他点赞了

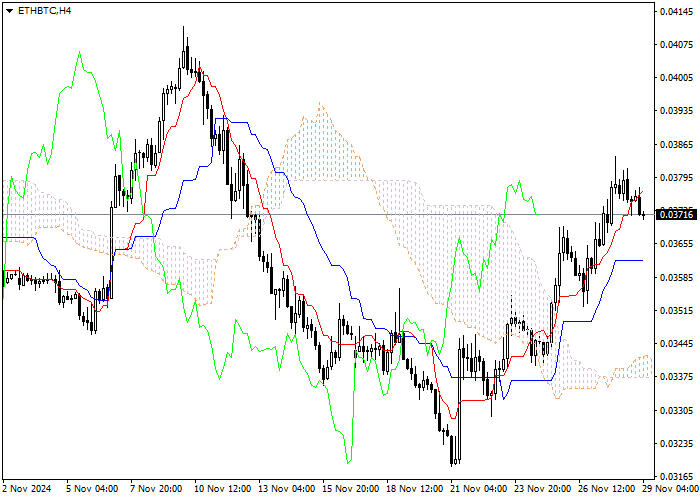

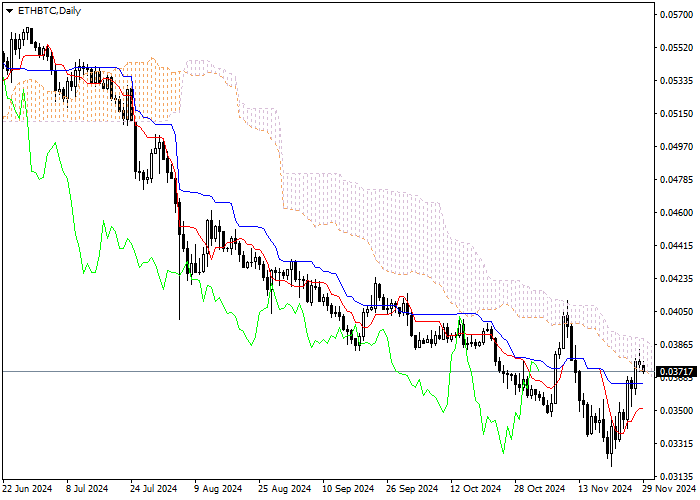

ETH/BTC: Ichimoku indicators analysis

ScenarioTimeframeIntradayRecommendationBUYEntry Point0.0371Take Profit0.0491Stop Loss0.0331Key Levels0.0310, 0.0331, 0.0491, 0.0551Let's look at the four-hour chart. Tenkan-sen line is above Kijun-sen, the red line is directed upwards, while the blue one remains horizontal. Confirmative line Chikou

