他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

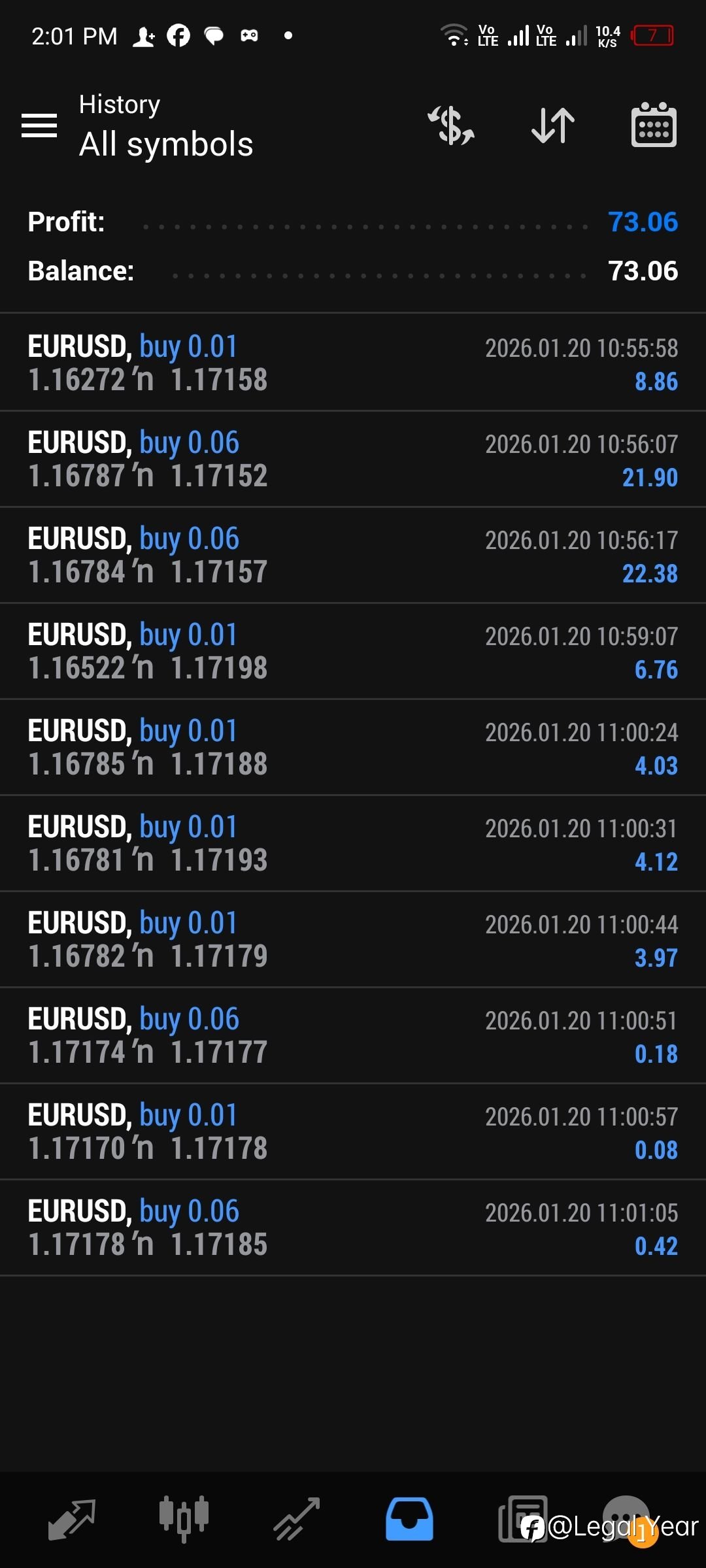

跟随收益

1,205.42

USD

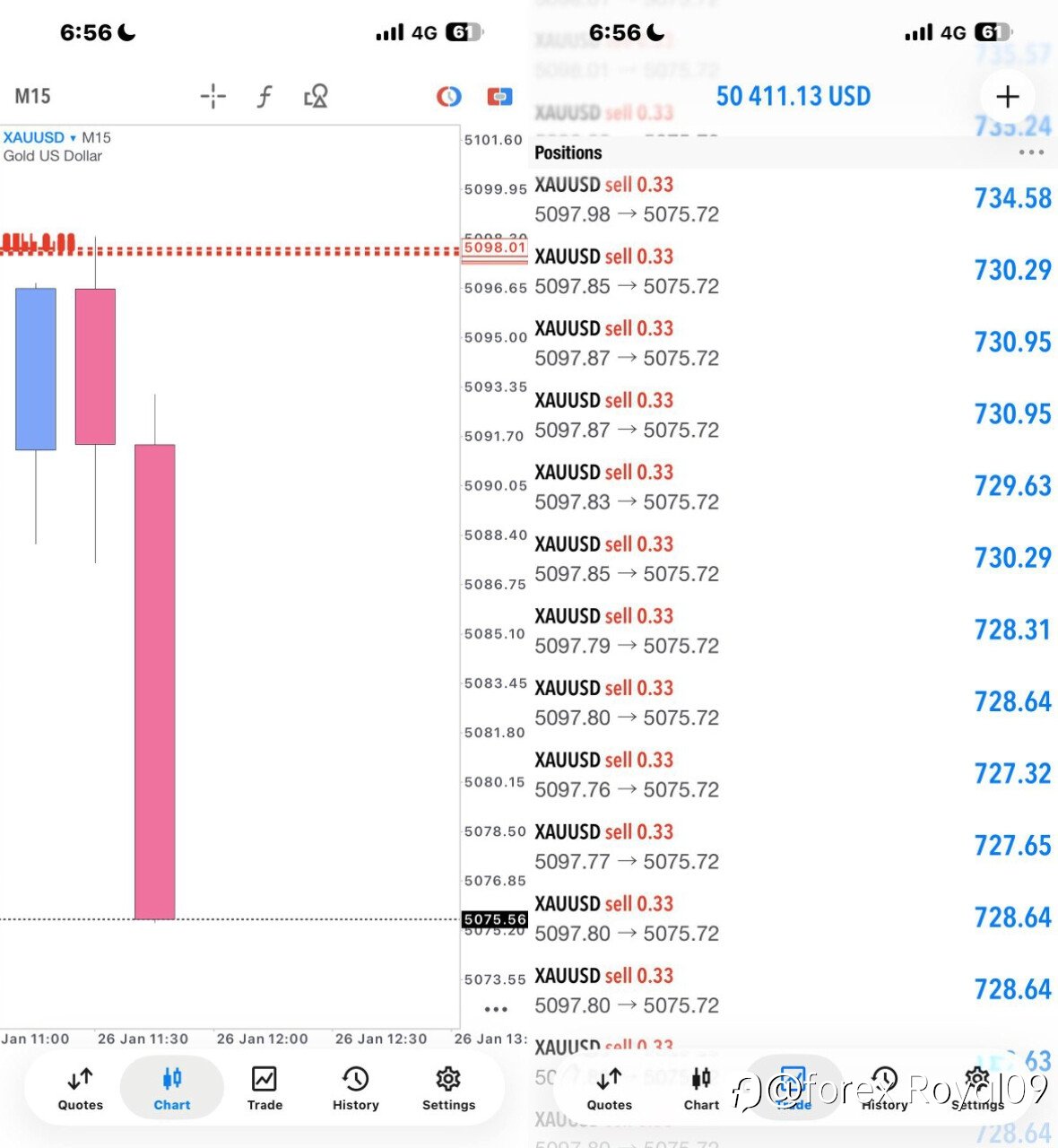

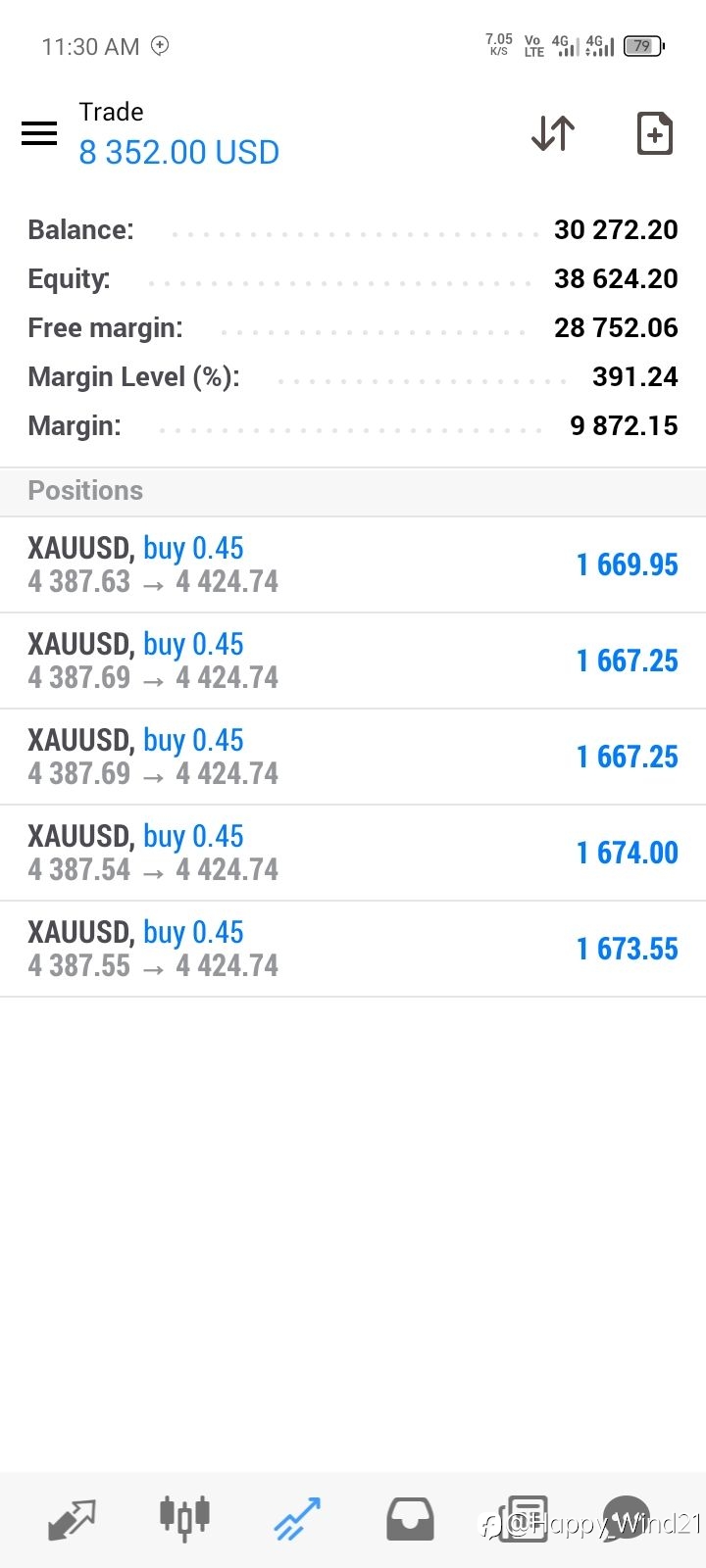

- 品种 XAU/USD

- 交易账户 #1 8081309

- 交易商 Windsor Brokers

- 开/平仓价格 4,331.87/4,445.44

- 交易量 买入 0.1 Flots

- 收益 1,135.70 USD

他点赞了

他点赞了

Haflong Black Tea: Premium Assam Tea from Singapore

Haflong Tea brings authentic Assam black tea from India's finest tea estates to your cup. This Singapore-based brand partners with tea gardens that have over a century of expertise in crafting exceptional tea. What Makes It Special Their signature "Tales of Assam" features organic FTGFOP grade tea—t

