他点赞了

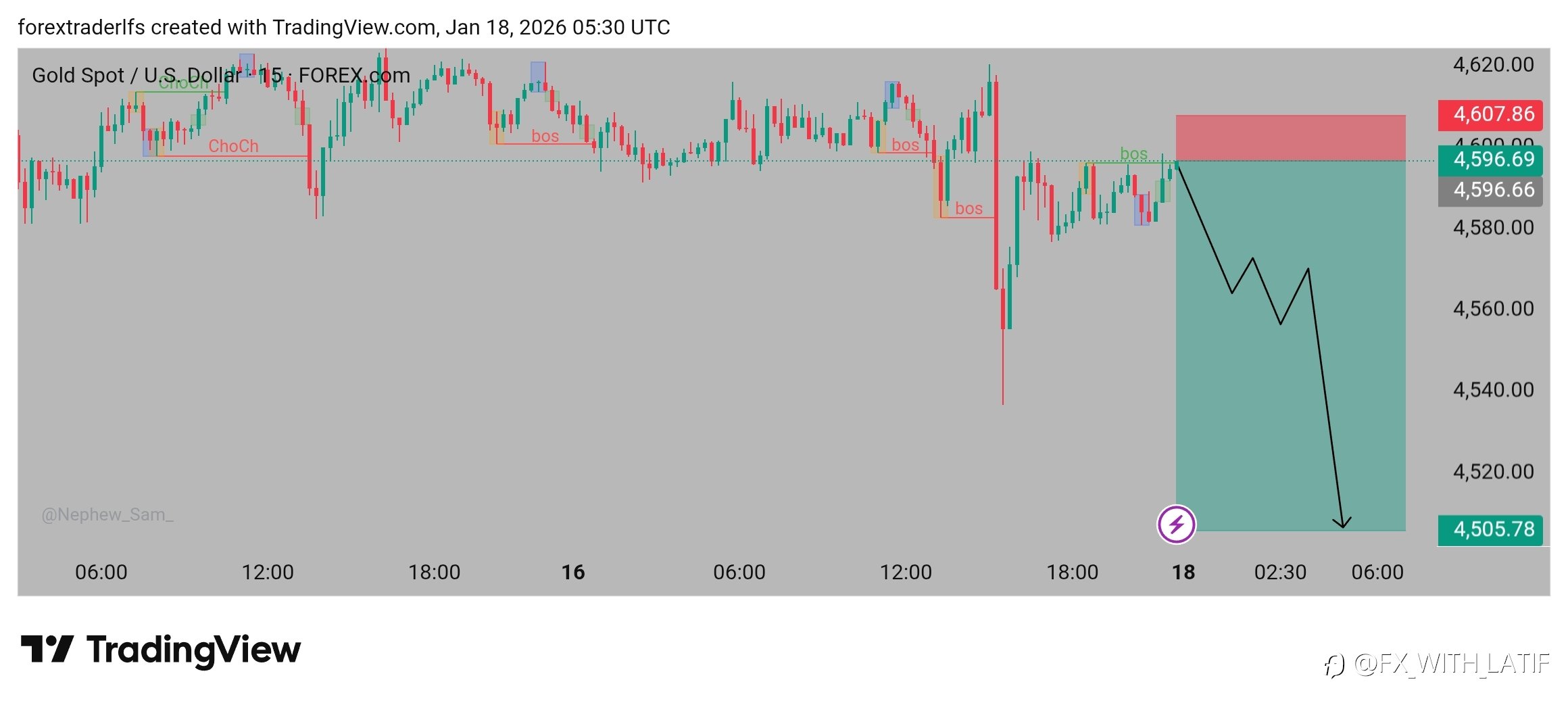

USD Trades Choppy as Forex Remains Headline-Sensitive

Global financial markets on 28 January 2026 continue to trade in a cautious and headline-sensitive environment, as investors remain reluctant to commit to a clear directional view. In the FX market, the USD continues to fluctuate within wide ranges, reflecting the ongoing tug of war between interest

