他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

How Japan and the U.S. Defended the Yen Without Spending

Partner Center Last Friday delivered a stark reminder that in currency markets, words can move billions of dollars faster than any actual transaction. The Japanese yen surged 1.75% in a single day—its sharpest rally since August—after the Federal Reserve Bank of New York conducted “rate checks” with

他点赞了

GBP’s Initial Gains Reverse Despite Hotter UK Inflation as Risk Sentiment Shifts

Partner Center U.K. consumer price inflation rose to 3.4% year-on-year in December, up from 3.2% in November and slightly above the 3.3% market consensus, marking the first increase in five months. The uptick was driven primarily by higher tobacco prices following duty increases announced in the lat

他点赞了

As a New Trader, This Shows Me How Quickly a “Small Test” Can Turn Into a Family Disaster

As someone still early in my trading journey, reading this story honestly scares me. Sending what feels like a “manageable” amount to test a platform sounds reasonable when you’re new, especially if the account balance keeps going up on screen. But realizing that those

他点赞了

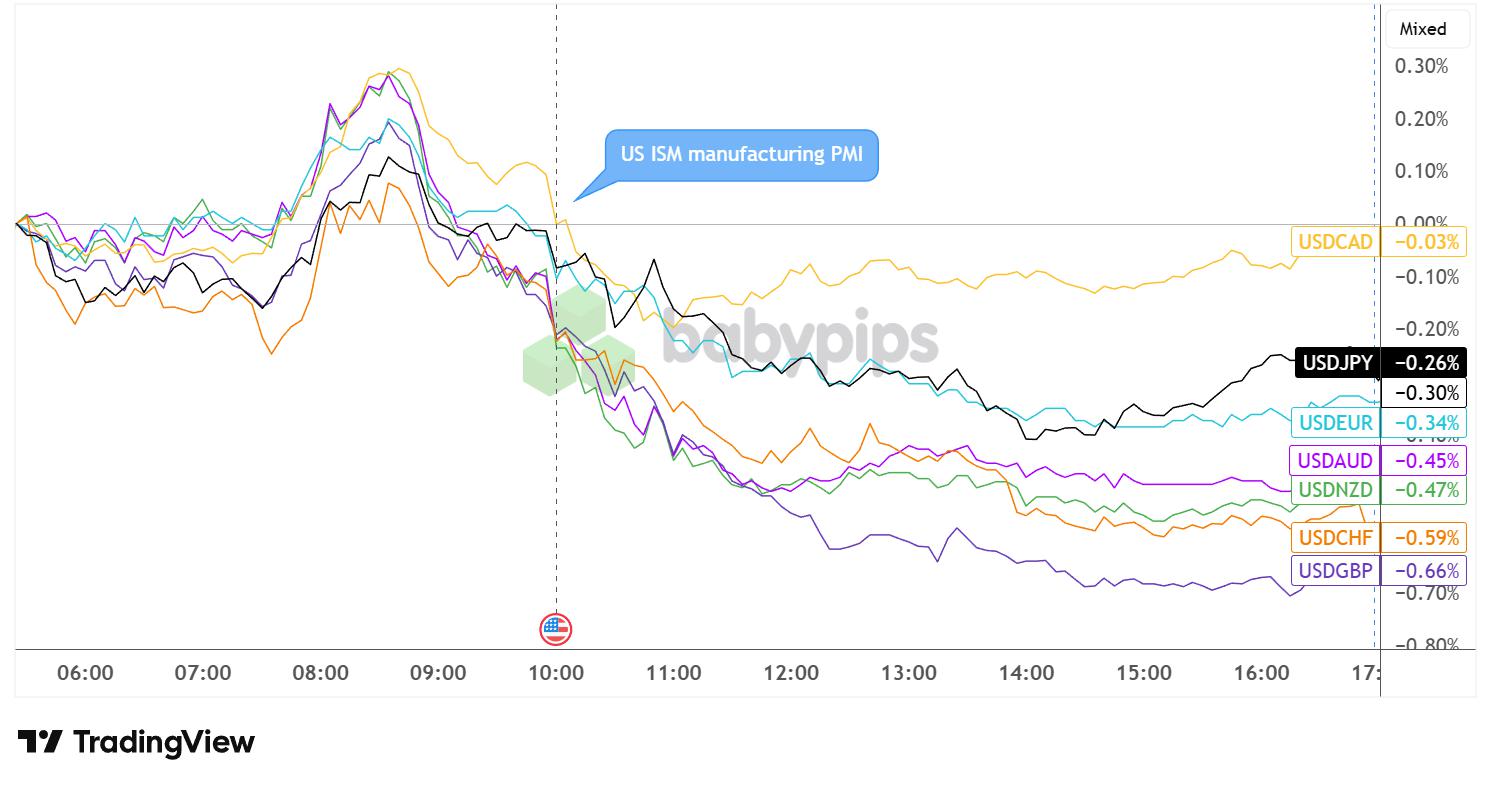

U.S. ISM Manufacturing PMI Reflected Deeper Contraction in December

Partner Center The U.S. manufacturing sector capped off a turbulent 2025 with continued weakness in December, as the ISM Manufacturing PMI slipped to 47.9%, marking the lowest reading of the year and the tenth consecutive month of contraction. Key Takeaways Manufacturing PMI declined to 47.9% from 4