他点赞了

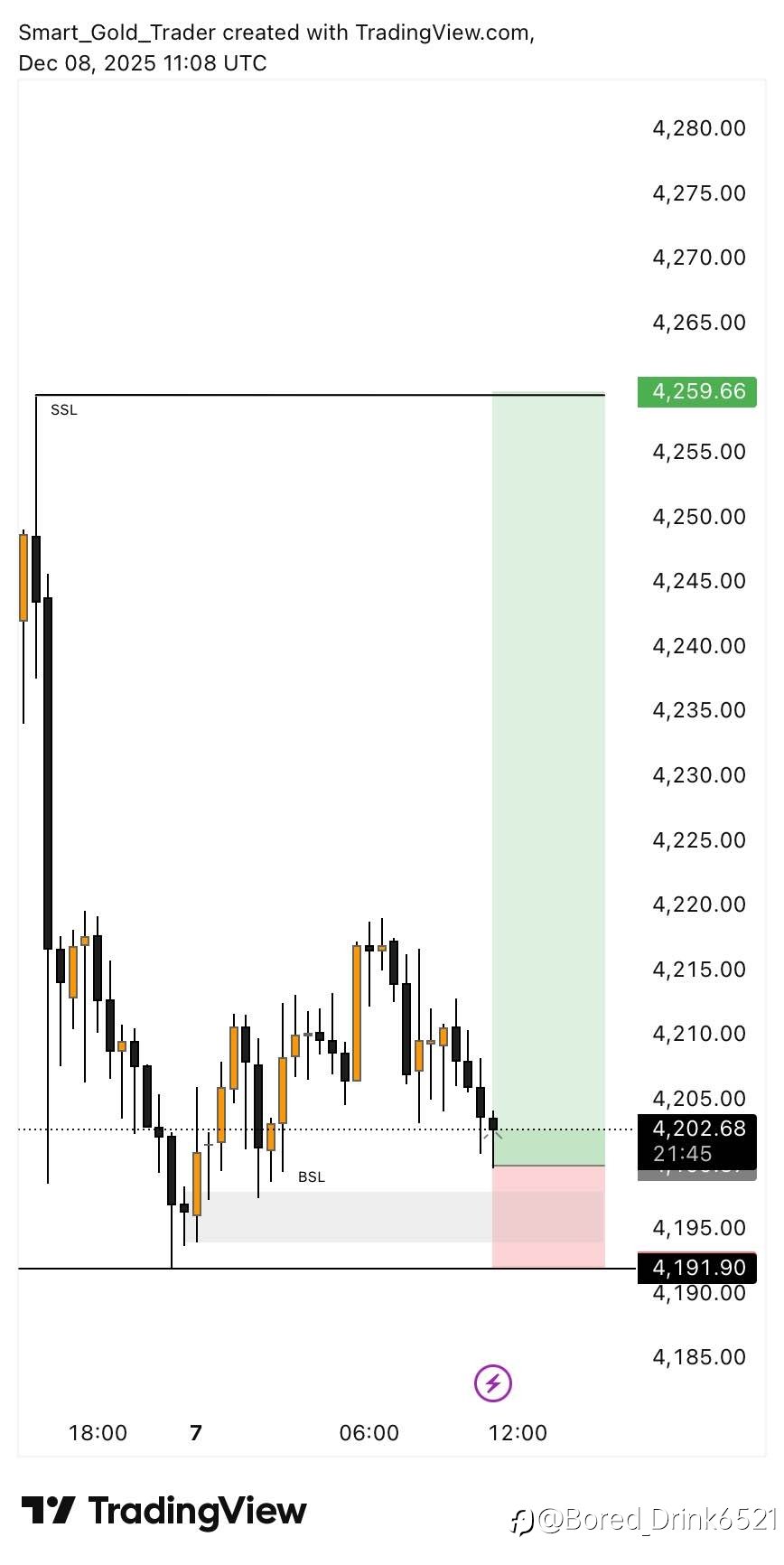

📊 Gold Intraday Analysis – Bias Remains Bullish

Gold continues to hold a strong bullish structure, with price action aligning above key moving averages on the 30-minute timeframe. Market momentum remains positive as buyers maintain control, pushing price toward higher resistance zones. 📈 Key Technical Levels🎯 Target Level: 4265🔹 Pivot Level: 4

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 10 Points that can withdraw. Click to know more details about //soci...

他点赞了

Bitcoin

Bitcoin reclaimed $90,000 overnight as holiday-thinned liquidity and a wave of risk-on sentiment in Asia helped drive price higher. Key drivers: • Fed officials signal growing support for a December rate cut. • Rate-cut odds jump to 85% in futures markets. • Asian equities rally as USD softens. • Te

他点赞了

Eli Lilly & Company (LLY) Favors Rally Targeting 1188

Eli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It comes under Healthcare sector & trades as “LLY” ticket at NYSE. LLY is bullish in weekly & favors rally in (V) against 8.08.2025 low. It should extend rally towards 1054.6 – 1187.8 area within

正在加载中...