Cocker

他点赞了

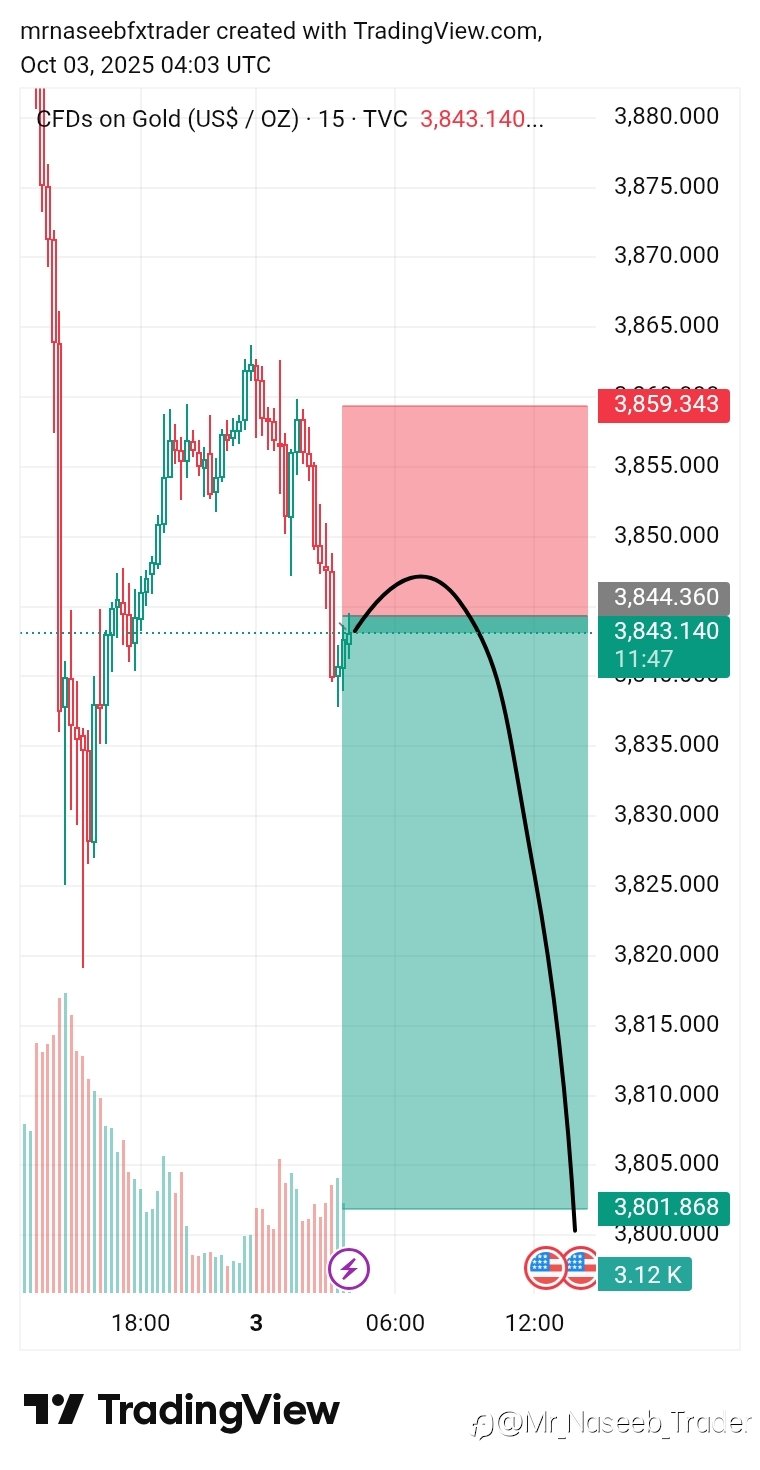

What the US-China Trade Framework Really Means

Partner Center Wondering what’s up with the risk rallies early this week? Equity indices soared to all-time highs on Monday while safe-haven gold tumbled and the lower-yielding dollar weakened. Welcome to what happens when the world’s two largest economies step back from the brink of a full-blown tr