他点赞了

他点赞了

他点赞了

他点赞了

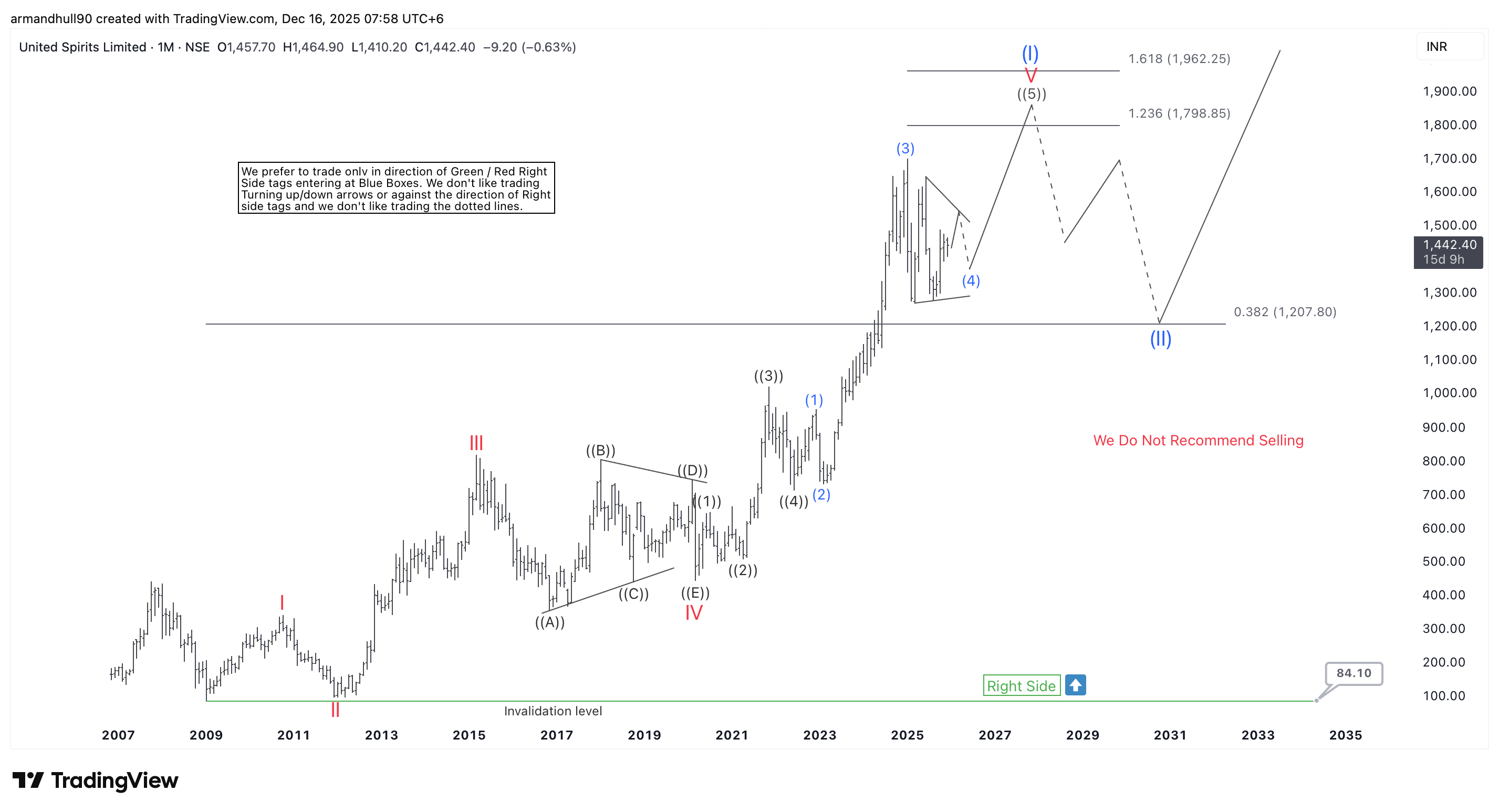

UNITDSPR Elliott Wave Outlook: Bullish Structure Points to ₹1,798–₹1,962 Targets

Monthly Elliott Wave analysis shows Wave I nearing completion, key Fibonacci targets ahead, and a corrective pullback before the next major rally. United Spirits Limited (NSE: UNITDSPR) continues to trade in a strong long-term bullish Elliott Wave structure on the monthly chart. The broader trend re

正在加载中...