他点赞了

Safe Haven vs Risk Assets: A Practical Framework for Forex Analysis

In Forex, price does not move because an asset is labelled “safe” or “risky.” It moves because capital reallocates in response to changing expectations around growth, liquidity, and policy. Understanding the relationship between safe haven assets and risk assets gives traders

他点赞了

Why the U.S. Dollar Remains Weak Despite Strong GDP Data

On the surface, the latest U.S. GDP figures send a clear message: economic momentum remains intact. Growth is stable, consumption is holding up, and the economy continues to outperform many of its peers. Traditionally, this backdrop would provide firm support for the U.S. dollar. Yet price action te

他点赞了

Indian Rupee Volatility Returns as RBI Steps In to Steady Markets

The Indian rupee (INR) has re entered a period of heightened volatility, reflecting a complex mix of offshore flows, hedging activity, and central bank intervention. After a brief rebound driven by strong buying in the non deliverable forward (NDF) market, the rupee weakened again, underscoring how

他点赞了

他点赞了

Monetary Policy Divergence in 2025–2026: How Traders Are Reframing the Forex Landscape

As markets move deeper into the 2025 - 2026 cycle, one theme is becoming increasingly clear: policy divergence among major central banks is no longer a side narrative it is the core driver of FX positioning. After years of broadly synchronized tightening, traders are now navigating a world where int

他点赞了

Bank of Japan and the Historic Interest Rate Shift

For decades, the Bank of Japan (BoJ) stood apart from other major central banks. While the US Federal Reserve, ECB, and others cycled through tightening and easing phases, Japan remained locked in an era of ultra low and even negative interest rates. That era is now changing and for Forex traders, t

- Elon Musk Fan page :hello

他点赞了

What Traders Must Check Before Trusting Any Platform

An Essential Risk Awareness Guide for Traders and Copy Traders The global trading industry continues to expand, but alongside this growth, a quieter and more dangerous threat has been gaining ground: clone broker scams. Unlike obvious frauds, clone brokers do not rely on poorly designed websites or

- 小飞侠142 :完成活动,发信息客服不回 无语

- Crazy_Time0137 :Saluton, kiel vi fartas? Mi esperas, ke vi fartas tre bone. Bone, mi volis rigardi vian profilon, kaj vi estas tre bela. Bone, mi venos ĉi tien por proponi ion al vi kiam vi interesiĝos.

他点赞了

Wall Street Futures Tick Up Amid Rate-Cut Optimism

Wall Street futures edged higher recently, even though trading was thinner than usual because of the holiday season. Investors seem encouraged by renewed hopes that the central bank may cut interest rates soon. This optimism around looser monetary policy is giving markets a little lift a boost many

他点赞了

Expectations of Fed Rate Cuts Put Pressure on the US Dollar

Growing expectations that the Federal Reserve may cut interest rates soon have started to weigh on the US Dollar. When markets believe that borrowing costs are about to fall, the Dollar often loses some strength because lower rates reduce the currency’s yield advantage over others. This shift in sen

他点赞了

How a Softer Dollar Shapes Global Markets as the Fed Signals Easing

As speculation grows that the Fed is preparing to lower interest rates, the softer US Dollar is creating ripple effects across global markets. Lower rates generally make the Dollar less attractive, encouraging investors to look for opportunities in other currencies, emerging markets, and risk-sensit

他点赞了

The Black Friday Paradox: More Shoppers, But Less Spending

This year’s Black Friday brings a surprising twist: even though more people are out shopping, total spending hasn’t picked up as you might expect. Many stores have seen crowded aisles and long checkout lines — but the cash flowing through registers doesn’t seem to match the foot traffic. The situati

他点赞了

🔥 Hot Topics Driving the Forex Market Right Now

The Forex market is entering a highly sensitive phase as traders position themselves ahead of major central-bank decisions, political shifts, and global macroeconomic developments. Several key themes are shaping currency movements today, and they are becoming the main catalysts for volatility across

他点赞了

Markets Pause as They Look for Clearer Signals From the Fed

Markets are entering an important transition phase, and the key driver right now is uncertainty about the Federal Reserve’s next move. Investors are not just waiting for a rate cut they are waiting for clarity. The Fed’s tone has become the anchor of global sentiment, and the absence of strong guida

他点赞了

Market Expectations Build Around Potential Fed Rate Adjustments

Expectations for the Federal Reserve’s next interest-rate move continue to guide market sentiment. Investors are weighing every new signal to understand whether the Fed is preparing to cut rates, hold steady, or wait for more data. These expectations play a major role in shaping the value of the US

他点赞了

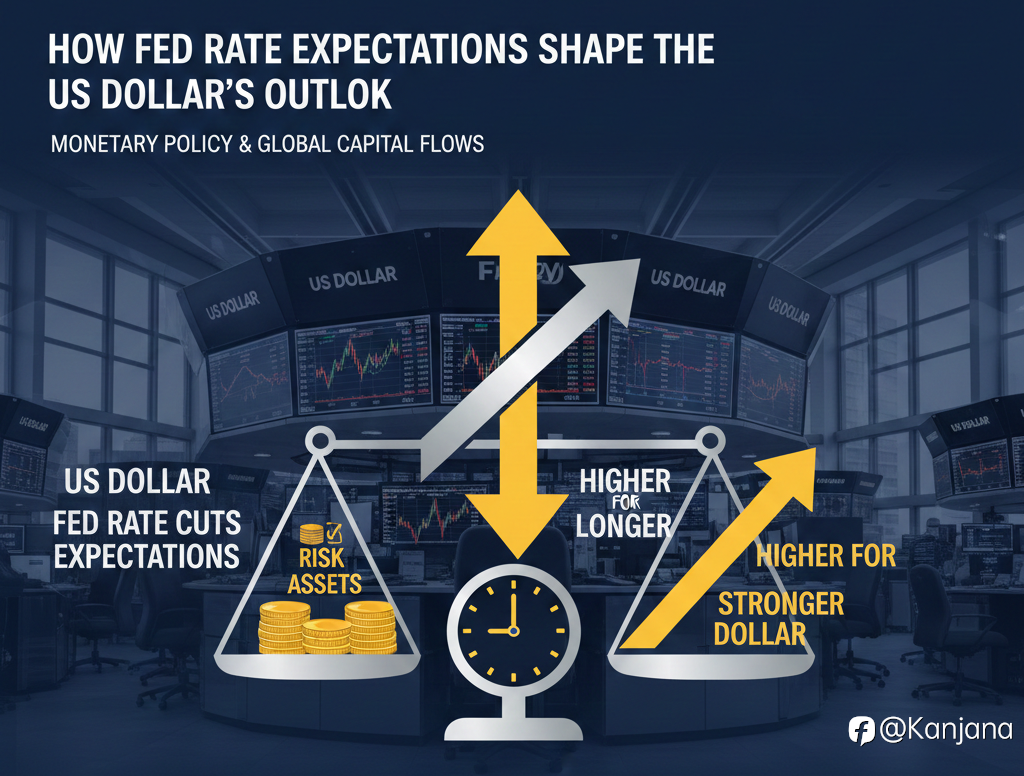

How Fed Rate Expectations Shape the US Dollar’s Outlook

The outlook for the US Dollar is closely tied to expectations about Federal Reserve policy. As discussions about potential rate cuts grow louder, currency markets are responding with heightened sensitivity. A single comment from a Fed official or an unexpected economic reading can move the Dollar no

正在加载中...