他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

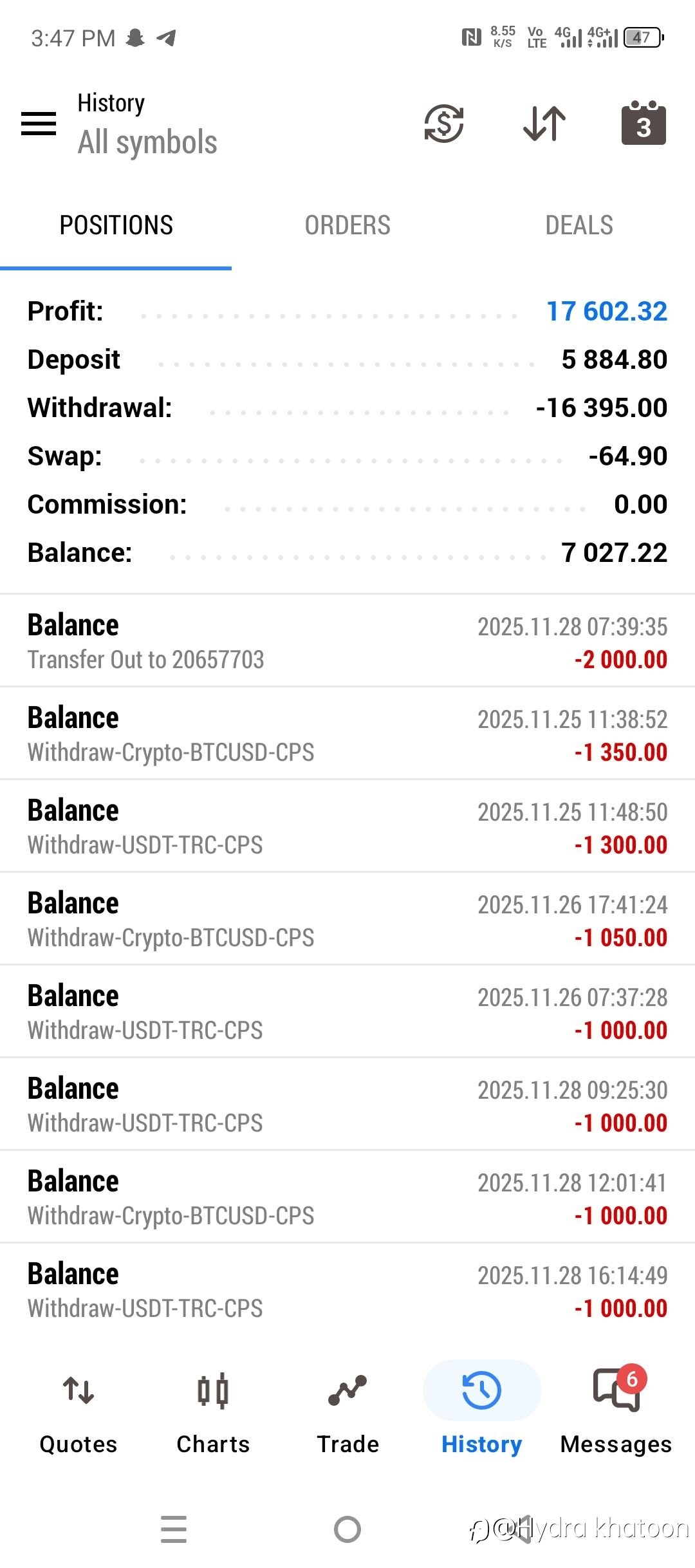

- Public_World4233 :all target completely done ✅

他点赞了

他点赞了

The Mechanics Behind the Volatility in These Major Forex Pairs

The reason XAUUSD, USD/JPY, and EUR/USD experience heavy impact lies in their connection to global liquidity and monetary policy cycles. These markets act as channels through which investors express their expectations about inflation, recession risks, and central-bank decisions. For XAUUSD, the main

