他点赞了

他点赞了

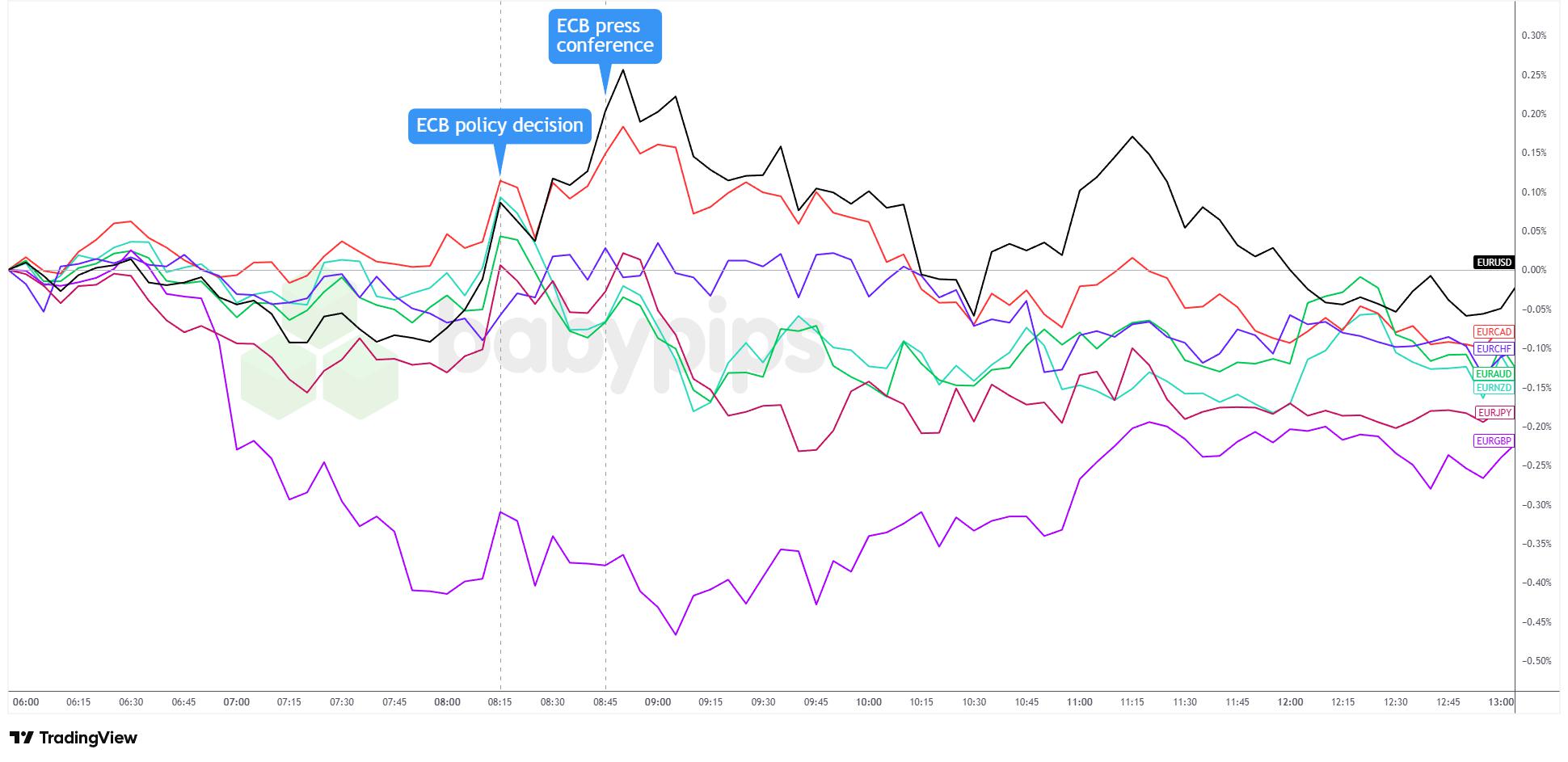

ECB Holds Rates Steady, Signals Easing Cycle Likely Over

Partner Center The European Central Bank (ECB) kept its deposit rate unchanged at 2.00% on Thursday for a fourth consecutive meeting, maintaining its pause in the easing cycle that saw eight rate cuts between June 2024 and June 2025. The unanimous decision came as the ECB upgraded its economic growt

他点赞了

他点赞了

- Elon Musk Fan page :ILUSTRASI. Departemen Energi AS akan mengalokasikan anggaran sebesar US$ 15,5 miliar. Anggaran jumbo ini berbentuk dana hibah dan pinjaman untuk produsen dan distributor kendaraan listrik. Have you su...

他点赞了

他点赞了

他点赞了

他点赞了

Myth vs. Reality: The Truth About Prop Firms

Partner Center Prop trading firms or funded trading companies have become increasingly popular among aspiring retail traders looking for capital, but they’re also surrounded by misconceptions and exaggerated claims. When you first hear about retail prop firms, it almost feels like you’ve stumbled on

他点赞了

BLS says full October jobs data won't be released, available figures to be included in next report

The Bureau of Labor Statistics said Wednesday it will not release a full U.S. jobs report for the month of October, following the longest government shutdown in the history of the country. Instead, the agency said October payroll data will be released along with a full report for November. An unempl

他点赞了

أفضل مقابر 6 أكتوبر طريق الواحات بمساحات واسعة وتشطيب متك

تُعد مقابر 6 اكتوبر طريق الواحات من أبرز المناطق التي يبحث فيها الكثير من العائلات عن مدافن جاهزة بمواصفات ممتازة وأسعار مناسبة. هذه المنطقة تُعرف بتنظيمها الجيد وهدوئها، إضافةً إلى موقعها الاستراتيجي الذي يجعل الوصول إليها سهلًا من سكان أكتوبر والشيخ زايد والمناطق المجاورة. ومع ازدياد الط

他点赞了

Behind the Numbers: What’s Driving the Downturn and What’s Holding Up

Digging deeper into Japan’s Q3 data gives a clearer picture of where the strength and weakness lie. Private consumption barely grew, just about +0.1%, reflecting weak household spending under the pressure of inflation and slower wage growth. External demand dragged on the economy too: exports

他点赞了

Australia Reported Hotter Than Expected October Jobs Data, Unemployment Down to 4.3%

Partner Center The Australian economy just printed yet another upbeat data point, with the employment change and unemployment rate beating expectations for October. Hiring jumped 42.2K during the month, surpassing estimates of a 20K gain, while the jobless rate slipped from 4.5% to 4.3% on a seasona

正在加载中...