他点赞了

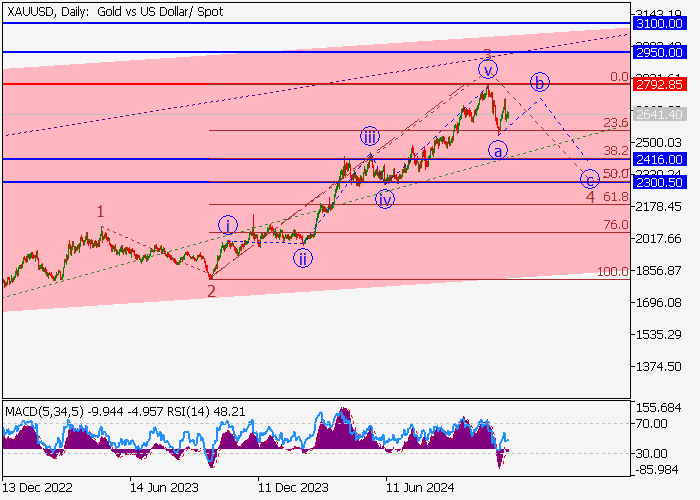

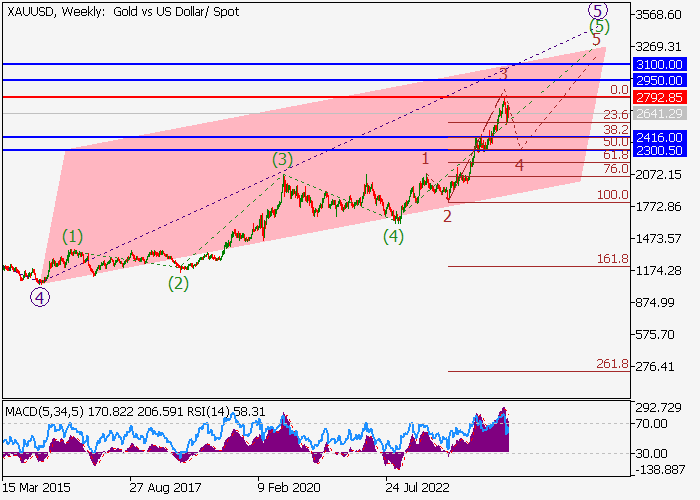

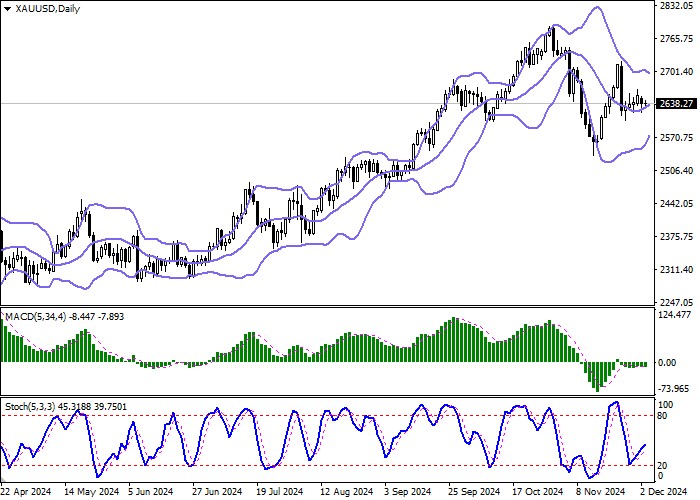

XAU/USD: wave analysis

ScenarioTimeframeWeeklyRecommendationSELLEntry Point2660.05Take Profit2416.00, 2300.50Stop Loss2792.85Key Levels2300.50, 2416.00, 2792.85, 2950.00, 3100.00Alternative scenarioRecommendationBUY STOPEntry Point2792.90Take Profit2950.00, 3100.00Stop Loss2740.55Key Levels2300.50, 2416.00, 2792.85, 2950.

他点赞了

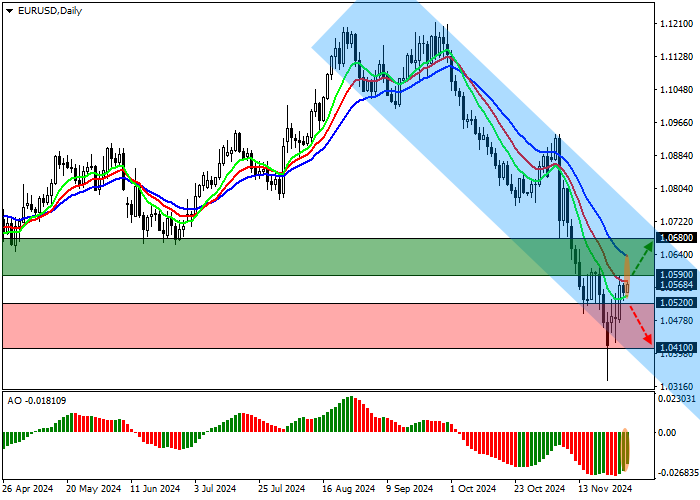

EUR/USD: Analysts predict inflation growth in leading eurozone economies

ScenarioTimeframeWeeklyRecommendationsBUY STOPEntry point1.0590Take Profit1.0680Stop Loss1.0550Key levels1.0410, 1.0520, 1.0590, 1.0680Alternative scenarioRecommendationsSELL STOPEntry point1.0520Take Profit1.0410Stop Loss1.0560Key levels1.0410, 1.0520, 1.0590, 1.0680Current dynamics The EUR/USD pai

他点赞了

行业动态 | 美国核心 CPI 连降四个月,思科宣布裁员跳涨逾 5%

14 日至 15 日,日本二季度 GDP 超预期增长,日股反弹;中国央行连三日大额净投放,中标利率 1.7%;美国 CPI 符合预期,降息预期减弱;思科业绩好于预期,宣布裁员后涨逾 5%;巴菲特再调仓,抄底优质美妆股。 日本二季度 GDP 超预期增长,日股反弹 15 日,日本内阁府公布,第二季度 GDP 折合年率增长 3.1%,大幅高于预估的 2.3%;第二季度 GDP 环比增长 0.8%,高于预估的 0.6%。 图片来源:金十数据 然而,按年计算,日本 GDP 连续第二个季度下滑,继第一季度下滑 0.9% 之后,第二季度又下滑了 0.8%。 日本

