Bad Tick Data Killed Your Strategy? Fix It Now

Let’s be real—how many of you on Followme have been here? You grind for weeks on a quant strategy: backtests show 20% annual returns, risk metrics are bulletproof. Hit “live” on your Followme account… and boom—15% gone in a month. You debug until your eyes burn… only to find it’s not your code. It’s

HFT Profit Killer: Why Google Finance Fails & AllTick Fixes It

FollowMe traders, let’s cut to the chase: High-Frequency Trading (HFT) lives or dies by data. I lost weeks of profits trusting Google Finance—its “real-time” 15-minute delay turned my 80% backtest win rate into a live trading disaster. If you’re using free tools for US stock HFT, this mistake could

Quant Strategy Pitfalls: How to Avoid Live Losses

If you’re a cross-border quant trader, you’ve probably faced two frustrating issues: Your strategy hits 80% wins in backtests but loses money live, or you can’t pick a framework that works for stocks, forex, and crypto. The root cause? Wrong framework fit and poor data quality. Cross-border trading

Quant Trading 101: Master Market Data APIs for Forex & Crypto

For quant traders—whether you’re scalping forex pairs or backtesting crypto strategies—data is your most valuable asset. A winning strategy falls flat if it’s fed messy, delayed, or incomplete market data. Market data APIs are the pipelines that deliver real-time and historical prices, volumes, and

Avoid Quant Trading Disappointment: The 3 Key Data Standards You’re Missing

For many quant traders, the frustration is all too familiar: a strategy that shines in backtests—boasting a Sharpe ratio of 2.8, with a steadily climbing profit curve—crashes and burns in live trading, racking up losses of 20% or more in just weeks. You audit code, swap platforms, and tweak logic, b

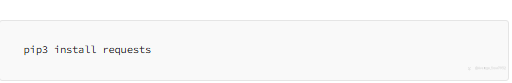

How to Pull Forex/Precious Metals Data in 10 Minutes (Python + AllTick)

For traders diving into quantitative analysis or strategy testing, one common roadblock is accessing usable market data. You can track prices on trading platforms or apps, but when it comes to backtesting a strategy, running time-series analysis, or validating trading models, unstructured data that

The Hidden Cost of Free Forex Data (It’s Big)

Ask any forex strategy developer—they’ll tell you the worst feeling: A backtest that crushes it, but bombs when real money’s on the line. You tweak every setting, check code twice, and still, orders miss, stops fail, and profits vanish. The problem? It’s not your strategy. It’s the data feeding it.

- forex standard :good

My Experience Fixing Quant Trading Data Headaches—A Practical Share

If you’re into quant trading, you’ve probably faced the frustration: a strategy that performs well in backtesting falls flat in live markets. It’s either slow to catch signals, misjudges market trends, or hits unexpected snags that eat into potential profits. For years, I struggled with this too, as

500ms Death Trap to 170ms Win: How AllTick Fixes Your US Stock HFT?

Hey FollowMe traders—let’s chat about the most frustrating part of US stock HFT: when your trade falls through not because of your call, but because your data lets you down. I’ve been there: saw a clear buy signal on Tesla, hit “enter” immediately, and watched the price jump 5% before my order went

Risk Management Systems: Building Real-Time Portfolio Monitoring with AllTick

In today's interconnected financial markets, effective risk management requires real-time monitoring and immediate response capabilities. Traditional end-of-day risk reporting is no longer sufficient to protect against rapid market moves. This guide explores building comprehensive risk management sy

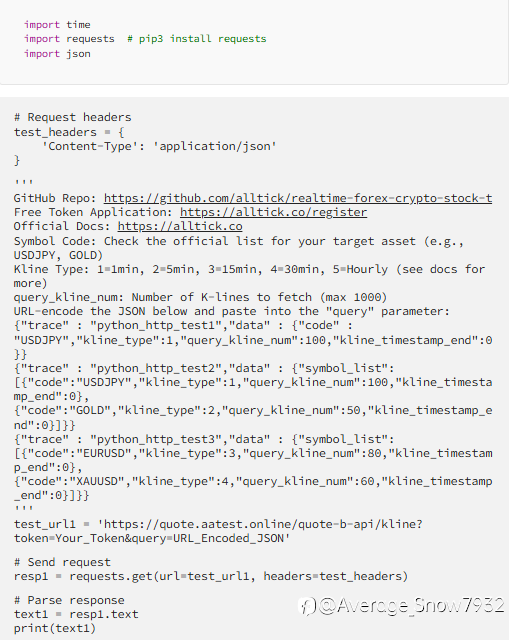

Choosing the Right Forex Data Feed: Broker API vs. Dedicated Provider

When building forex trading systems, developers face a fundamental choice: should they use their broker's API or connect to a dedicated forex data provider? This decision has significant implications for system architecture, performance, and long-term flexibility. Many traders start with broker APIs

