#RiskAversion#

421 浏览

55 讨论

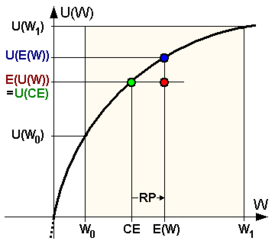

In economics and finance, risk aversion is the behavior of humans (especially consumers and investors), who, when exposed to uncertainty, attempt to lower that uncertainty. It is the hesitation of a person to agree to a situation with an unknown payoff rather than another situation with a more predictable payoff but possibly lower expected payoff.

กลยุทธ์ในการบริหารความเสี่ยง

นอกจากการศึกษาเรื่องความเสี่ยงจะช่วยให้เราระวังตัวไม่ประมาทในการลงทุนได้แล้ว กลยุทธ์ในการบริหารความเสี่ยงก็ยังจำเป็นสำหรับนักลงทุนมือใหม่ ทำให้สามารถวิเคราะห์และมองภาพกว้างก่อนหรือระหว่างการลงทุนได้มากขึ้น 1. การประเมินตนเองและตั้งเป้าหมาย ก่อนลงทุน ควรทำความเข้าใจว่าเรายอมรับความเสี่ยงได้มาก

การบริหารจัดการความเสี่ยงในการลงทุนหุ้น

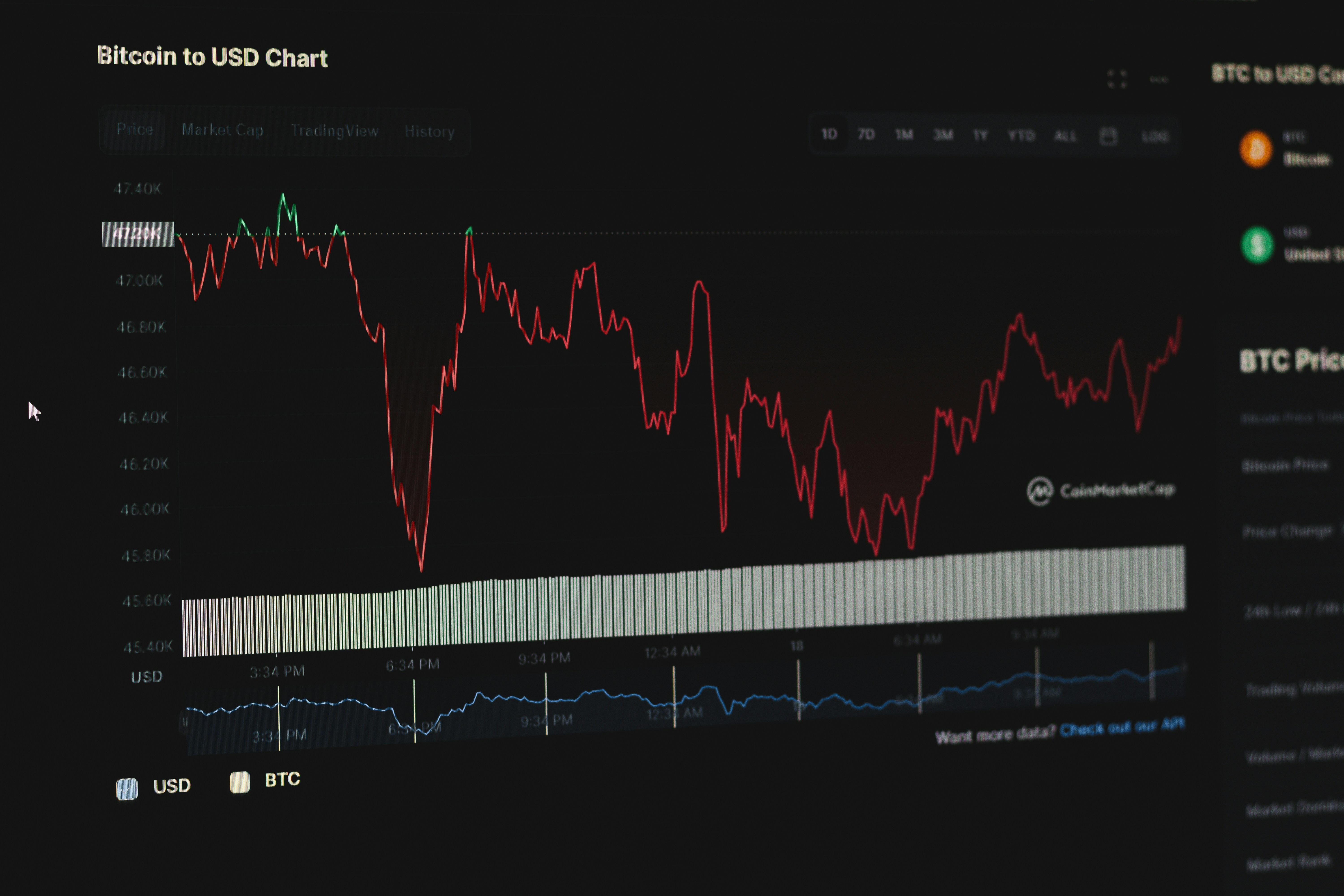

การบริหารจัดการความเสี่ยงในการลงทุนหุ้นเป็นสิ่งสำคัญอย่างยิ่งเพื่อปกป้องเงินลงทุนและเพิ่มโอกาสในการสร้างผลตอบแทนที่ยั่งยืน การลงทุนในตลาดหุ้นมีความผันผวนสูงและมีปัจจัยที่ควบคุมไม่ได้มากมาย ดังนั้น นักลงทุนจำเป็นต้องมีกลยุทธ์ในการบริหารจัดการความเสี่ยงที่ดี เพื่อรับมือกับสถานการณ์ต่างๆ ที่อาจเกิดขึ้น

ผลตอบแทนและความเสี่ยงในการลงทุน

ถึงแม้ว่าการลงทุนในหุ้นจะได้ผลตอบแทนที่ดีจากกำไรการขายหุ้น หรือเงินปันผลของหุ้น แต่ก็ยังมีความเสียงที่จะขาดทุนได้เช่นกัน โดยทั่วไปแล้ว หุ้นที่มีความเสี่ยงสูงก็ย่อมได้ผลตอบแทนที่สูงกว่าเพื่อชดเชยความเสี่ยงนั้น ในขณะเดียวกัน หุ้นตัวที่มีความเสี่ยงต่ำก็จะให้ผลตอบแทนที่ต่ำกว่า ขาดทุนน้อยกว่า ซึ่งความเสี

Quỹ đầu cơ Mỹ giảm mạnh vị thế bán khống, nhưng chỉ tập trung vào cổ phiếu nhỏ