他点赞了

他点赞了

他点赞了

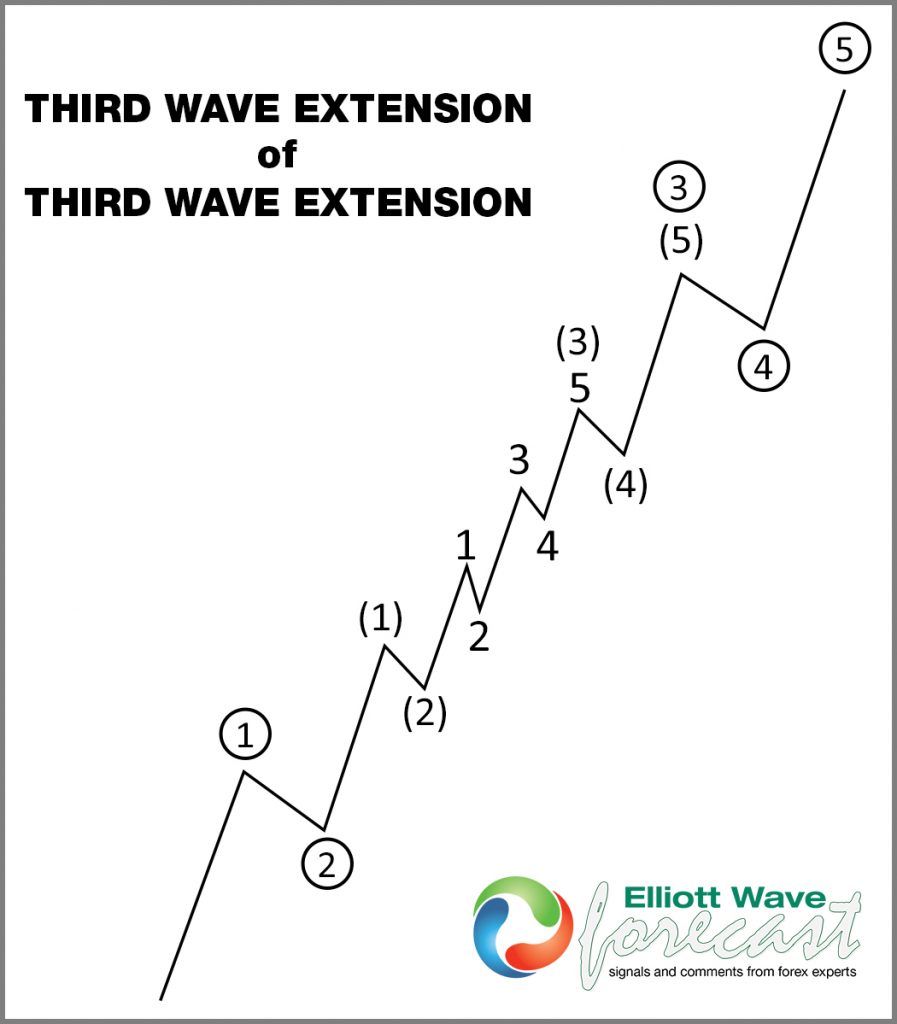

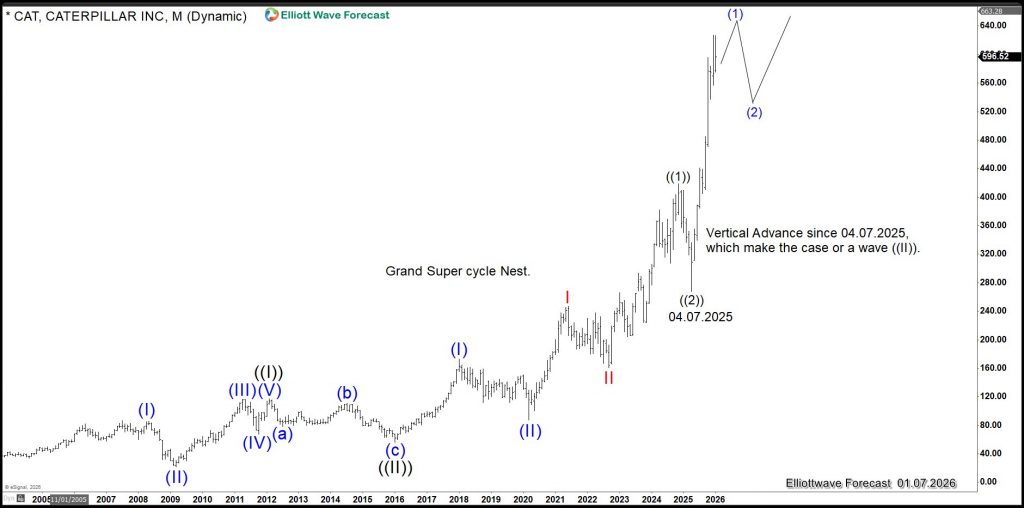

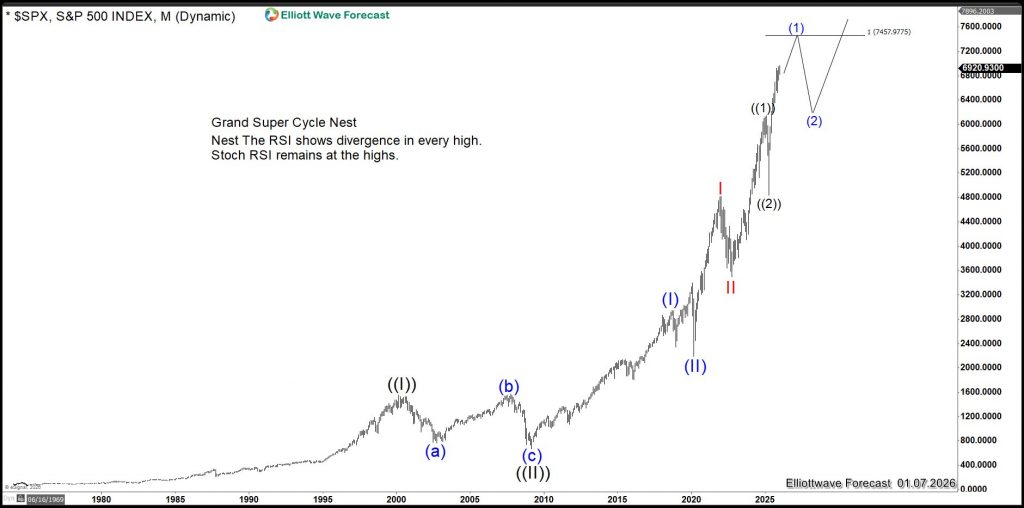