他点赞了

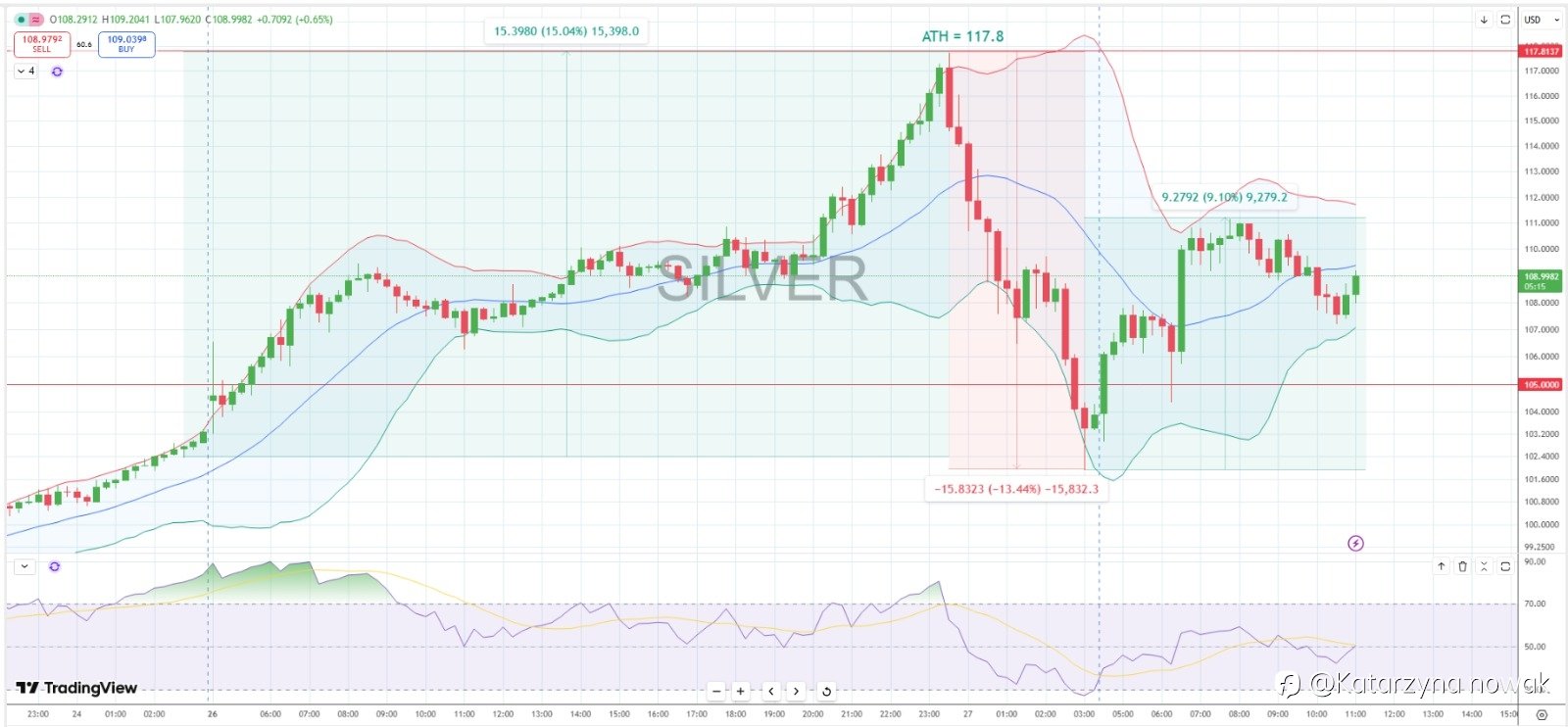

Gold Analysis

Gold (XAUUSD) is trying to rebuild momentum after yesterday’s washout, with price now approaching the $4,200–4,220 resistance band — the zone that must break for any sustained bullish recovery. On the downside, $4,175 acts as the first intraday support, while $4,163 remains the key structural level