Quỹ đầu cơ Mỹ giảm mạnh vị thế bán khống, nhưng chỉ tập trung vào cổ phiếu nhỏ Làn sóng mua cổ phiếu để trả lại và chốt vị thế bán khống (short-covering) đã làm chao đảo thị trường toàn cầu trong tuần trước. Tuy nhiên, có vẻ như hiện tượng này chỉ tập trung vào một số cổ phiếu vốn hóa thấp hơn là mộ

USD/JPY: Offered below 106.00 even as trade sentiment improves

USD/JPY stretches Thursday’s losses from 106.21 to trim Wednesday’s run-up.

Japan’s National Consumer Price Index grew 0.3% YoY in July, Jibun Bank Manufacturing PMI rose past-45.2 for August.

Japan eases re-entry restrictions for foreign residents, US House Speaker Nancy Pelosi again confuses stimu

Gold again faces rejection above $1,810

Gold has retreated to $1,808 from the session high of $1,813.

A sustained break above $1,810 remains elusive as the dollar draws bids.

Upbeat China GDP may weaken the haven demand for the yellow metal.

Gold bulls continue to struggle to establish a strong foothold above $1,810.

At press time th

Gold Price Forecast: Dollar pullback caps the upside ahead of NFP

Gold draws support from renewed US-China tensions, risk-off mood.

Dollar rebound could cap gains but buy the dips to remain in play.

Technicals warrant correction, US NFP to be the key decider?

Gold (XAU/USD) built on the ongoing rally and refreshed all-time highs at $2075.32 on Friday before p

AUD/USD Price Analysis: Attempts another run towards 0.72 amid falling channel breakout

The aussie’s path of least resistance appears to the upside.

The spot charts falling channel breakout on hourly sticks.

Extension of the USD sell-off could risk a test of 0.72 in AUD/USD.

AUD/USD has receded from daily highs of 0.7146 but still trades with sizeable gains above 0.7100 amid broad US

正在加载中...