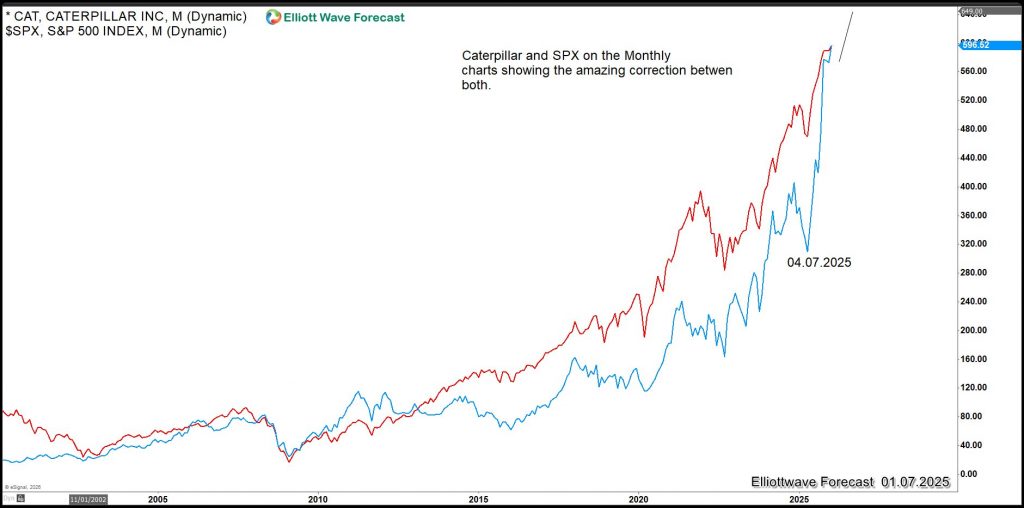

Caterpillar (CAT) Confirms Structural Nesting in the S&P 500 (SPX) With Targets at 10,000