D Prime

他点赞了

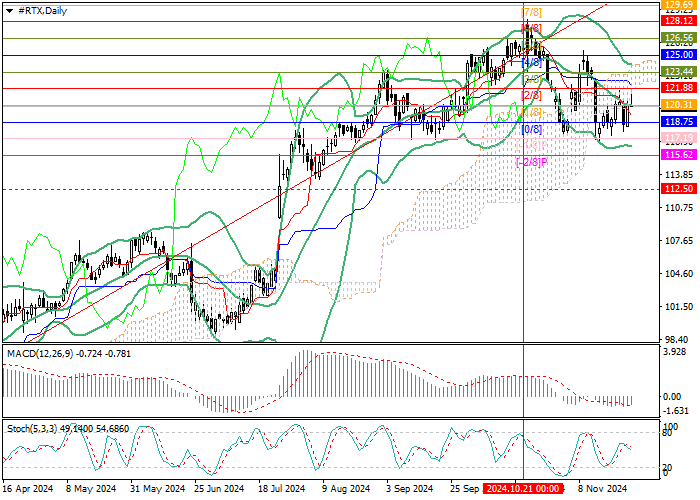

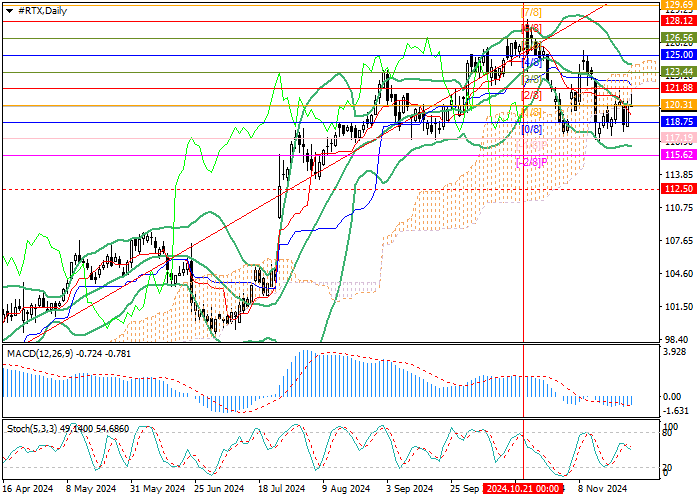

RTX Corp.: Murrey analysis

ScenarioTimeframeWeeklyRecommendationSELL STOPEntry Point118.70Take Profit115.62, 112.50Stop Loss121.00Key Levels112.50, 115.62, 118.75, 121.88, 125.00, 128.12Alternative scenarioRecommendationBUY STOPEntry Point121.90Take Profit125.00, 128.12Stop Loss119.60Key Levels112.50, 115.62, 118.75, 121.88,

他点赞了

Key releases

United States of America USD is weakening against JPY and is ambiguous against EUR and GBP. Labor market data will be released next week, the last before the US Fed’s December meeting. Note that the private consumption expenditure price index increased from 2.1% to 2.3%, and the core value increased