他点赞了

他点赞了

他点赞了

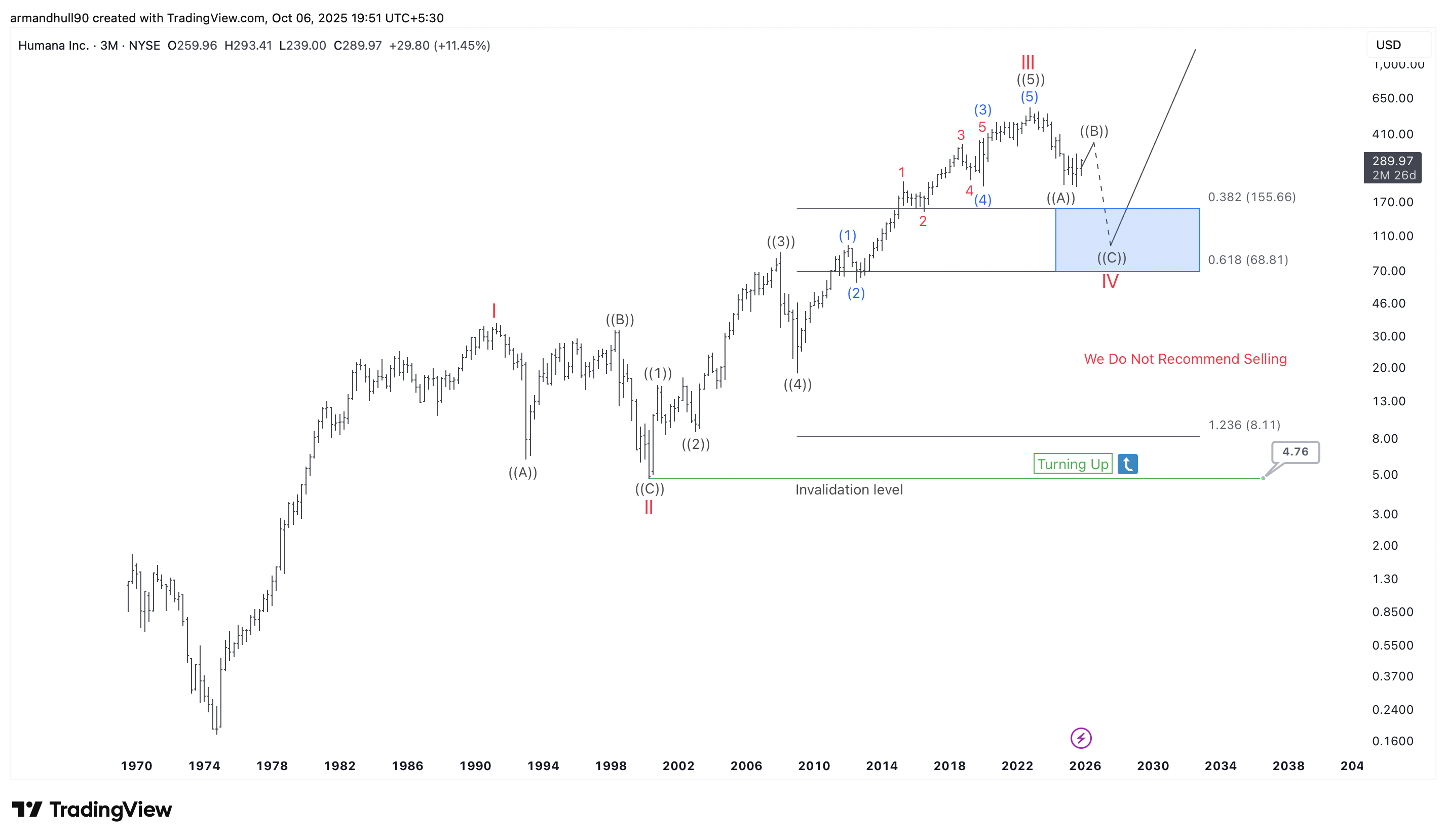

Humana Inc. (HUM) Elliott Wave Forecast: Wave IV Correction Nearing Completion

Humana (NYSE: HUM) shows signs that its large wave IV correction is almost complete, hinting at the next major bullish cycle ahead. Humana Inc. (NYSE: HUM) has spent the last few years correcting after a long and strong rally. The chart shows that the company completed a major five-wave advance from

