他点赞了

他点赞了

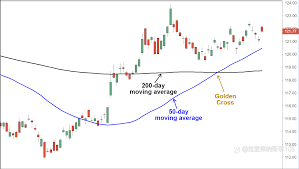

Moving Average Strategy in Forex: A Simple Trend-Following System That Works

#OPINIONLEADER# “Moving Averages help you trade with the trend, not against it. Learn the 50 & 200 Moving Average strategy used by professional Forex traders.” Introduction Many traders lose money because they fight the market. Moving Averages (MA) solve this problem by showing th

他点赞了

他点赞了

他点赞了

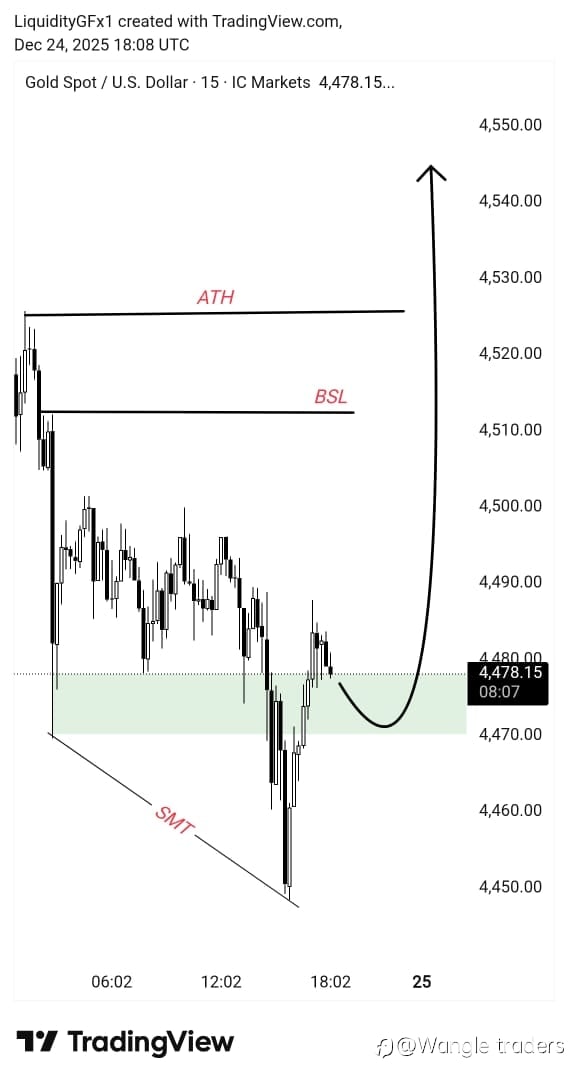

Markets Mixed: Asia Rallies as Gold Hits New Record High

Global markets entered today’s session in a mixed “risk-on” and “risk-off” mode. On one hand, Asian equities surged in tandem with Wall Street’s record highs, led by the tech sector and the AI growth narrative. On the other hand, safe-haven assets such as gold ral

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

📊 Bitcoin Intraday Analysis & Prediction – December 3, 2025

Pair: BTC/USD Timeframe: 30 Minutes Trend Bias: Bullish above 90,530 📈 Market Overview Bitcoin continues to show strong bullish momentum as long as the 90,530 support level holds. Price action remains above the 20 & 50-period moving averages, confirming that buyers still dominate the market str

他点赞了

Markets Pause as They Look for Clearer Signals From the Fed

Markets are entering an important transition phase, and the key driver right now is uncertainty about the Federal Reserve’s next move. Investors are not just waiting for a rate cut they are waiting for clarity. The Fed’s tone has become the anchor of global sentiment, and the absence of strong guida

正在加载中...