他点赞了

他点赞了

他点赞了

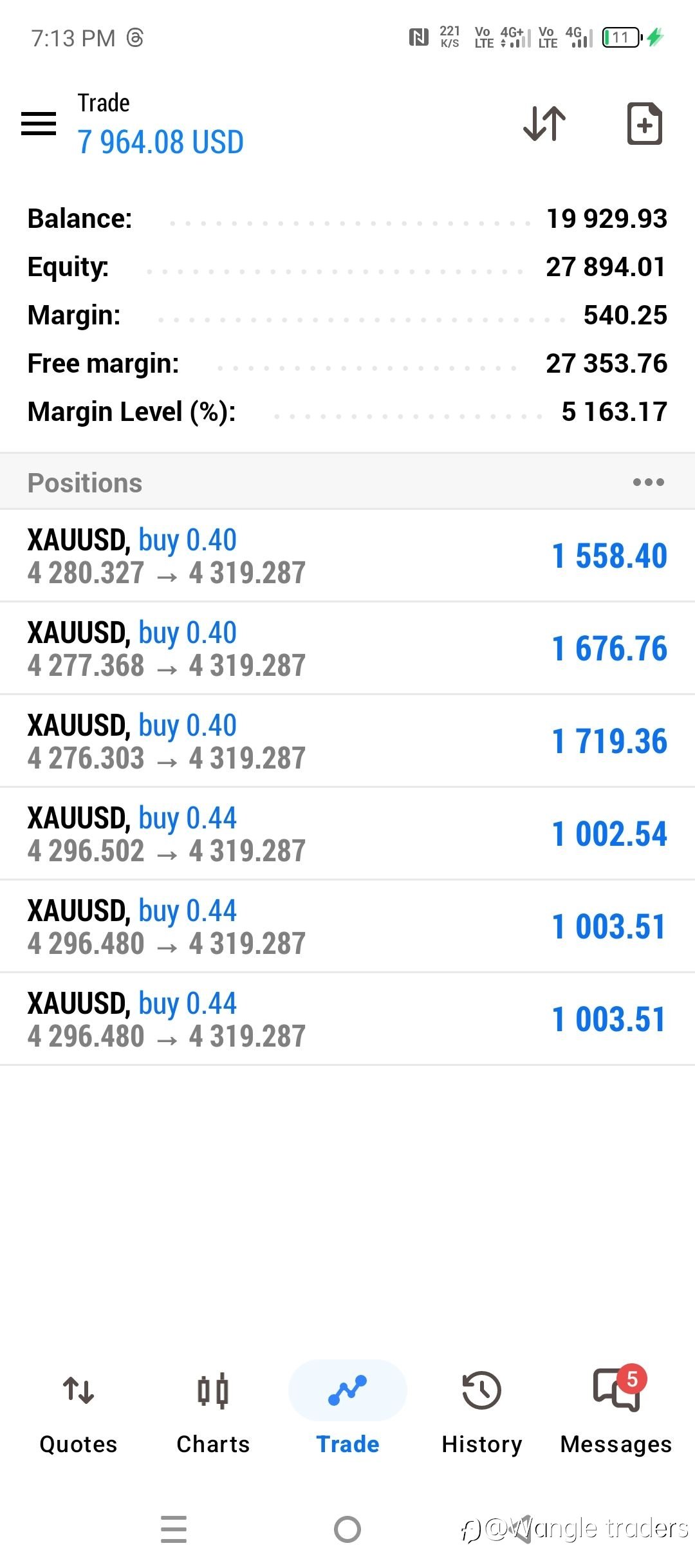

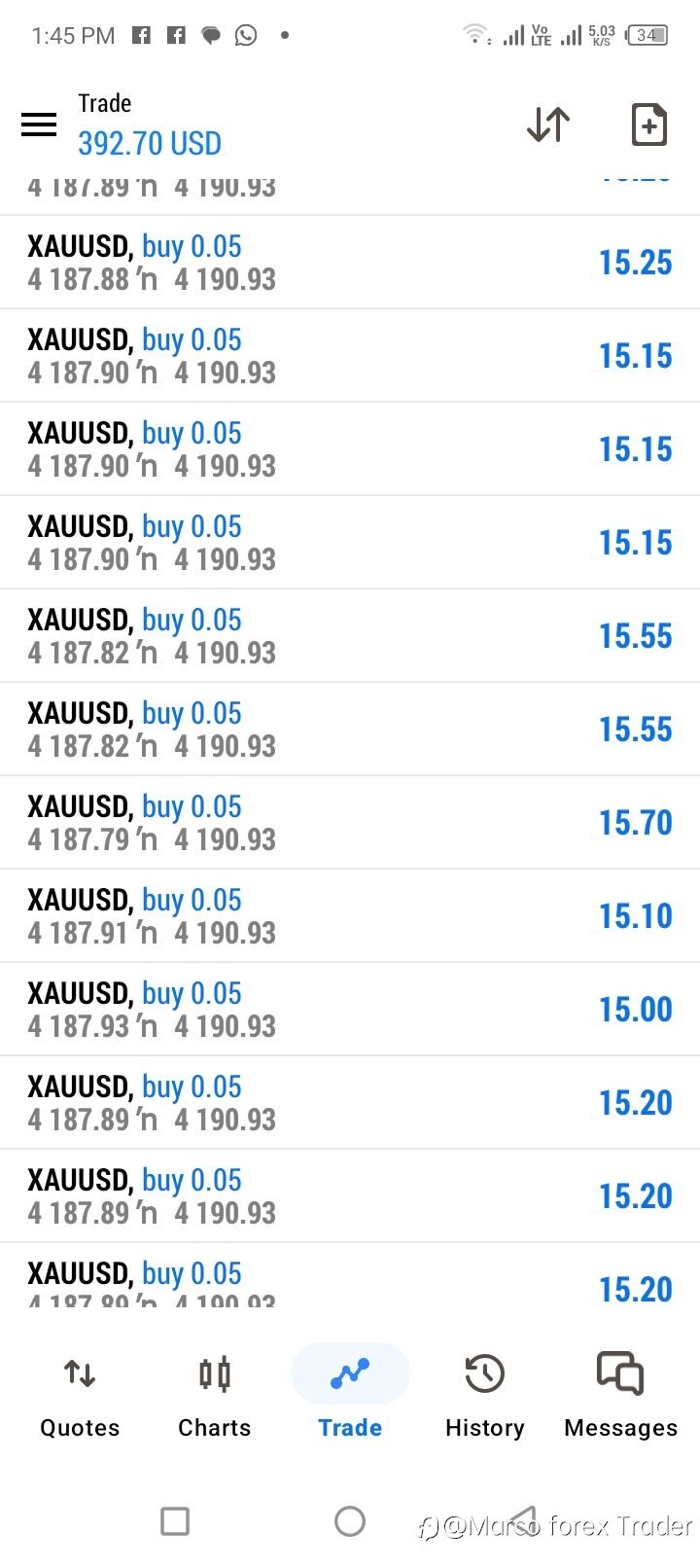

FX Consolidates as Gold Remains the Core Safe-Haven Flow

Global financial markets on 29 January 2026 show a cooldown in FX volatility, while gold continues to trade near elevated levels and remains the primary destination for defensive capital flows. Investors are largely in a wait-and-see mode following a series of volatile sessions earlier in the week.

