他点赞了

他点赞了

他点赞了

Saudi Arabia’s Ma’aden Adds 7.8 Million Ounces of Gold

On January 12, 2026, Saudi Arabia’s state-owned mining giant Ma’aden announced a major discovery: an additional 7.8 million ounces (approximately 242.6 metric tons) of gold resources confirmed through new drilling and geological exploration. This marks a significant step in the Kingdom’s effort to d

他点赞了

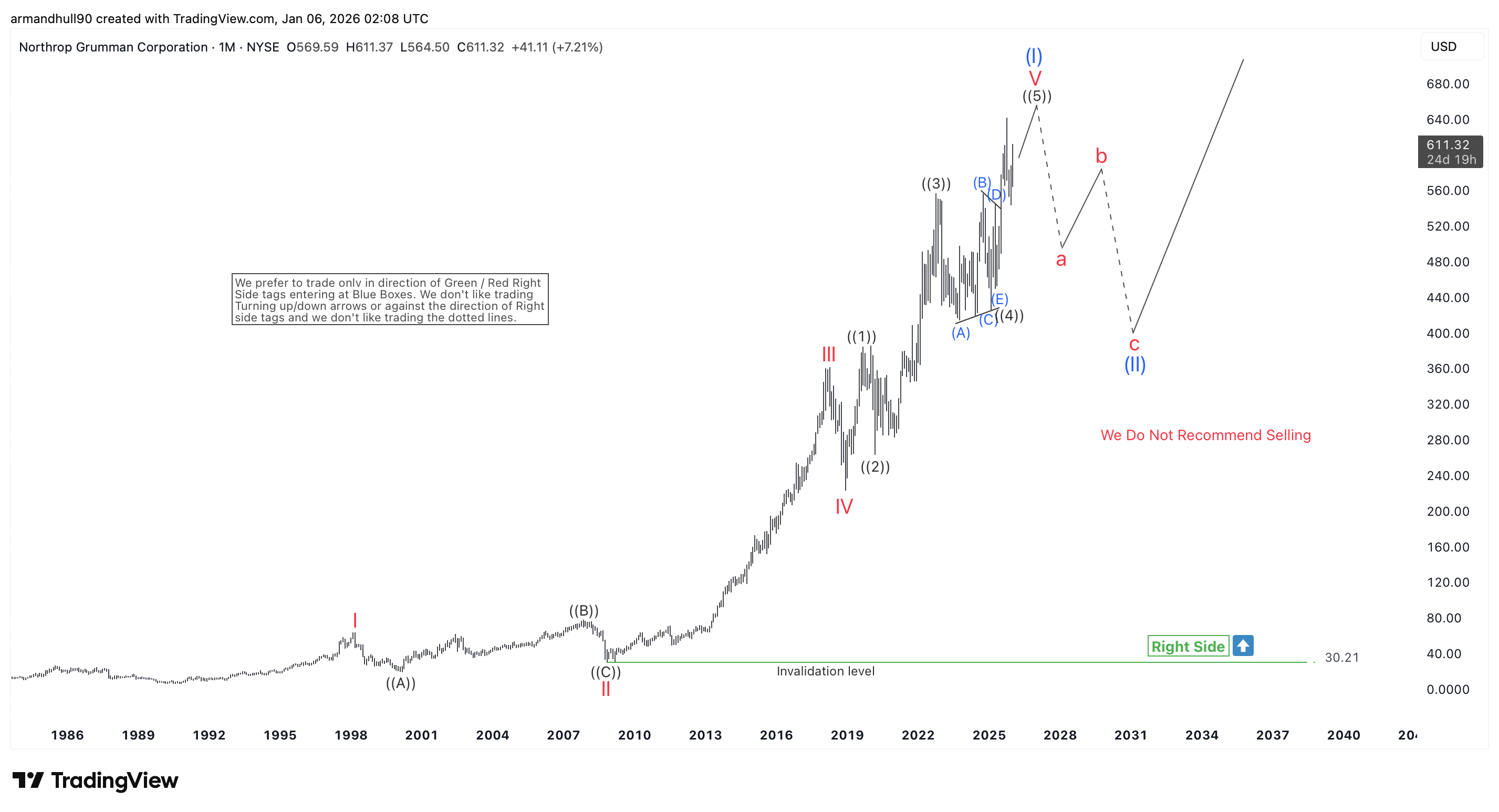

NOC Bullish Cycle Nearing Completion with Possible Retest of Highs

NOC remains in a strong long-term bullish structure, but the Elliott Wave cycle looks mature and may retest recent highs before a deeper corrective phase begins. Northrop Grumman Corporation (NYSE: NOC) remains in a strong long-term bullish trend on the monthly chart. The stock has shown years of st

