他点赞了

他点赞了

他点赞了

Evolution of Consciousness: The Integral Evolution Online Course

Take your spiritual journey to the next frontier with Integral Evolution: The Next Frontier, a trailblazing four-week online course hosted by Clear Sky Meditation Centre. In our rapidly changing world, traditional meditation often isn't enough; we must also "grow up" by integrating our awakening int

他点赞了

UK economy surprises with stronger-than-expected 0.3% growth in November

The U.K. economy grew by a more-than-expected 0.3% in November, data from the Office for National Statistics (ONS) showed Thursday. Economists polled by Reuters had expected a very modest growth figure of 0.1%. The ONS said services and production both grew in November, by 0.3% and 1.1%, respectivel

他点赞了

他点赞了

他点赞了

BOE Cuts to 3.75% in Divided Vote, Sterling Edges Higher on Hawkish Tone

Partner Center The Bank of England (BOE) cut its Bank Rate by 25 basis points to 3.75% at its December meeting, delivering the sixth rate reduction since August 2024. However, the decision proved far more contentious than markets anticipated, with the Monetary Policy Committee voting 5-4 in favor of

他点赞了

他点赞了

他点赞了

🚨 Pi Network KYC STILL Stuck?

You’re not alone — 25–30% of Pioneers remain trapped in pending reviews, failed liveness checks & tentative approvals. We broke down every fix that actually works in 2025 — app updates, ID corrections, support form tricks, region delays & more. 🔧 Full guide: Fix KYC. Unlock migration. 📊 Pl

