他点赞了

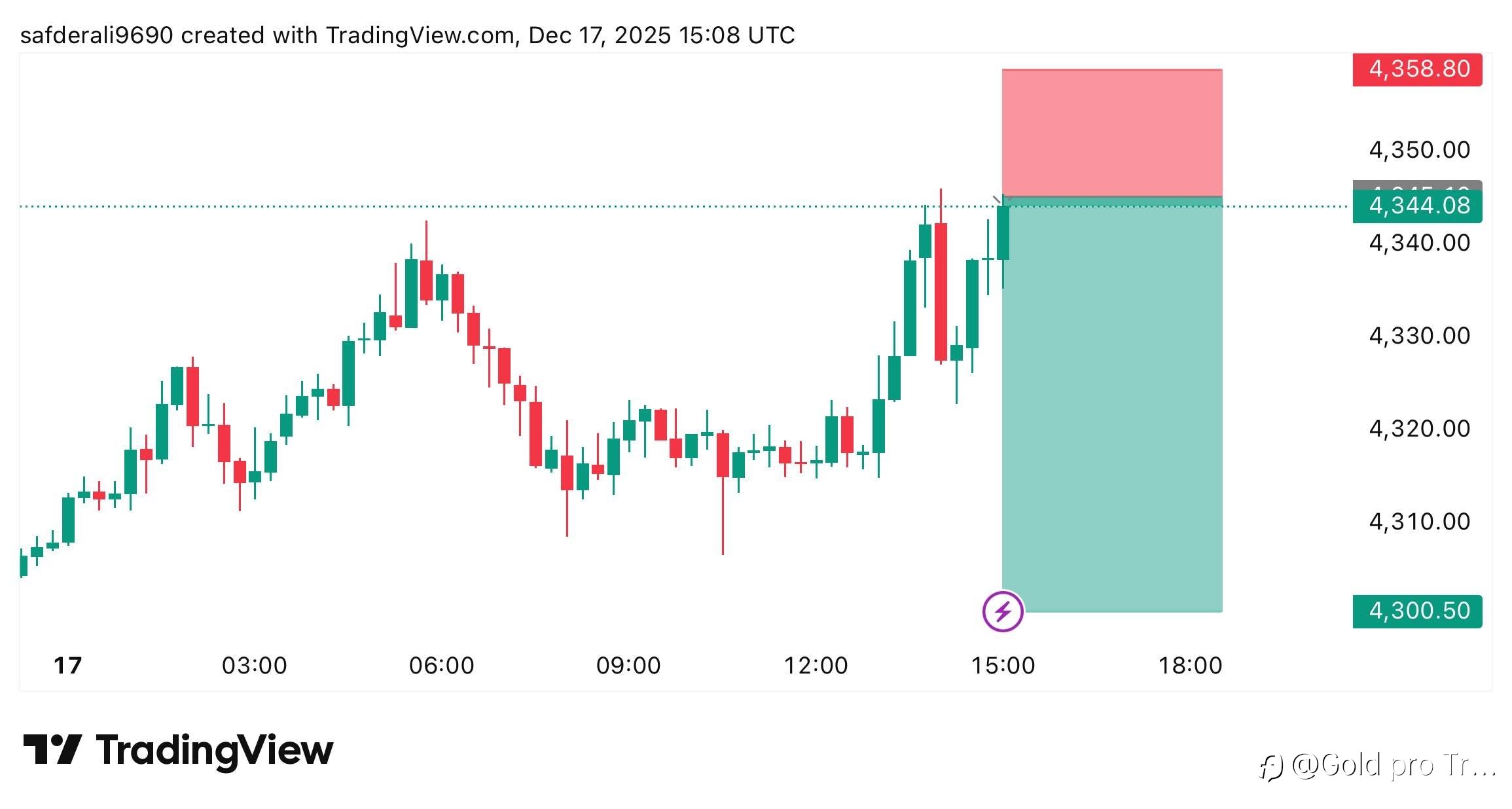

Gold (XAU/USD) Intraday Outlook

Date: January 5, 2026 | Time: 08:41 AM (UTC 5) Current Price Action & Key Observations Gold is currently trading near 4,404, positioned between the 20-period MA Bollinger Band and the 50-period MA, indicating a consolidation phase with a bullish bias. The price is holding above the critical pivo