As a bellwether industrial stock, Caterpillar often reflects the underlying strength of the economy and signals long-term market positioning. Its price behavior tends to lead broader market trends, offering insight into structural phases rather than short-term fluctuations. Viewed through this lens,

他点赞了

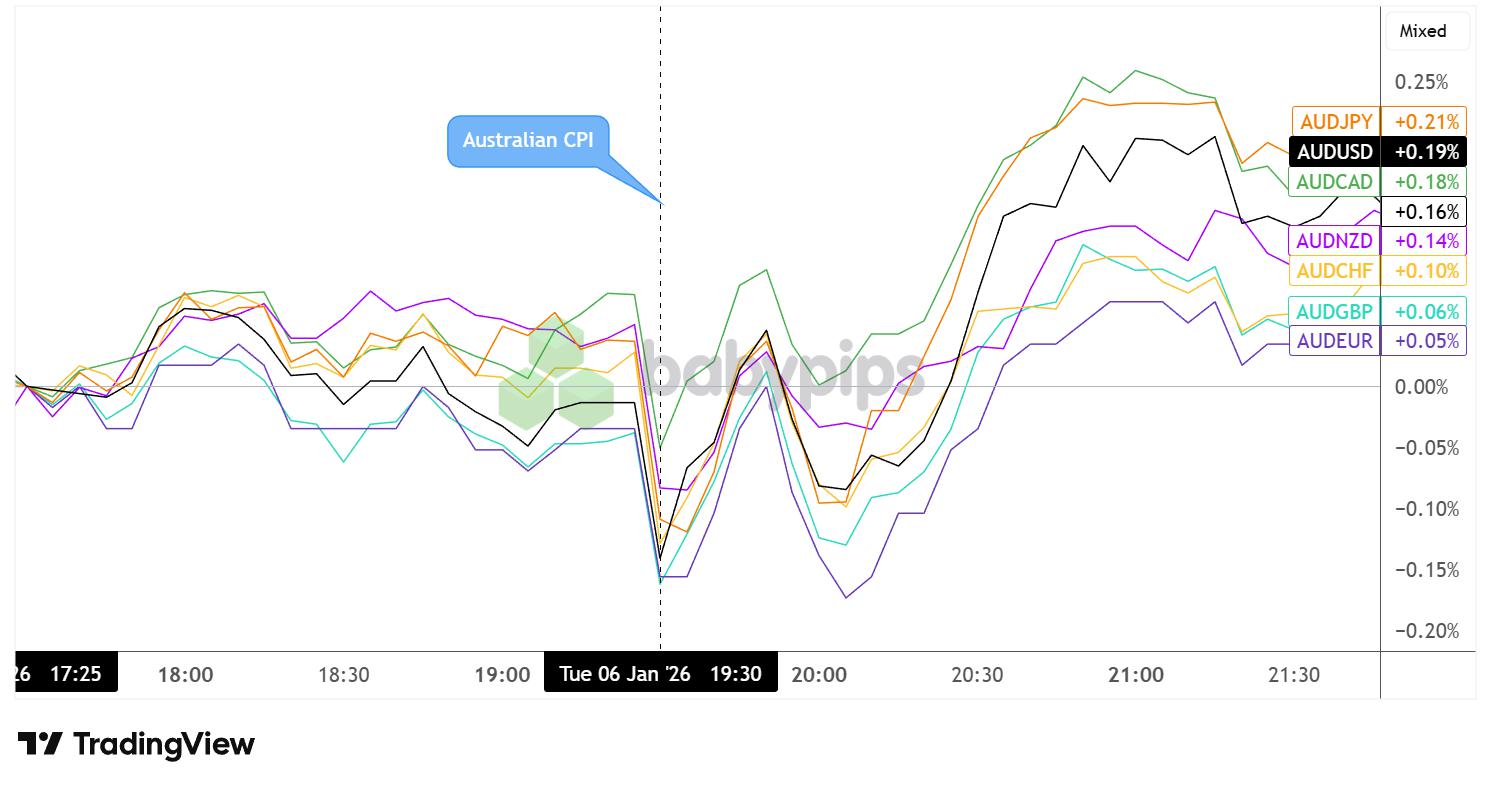

Australian Inflation Cooled to 3.4% in November, But AUD Still Supported

Partner Center Australia’s headline CPI fell from 3.8% to 3.4% year-on-year in November, prompting traders to briefly consider the idea of further RBA easing. November data from the Australian Bureau of Statistics reflected broad-based deceleration in price pressures, with both goods and services in