他点赞了

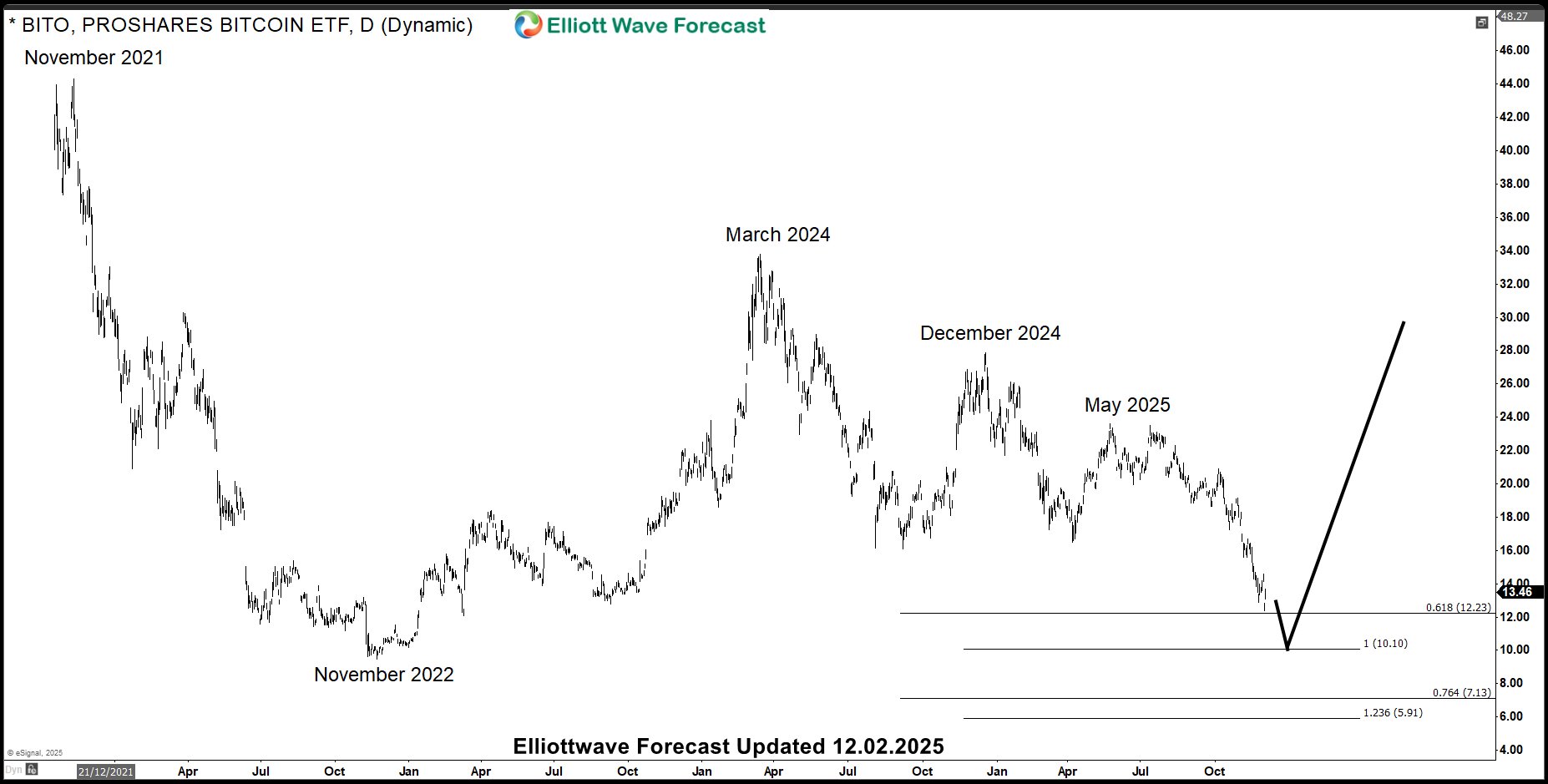

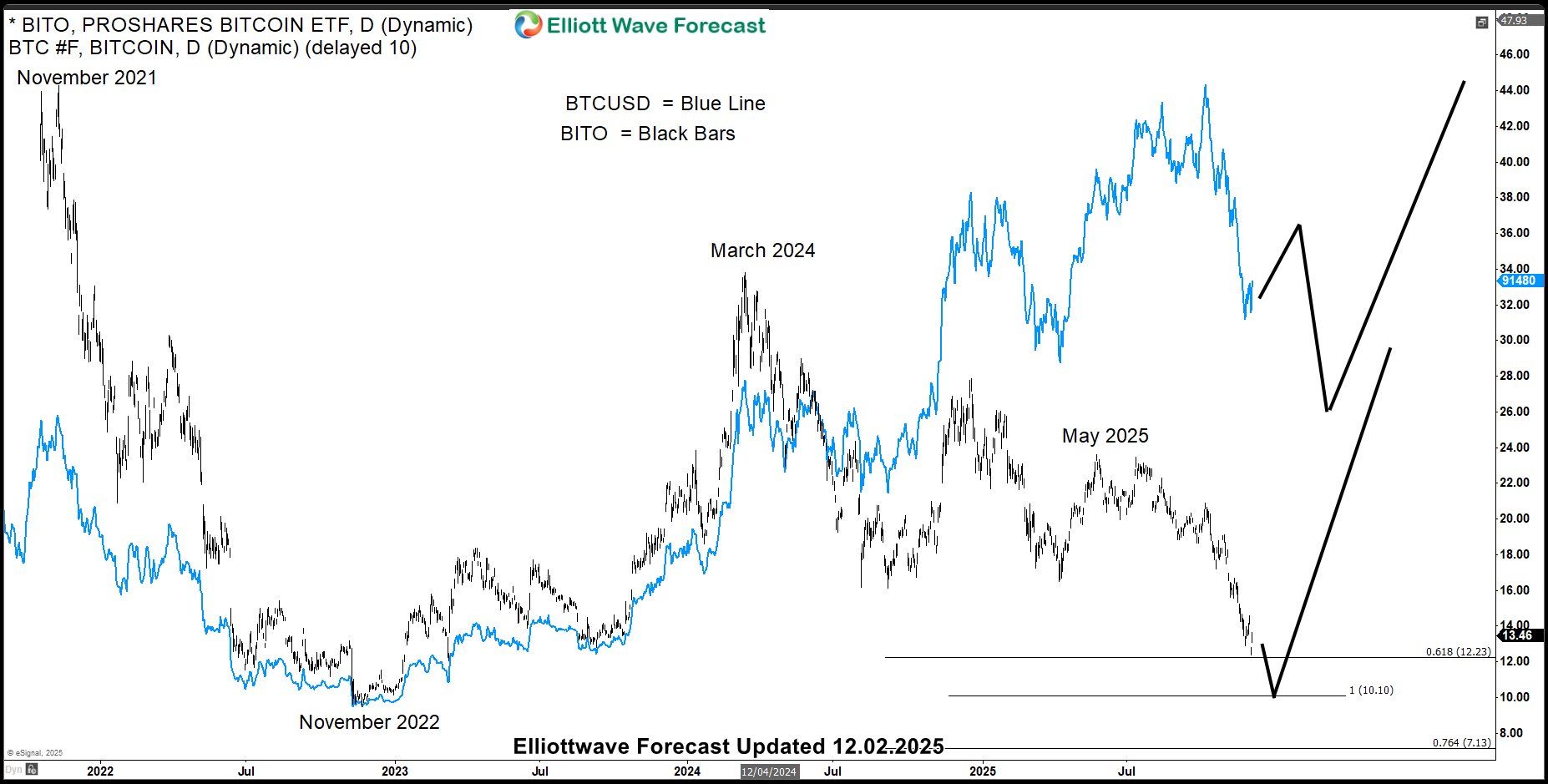

BITO Proshares Bitcoin ETF Warning: Why Bitcoin Isn’t Ready to Fly Yet

Bitcoin’s recent surge toward $91K has traders buzzing with excitment and some are already anticipating the start of next bullish leg, but the charts tell a different story. ProShares Bitcoin ETF (BITO) is flashing signs of weakness, with a potential retracement toward the $10.10 zone. In Elliott Wa

正在加载中...