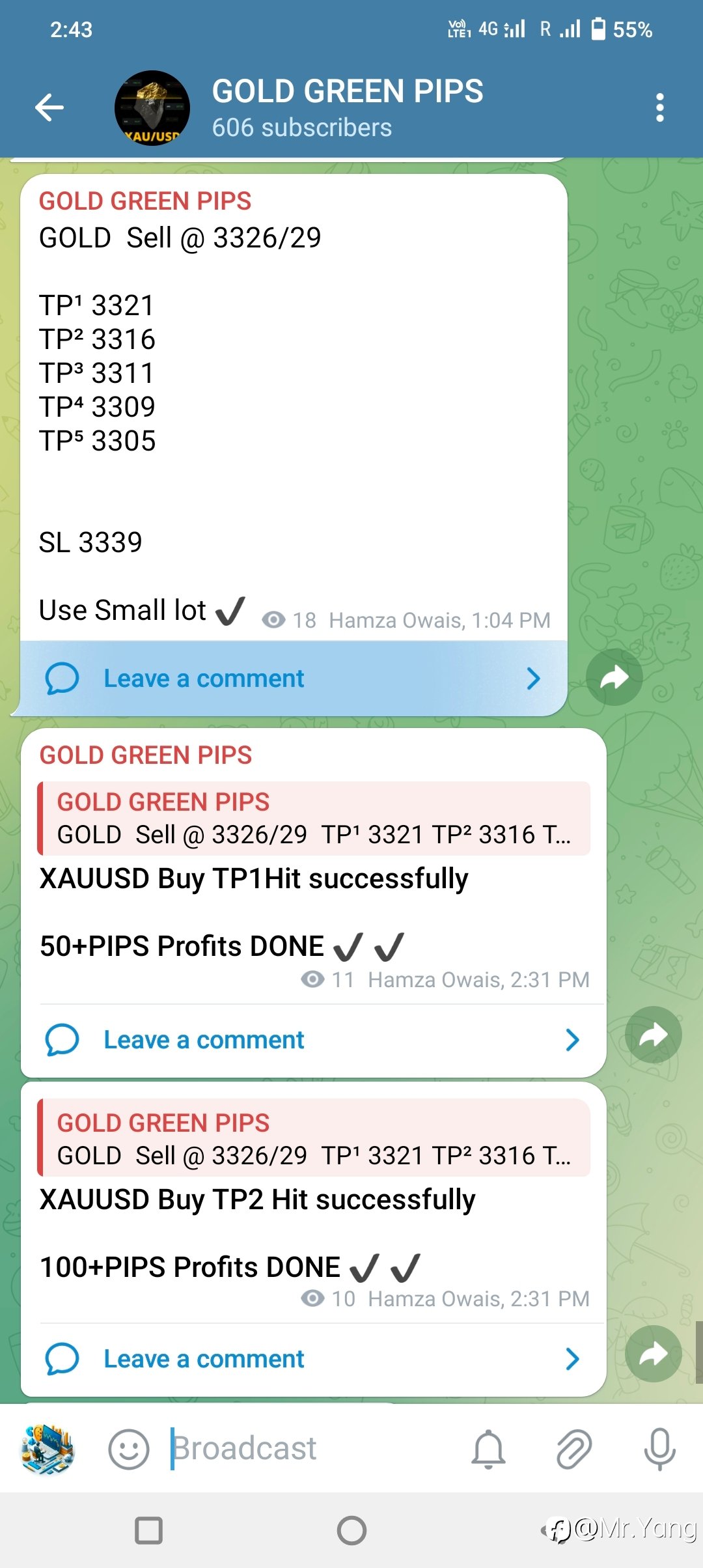

📰 Fundamental Analysis XAU/USD (Gold) Outlook

The technical setup on your chart points to a potential short-term pullback into a strong demand zone. The fundamental backdrop, dominated by the US Federal Reserve (Fed) meeting this week, largely supports this perspective by creating two-sided risk and potential volatility. 1. 🇺🇸 U.S. Feder

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 20 Points that can withdraw. Click to know more details about //soci...