他点赞了

他点赞了

他点赞了

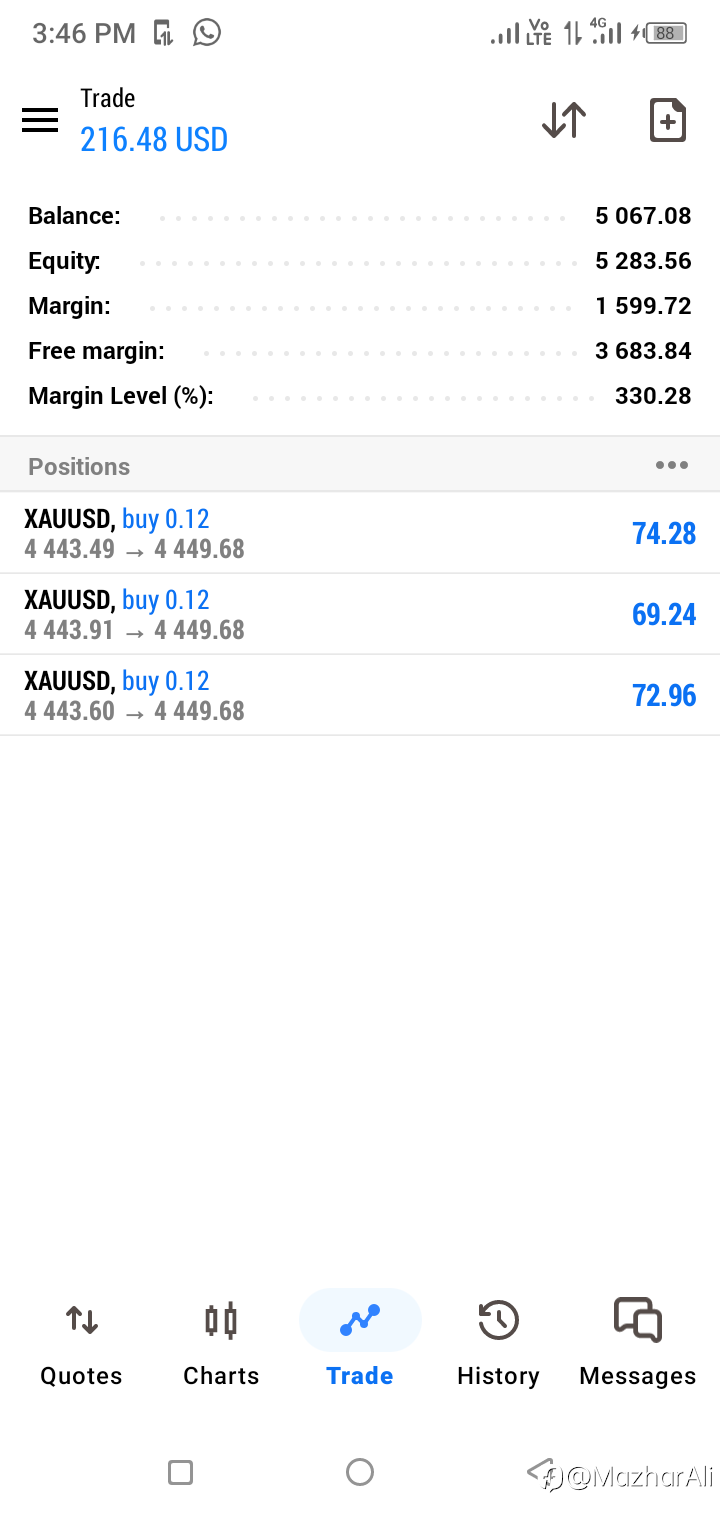

Stuck in a Cycle of Forex Losses? There’s a Better Way

Is your trading account not reflecting the effort you put in? You're not alone. Many traders face challenges with strategy, emotion, and risk management. Instead of chasing "recovery," let's focus on building a sustainable approach.Our Managed Account Service Provides: ✅Transparent Risk Management:

