他点赞了

他点赞了

USD Direction and Major Currency Movements: Market Structure in a Headline Driven Environment

Global FX markets are currently operating under a highly headline sensitive regime, where price movements are less driven by traditional economic data and more influenced by confidence, policy expectations, and shifts in global risk sentiment. In this environment, the U.S. dollar (USD) remains the c

他点赞了

他点赞了

他点赞了

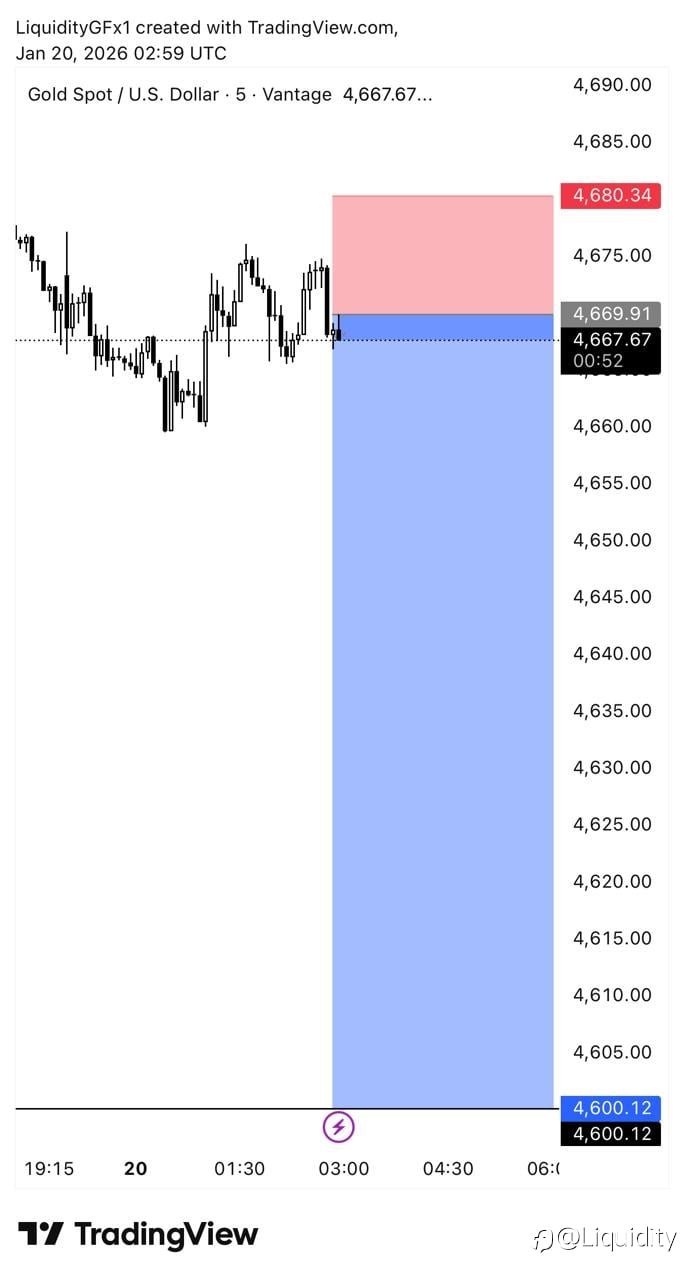

- Chloe_Jeck :*Gold Update | XAUUSD* As per yesterday’s analysis, Gold continued its bullish move, successfully breaking *4450* and printing a high at *4497.6* — just *25 pips* away from the *4500* psychological...

他点赞了

他点赞了

This Makes Me Question Every “Safe” and “Guaranteed” Offer

As someone still early on my trading journey, cases like this honestly make me more cautious and a little more skeptical. When you’re new, hearing phrases like “guaranteed monthly returns” or “proven algorithm” can sound comforting, especially if the person presenting i

他点赞了

The Peace Premium: How Geopolitical Easing Shapes Investment Markets

#OPINIONLEADER# In financial markets, the concept of a peace premium is often overlooked but highly influential. It refers to the extra value or price movement in assets when war or conflict risks decline and prospects for peace improve. Understanding the peace premium helps investors

他点赞了

Mastering Risk Management in Trading: The Foundation of Long-Term Success

#OPINIONLEADER# Mastering Risk Management in Trading: The Foundation of Long-Term Success In the world of trading, profit potential often takes center stage. Yet, the true cornerstone of lasting success lies in risk management. Traders who know how to protect their capital can withsta

他点赞了

他点赞了

Lim Meng Hoong: Investment Market Dynamics and the Acceleration of Value Repricing

Global market volatility has intensified. Asian indices have weakened, US equity futures have retreated, and crypto assets have suffered sharp short term swings. These developments indicate that capital is recalibrating risk. Lim Meng Hoong argues that when markets diverge over interest rate traject

正在加载中...