他点赞了

他点赞了

他点赞了

Kiwi Stays Afloat As New Zealand Inflation Cooled to 0.6% in Q4 2025

Partner Center New Zealand’s consumer price inflation dipped from 1.0% to 0.6% on a quarterly basis in Q4 2025, bringing the annual rate to 3.1%. This surpassed both market expectations of a 0.5% quarter-on-quarter gain and the Reserve Bank of New Zealand’s forecasts, as elevated domestic price pres

他点赞了

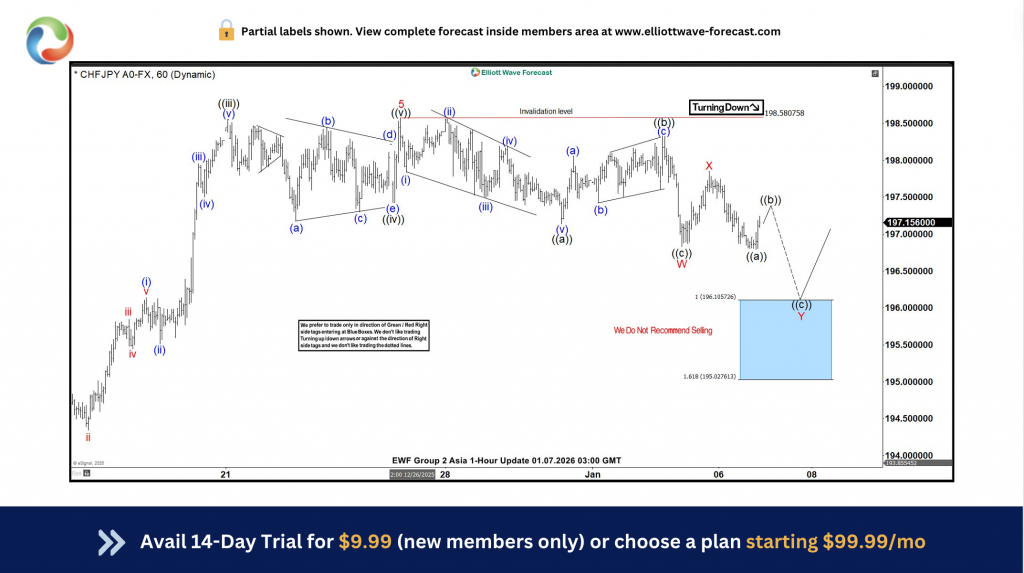

CHFJPY Aims $200 from Blue Box As Buyers Regain Control

Hello traders and welcome to a new blog post discussing about our blue box trading strategy. In this post, the spotlight will be on CHFJPY currency pair. The Yen pairs continue to rise as expected, with bullish cycles from last year appearing incomplete despite being in advanced stages. This present

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

正在加载中...