他点赞了

他点赞了

他点赞了

DXY: ADP, ISM Manufacturing today – OCBC

US Dollar (USD) traded a touch softer overnight in amid concerns of US government shutdown. DXY last seen at 97.62 levels. BLS has already confirmed that it will delay the release of the jobs report (due on Fri) if the US government shutdown occurs, OCBC's FX analysts Frances Cheung and Christopher

他点赞了

Fed divisions come to light: Hawks, doves, and Powell’s balancing act

Introduction The Federal Reserve delivered its first rate cut of 2025, but the market’s reaction has been anything but uniform. Beyond the mechanics of a 25-basis-point reduction, what traders are really debating now is the internal balance of power within the Federal Open Market Committee (FOMC). C

他点赞了

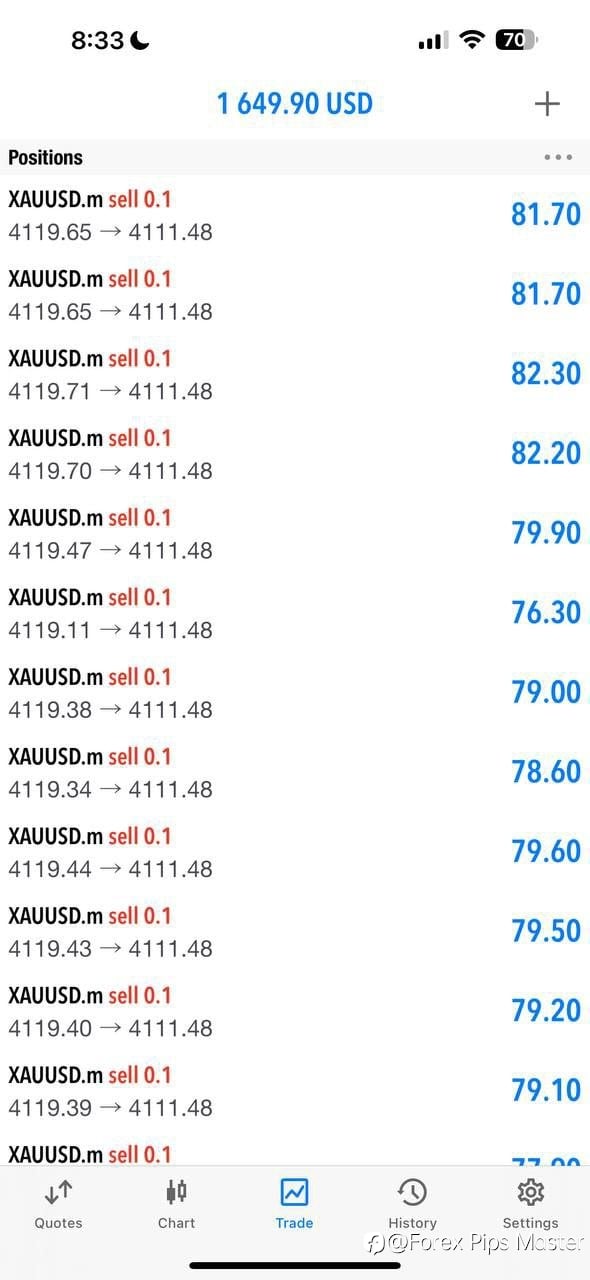

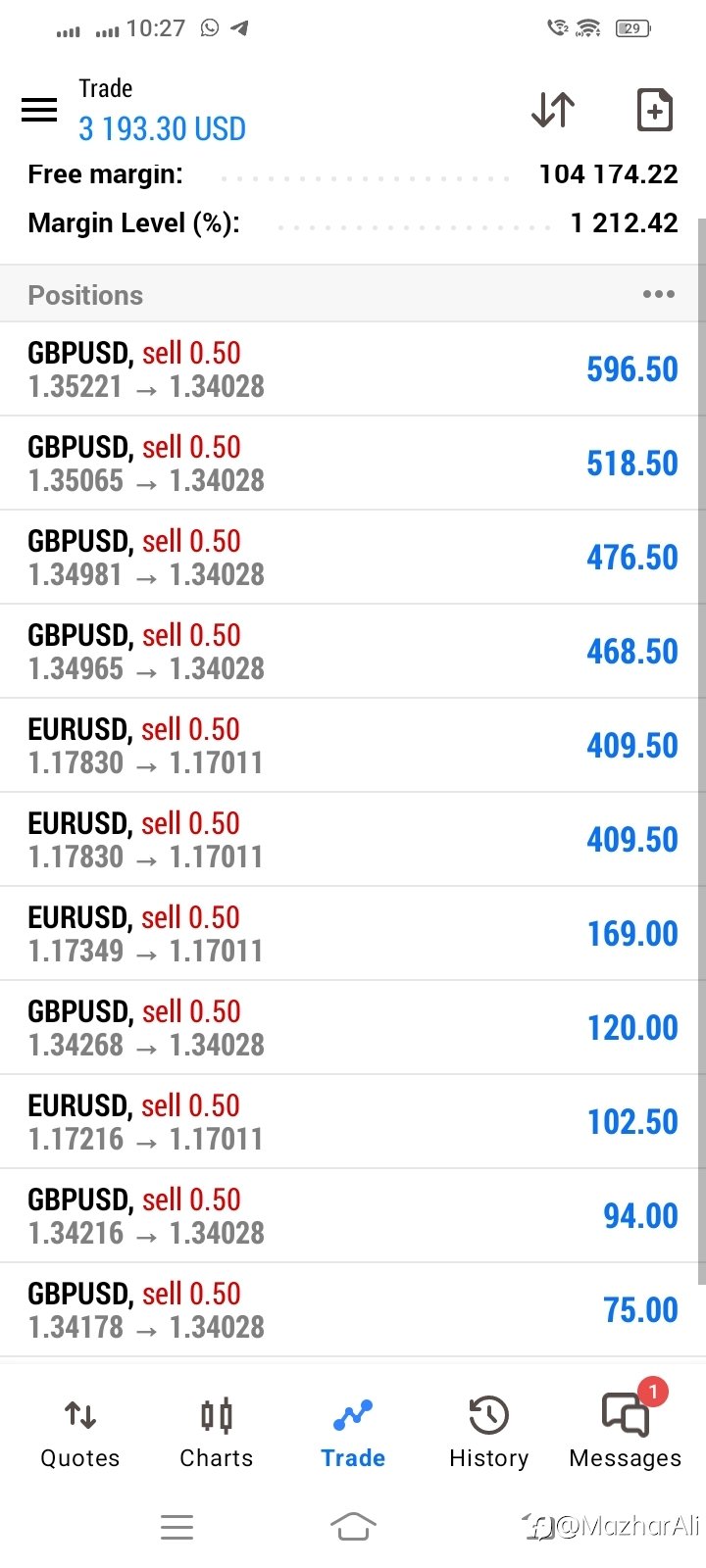

Achieve Consistent Results with Professional Forex Account Management

Tired of the emotional rollercoaster of trading? Spend less time staring at charts and more time enjoying your profits. Let a proven strategy work for you. Why Choose My Management Service? The attached performance snapshot speaks for itself. It demonstrates a disciplined approach focused on risk ma

- Crypto recovery services :Are you a victim of loss crypto Text me directly to recover immediately