- MazharAli :All TP target complete

他点赞了

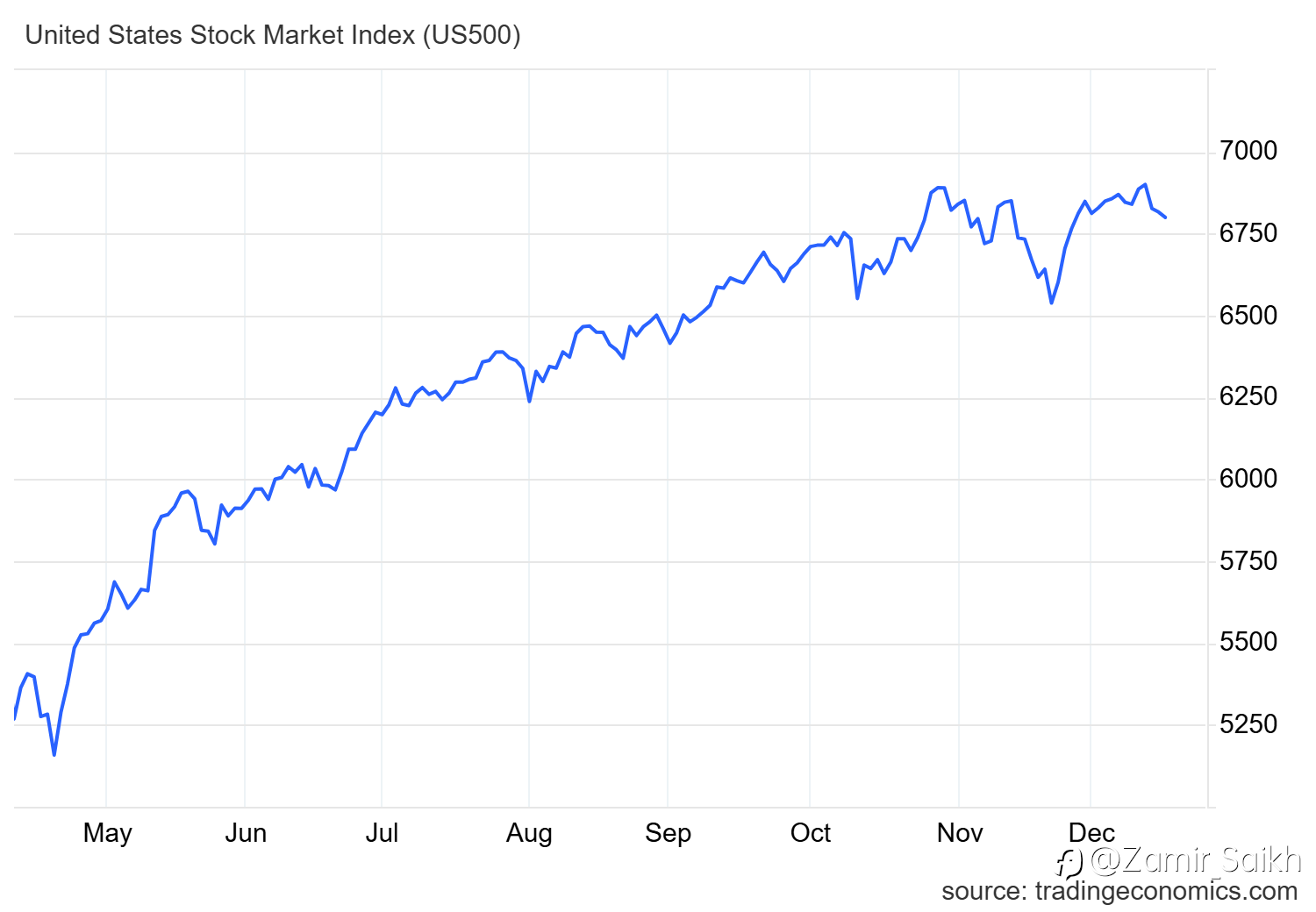

What This Market Setup Means for Forex Traders Next

The combination of rising Asian stocks and record-high precious metals points to a broader shift in market expectations. Traders are increasingly focused on what comes next not what has already happened. In Forex, this environment often leads to increased movement in major pairs. A softer Dollar out

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

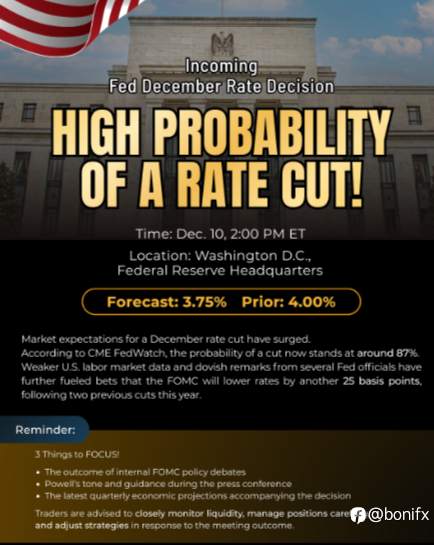

The Incoming Fed December Rate Decision: What Forex Traders Should Watch

Date: December 9–10, 2025Backdrop: The Fed faces a delicate balancing act. Inflation remains stubbornly above the 2% target, while the labor market shows signs of weakening.Complication: A recent U.S. government shutdown delayed key economic data, leaving policymakers with less clarity than usual.Di

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 20 Points that can withdraw. Click to know more details about //soci...

他点赞了

November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports

The U.S. labor market slowdown intensified in November as private companies cut 32,000 workers, with small businesses hit the hardest, payrolls processing firm ADP reported Wednesday. With worries intensifying over the domestic jobs picture, ADP indicated the issues were worse than anticipated. The

他点赞了

Why Tech Pull-Back Could Spill Into Forex Territory

After a sharp tech correction, futures have given a bit of a rebound — a small sigh of relief in a tense market. But the underlying worry remains: valuations in the tech sector look lofty, and macro uncertainties (like delayed economic data) are casting shadows. So what does that have to do wi

正在加载中...