From GitHub to Live Trading: Deploying Your Open-Source Strategy

The open-source community has revolutionized quantitative trading, with platforms like GitHub hosting thousands of trading strategies, backtesting frameworks, and exchange connectors. However, there's a significant gap between running a strategy in a development environment and deploying it for live

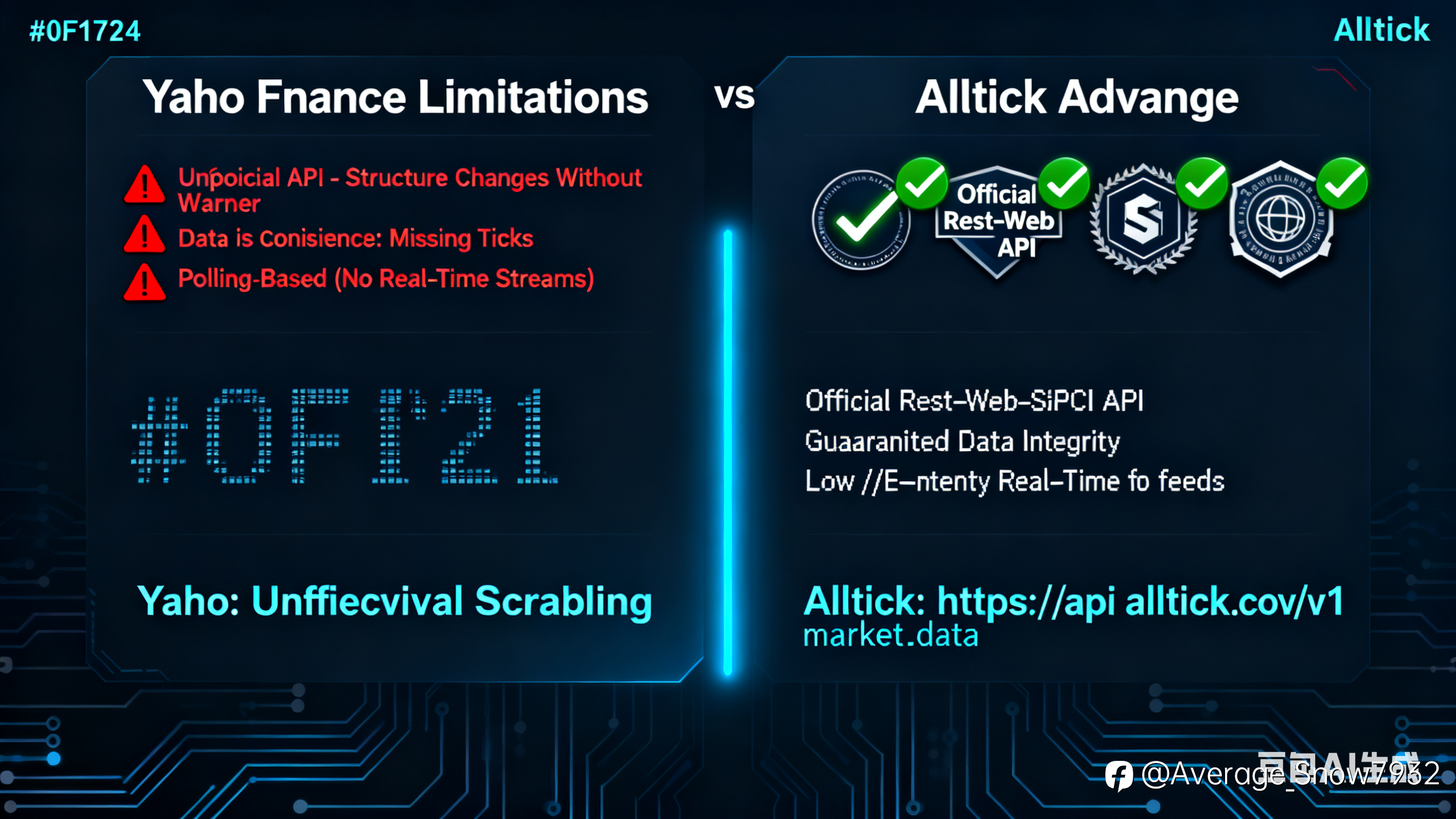

Yahoo Finance API Alternative: Why Traders Are Switching to Alltick

For years, the unofficial Yahoo Finance API has been a popular starting point for developers and traders needing free market data. Its ease of access and wide coverage made it a go-to tool for prototypes and personal projects. However, as projects mature and require reliability, many are discovering

