他点赞了

他点赞了

他点赞了

他点赞了

The January CPI inflation report is due out Friday morning. Here's what it's expected to show

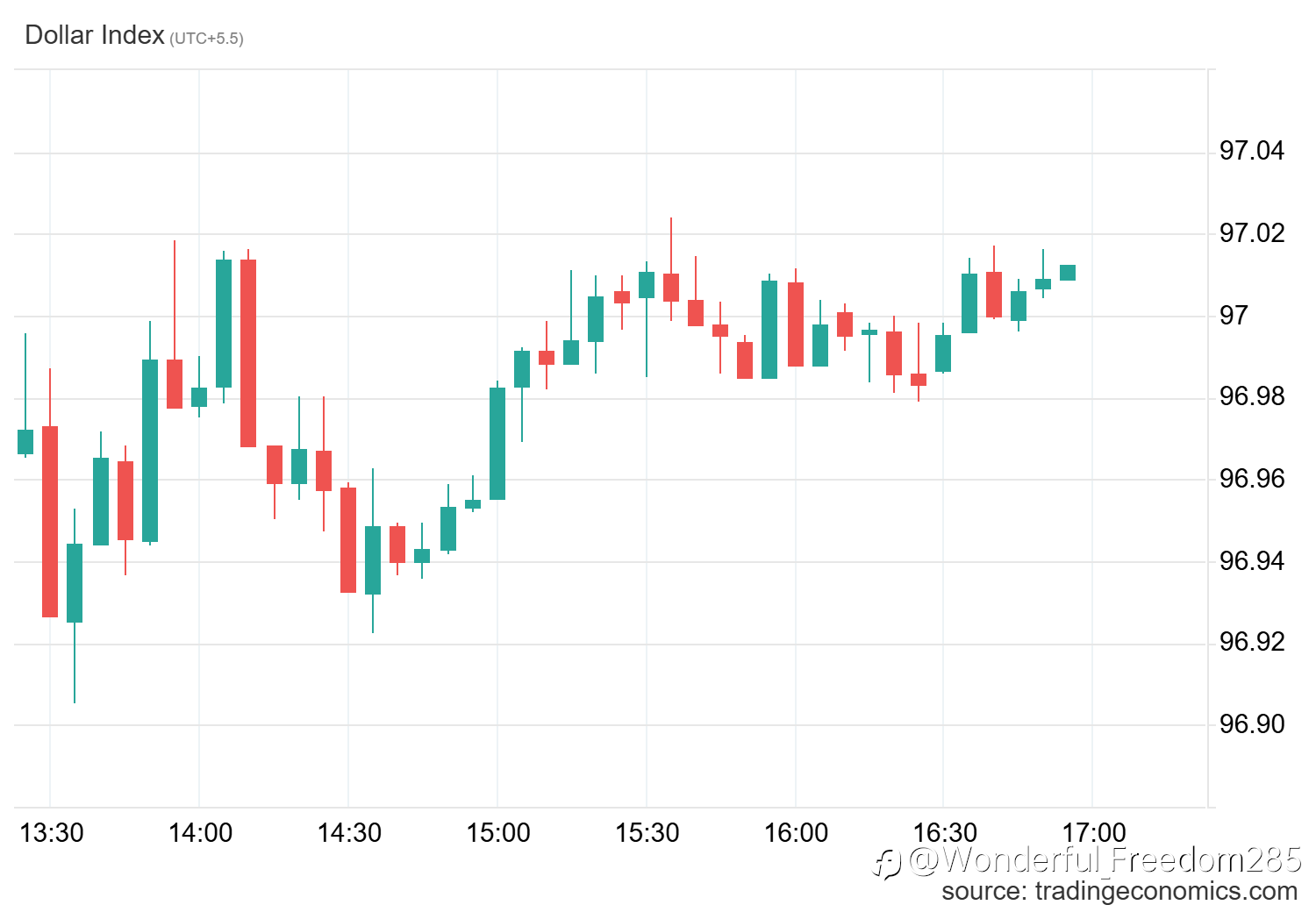

Investors got some good news this week on the state of the labor market and more may be on the way Friday on inflation. The consumer price index, a broad measure of goods and services costs across the U.S. economy, is expected to show a 2.5% gain from a year ago, according to the Dow Jones consensus

他点赞了

他点赞了

他点赞了

Why Cryptocurrency Scams Still Work: It’s All About Trust and Manipulation

As someone who’s witnessed countless scams come and go, Taiwan’s dismantling of the crypto-linked investment fraud ring feels familiar, but also deeply concerning. What strikes me about this case is the psychological manipulation involved. Scammers are no longer relying on c

他点赞了

XAU/USD Alert – Gold shines as Greenland tariff talk shakes markets

XAU/USD Alert – Gold shines as Greenland tariff talk shakes markets Gold just rewrote the highs again. A fresh wave of Greenland-linked tariff headlines flipped the market into risk-off mode, sending traders back to safe havens as XAU/USD momentum accelerated. Gold surged on renewed geop

他点赞了

他点赞了

2026 Market Crystal Ball: Bold Bets on USDJPY, EURUSD, Gold, Silver, Oil, and Bitcoin

As we close out 2025 with markets in flux, I'm channeling my 15+ years as a pro trader to forecast 2026's wild ride. Trump's policies, Fed pauses, and global tensions will dominate, creating winners in safe-havens and losers in energy. Expect volatility spikes mid-year, but trends favor dollar stren

正在加载中...