他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

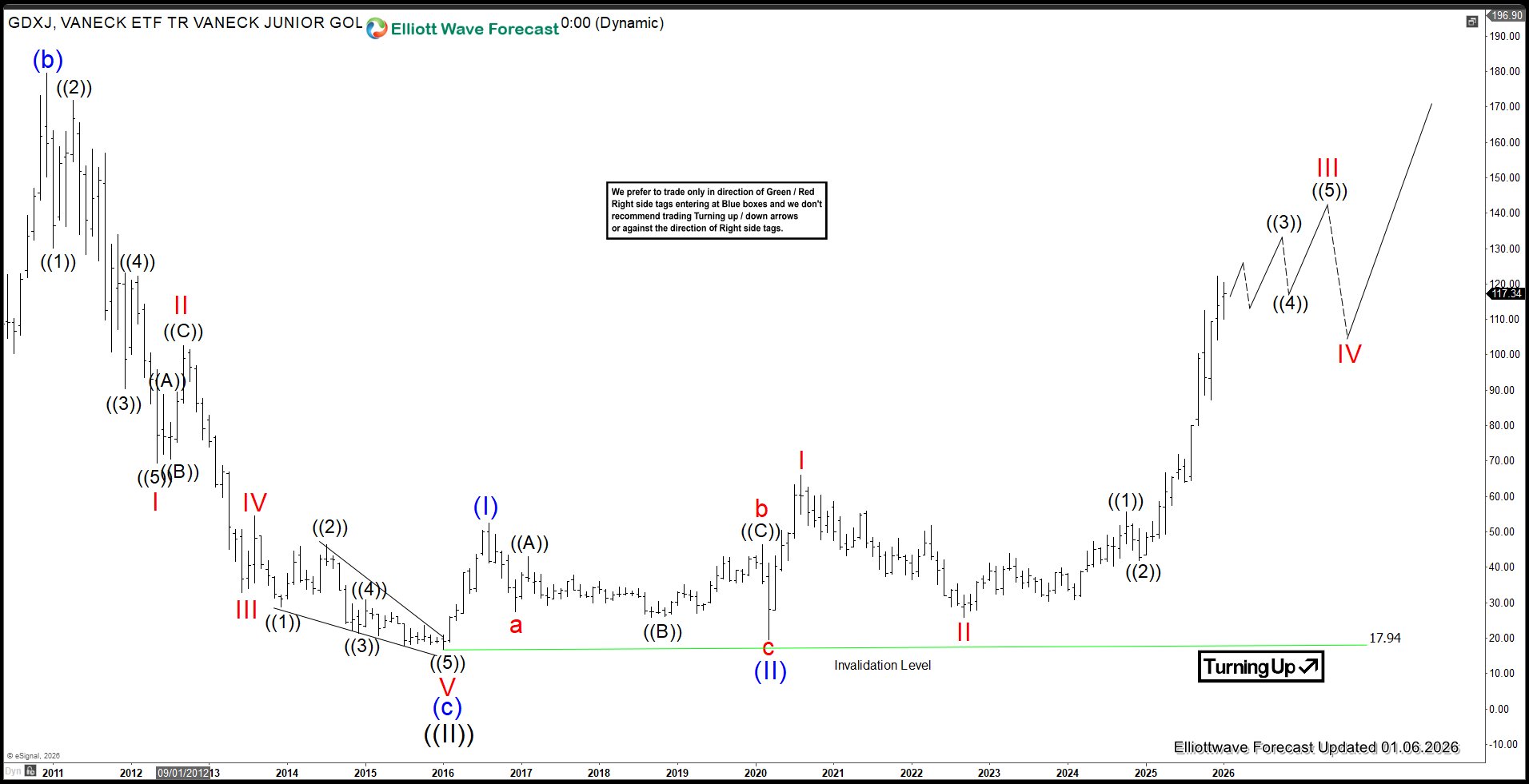

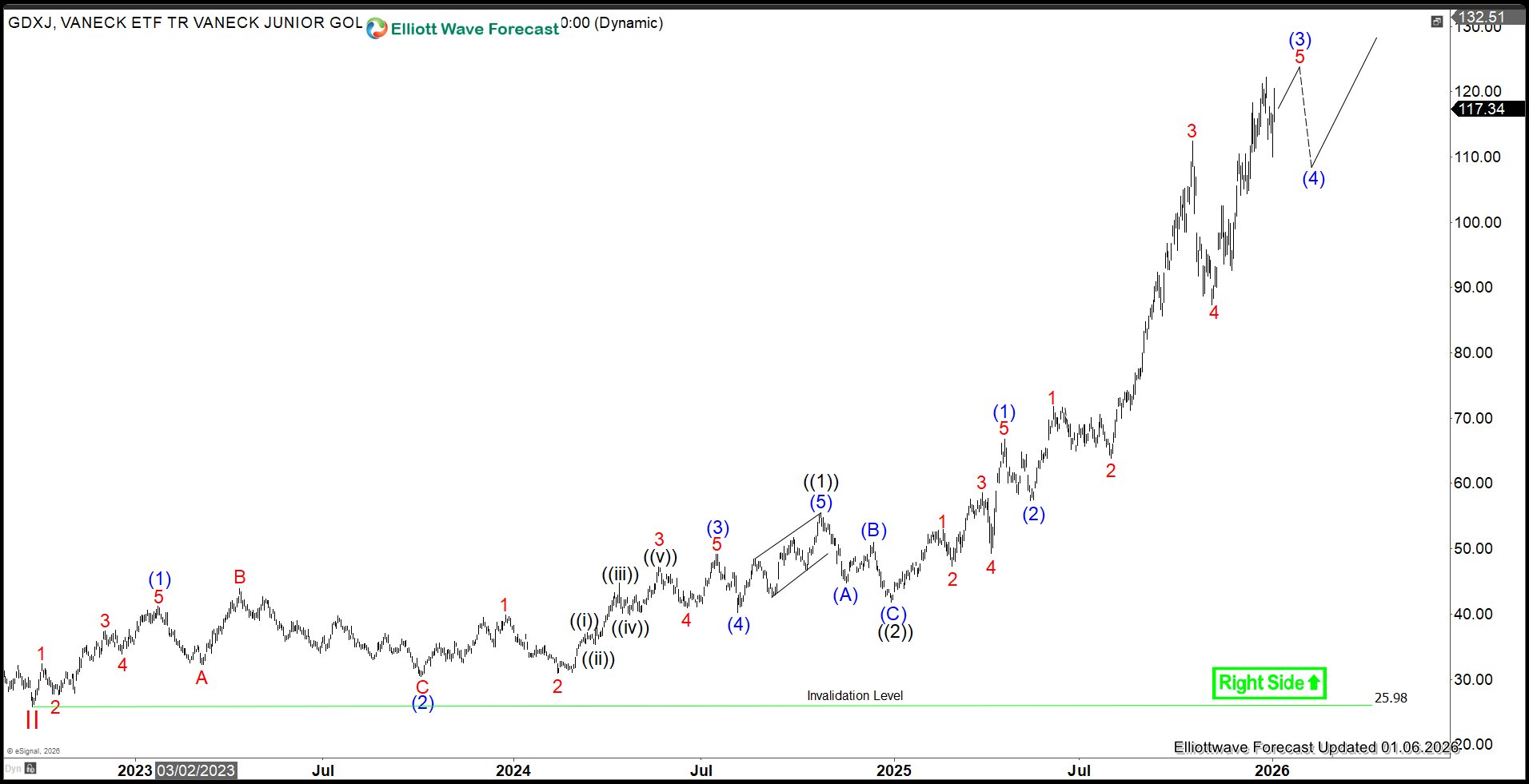

GDXJ – Gold Miners Junior: Impulse Rally in Motion

The VanEck Junior Gold Miners ETF (GDXJ) is an exchange-traded fund that provides exposure to small- and mid-cap companies primarily engaged in gold and silver mining worldwide. In this article, we will explore the long term Elliott Wave technical path of the ETF. GDXJ Monthly Elliott Wave View

他点赞了

他点赞了

他点赞了

🎄 Holiday Forex Trading Risks: Why Christmas and New Year Are Not Ideal Times to Trade

#OPINIONLEADER# Every year during Christmas and New Year holidays, the forex market enters a “hibernation mode.” Trading volumes drop sharply, liquidity dries up, and spreads widen—making trading risk significantly higher. For traders holding losing positions or open trades, this peri

他点赞了

他点赞了

How to Evaluate the Best Crypto No Deposit Bonus Deals

The rise of crypto casinos has introduced players to a new era of bonuses, rewards, and promotional offers. Among them, the no deposit bonus is one of the most appealing because it gives players a chance to explore a casino and even win real crypto without risking their own funds. However, not all b

正在加载中...