Fundamental and Technical Trajectories for the Week of January 5-11, 2026

The global gold market enters the first full trading week of January 2026 positioned at a historical and psychological crossroads. Following an extraordinary fiscal year in 2025, characterized by a staggering appreciation of nearly 65% to 70%—the most significant annual gain since 1979—the yellow me

Jurus Ampuh: Cara Analisa Teknikal Forex untuk Profit Konsisten

Coba jujur, kalau Anda baru di dunia trading valuta asing, pasti melihat grafik harga itu bikin pusing, ya kan? Kita merasa seperti membaca kode yang entah dari mana asalnya. Padahal, sebenarnya, kunci untuk mengubah grafik yang terlihat acak itu menjadi peta peluang ada pada cara analisa teknikal f

Apa Itu Analisa Fundamental Forex dan Cara Kerjanya

Pengantar Bagi banyak trader, analisa fundamental forex adalah cara buat benar-benar ngerti kenapa harga mata uang bisa naik turun, bukan cuma menebak arahnya. Kalau analisa teknikal ngomongin pola di grafik dan garis-garis indikator, analisa fundamental justru nyelam lebih dalam: ngelihat gimana ek

💥 $100 Silver? Here’s Why Analysts Think the Rally Might Just Be Getting Started

#Silver# is once again making headlines - crossing above $51 per ounce and setting a new all-time high. But what’s catching traders’ attention now isn’t just the breakout… it’s the growing belief that this could be the early phase of something much bigger. Many analysts are now floati

📈 Market analysis: JPMorgan Forecasts Strong 8% Growth for S&P 500, Lifts 2025 Target

JPMorgan raised its 2025 S&P 500 target to 6,500, up from its prior 2024 estimate of 4,200, citing U.S. economic strength, AI growth, and consumer resilience. It forecasts 10% earnings growth, with Fed rate cuts expected to sustain market momentum. 📘Read the full analysis here: https://www.kvbp

Fundamental Itu Gak Bohong

Kadang indikator bilang “buy”, tapi market malah nge-ghosting. Baru sadar, harga itu nggak bohong sama ekonomi. Inflasi naik? USD ngegas. Data NFP keluar? Pasangan mata uang rebutan. Sejak itu, saya mulai baca berita ekonomi tiap minggu, catat efeknya, dan ternyata hasil trading lebih ko

Live Analysis 25 Maret 2022

Traders, penasaran gak sih dengan apa yang sebenarnya Putin inginkan terkait Invasi Rusia ke Ukraina? Akankah perang ini berakhir? Jangan sampai lewatkan pembahasan menarik di DCFX Live Analysis ya! Tentunya akan ada insight yang dapat diambil untuk menentukan langkah traders dalam bertrading. Catat

Dupoin

Access daily market analysis on KVB App for free!

Every day is a challenge on the charts. But with the right insights, you're ready for whatever the markets throw your way. KVB delivers daily analysis to help you stay sharp, spot key opportunities, and trade with confidence. Download KVB App now! #KVB#

Your One-Stop Platform for Everything Trading! 📊

At KVB, we bring everything you need for trading into one seamless platform. Whether you're strategizing, planning, or staying informed, we've got you covered: ✅Market Analysis ✅Economic Calendar ✅Flash News Stay in the loop with real-time updates on the market's biggest stories and developments. 👉

FOLLOWLIVE Xem lại video : Phân tích kỹ thuật - Bắt đầu như thế nào?

Có khá nhiều người có những ý kiến trái ngược về phân tích kỹ thuật, có người cho rằng nó hữu ích, có người cho rằng làm phân tích kỹ thuật không giúp ích được gì. Nhưng tất cả chúng ta có thực sự biết phân tích kỹ thuật là gì hoặc làm thế nào để thực hiện một phân tích kỹ thuật thích hợp? Phân tích

Jingle Bells, Jingle Stocks: How will Christmas affect your trades? 🎄✨

With many big players taking time off, the market gets quieter, and volatility increases. Lower liquidity means even small trades can cause big price moves. The Santa Claus Rally may be on the horizon, fueling optimism for positive market returns, but only for those prepared to navigate the fe

📈 Market analysis: Australian Dollar Faces Downward Pressure as US Dollar Holds Strong

The Aussie Dollar (AUD) is struggling against the US Dollar (USD) ahead of the US CPI data release, expected to show a slight inflation rise. A strong inflation print could boost the USD, reducing the chances of a Fed rate cut. The RBA also kept rates unchanged at 4.35%, adding pressure to the AUD.

正在加载中...