他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

Warsh sprints ahead in Fed chair race following Trump comments on Hassett, prediction markets show

Former Federal Reserve Governor Kevin Warsh on Friday vaulted to the front of the pack in the race for central bank chair following remarks from President Donald Trump, according to a closely watched prediction market. Traders on Kalshi pushed Warsh well ahead of the person seen as his closest compe

他点赞了

الدليل الشامل لدراسة الدكتوراه وشروط دراسة الطب في مصر

هل تطمح إلى بلوغ أعلى المراتب في المجال الطبي؟ هل تحلم بارتداء المعطف الأبيض والتخصص في أعرق كليات الطب، أو تسعى لنيل درجة الدكتوراه التي تمثل قمة الإنجاز العلمي؟ 🩺 إن مصر، بتاريخها الطبي العريق الذي يمتد لآلاف السنين، تفتح أبوابها اليوم لتحقيق هذا الحلم. هذا الدليل هو خارطتك لفهم كل ما يتعلق بالدر

他点赞了

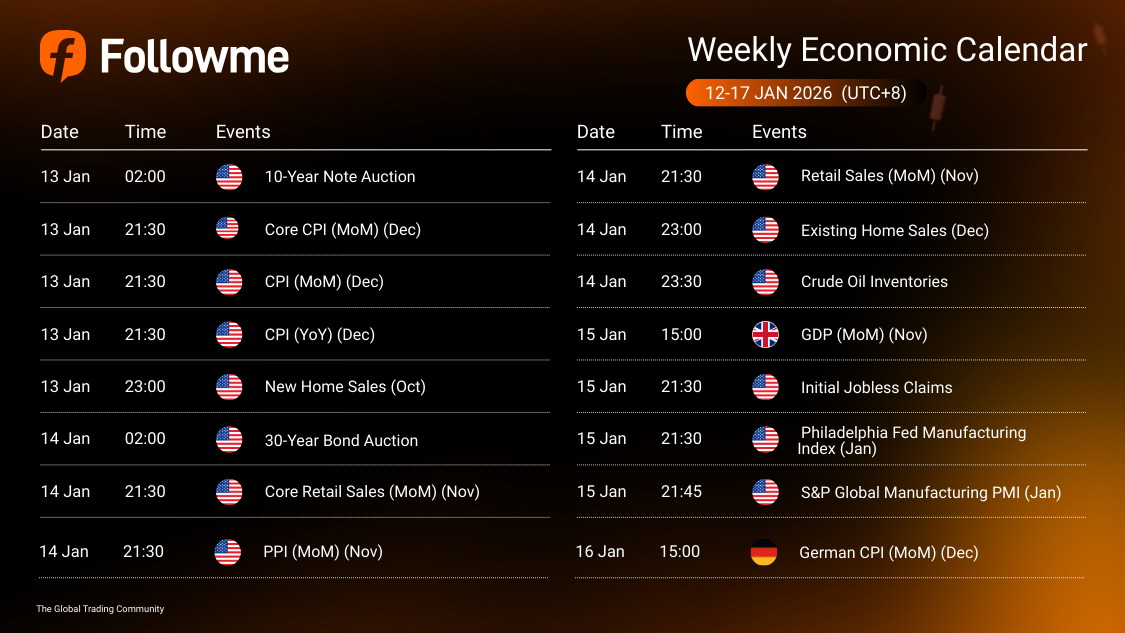

Weekly Economic Calendar: Week of January 12-17, 2026

Weekly Economic Calendar: Week of January 12 - 17, 2026 (GMT+8) This week’s macro calendar is driven by U.S. inflation + consumer demand (CPI → Retail Sales) and rates sensitivity (Treasury auctions), with follow-through risk from U.S. labour + manufacturing checks late-week. Expect the s

他点赞了

他点赞了

Understanding Overnight Lending Stress: SOFR vs IORB

Partner Center You’ve learned that liquidity drives markets. Now it’s time to measure it. The SOFR vs IORB spread is your first indicator, and it’s one of the most visible ways to gauge stress in the overnight lending market, where banks borrow from each other every single night. Think of it as the

他点赞了

他点赞了

Low Liquidity, Wide Spreads, and Unexpected Price Swings

One of the biggest challenges during Christmas Eve trading is wider spreads. With fewer market makers and reduced trading volume, brokers often widen spreads to manage risk. This can increase trading costs and make short term trades less attractive. Another risk is unusual price swings, sometimes ca

- brandymass1126 :How are you doing now

正在加载中...