How Bitcoin Is Changing Money, Markets, and Global Financial Power

The approval of the first spot Bitcoin ETFs on January 10, 2024, marked a turning point, with cryptocurrency pivoting towards major institutional adoption and global financial regulations to prompt nation-state adoption and legitimize Bitcoin with traditional finance. In 2025, Bitcoin is no longer j

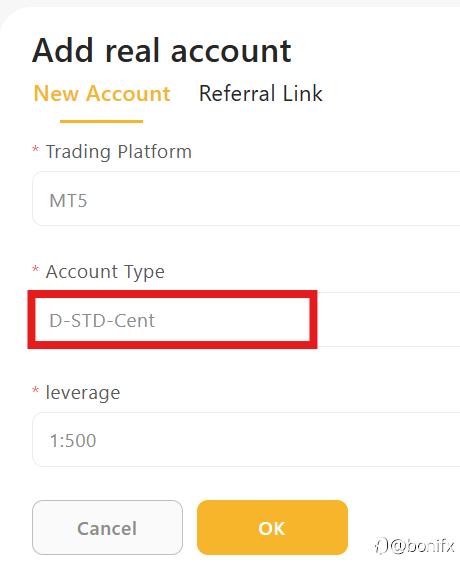

Main Uses of a Cent Account in Forex

Beginner PracticeTrade with very small amounts of real money to experience live market conditions.Learn how to use the trading platform (MT4/MT5): placing orders, stop loss, take profit, pending orders, etc. Risk ControlSince the balance is displayed in cents, the trading volume is reduced, and prof

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 10 Points that can withdraw. Click to know more details about //soci...

- Barbara Tollefson :sey hi to me

XAUUSD Accuracy Check 📊

Yesterday’s buy zone (4400–4420) played out perfectly. Gold dipped to 4407 and pushed up to 4479 — a solid 720+ pips move 📈 Clear levels, patient execution, and disciplined planning made the difference. Chart shared for transparency. 💬 Always open to DMs for market discussion.

SHOCK NFP: Emas Lari Kencang, Dolar Punya Peluang 99% Balik Arah!

Kenapa Laporan NFP 16 Desember Ini Wajib Kamu Pantau? Laporan Non-Farm Payrolls (NFP) yang dirilis pada 16 Desember 2025 adalah kunci penentu langkah The Federal Reserve (The Fed) untuk suku bunga sepanjang 2026. Ini bukan sekadar data biasa, tetapi laporan ganda yang mencakup angka pekerjaan Oktobe

正在加载中...