他点赞了

🌍 Morning Update | Friday, January 30

Global markets are ending the week in a risk-off mood as investors reassess Fed leadership expectations, geopolitical signals and stretched positioning across assets. Asian equities closed mostly lower 📉. Chinese indices fell between 0.85% and 1.40%, Australia’s AU200.cash dropped 1.10%, while Japa

他点赞了

The Role of Crypto Payments in Faster Horse Racing Wagers and Payouts

The way people place wagers on horse racing has evolved significantly with the rise of cryptocurrency payments. What was once a process slowed down by banks, payment gateways, and withdrawal delays is now becoming faster, more transparent, and more accessible. Crypto payments are playing a central r

他点赞了

Weekly Data Report | Spotlight on Top Performers 30 December 2025 - 5 January 2026

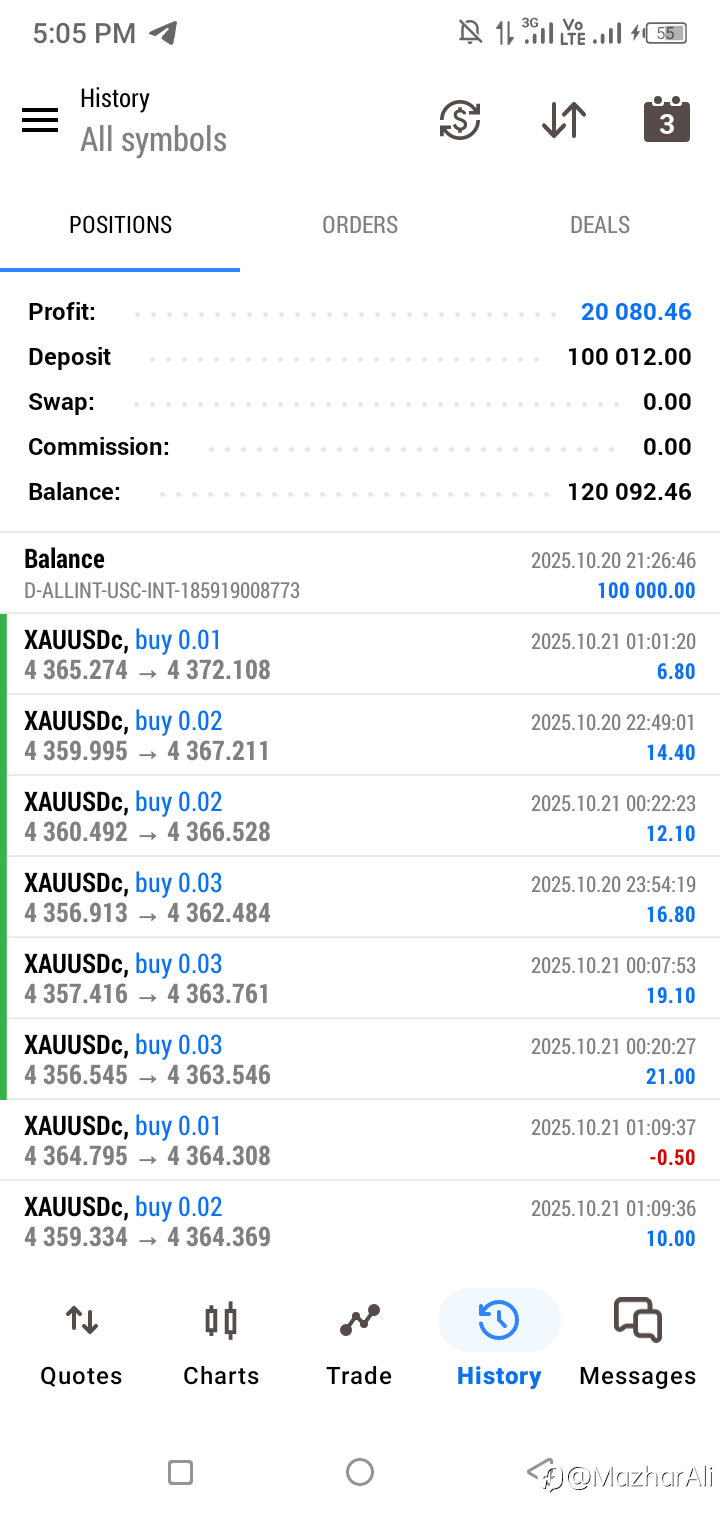

Last Week's Trading Frenzy: $112,255.41 in Total Profit! The Followme trader community has been on fire. Last week's profit isn't just high, it's phenomenal. With market moves this active, our top traders have truly outdone themselves. Let's dive into the leaderboard and follow the stars of th

他点赞了

他点赞了

他点赞了

他点赞了

A 100% Return Promise Isn’t Innovation, It’s a Ponzi With Better Marketing

As someone who has been in the trading world long enough to see countless cycles of hype and collapse, the CBEX case in Nigeria follows a painfully familiar script. An unregistered platform, big talk about AI-driven profits, and a bold promise of 100% returns in 30–45 days is not a trading str

