他点赞了

他点赞了

他点赞了

他点赞了

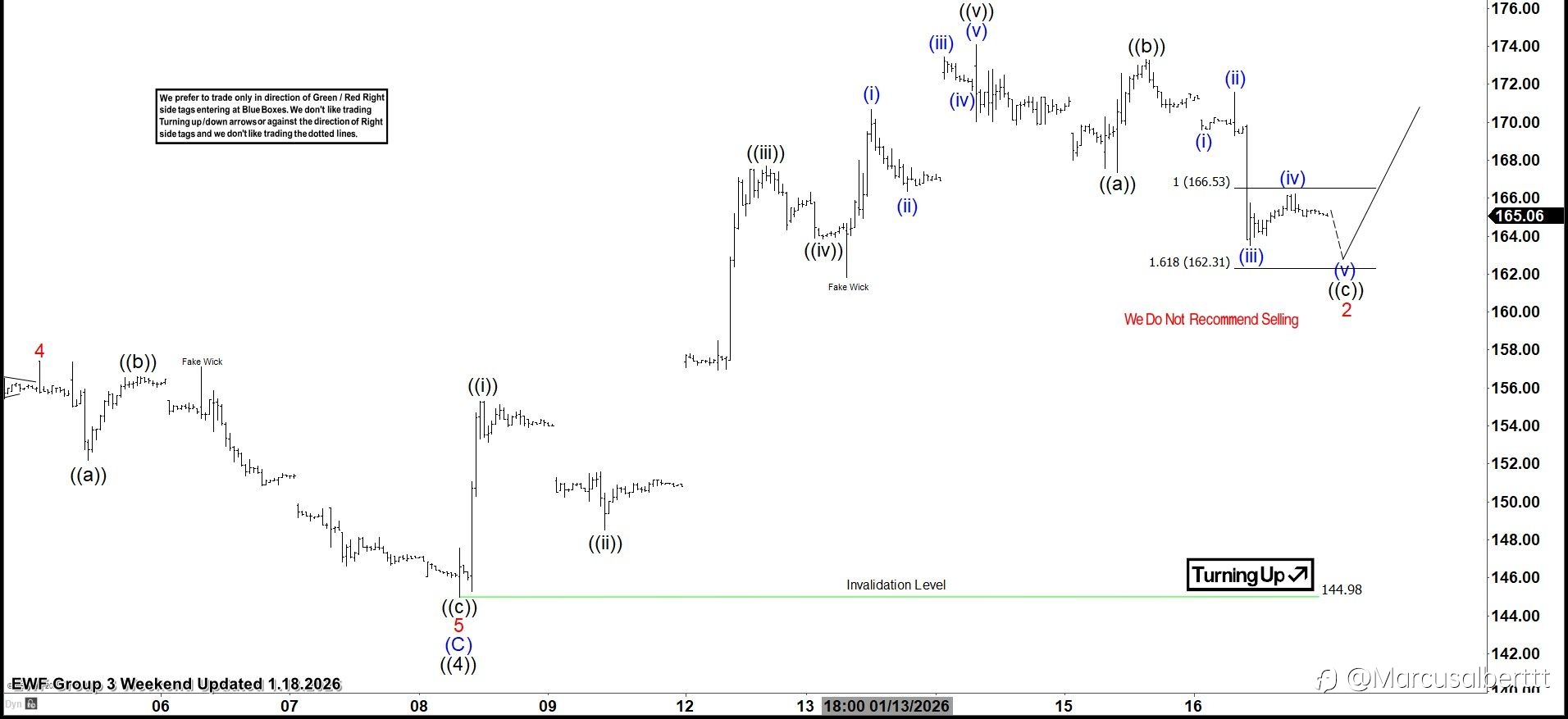

SoFi Technologies (SOFI) Favors Rally Between $34.95 - $38.49

SoFi Technologies, Inc., ( SOFI ) provides various financial services in the US, Latin America, Canada & Hong Kong. It operates through three segments; Lending, Technology Platform & Financial services. It comes under Financial Services sector & trades as “SOFI” ticker at Nasdaq. SOFI fa

他点赞了

他点赞了

Weekly Data Report | Spotlight on Top Performers 16 - 22 December 2025

Last Week's Trading Frenzy: $48,342.91 in Total Profit! The Followme trader community has been on fire. Last week's profit isn't just high, it's phenomenal. With market moves this active, our top traders have truly outdone themselves. Let's dive into the leaderboard and follow the stars

