他点赞了

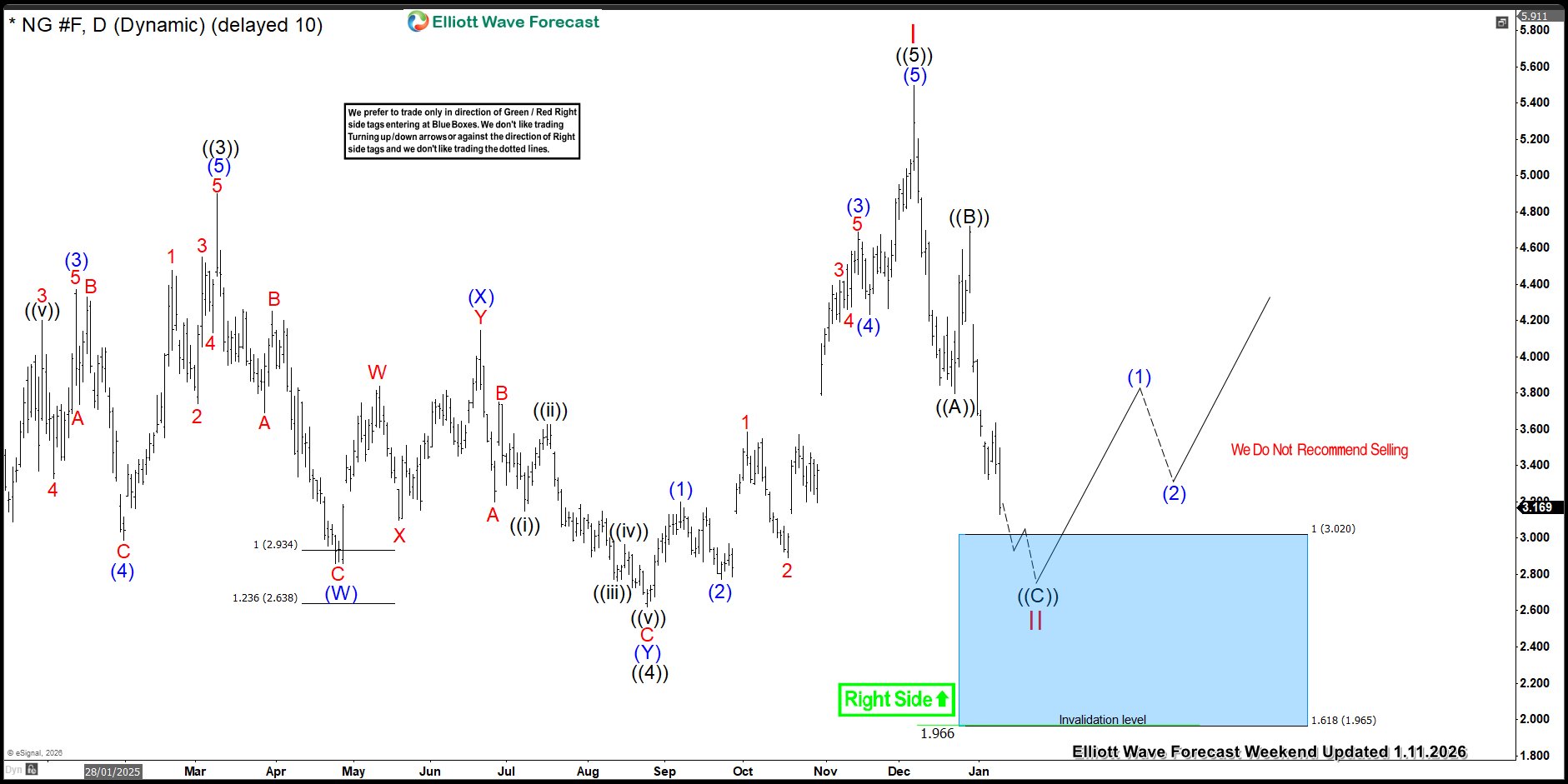

From Fib Levels to Fireworks: Natural Gas Explodes 146% in 12 Days

Natural Gas has once again reminded traders of its explosive potential. After finding buyers at a key Fibonacci extension area, prices catapulted 146% in just 12 trading days—an extraordinary rally that left skeptics behind and rewarded those who trusted the technical confluence. This surge wasn’t j