他点赞了

他点赞了

他点赞了

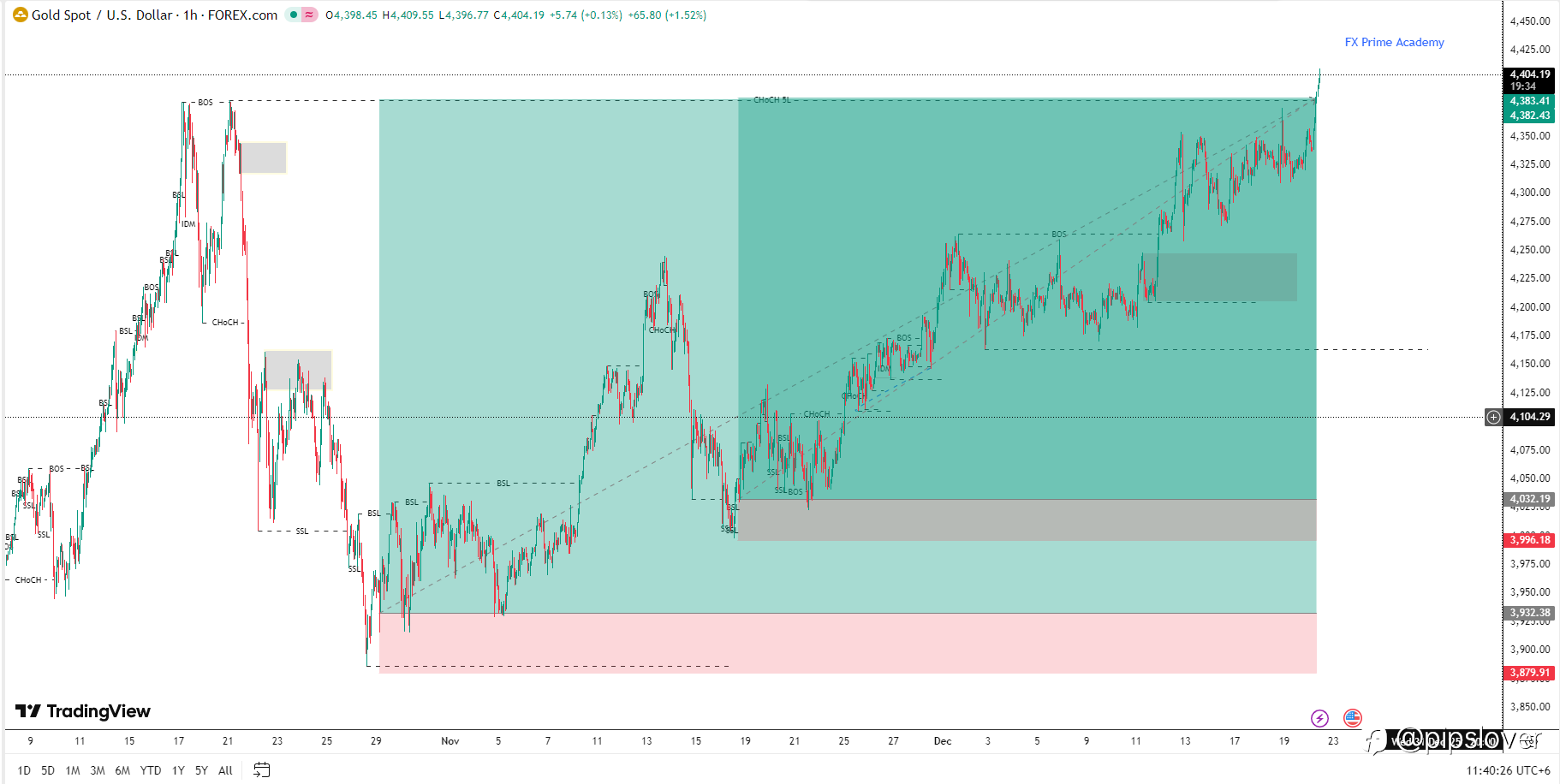

What to Watch Next in the Gold Market and Why It Matters

Looking ahead, several key factors will shape the next move in gold prices. Inflation trends remain important, as rising prices can support gold’s role as a hedge. At the same time, central bank signals especially around interest rates will continue to influence gold’s appeal versus yiel

他点赞了

他点赞了

The Santa Claus Rally: Are Gains Coming to Town This Year?

Partner Center Why are markets typically buzzing about a so-called Santa Claus rally during this time of the year, and how often does it happen? Let’s break down one of Wall Street’s favorite holiday traditions and what beginner traders should know about this seasonal market pattern, and why it matt

- Satellite d'Arusha :Good morning, how are you doing ?

他点赞了

U.K. Budget Breakdown: Tax Hikes, Data Leak, and Market Impact

Partner Center All eyes and ears were on U.K. Chancellor Rachel Reeves Budget Statement this week, with markets zoned in on every clue and headline ahead of the actual announcement. So when the U.K. government’s fiscal watchdog (Office for Budget Responsibility) accidentally published the entire Bud

他点赞了

What Rate-Cut Bets and Fed Signals Mean for Markets & Investors

With the chance of a rate cut rising, investors are watching closely for signals from the Fed including statements from central-bank officials and upcoming economic data. If the Fed moves to ease, it could boost sectors sensitive to interest rates like technology, real estate, and growth stock

正在加载中...