他点赞了

Mastering Risk Management in Trading: The Foundation of Long-Term Success

#OPINIONLEADER# Mastering Risk Management in Trading: The Foundation of Long-Term Success In the world of trading, profit potential often takes center stage. Yet, the true cornerstone of lasting success lies in risk management. Traders who know how to protect their capital can withsta

他点赞了

他点赞了

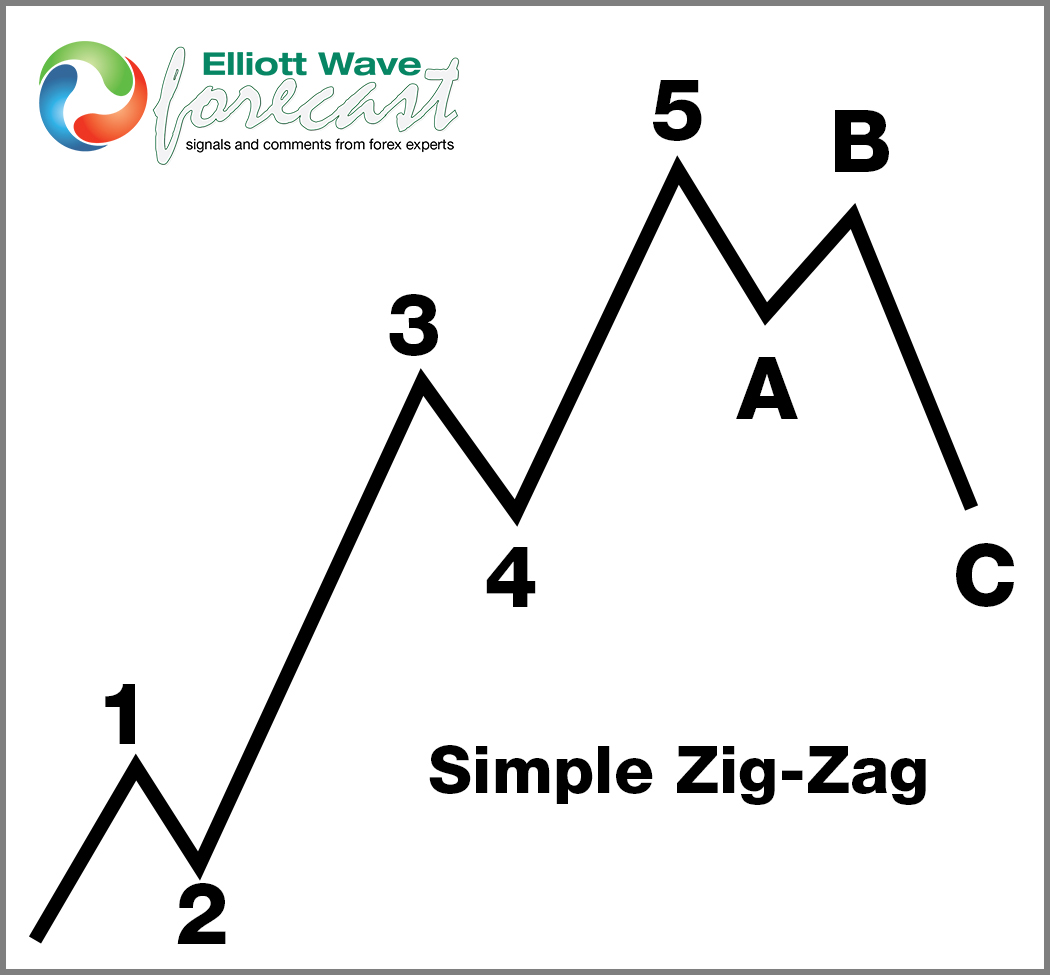

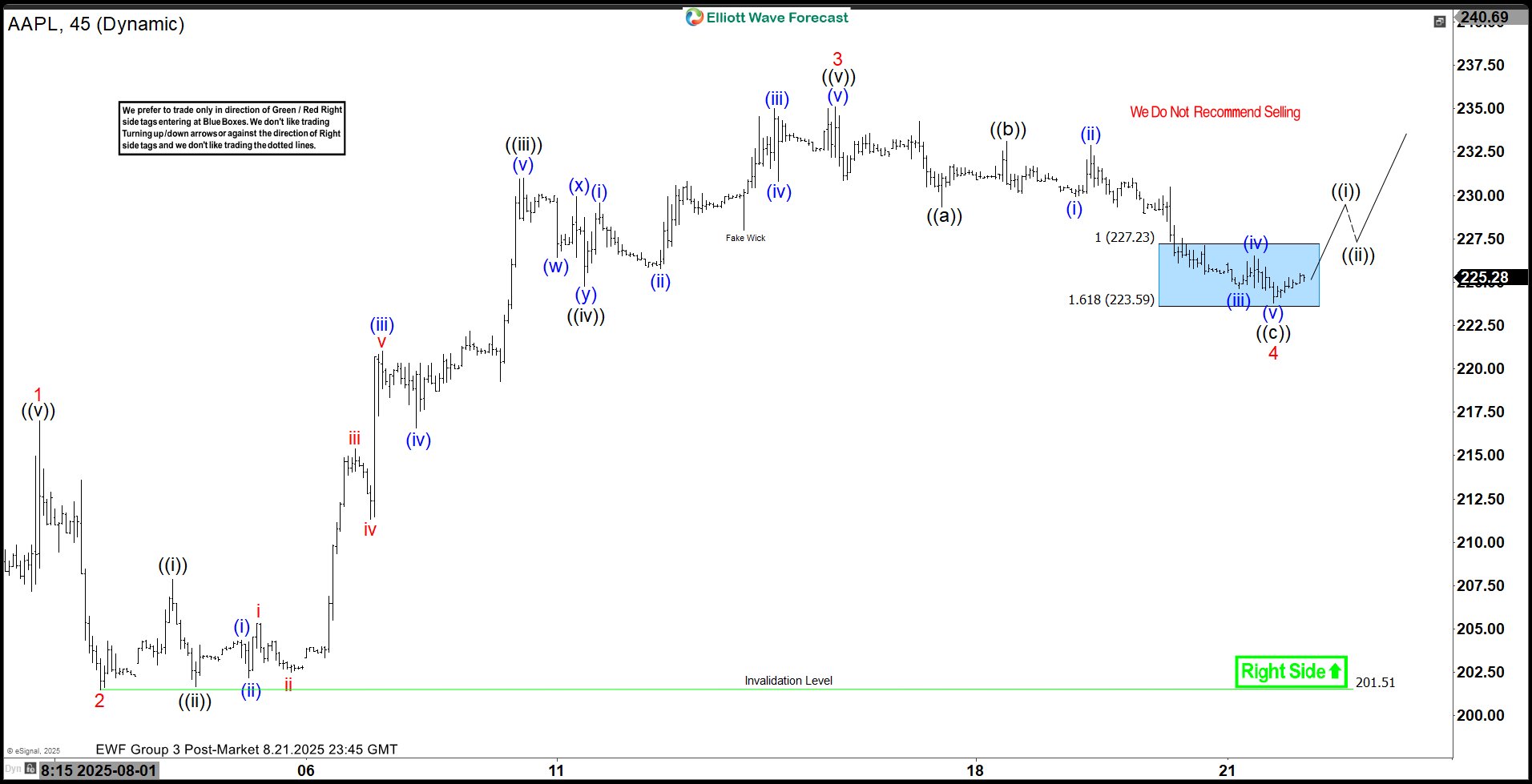

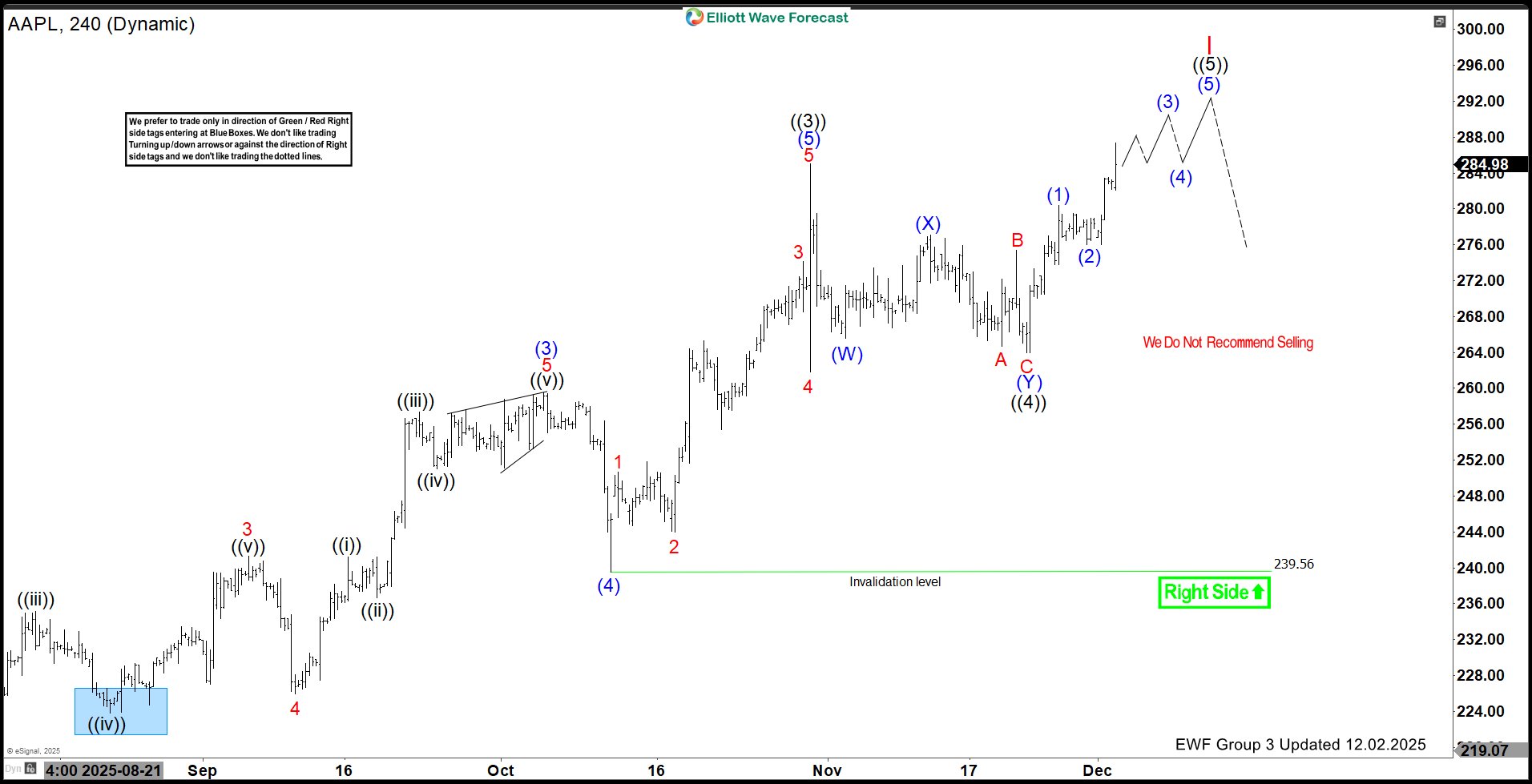

Apple Inc. $AAPL Soars 30% from Blue Box Area, With $290 Target Still Ahead