他点赞了

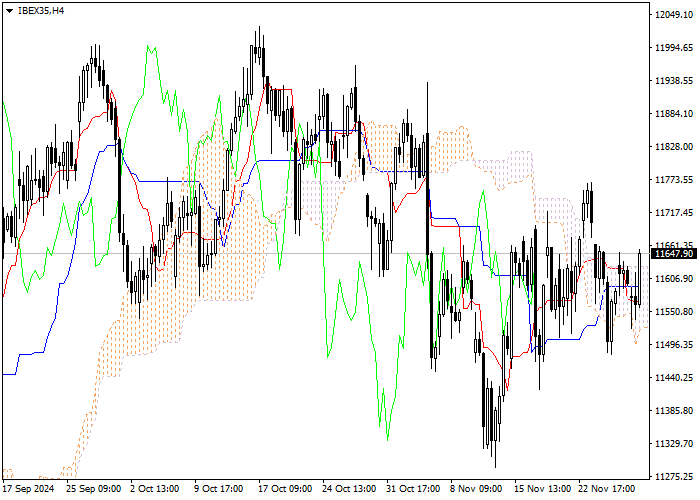

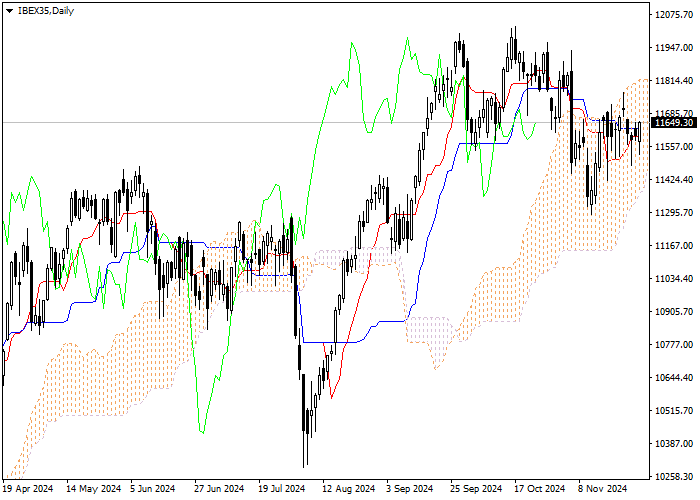

IBEX35: Ichimoku indicators analysis

ScenarioTimeframeIntradayRecommendationSELLEntry Point11635.90Take Profit11626.19Stop Loss11644.12Key Levels11618.85,11626.19,11643.38,<wbr>11644.12Let's look at the four-hour chart. Tenkan-sen line is below Kijun-sen, the lines are horizontal . Confirmative line Chikou Span is crossing the pr

他点赞了

CNMA Buka Bioskop Pertama di Timika

Pasardana.id - PT Nusantara Sejahtera Raya Tbk (Cinema XXI) (IDX: CNMA), jejaring bioskop terbesar di Indonesia dengan pengalaman lebih dari 35 tahun di industri pertunjukan film, resmi membuka bioskop pertama di Timika (Kabupaten Mimika, Provinsi Papua Tengah), yakni Diana Mall XXI. Pj. Sekda Mimik

他点赞了

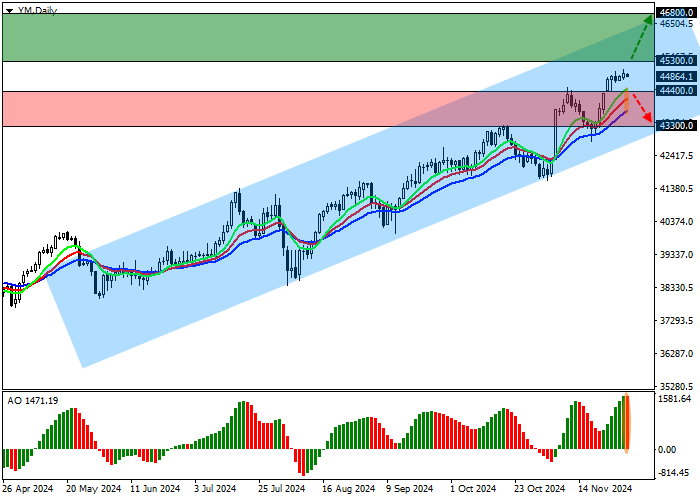

DJIA: US stock market poised to continue rally supported by Donald Trump's rhetoric

ScenarioTimeframeWeeklyRecommendationsBUY STOPEntry point45300.0Take Profit46800.0Stop Loss45000.0Key levels43300.0, 44400.0, 45300.0, 46800.0Alternative scenarioRecommendationsSELL STOPEntry point44400.0Take Profit43300.0Stop Loss44800.0Key levels43300.0, 44400.0, 45300.0, 46800.0Current dynamics T

他点赞了

Key releases

United States of America USD is strengthening against EUR and GBP but has ambiguous dynamics against JPY. The positive dynamics are developing against comments by US President-elect Donald Trump that the BRICS countries should not create a single currency alternative to the US. Otherwise, they will