他点赞了

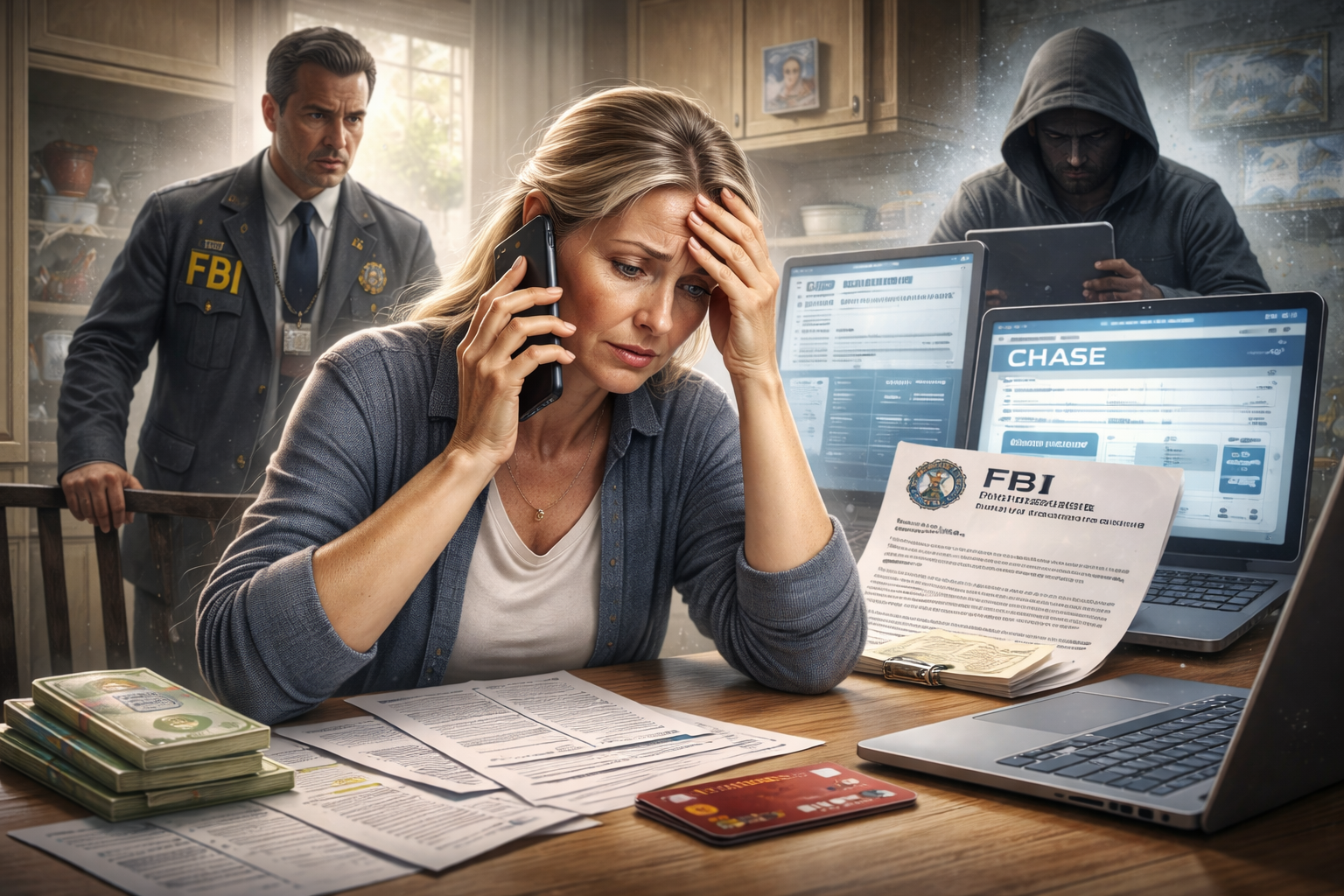

Impersonating the FBI is Not a Trading Strategy, It’s a Crime

As a retired professional trader, this Houston case highlights one of the darker aspects of financial manipulation that goes beyond just market moves — it exploits human trust. Scammers impersonating trusted institutions like banks and the FBI is an old trick but with new, sophis

他点赞了

他点赞了

他点赞了

他点赞了

🚨 Stellar (XLM) slips below $0.22 — what’s driving the weakness?

#XLM/USD# fell 1.18% in 24h, underperforming the crypto market as bearish momentum builds ⚠️ 🔍 What’s happening? • ❌ Rejected at key resistance ($0.232 pivot / 30-day SMA) • 🟠 #Bitcoin# dominance jumps to 59.1% → altcoin liquidity drain • 💧 24h volume drops 16% to $11

他点赞了

他点赞了

Payrolls rose by 64,000 in November after falling by 105,000 in October, delayed jobs numbers show

Nonfarm payrolls grew slightly more than expected in November but slumped in October while unemployment hit its highest in four years, the Bureau of Labor Statistics reported Tuesday in numbers delayed by the government shutdown. Job growth totaled a seasonally adjusted 64,000 for the month, better

他点赞了

AIZ Trade Setup: Buyers Launched from Blue Box Aiming $250

On AIZ stocks, buyers activated new Longs from the blue box while aiming $250-$260 as the bullish cycle from year 2020 continues. In this blog post, we'll discuss potential targets for this setup as well as where and where traders can wait for next opportunity. Assurant Inc. (NYSE: AIZ) is a l

正在加载中...