他点赞了

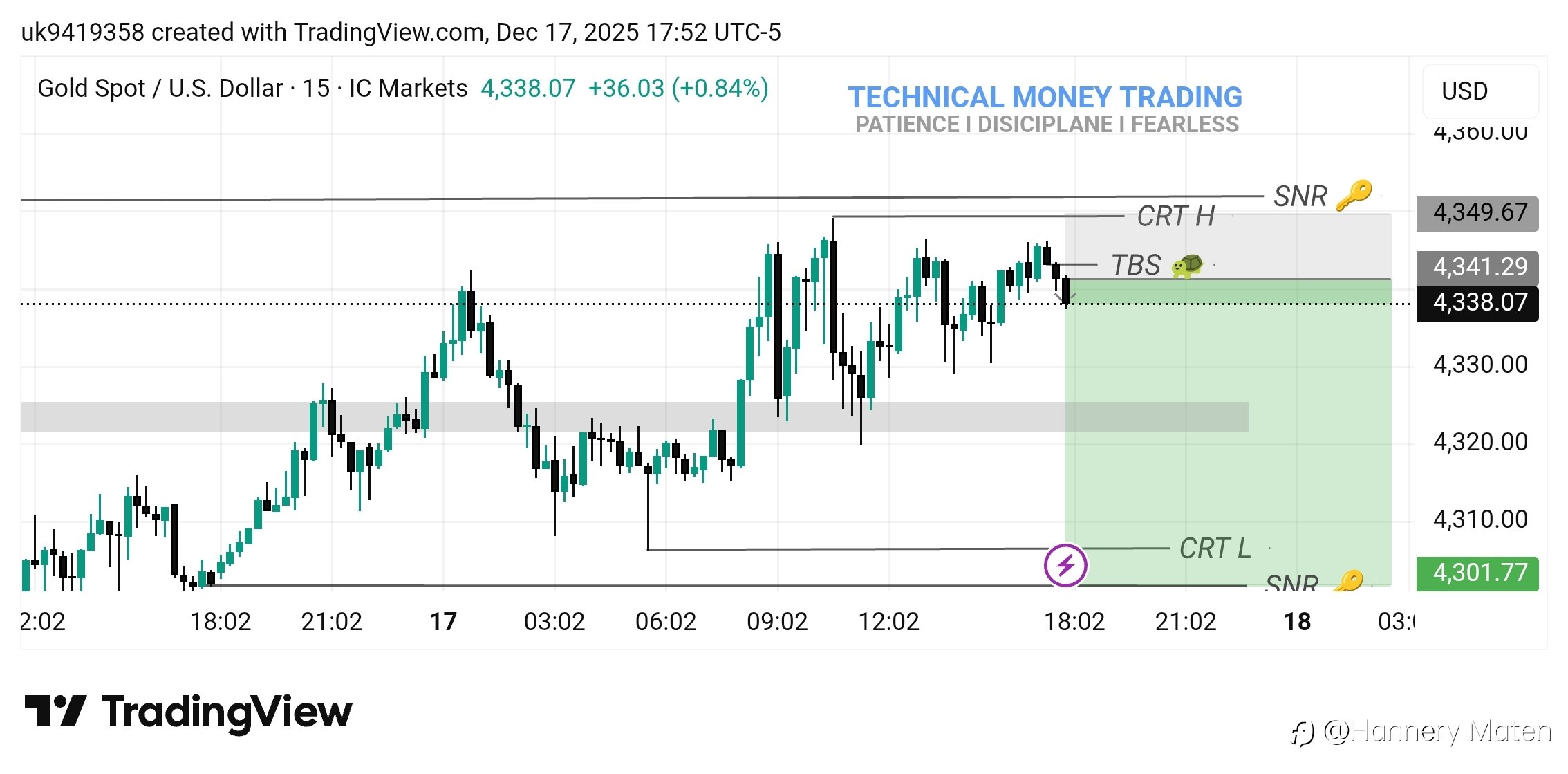

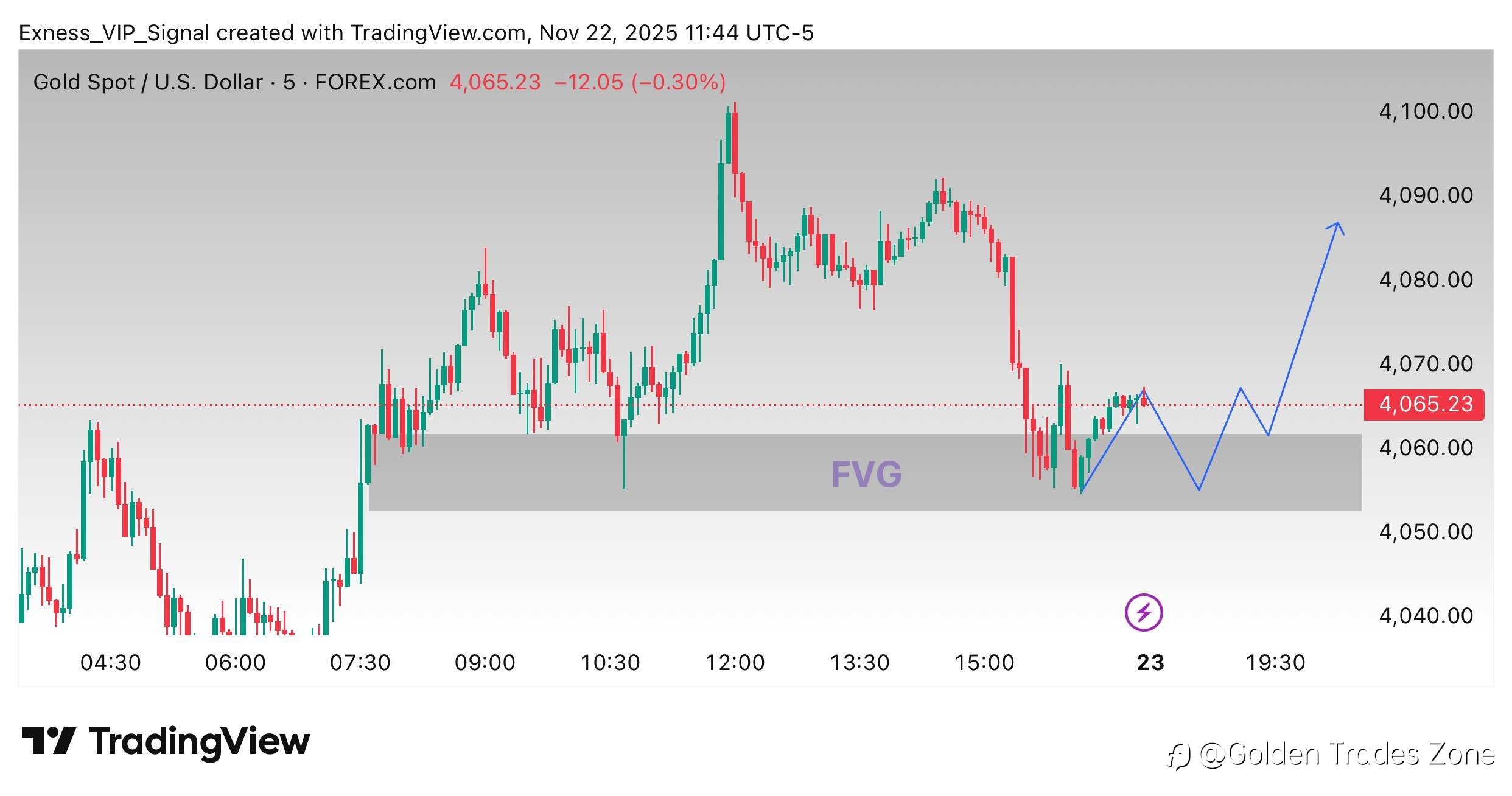

Gold and Forex Markets React to Shifting Rate Expectations and Global Risk Sentiment

Gold and Forex Markets React to Shifting Rate Expectations and Global Risk Sentiment In recent sessions, gold and major currency pairs have moved sharply as traders reassess global interest rate expectations, geopolitical risks, and the market’s appetite for safe haven assets. While technical

他点赞了

Today’s Key U.S. Data – Dec 4

• 19:00 Jobless Claims (main market mover) • 20:30 Factory Orders • 21:00 Atlanta Fed GDPNow • 22:30 Bowman speaks (FOMC) Market Reaction Guide: Strong claims = USD strength + Gold/Indices pullback. Weak claims = USD soft + Gold/Indices bounce. Fed speech may trigger quick volatility. For US session

他点赞了

Lim Meng Hoong: Who Is Sharing the Dividends of Malaysian Trade Recovery?

Amid recent turbulence in Malaysian financial markets, Mr. Lim Meng Hoong raises a provocative question: with the ringgit appreciating, trade surpluses expanding, and stock indices stable, why do inflation and consumer behavior remain cautious? Is this the eve of a true recovery, or are asset prices

他点赞了

正在加载中...