他点赞了

When the U.S. Becomes the Risk: Trump’s Greenland Tariffs Flip Markets

Partner Center The tariff threat over Greenland sent stocks tumbling and gold soaring—but this time, traders fled from the dollar, not to it. What’s Happening Between the U.S. and NATO? Over the weekend, President Trump announced something that caught even seasoned market veterans off guard: the Uni

他点赞了

他点赞了

U.S. payrolls rose 50,000 in December, less than expected; unemployment rate falls to 4.4%

The U.S. labor market ended 2025 on a soft note, with job creation in December less than expected, according to a report Friday from the Bureau of Labor Statistics. Nonfarm payrolls rose a seasonally adjusted 50,000 for the month, lower than the downwardly revised 56,000 in November and short of the

他点赞了

他点赞了

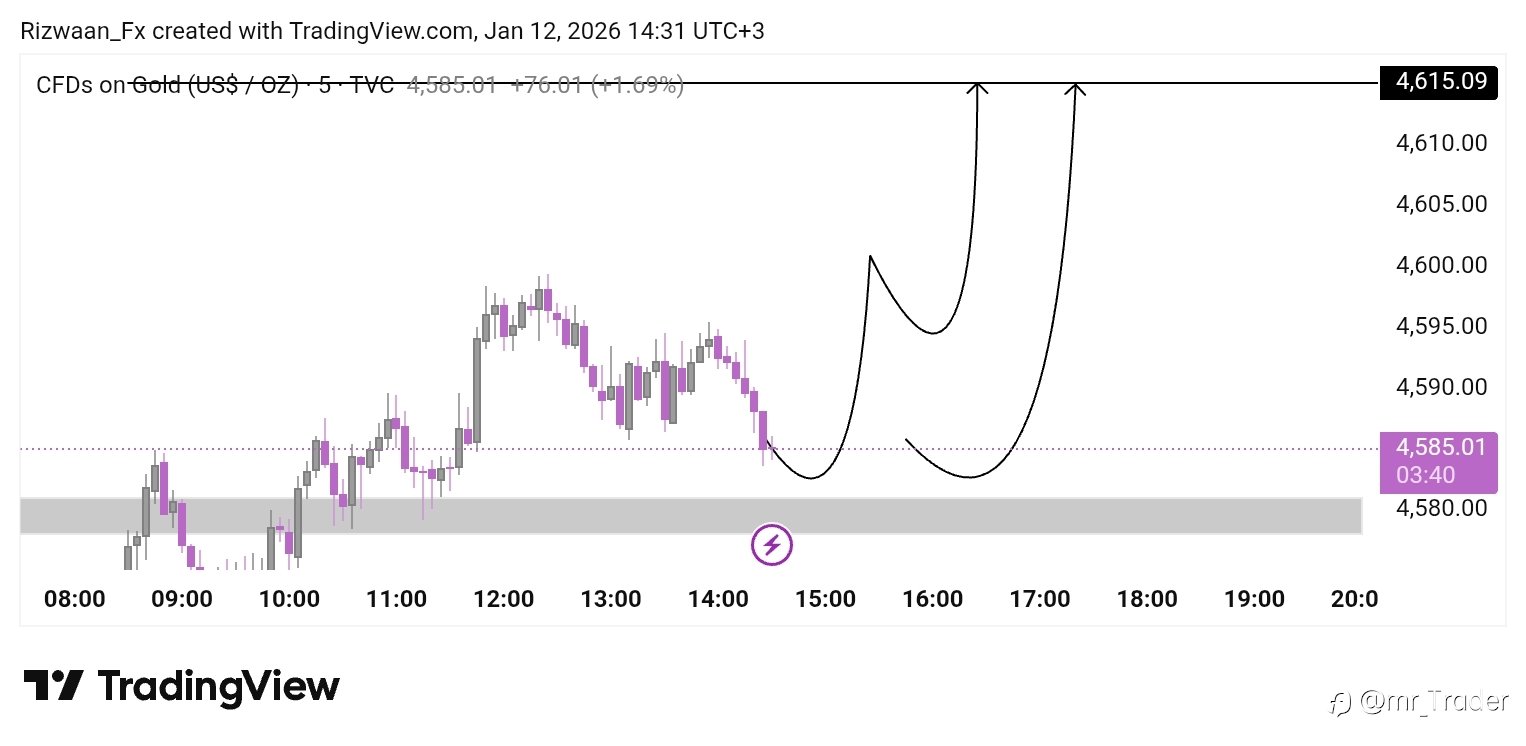

XAUUSD Accuracy Check 📊

Yesterday’s buy zone (4400–4420) played out perfectly. Gold dipped to 4407 and pushed up to 4479 — a solid 720+ pips move 📈 Clear levels, patient execution, and disciplined planning made the difference. Chart shared for transparency. 💬 Always open to DMs for market discussion.

他点赞了

他点赞了

他点赞了

China’s CPI Accelerated to 3-Year High in December 2025, But Deflation Woes Remain

Partner Center China’s consumer prices accelerated to their fastest pace in nearly three years in December while producer prices remained mired in deflation for a 40th consecutive month, reinforcing expectations for additional policy support. Headline CPI rose 0.8% year-on-year versus the previous 0

他点赞了

他点赞了

Forex and Cryptocurrency Forecast for January 12-16, 2026

The second full trading week of 2026 begins with markets refocusing on macroeconomic drivers after the initial post-holiday repositioning. Inflation data, expectations regarding monetary policy, and shifts in global risk sentiment are likely to remain the main catalysts, keeping volatility elevated

他点赞了

EUR/USD outlook: Conflicting techs keep the euro in directionless mode, US jobs data in focus

EUR/USD Near-term action remains in a sideways mode on conflicting technical signals and ahead of US jobs data, which could provide more evidence about Euro’s direction. Recovery attempts from new 2021 low that left a bear-trap under 1.1290 Fibo level, underpin the action, but overall bearish daily

- an4302 :hi

- Candle_001 :hello

- Russell Sanchez :Expert binary option trader/forex @facebook Magdalenajgabriel 💯🏅🏆

他点赞了

他点赞了

- Shutter Foz :Are you bothered on how to begin making profits from crypto currency investment? Just follow marlena_official_trade on insta

- dore22 :hello

正在加载中...