他点赞了

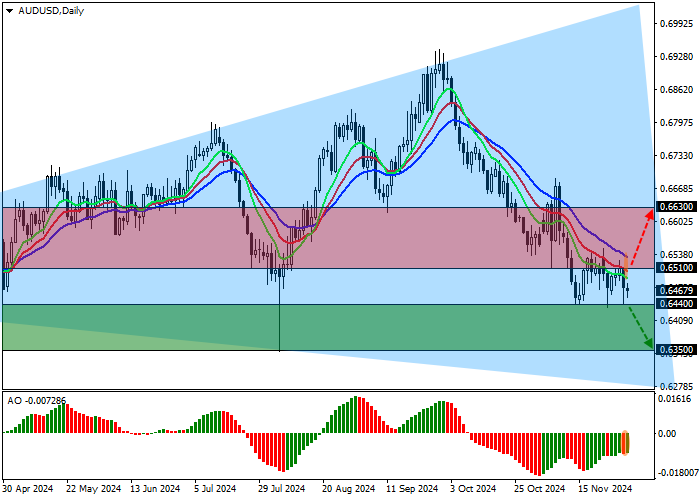

AUD/USD: Growth in manufacturing activity supported the US dollar's position

scenariochartWeeklyRecommendationSELL STOPentry point0.6440Take Profit0.6350Stop Loss0.6500main levels0.6350, 0.6440, 0.6510, 0.6630alternative scenarioRecommendationBUY STOPentry point0.6510Take Profit0.6630Stop Loss0.6470main levels0.6350, 0.6440, 0.6510, 0.6630The ongoing trend The AUD/USD curren

他点赞了

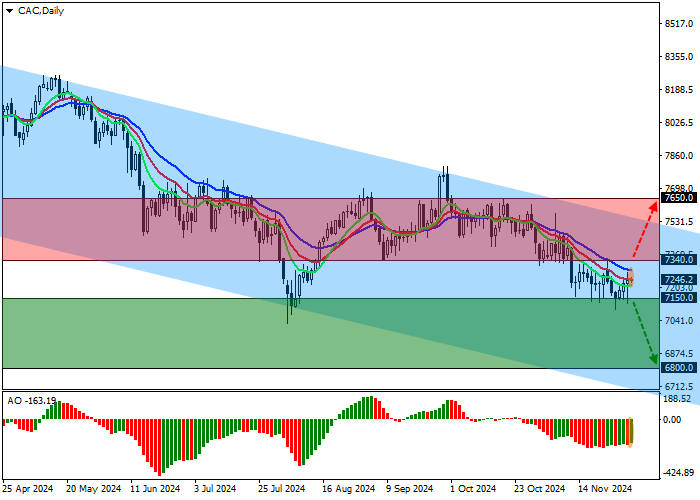

CAC 40: Strengthening Downward Momentum – In Prospect

ScenarioTimeframeWeeklyRecommendationsSELL STOPEntry point7150.0Take Profit6800.0Stop Loss7260.0Key levels6800.0, 7150.0, 7340.0, 7650.0Alternative scenarioRecommendationsBUY STOPEntry point7340.0Take Profit7650.0Stop Loss7220.0Key levels6800.0, 7150.0, 7340.0, 7650.0Current dynamics Negative corpor

他点赞了

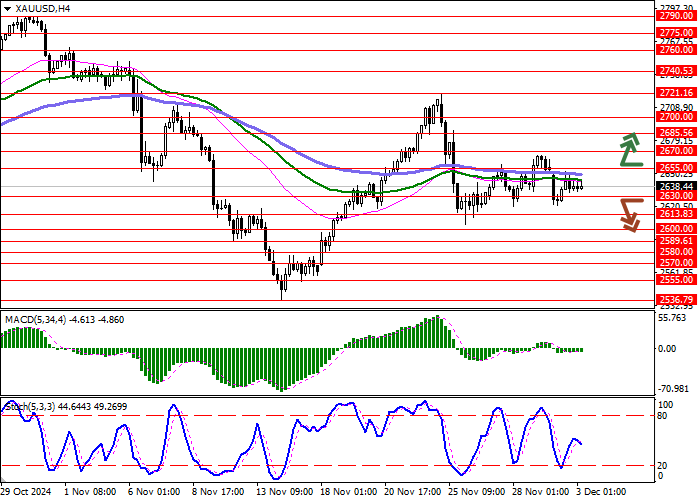

XAU/USD: Investors are increasing their long positions again, expecting the price to continue to rise

ScriptTime frameIntradayRecommendationSELL STOPEntry point2630.00Take Profit2589.61Cut loss2650.00Level of importance2589.61, 2600.00, 2613.83, 2630.00, 2655.00, 2670.00, 2685.56, 2700.00Other optionsRecommendationBUY STOPEntry point2655.00Take Profit2700.00Cut loss2630.00Level of importance2589.61,

他点赞了

PRAKIRAAN HARGA GBP/USD: MELONJAK KE PUNCAK EMPAT HARI, DI ATAS 1,2600

GBP/USD menguat ke level tertinggi empat hari di 1,2667, diperdagangkan pada 1,2646 saat artikel ini ditulis, naik 0,64% setiap hari.Bulls perlu merebut kembali 1,2700 untuk menargetkan SMA 200-hari di 1,2818, sementara penembusan di atasnya dapat menggeser bias ke atas.Pada sisi negatifnya, pergera

正在加载中...