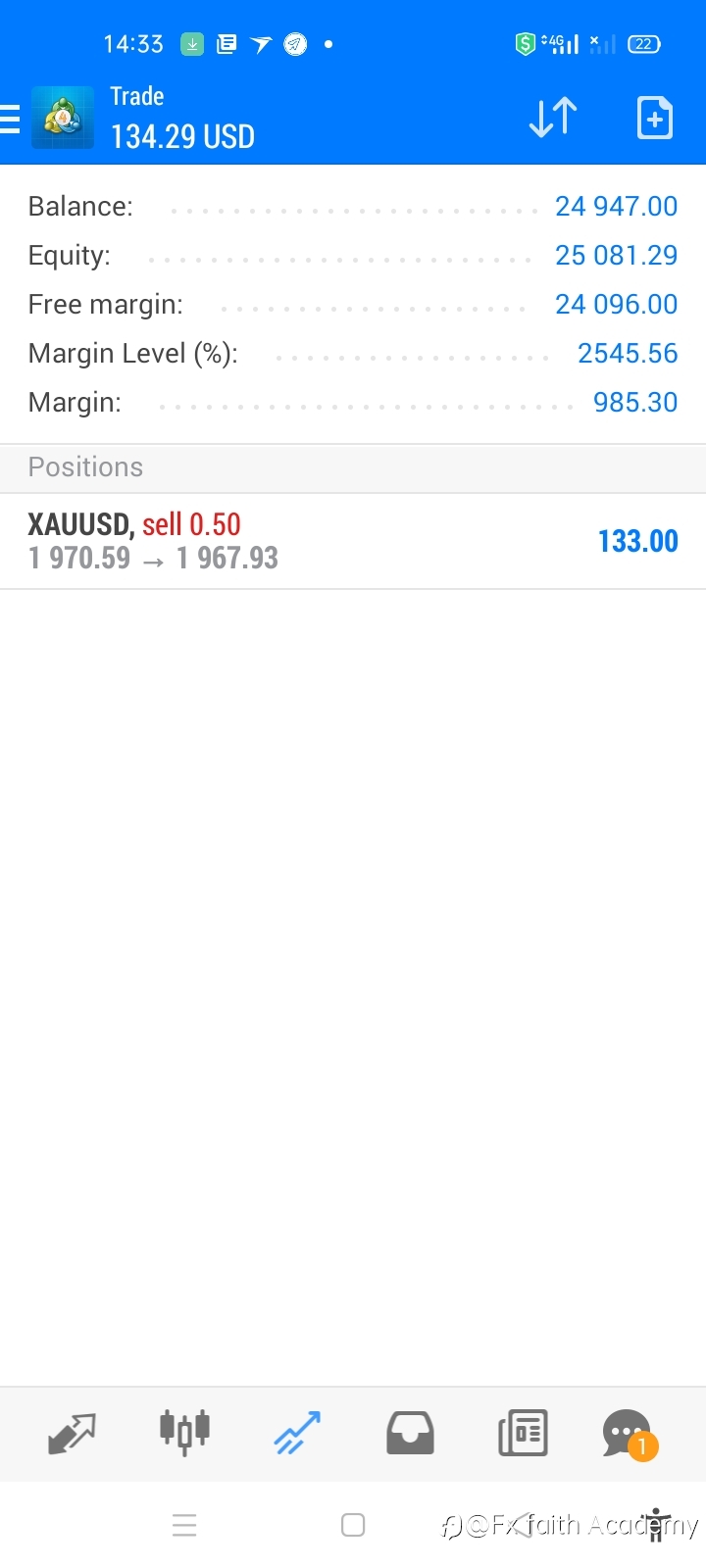

Gold Price Analysis: Acceptance above $1775 is critical for the XAU bulls – Confluence Detector

Gold kicked-off a fresh week on the defensive amid the upbeat market mood, although held onto the $1770 level. The stimulus expectations led rally on the global stocks could likely weigh on the safe-haven. Key technical levels to watch.

The Technical Confluences Indicator shows that the yellow metal

USOIL-Looking again for (X) or (4) to above 90$

#OPINIONLEADER# #ElliottWaves# #CrudeOil# #BullishSentiment# #howtotrade# #howtomasterforextrading# #ForexEducation# Market Commentary: 1. Looking for a sharp bounce in 5 wave structure to the me

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 60 FOCIN that can withdraw. Click to know more details about //socia...

WTI Price Analysis: Stuck around $42.50 in a symmetrical triangle

WTI stays struggles to extend the run-up past-100-bar SMA inside an eight-day-old triangle.

Normal RSI conditions, sustained trading above the key SMA keeps buyers hopeful.

Sellers may aim for $40.60/55 on the confirmed downside.

WTI eases from intraday top of $42.69 to $42.51, still up 0.06% on a

NZDUSD, Where to Buy?..

#NZD/USD#

If the price will show an exit from that triangle we can look for a Buy position. The Global trend is bullish that's why buy is more possible! Dear followers, the best "Thank you" will be your likes and comments! Before to trade my ideas make your own analysis. Thanks for yo

正在加载中...