- Physical_Sink6109 :xjjdjdjⓔⓙⓙⓕⓙⓓⓙⓕⓙⓕⓙⓓⓙⓕⓙⓕ

他点赞了

他点赞了

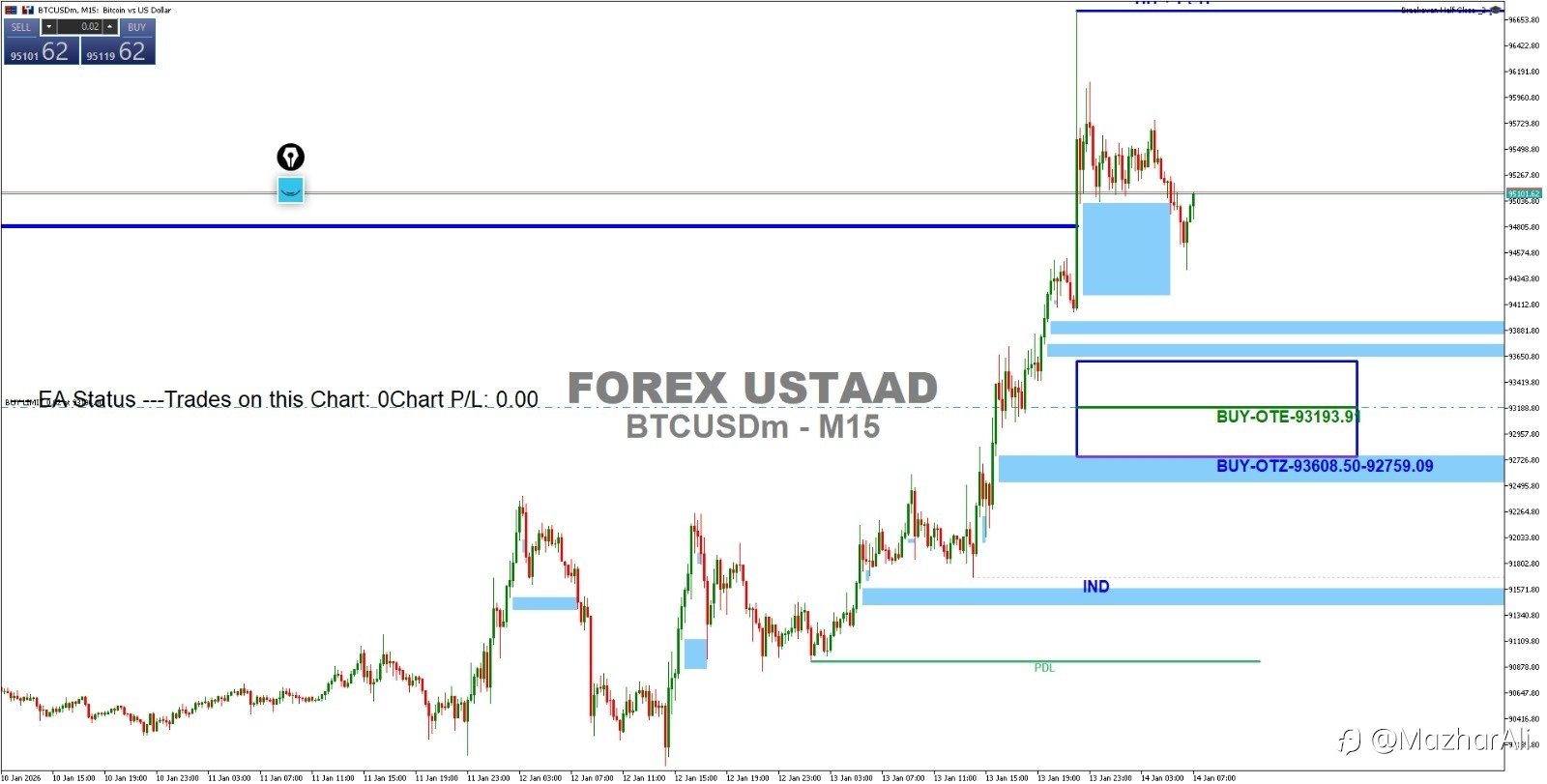

BTCUSD M15 Analysis

🔄 Market State: Neutral & Ranging The signal indicator shows a perfect balance of 62 SELL vs 62 BUY signals, suggesting the market is in a tight consolidation phase on the 15-minute timeframe. No strong directional bias is present in the short term. 📊 Key Dynamic Level Price is currently inter

他点赞了

他点赞了

If the “Broker” Lives on Telegram and a Cloned Website, It’s Not Investing, It’s a Funnel

This Bangladesh case is a classic retail-trap playbook dressed up with modern tools: a cloned website to borrow legitimacy, Telegram groups to mass-recruit, and a web of bank and crypto accounts to move money fast and disappear cleanly. Real investing does not require you to trust anonymous &

他点赞了

How the BoJ’s Rate Hike Impacts the Yen and Forex Markets