他点赞了

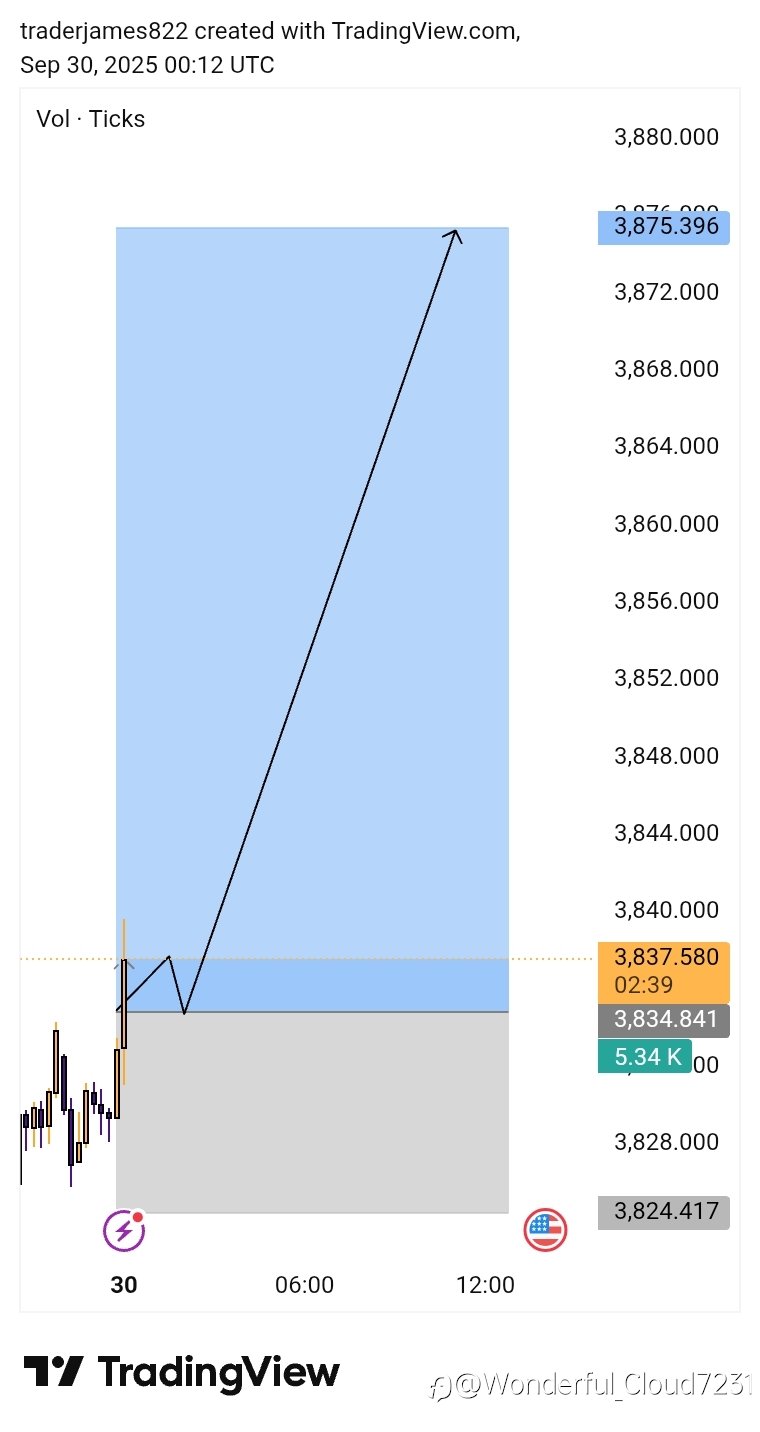

US rate cut pricing sinks 20bp as growth revised upwards in Q2

Following the biggest 12-month revision in NFP data, investors are paying very close attention to weekly initial jobless claims prints, looking for early signs of whether the ‘no hiring’ will turn into the rather more concerning ‘no firing’. So far, so good. Today’s print is the second in a row to s

正在加载中...