他点赞了

Hotter Than Expected Australian CPI Boosted March RBA Hike Hopes

Partner Center Australia’s consumer prices rose more than expected in January, while core inflation climbed to its highest level in over a year, solidifying market expectations for another RBA interest rate hike. The monthly headline CPI rose 0.4% in January, beating the median forecast of a 0.3% up

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

Global Trading Competition S17 Rankings Released

After days of intense competition, the Season 17 Followme Global Trading Competition, jointly hosted by the Followme trading community and the renowned broker, Macro Global Markets, has successfully concluded. Preliminary award rankings for the 3 categories (Large Group, Micro Group, Evergreen) have

- Asadfx :hello

他点赞了

他点赞了

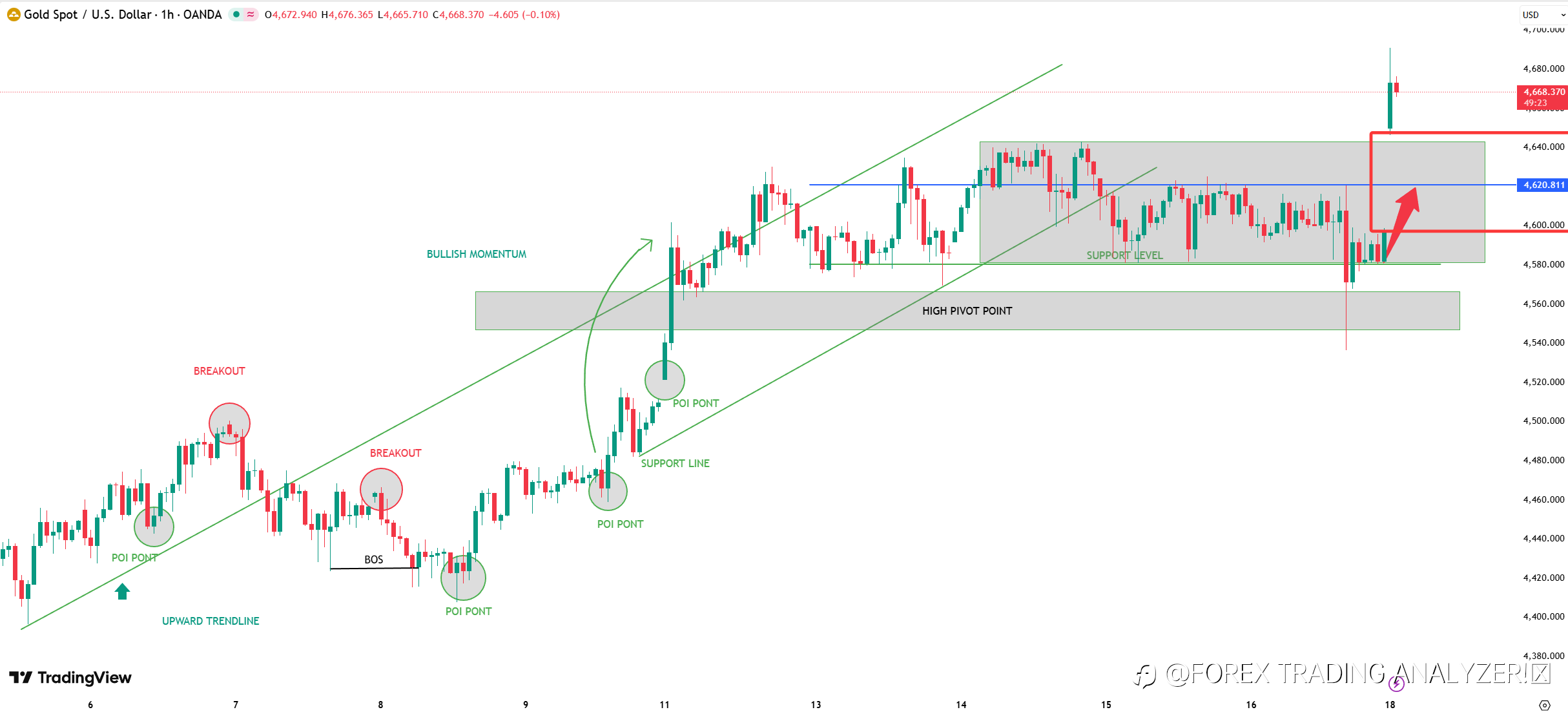

Mid-January checkpoint: trend or noise? 📊

Markets are reaching an important psychological point as January approaches its midpoint. After a volatile start to the year, investors are trying to determine whether recent moves represent the beginning of sustainable trends or simply short-term noise driven by headlines and positioning. Geopoliti

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

🌅 Morning Update | 17 December 2025

📈 Markets: Futures on major indices are trading higher, rebounding after yesterday’s pressure triggered by mixed US macro data. US100 is up 0.35%, US500 adds 0.2%, while EU50 gains 0.05%. 🏛 US politics & energy: Donald Trump announced a full blockade of all sanctioned oil tankers travelling to

正在加载中...