The Japanese yen is one of the most sensitive currencies in the Forex market, and interest rate changes play a major role in its movement. For years, low Japanese rates encouraged carry trades, where investors borrowed in yen and invested in higher yielding currencies. This kept the yen relatively w

他点赞了

As a New Trader, Stories Like CBEX Make Me Slow Down and Be More Careful

As someone still early on my trading journey, reading about the CBEX collapse honestly makes me more cautious than ever. At first, claims of AI-powered crypto profits and quick returns sound exciting, especially when you’re still learning and looking for confidence. But seeing how many people

他点赞了

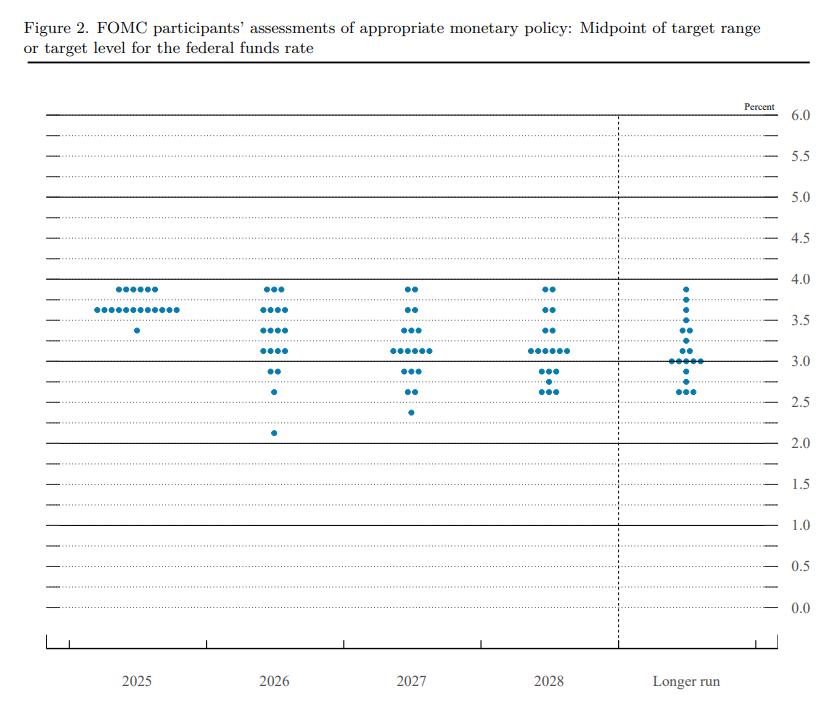

FOMC Delivered 0.25% “Hawkish Cut” in Historic 9-3 Vote

Partner Center The Fed cut interest rates by 25bp as expected from 4.00% to 3.75% in their December decision, with policymakers signaling a higher bar for further easing. This decision was reached through a 9-3 vote, with two hawkish members calling for no change in policy while dovish policymaker M

正在加载中...