他点赞了

他点赞了

Global Trading Competition S17 Rankings Released

After days of intense competition, the Season 17 Followme Global Trading Competition, jointly hosted by the Followme trading community and the renowned broker, Macro Global Markets, has successfully concluded. Preliminary award rankings for the 3 categories (Large Group, Micro Group, Evergreen) have

- Asadfx :hello

他点赞了

他点赞了

他点赞了

他点赞了

U.S. has to stop taking in 'below-average' immigrants who won't help economy, says Lutnick

Commerce Secretary Howard Lutnick said Thursday that the U.S. should focus on bringing in immigrants that help grow the economy as the White House rolls out its long-awaited "gold card" visa. "We're the only great country that lets other people just come in without vetting them and deciding whether

他点赞了

他点赞了

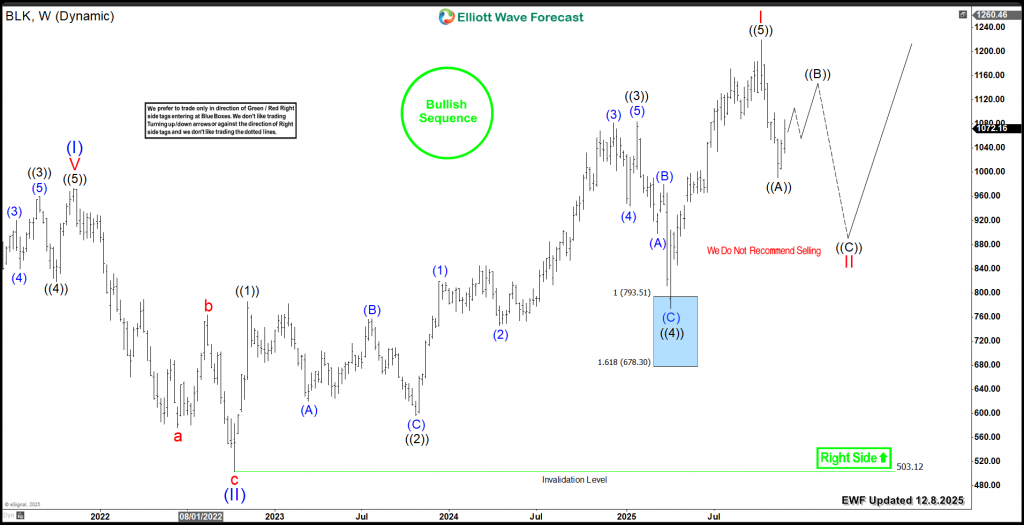

BlackRock (BLK) Next Buying Opportunity Below $1,000

We previously mapped BlackRock's (NYSE: BLK) bullish weekly path earlier this year. Today, our analysis continues with the Elliott Wave structure behind its rally from the 2022 low. This update highlights the next high-probability buying opportunity emerging for the stock. Elliott Wave Analysis Blac

正在加载中...