他点赞了

他点赞了

他点赞了

他点赞了

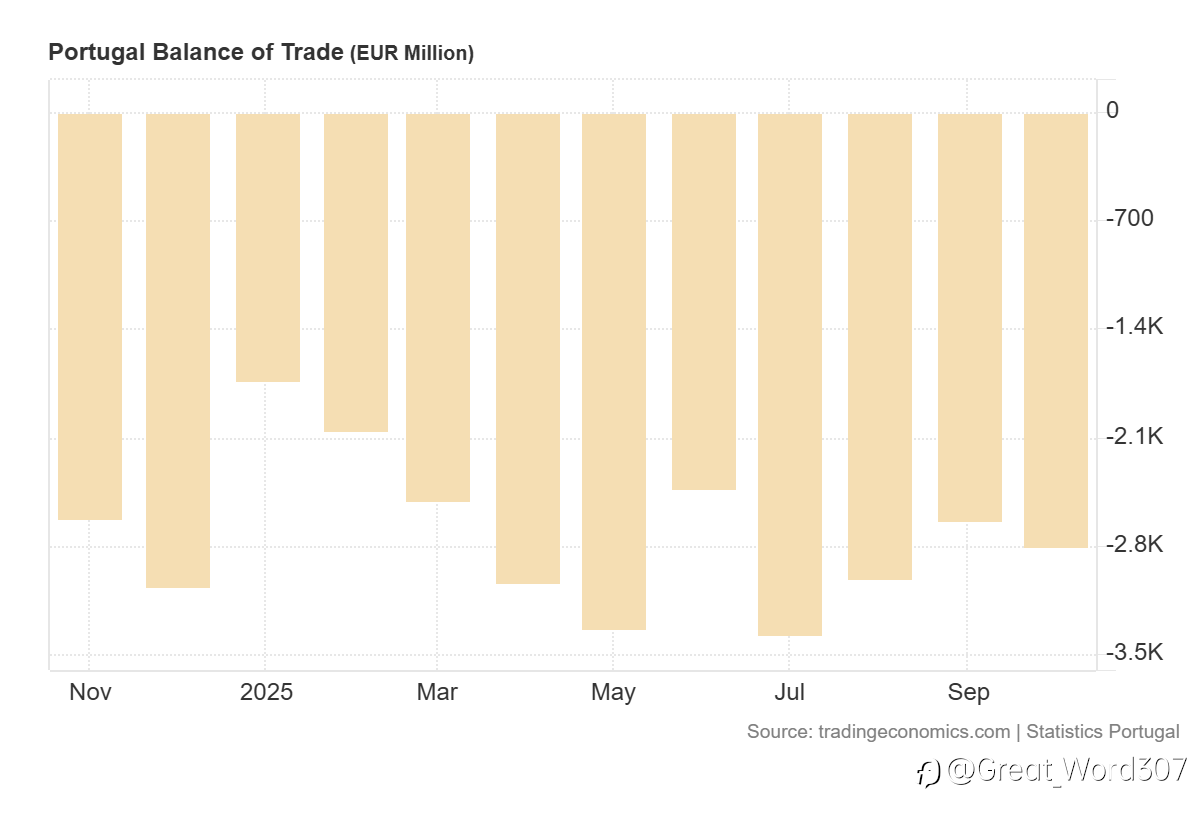

China’s Mixed Indicators Test Sentiment but Medium-Term Bias Holds

Mainland China and Hong Kong stocks extend a three-day decline as mixed PMI data and policy silence weigh on investor sentiment. USD/CNY weakness accelerates as Fed rate cut bets rise, easing trade tensions but challenging price margins for Chinese exports. Despite soft data and margin pressures, th

他点赞了

Bank of Korea Signals a Pause on Further Rate Cuts

The Bank of Korea has indicated that it may pause any additional interest-rate cuts, suggesting that the current policy level may remain in place for longer than markets previously expected. This shift comes at a time when global central banks are weighing how quickly they should move toward easing.

他点赞了

正在加载中...