他点赞了

他点赞了

他点赞了

The Fed Just Ended QT: What It Could Mean for the Dollar

Partner Center So the U.S. Federal Reserve ended “QT” on December 1, 2025. What does that actually mean for currency traders? No, the U.S. central bank is not ending “Quality Time” because FOMC members are divided on their policy biases. Instead, after three years of draining money from the financia

他点赞了

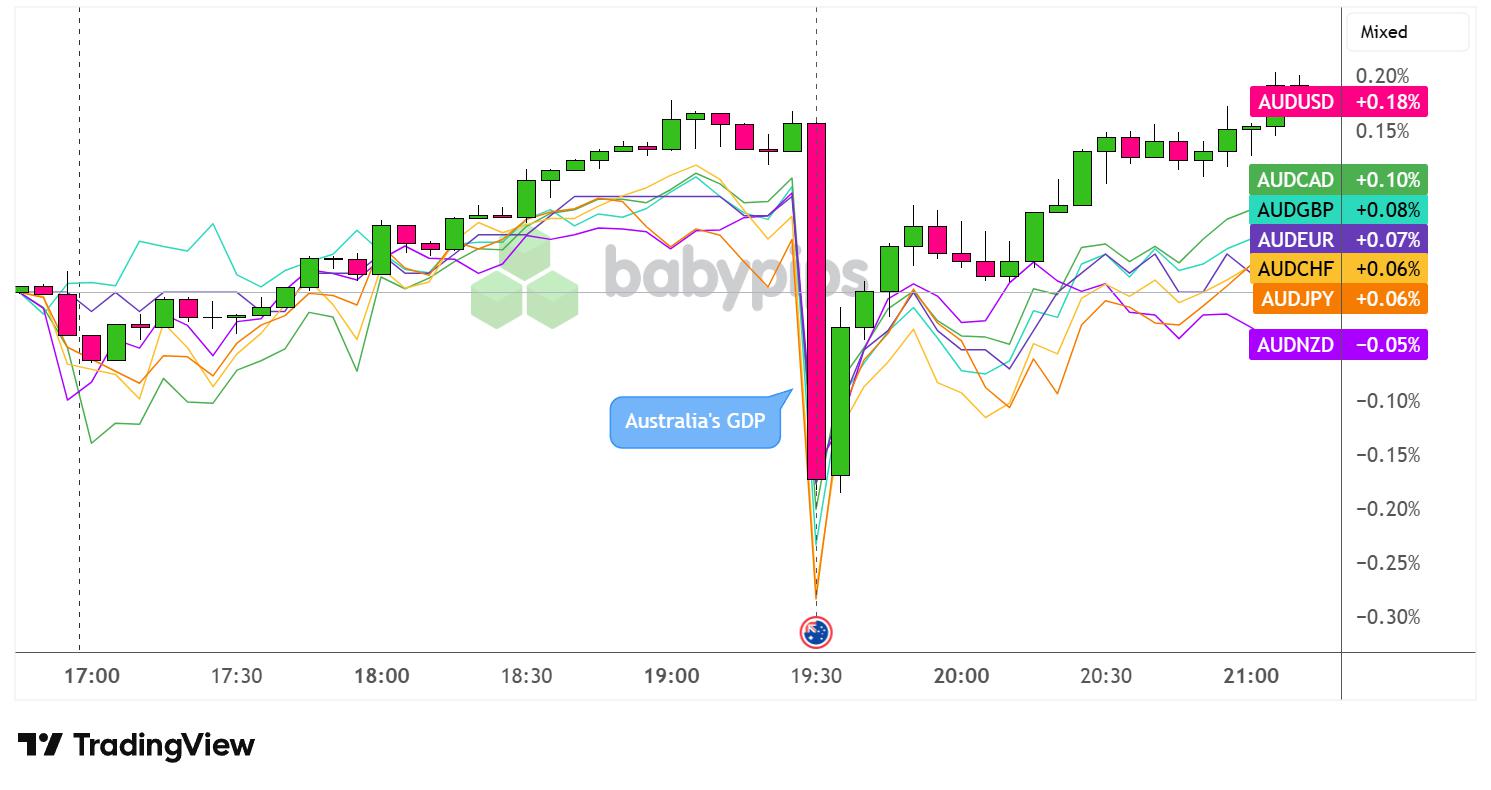

AUD Slumps Then Quickly Recovers After Q3 2025 Australian GDP Miss

Partner Center Australia’s economic growth disappointed market expectations in the third quarter of 2025, with GDP expanding 2.1% year-over-year compared to forecasts of 2.2%. On a quarterly basis, the economy grew 0.4%, missing the 0.7% Reuters poll estimate, according to data released by the Austr

正在加载中...