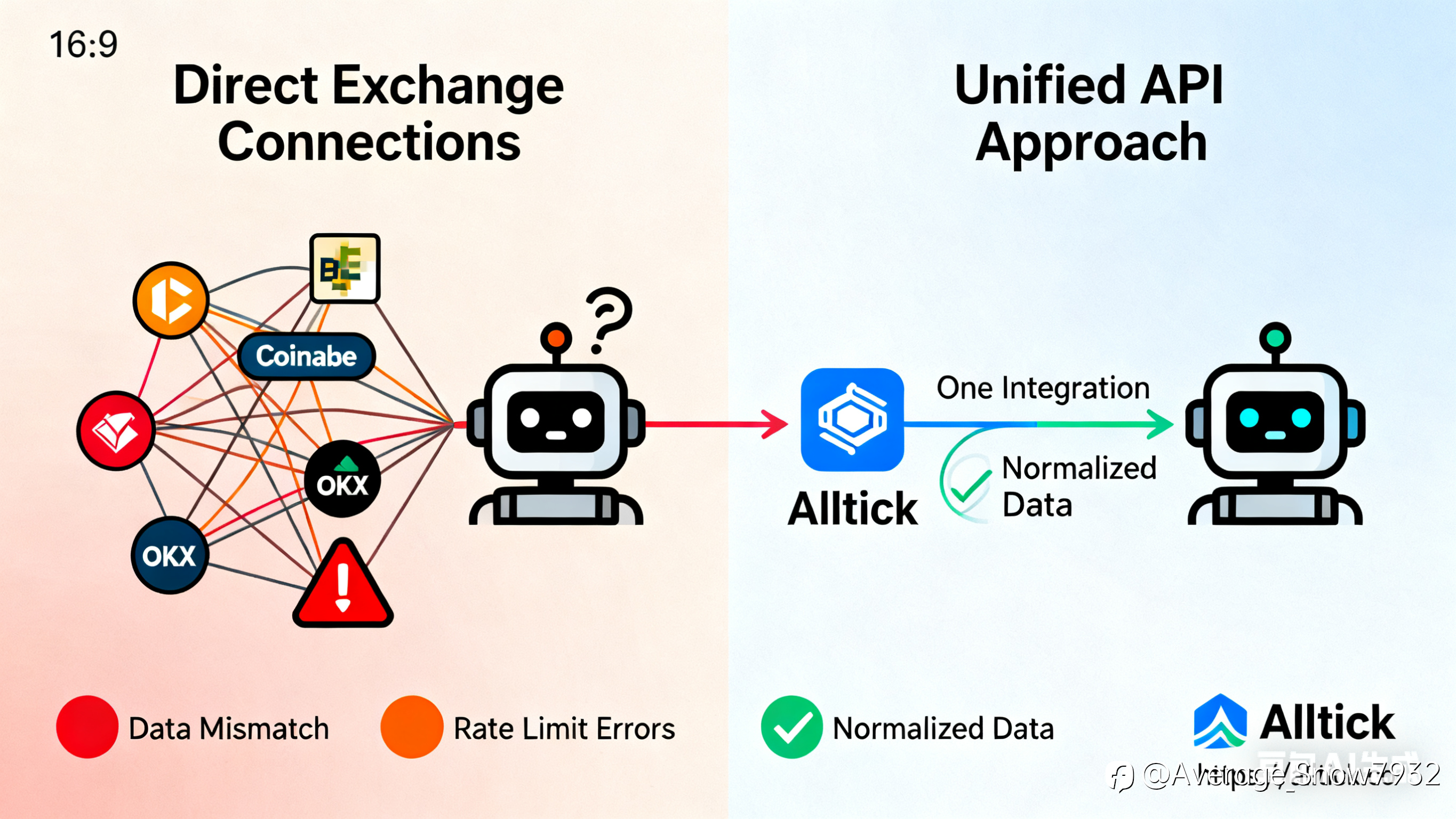

Cryptocurrency Trading Bots: How to Connect to Exchange APIs like Binance

The cryptocurrency market never sleeps, making automated trading bots an essential tool for many serious traders. The heart of any trading bot is its connection to market data and execution venues. Most developers start by connecting directly to exchange APIs like Binance or using a data tracker API

The Importance of Consumer Education in Digital Finance

As digital finance continues to evolve, consumer education has become critical for individuals and businesses navigating this complex landscape. With the rise of cryptocurrencies, stablecoins, and various online financial services, understanding these concepts is essential for making informed decisi

正在加载中...