Hello everyone! In today’s article, we’ll examine the recent performance of Apple Inc. ($AAPL) through the lens of Elliott Wave Theory. We’ll review how the powerful rally from the August 2025 low unfolded as a textbook 5-wave impulse and discuss our evolving forecast for the next move. Le

他点赞了

The Fed Just Ended QT: What It Could Mean for the Dollar

Partner Center So the U.S. Federal Reserve ended “QT” on December 1, 2025. What does that actually mean for currency traders? No, the U.S. central bank is not ending “Quality Time” because FOMC members are divided on their policy biases. Instead, after three years of draining money from the financia

他点赞了

Top Passive Income Ideas 2026 | Smart Ways for Beginners to Earn While You Sleep

Building wealth no longer depends solely on working harder. In 2026, the smartest investors are finding ways to make money work for them. Passive income ideas are gaining popularity as more people seek financial freedom and flexibility. Whether you’re a beginner or a seasoned investor, learning how

他点赞了

他点赞了

Expectations of Fed Rate Cuts Put Pressure on the US Dollar

Growing expectations that the Federal Reserve may cut interest rates soon have started to weigh on the US Dollar. When markets believe that borrowing costs are about to fall, the Dollar often loses some strength because lower rates reduce the currency’s yield advantage over others. This shift in sen

正在加载中...